Gold and gold miners have been among the better-performing asset classes so far in 2025 and they were among the strongest performers in 2024. The price of gold recently hit another record high, with ICE’s LBMA price index surpassing US$3,000 for the first time.

Recent price rises have been attributed to Trump’s tariffs and the US Federal Reserve potentially pausing any more rate cuts. While this uncertainty and interest rate environment bodes well for gold, these elements were absent in 2024.

The price movements of gold in 2024 had many analysts scratching their heads, because normally when risky assets such as equities do well, as they did, defensive assets, such as gold, do poorly. In 2024, both ‘risky’ equities and ‘defensive’ gold performed well.

Also, when interest rates fall, as they started to in the US in the second half of 2024, gold has historically not done well. It’s therefore worthwhile to understand what could have driven the price of gold and understand why demand for the yellow metal could continue. And why gold miners are profiting.

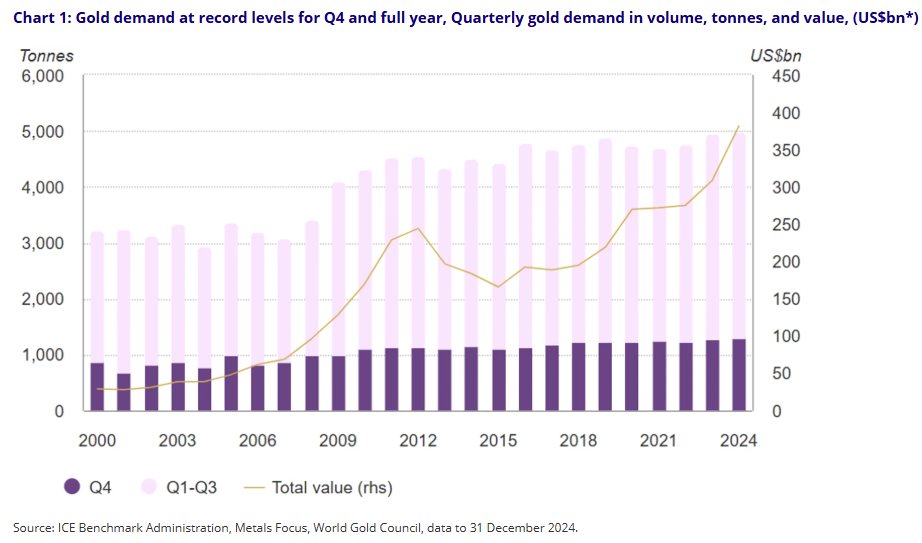

Firstly, central banks have been stockpiling gold. 2024 was a big year of central bank buying. According to the World Gold Council, ”central banks continued to hoover up gold at an eye-watering pace: buying exceeded 1,000 tonnes for the third year in a row, accelerating sharply in Q4 to 333 tonnes.”

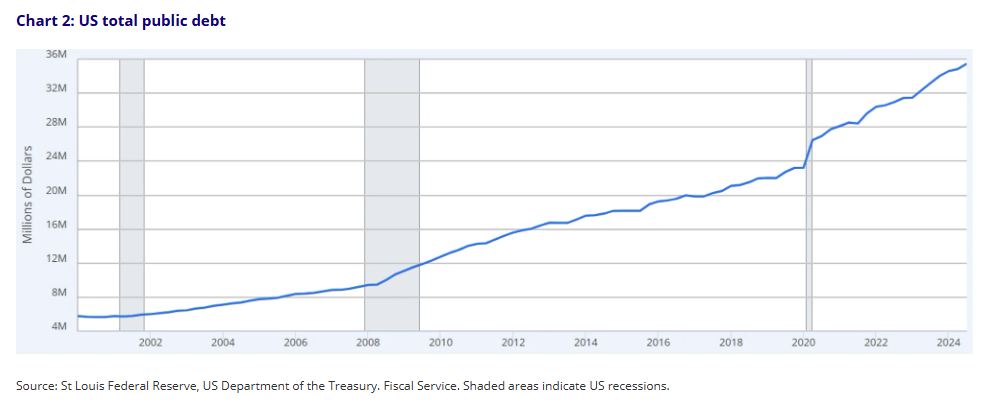

In addition to central bank buying, the other factor driving gold demand has been growing geopolitical uncertainty, the threat of tariffs and US debt. Tariffs lead to inflation. In addition, many investors are staying away from US treasury bonds as the American economy remains embroiled in heavy, seemingly uncontrolled debt.

The rationale is that rising US debt often leads to concerns about inflation. When a government accumulates significant debt, it may resort to measures such as printing more money or increasing government spending, potentially leading to inflationary pressures. With inflation at the forefront of investors’ minds, they may be buying gold as a hedge against the return of inflation.

Buying physical gold is not the only way to potentially benefit from a rising gold price. Some investors buy gold miners.

Gold miners

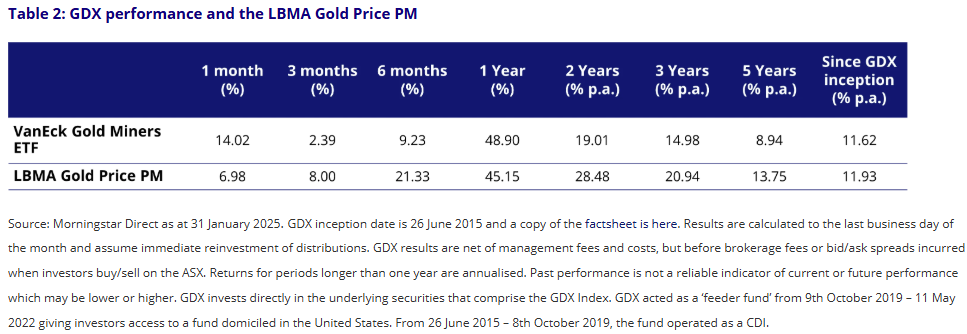

One of our predictions for 2025 was captured in the title of our blog, “Gold stocks seek to reconnect with gold in 2025.” We highlighted that the performance of gold miners had been lagging the performance of physical gold over the past few years. This was unusual and we expected the miners to reconnect.

In the past, gold miners tended to outperform gold bullion when the price of gold rose and underperform when the gold price fell. We think the connection may have restarted.

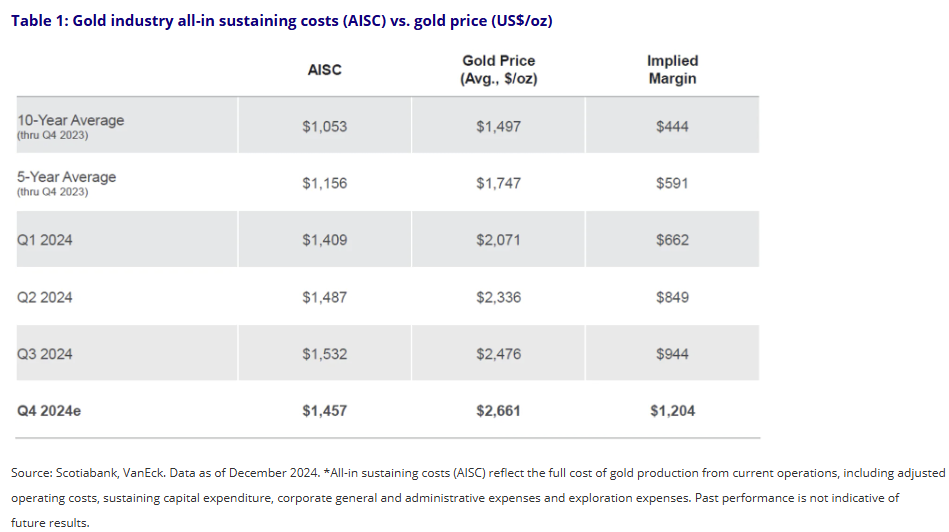

We think, fundamentally, that gold miners also have positive tailwinds. While gold miners were not immune from the recent inflation, and the all-in-sustaining costs for mining gold have risen since 2016, disciplined mining companies can now generate substantial margins with the price of gold so high.

Investors are starting to take note. As mentioned above, GDX rose by 14.02% in January. This could be the beginning of a reversion-to-the-mean trend that sees gold mining equities again displaying their leverage to the gold price and outperforming bullion when gold prices rise. It still has a long way to go. You can see that over six months, the gold price has risen 21.33%, but GDX has only returned 9.23%.

Accessing gold through ETFs

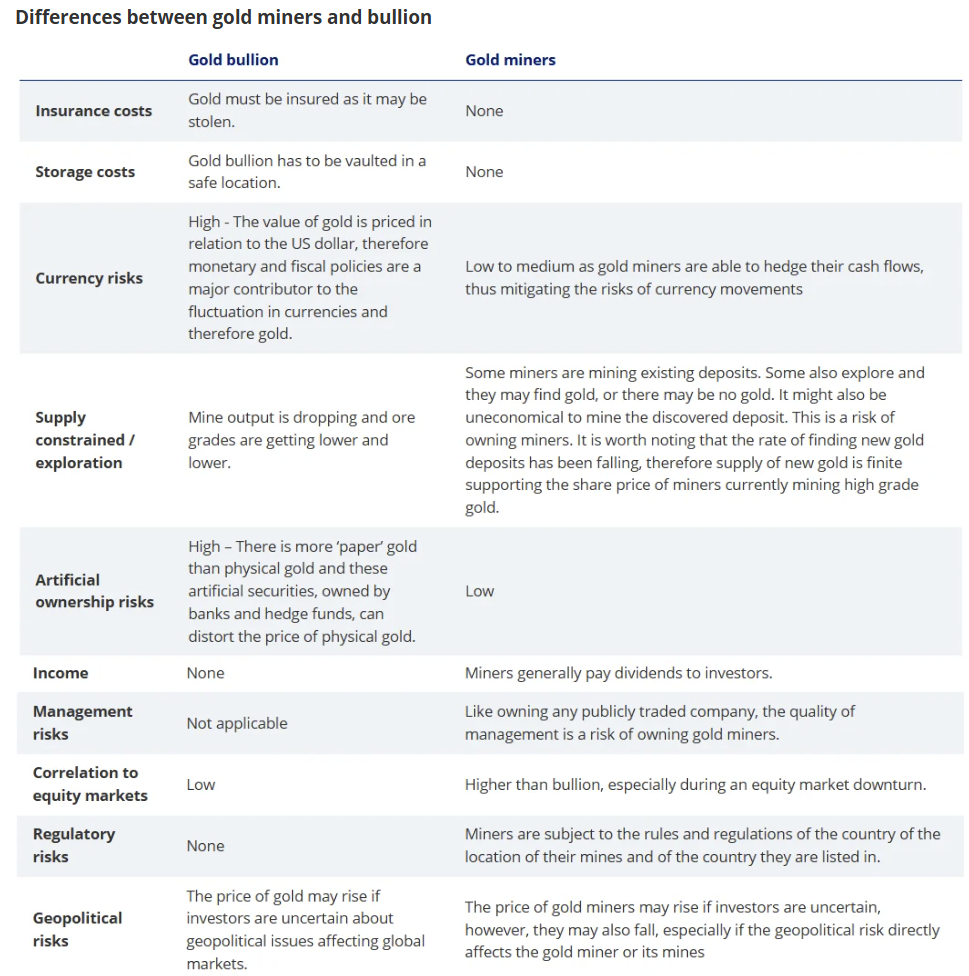

ETFs are an efficient way for investors to access gold investing. There are gold miners ETFs and there are ETFs that invest in physical gold bullion. Below we outline the risks of each type of exposure to gold, owning gold bullion and owning gold miners:

While each gold strategy has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Arian Neiron is CEO & Managing Director of Asia Pacific at Van Eck. VanEck’s Gold Bullion ETF (ASX: NUGG) is an investment in Australian sourced gold. Investors can get diversified exposure to gold miners through the Van Eck Gold Miners ETF (ASX: GDX). Past performance is no guarantee of future performance and the above is not a recommendation. Speak to your financial advisor or stockbroker.