In an advanced look at the results, the 2016 Investment Trends High Net Worth (HNW) Investor Report updates research on the use of advisers and the latest asset allocations.

The study is based on 2,500 responses from HNWs with investible assets (excluding super in public funds but including SMSF balances) of over $1 million, net of debt. This group is estimated to control about $9 billion of the $1.5 trillion held by all HNWs in Australia.

Some highlights include:

1. The number of HNWs in Australia fell to 425,000 in 2016 from 440,000 in 2015, partly due to market conditions and partly because of using debt to invest in property. The number with $2.5 million and above is growing.

2. The main investment problem identified by half the respondents is they are seeking growth in their portfolios but don’t expect it will come from Australian shares in 2017 (their return expectations have recovered somewhat since bottoming in September 2016, but they are still bearish). They know they should not allocate significantly to cash.

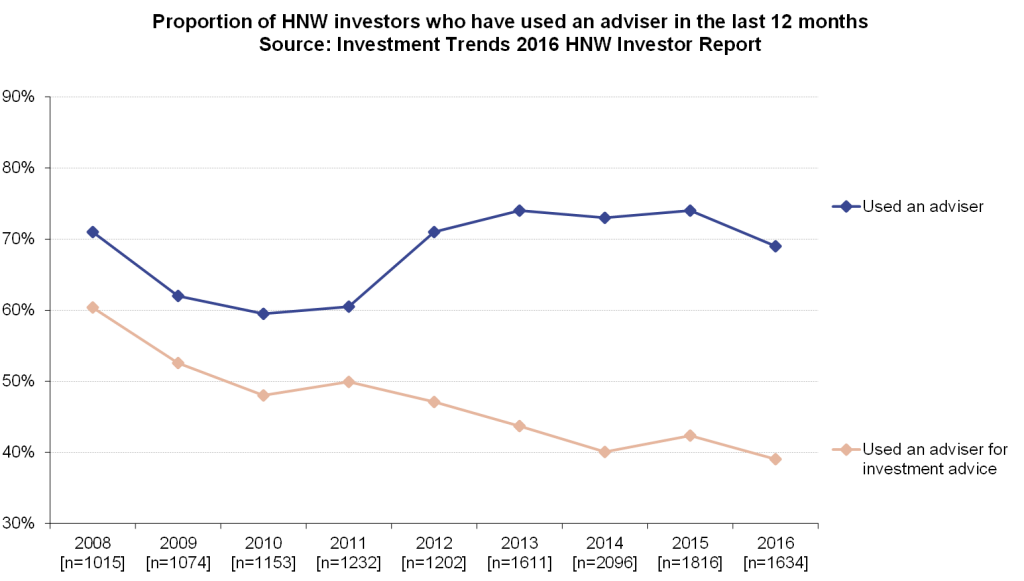

3. As expected in such uncertain times, there is an increasing unmet need for advice. Says Recep III Peker, Research Director at Investment Trends, “Over half of HNWs have large unmet needs for advice. In spite of this, they are increasingly reticent to seek advice, and the use of advisers is falling. Financial planners and full service stock brokers are losing ground, especially for investment advice.”

The changes for full service stockbrokers are particularly challenging. Those who have retained clients have a more holistic relationship, including in asset classes other than equities. But only 40% will actually call themselves a stockbroker, with most preferring names such as ‘wealth managers’, signifying a more diversified offering. They have not become ‘financial planners’, but their businesses are changing. For example, they commonly sell global ETFs to give their clients an international equity exposure.

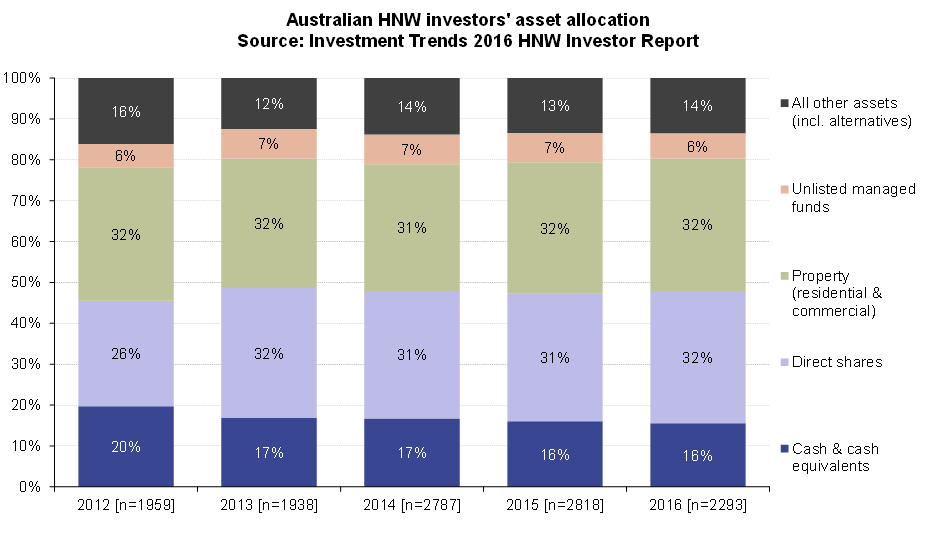

4. Asset allocation has not changed significantly in last few years. The top-level asset distribution is 32% direct shares, 32% property, 16% cash and TDs and the rest in listed or unlisted managed funds and alternatives. Geographically, the proportion of assets overseas averages only 5%, although for the wealthy with assets $10m+, it is a much higher 10%.

Uncertain times and stretched market values seem to have paralysed reallocation. The amount in cash and TDs has fallen slightly by 1% to 16% in the last two years, despite uncertainty in the share market, due to low rates. HNWs in Australia are estimated to be holding $240 billion in cash, with $100 billion temporarily waiting for better market conditions.

The proportion of HNWs planning to invest in managed funds remained at 20% in 2016. About half of these HNWs want actively managed international equity funds, and two in five seek active Australian equity funds. Says Peker, “It’s been a bit of a missed opportunity that the industry has not grown its share of the HNW pie, but there is still good appetite for managed funds.”

The number of HNWs who have direct property has increased but average holding size has come down, perhaps indicating property is held in an SMSF.

Graham Hand is Managing Editor of Cuffelinks and this preliminary release is courtesy of Investment Trends.