Financial advisers have an opportunity to capitalise on a shift from direct investing by SMSF trustees, as well as the large-scale financial illiteracy in the community, according to separate reports from Vanguard and Workplace Super Specialists Australia (WSSA).

The 2016 Vanguard/Investment Trends SMSF Report is a comprehensive study of Australian SMSF investment patterns, collating responses from more than 3,500 SMSF trustees and 570 financial planners. It found that increasing market volatility was affecting the way SMSF trustees were investing.

Elsewhere, WSSA found that almost two fifths of Australian workers need to improve their financial wellbeing, and that only about a third were considered financially healthy.

Both these surveys suggest potential clients have significant unmet needs, and advisers should find a way to connect and educate.

Shift from equities to managed funds

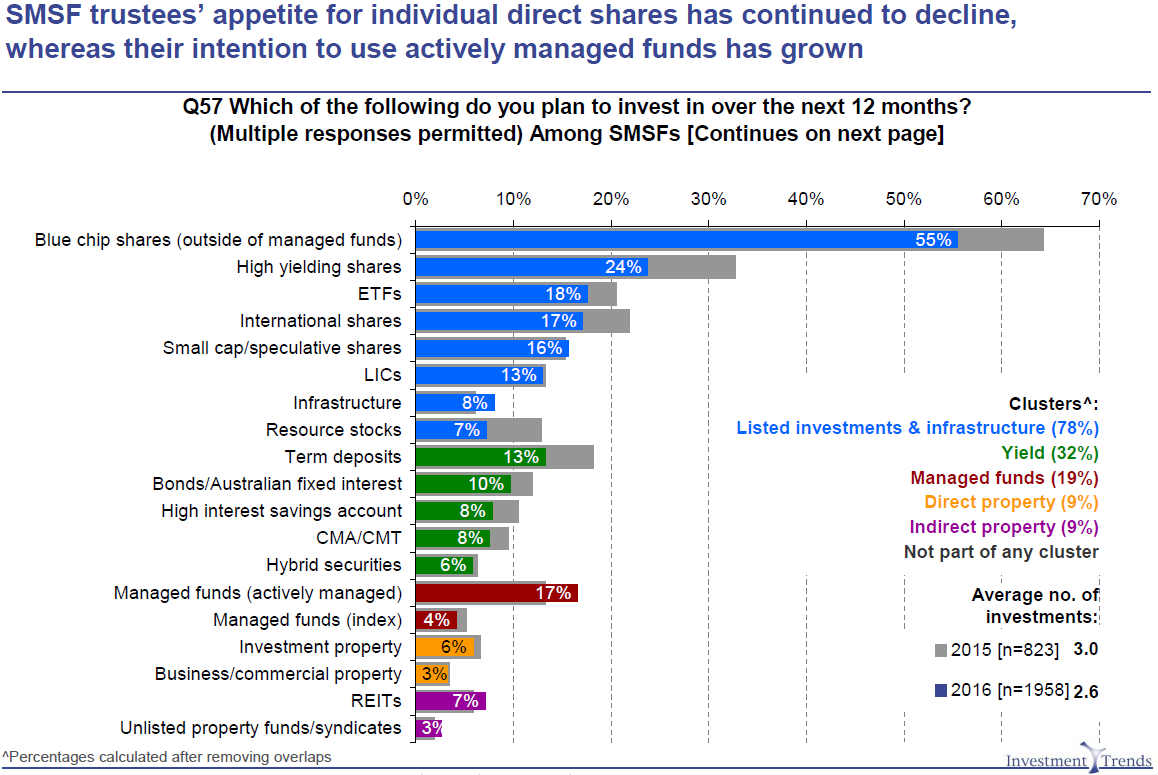

Among the Vanguard survey’s findings was a significant move in fund allocation from domestic shares towards actively managed funds, infrastructure and REITs. Direct equities as a share of SMSF portfolios has fallen to 38% on average from a peak of 45% in 2013. Over the same period, the percentage of managed fund investments in SMSF portfolios has increased from 7% to 10%.

Speaking at the report’s launch, Recep Peker, Investment Trends’ Head of Research, Wealth Management, said,

“SMSF investors often favour blue-chip shares that promise premium dividends and franking credits. But this year we saw trustees’ appetite for direct shares fall. In previous years, fixed income products have been popular in volatile times, but with interest rates at all-time lows, SMSFs want assets that diversify their portfolios, the data suggests.”

SMSF sector seeks more help

Interestingly, the number of SMSF trustees who said they had ‘unmet financial advice needs’ rose from 212,000 to 255,000 over the past 12 months, the survey found. “Consistent with previous years, trustees cited inheritance and estate planning, pension strategies, and longevity risk as key areas where they need more advice,” Peker said.

Vanguard Australia Head of Market Strategy Robin Bowerman said the research also revealed that SMSF trustees want professional help validating their investment strategies and portfolio construction.

Ben Marshan, Head of Policy and Government Relations at the Financial Planning Association of Australia, agreed that there were great opportunities for financial planners to develop strategies for SMSFs, but they needed to fully understand their own skill sets.

“My concern is that planners often don’t have the tools required to build portfolios. They may be good at modelling and cash flow but are lacking a sufficient understanding of which balanced funds to put specific customers into.”

If financial planners really want to capture more of this market share they need to make decisions about the type of advice they’re providing, who they’re providing it to and have a deep understanding of the best products to offer, he added.

Over the 12 months covered by the report, only 37% of SMSFs used a financial planner, which was a slight increase over last year but did represent the first rise in that statistic since 2007. It also revealed how much of the SMSF market is still untapped for planners.

The amount of revenue financial planners derive from SMSF clients was steady at 19%, however, the planners surveyed were positive about the potential to grow this to an average of 27%. The total proportion of financial planners who work with SMSF clients remained steady at 69%.

Financially unwell staff

Meanwhile, WSSA has released its inaugural Financial Wellness Index of Australian workers. CoreData conducted the research for WSSA, and found 39% of employees were categorised as either ‘financially unwell’ (12%) or having ‘room for improvement’ (27%). Under a third (29%) were ‘on the way to wellness’, while 26% were ‘financially well’ and 6% were rated ‘superstars’.

WSSA represents workplace superannuation specialist advisory businesses and its members currently provide financial advice to thousands of corporate super funds.

“This data should be regarded as a cry for help from everyday Australians and their day-to-day reality,” WSSA President Terry Rhodes said. “It is a situation that is both stressful and costly for employees and employers.”

The most common behavioural impact of poor financial wellness in the workplace described by employers is stressed employees (61%), unengaged/distracted employees (43%), and low morale (30%).

The survey also found a key driver of financial wellness was financial literacy: more than half of the ‘financially unwell’ have poor or very poor financial literacy, whereas 93% of ‘superstars’ have strong or very strong financial literacy.

Marshan said only 20% of consumers currently seek out financial planners and 10% have ongoing relationships.

“For many people, understanding their own financial position and what their choices are can be overwhelming. These statistics highlight how broad the market is and the extent of the opportunities available.”

He said financial planners looking to take advantage of consumer demand should carve out their own niche, acquire as many professional certifications as possible and belong to the most relevant associations for contacts. They should also take full advantage of tools such as social media including Facebook, Twitter, Pinterest, and Linked In.

Australian employers do support improving financial literacy: more than 60% said employees’ financial literacy was extremely or very valuable. An overwhelming 90% of employers said one-on-one sessions with advisers was the most valuable way to improve financial literacy.

Both these surveys confirm there is strong potential for financial advisers to improve long-term outcomes and enhance the financial literacy of their clients.

Alan Hartstein is Deputy Editor at Cuffelinks.