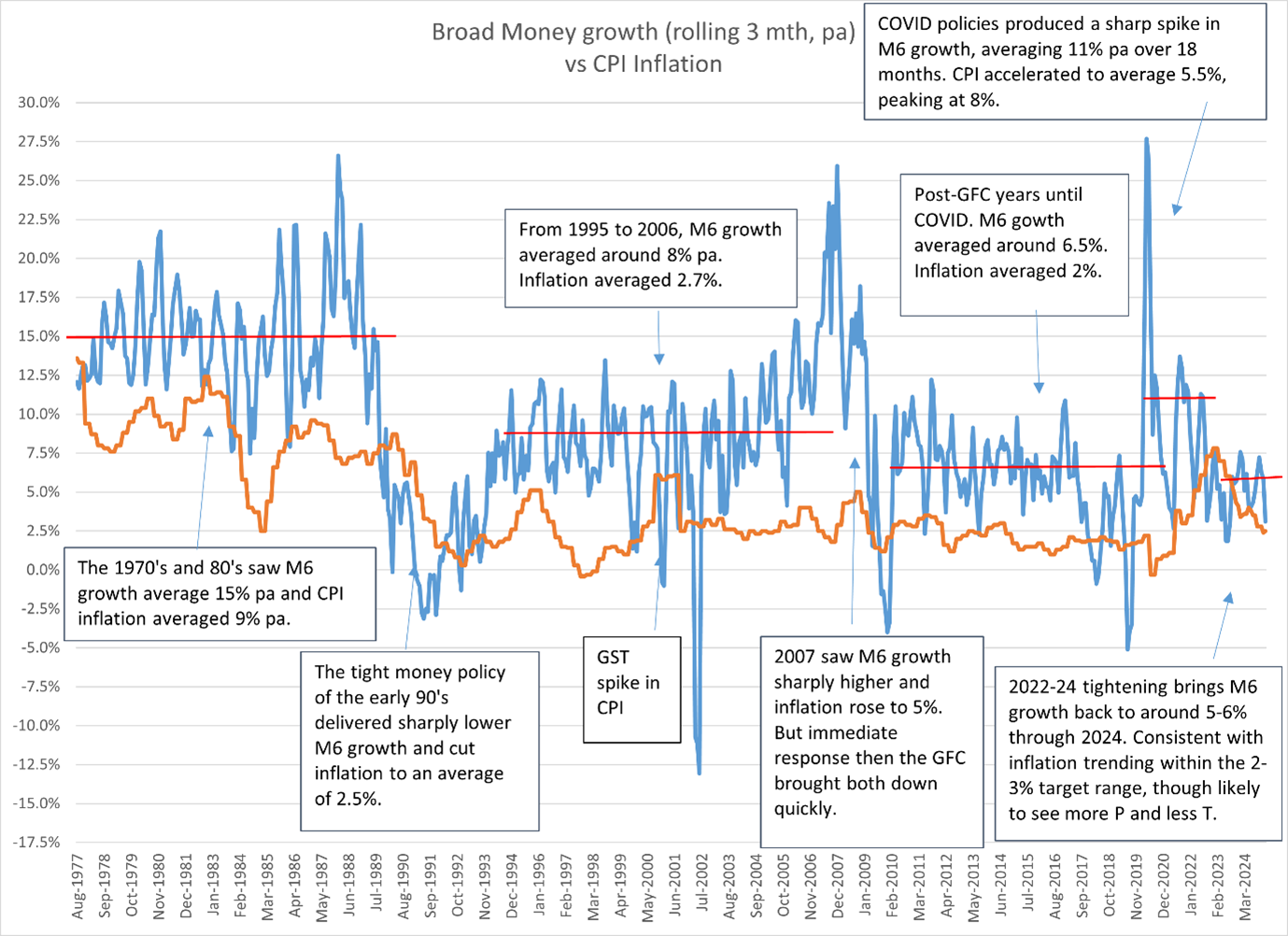

In the middle of last year I wrote about the relationship between money supply growth and prices growth (aka inflation) – see this article from Firstlinks. I’ve been asked for an update on how the story is playing out, so here we go.

In that article, I noted that the annual growth rate of broad money (aka M6) had dipped to 4% in early 2024 but appeared to be trending at around 6%. I proposed that, if this trend rate continued, then that was consistent with inflation heading back into the 2-3% band. On that basis, there would be an emerging case through late 2024 into 2025 for the cash rate to be reduced, though even then I was suggesting that reductions would or should only be modest, into a ‘neutral’ policy range of 3.75-4.0%.

It's played out that way

That’s pretty much what we’ve seen since. M6 growth did accelerate from 4% back up to 5-6% through the spring of 2024 but has slipped again in the summer (to just over 3% p.a.). It continues to trend at around 6%, though possibly a little on the weaker side of that number. In the 6 months since I wrote the article the annualised growth rate has been only 5.2%.

At the same time, inflation has declined from 4% to less than 3%. The CPI figures – both quarterly and monthly – are posting year-to rates at 2.5%.

Many are quick to point out that these outcomes have been manipulated to the downside to some extent by the Government’s energy rebate payments and point to the year-to rate of inflation measured by the trimmed mean of the CPI still being at 3.2% in 2024. I have two responses to that:

- I acknowledge that it’s mathematically true, but ask “so what?” I argue that lower actual inflation rates, from whatever source they come, can be expected to feed into inflation expectations, creating a self-reinforcing trend in the economy.

- To also point out that looking only at year-to rates of growth still includes too much of what was happening almost a year ago and doesn’t look closely enough at what’s going on now. And what’s going on now with trimmed mean inflation is that, for the second half of 2024, it was running at an annual rate of only 2.7%.

So I rest my case. Money growth has been 5-6% pa since I wrote my article and core inflation has slowed to 2.5-3.0%. Although the RBA still doesn’t mention the money supply data in its statements about policy, this is the undeniable background to the rate cut announced this month.

The cash rate of 4.35% did its job. It got inflation down from 8% to less than 3%. It did that by changing the demand for and supply of credit, which is captured in the money supply data. Hence, M6 growth has also slowed from its double-digit levels in 2020-22 to the recent 5-6%.

In the past, M6 growth at this rate lined up with inflation below 2.5%. Unless there’s an over-reaction by borrowers to this month’s rate cut, resulting in a rebound in money growth, this means that the macro environment shows some strong evidence that the RBA’s new inflation target is well within reach.

Here’s an update of the chart that I included in last year’s article.

One RBA review error

I can’t let what I just had to say pass without comment. Of all the things to come out of the review of the RBA, the change from the target being expressed as inflation of “2-3% on average over the cycle” to targeting the mid-point of that range, 2.5%, is the most disappointing and unnecessary. The rationale for the previous formulation was well argued by successive Governors and Deputy Governors over many years. It is a clear commitment to inflation management at a sensible level but doesn’t have the misleading appearance of fine-tuning precision that a spot point target has. Saying that the target is 2.5% simply invites market pedants and the media to quibble if we were to get a reading of 2.4% or 2.6% that policy must be changed to achieve the target.

Money supply is not the whole story for inflation or monetary policy, but it provides an early and good read on whether the cash rate setting is transmitting to accelerating, steady or slowing price pressures. That is, it helps to evaluate if a policy change is working or not. It supports last month’s rate cut decision and I will continue to watch these data in the coming months to understand how much of an impact the cut to 4.1% is having.

Warren Bird has over 40 years’ experience in public service, business leadership and investment management. He is currently a Director of the WA Government Employees Super Board (GESB) and Chair GESB’s Investment Committee. He is also Chair of the independent Audit and Risk Committee of the Illawarra Shoalhaven Local Health District. This article reflects the personal views of the author.