The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

An older journalist once told me never to start an article with a question. Now that's out of the way, here's the question. Why do experienced multi-asset managers never set up their own boutique fund businesses, while managers of specific asset classes do so regularly? In Australia, there are hundreds of single asset fund managers with their own boutique businesses and supporters but none are multi-asset. Are there no asset allocators with a strong reputation? More on that in a moment, as the answers reveal a lot about investing.

***

Meanwhile, another Federal Budget has come and gone, and while it confirmed some changes already in play, there was not much new on superannuation and retirement. As Meg Heffron said in her response, "I don’t recall a Federal Budget with less to say about superannuation in my career of over 20 years." The inflation forecast looks highly optimistic, given ongoing energy cost and wage momentum, with Treasury forecasting a drop to an annual 5.75% for 2022/2023 and then 3.5% for 2023/2024.

The biggest surprise was preventing off-market share buybacks where franked dividends are 'streamed' to shareholders, as used by BHP and the major banks recently. The strategy allowed a capital return made up significantly on a franked dividend, and the article this week by Kevin Davis and Christine Brown covers similar ground.

Then the Australian inflation number released yesterday confirmed what we all knew. Prices are rising mightily, to a 32-year high of 7.3% in the year to the end of the September quarter. It dominates all investing decisions, and CBA's Gareth Aird updated his forecast to a 3.1% cash rate peak:

"There are no two ways about it – inflation is red hot in Australia right now, as it is in many parts of the world, and we expect the RBA will respond by raising the cash rate again at the November Board meeting next week. Indeed our call has been that the RBA will deliver one or two more 25bp rate hikes and then pause for an extended period (the base case was one further 25bp rate hike in November which would take the cash rate to 2.85%). Today we incorporate the second 25bp rate hike into our central scenario for the cash rate, which means we see the peak in the cash rate being 3.10%."

There is plenty of evidence that investment conditions are especially difficult at the moment, as Jonathan Ruffer, Chairman of Ruffer Investment Company, a large UK hedge funds, said recently:

“In the 45 years I have been an investor, I cannot recall a more dangerous period than today ... We see danger ahead. Markets are still too high, and protection is expensive in an increasingly nervous world; common sense suggests one should invest conservatively, and in safe assets. In a world where people find themselves without the ability to pay commitments as they arise, forced selling drives prices. Among risky assets like equities, one of the counter-intuitive things in a liquidity crisis is that securities perceived as safest and most liquid go down sharply, because investors are forced to sell what they can, not what they want to."

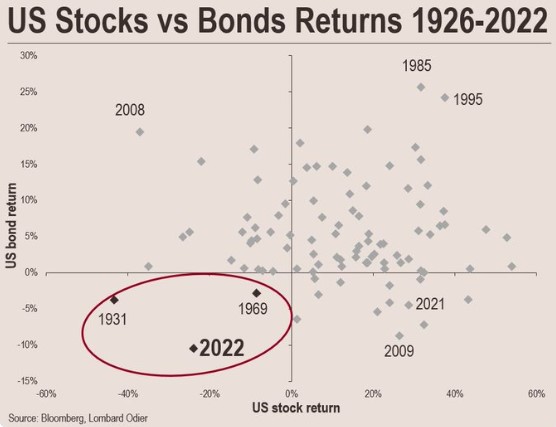

Balanced funds have been the surprise poor performers of 2022, where traditionally a fall in the equity market is offset by reduced interest rates and gains in bonds, protecting a 60% growth/40% defensive portfolio. But both bonds and equities have fallen this year, with returns in the US market among the worst in almost 100 years.

Let's move to the question posed above ...

When anyone starts investing, it must seem as though every professional is smart. They seem so assured and confident in their opinions. But with more experience, we gradually realise that the 'experts' are also befuddled by how markets work. Gerald Loeb was an author and founding partner of E.F. Hutton & Co., a leading Wall Street trader and brokerage firm. He died in 1974 but what did a long career in sharemarket investing teach him?

"The most important thing I have learned over the last 40 years in Wall Street is to realise how little everyone knows and how little I know. Human nature being what it is, a person buying a stock at the wrong time is very apt to double his error and sell it at the wrong time."

"How little everyone knows ..." So here's the question again. Why are the hundreds of portfolio managers who have left large institutions to set up their own boutique funds always focussed on a particular asset class (such as global equities, domestic bonds or property) and never allocators across multiple asset types? Most of the return in a balanced portfolio comes from asset allocation and not stock selection, and yet nobody steps out of a large fund manager with a strong personal reputation to establish their own boutique multi-asset fund.

I put the question to Chris Cuffe, who has spent much of his long and successful career selecting fund managers and allocating assets. Chris gave me a quick four-word answer: "Nobody can do it." He then elaborated to add, "Well, consistently over a long enough time period" and he reminded me of an article he wrote in Firstlinks called "Why we can't resist tactical asset allocation" which includes this quotation from Nobel Laureate, Daniel Kahneman:

“We cannot suppress the powerful intuition that what makes sense in hindsight today was predictable yesterday. The illusion that we understand the past fosters overconfidence in our ability to predict the future.”

Chris also noted that multi-asset funds attracted strong inflows in the early days of the managed fund industry, but then financial advisers took over the asset allocation roles. He initially launched his charitable Third Link Fund in 2008 as a multi-asset fund, thinking it was the structure to generate the most support, but in 2012, he switched it to invest only on Australian equities to meet the greater sector-specific demand.

I also asked the team at Pinnacle Investment Management why asset allocators do not set up boutiques. Pinnacle has alliances with 15 boutiques and assets under management of over $80 billion, and is always on the lookout for investment talent. Managing Director Ian Macoun replied:

“From our perspective, we don’t think there is a significant market for that service in the ‘mainstream’ retail or institutional markets. Institutions, financial advice groups and retail platforms have their own professionals who make the asset allocation decisions, and there are plenty of established firms who can provide advice to them if they seek external specialist assistance. It would be a different story in the ‘direct to retail’ market - but that is a tough market to crack.”

And Chris Meyer, Director, Listed Products at Pinnacle, who has delivered many boutique funds to an ASX listing, added:

"1. Most of our clients look to boutiques for excellence in individual asset classes rather than outsourcing the asset allocation.

2. Multi-asset funds haven’t (historically anyway) enjoyed great success in the Australian market other than through the more captive retail distribution channels and in the default super channel where those firms like AMP or Australian Super build those multi-asset funds themselves (sometimes using external managers or their in-house capabilities). Unless the independent advice channel start using multi-asset funds more, advisers really aren’t on the lookout for multi-asset boutiques/allocators."

So while nobody has a market-leading reputation for asset allocation, in any case, it is usually done within the large super funds under advice from asset consultants and from in-house resources. Even there, asset allocations are 'range bound' within relatively narrow bands. There is too much business risk in deviating from the range, especially due to APRA's performance tests.

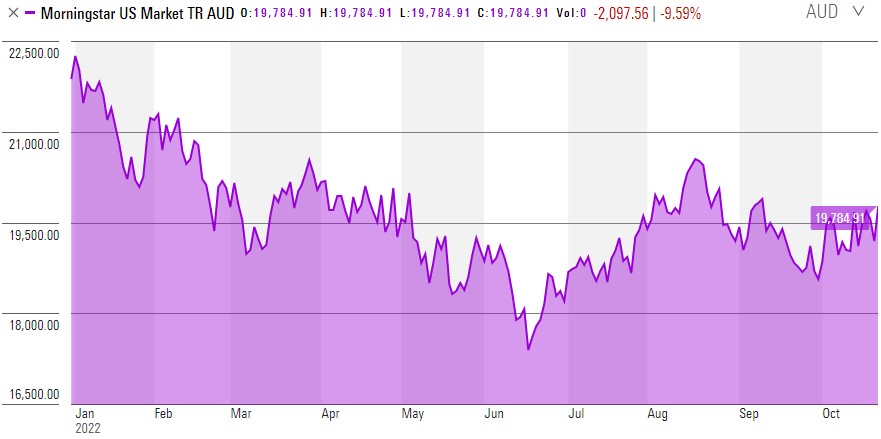

Consider the current market, where the Morningstar US market Total Return Index (in AUD terms) has lost 10% year-to-date. It has recently rallied based on expectations that after another 0.75% Fed funds increase in November 2022, the December increase will be only 0.5%. Do we have a market bottom or a 'bear market rally'? We all ask the question but the answer is known only in hindsight.

Many investors have stepped back from equity exposure while they wait for the market to settle, and we take a look at the alternative ways cash can be invested rather than suffering poor returns in the transaction accounts of major banks with six rules to consider.

And in case anyone saw my whinge about CBA last week and thought it reflected my technical ignorance, I finally received a response from CBA. The solution to opening a TD online is ... visit a branch.

"As advertised on the CommBank website you should be able to open a Term Deposit online under a personal or Self-Managed Super Fund (SMSF) name. We are aware of a current issue in completing this process within NetBank; that is causing an error message on some attempts (possibly even on repeated attempts). While it is being investigated I can, at this time, provide no timeframe for resolution. I wish to sincerely apologise for the inconvenience this causes. I can confirm that you are still able to open Term Deposits by visiting your nearest branch."

Gosh, opening a TD for an existing customer should be a walk in the park. But then it got worse for my CBA cash account. As I researched my article this week, I discovered that the account linked to my CommSec Trading Account (which CommSec does not want to respond to questions about because it is a CBA account) has been earning interest based on a lower rate scale than the proper SMSF rates, as shown in the following schedule. It was always known to CBA/CommSec that this was an account for my SMSF, and the name of the account is clearly my superannuation fund. CBA has the audacity to say it's my responsibility to ask for it to be switched. Wouldn't you think the recent fine of $20 million to CommSec for 'systemic compliance failures' would be an incentive to remove these practices? I have asked CBA to go back and calculate my interest at the higher rates.

* Option only available for self-managed superfunds (SMSF) that elect the SMSF CDIA

option at account opening or have requested to switch onto the SMSF option.

And in a weekend update, after I wrote the written complaint about these rates and asking for a change, I received a call from the Complaints Section advising me to call CBA. Say what? I asked whether it seemed strange that I had already put my request in writing, and now CBA was calling me to tell me to call CBA. She said she does not have authority to make the change. So I called CBA and gave up after an hour of music. Is this all designed to ensure I give up and stay on the lower rate?

Also in this week's edition ...

Instead of trying to pick the bottom of the market, Andrew Clifford and Julian McCormack of Platinum argue for investing in quality stocks at good prices even if market conditions are not ideal, and waiting for better times to return, rather than staying out of the market.

Jennifer Mead worked with the late Phil Ruthven for many years, and in a tribute to him, she describes five lessons she learnt from him which still guide her investment decisions. Ruthven was an adviser to many major companies and a great supporter of Firstlinks.

Australian residential property prices have fallen by about 10% from their February 2022 highs after the extraordinary gains in 2020 and 2021 under misguided central bank stimulus, but Damien Klassen of Nucleus Wealth looks at valuation metrics to suggest prices still have a way to fall.

As mentioned above, Christine Brown and Professor Kevin Davis examine the Government's proposals on franking credits funded from capital raisings in their submission to the Treasury consultation process which just closed, with relevance also to this week's Budget announcement on buybacks.

Sawan Tanna of The Perth Mint then takes a quick journey through the history of gold and other items as money, and explains why gold has retained its money characteristics over the centuries.

And Kristin Ceva of Payden & Rygel explains the diversification and yield benefits of emerging markets (EM) debt. Most Australian investors probably think of EM only in equity terms, but some EM debt markets throw up high returns which rely on income rather than capital gains.

In the two new Morningstar articles for the weekend, Ollie Smith checks the extraordinary 70% fall in the share price of Meta (Facebook) despite its strong balance sheet, while Christine St Anne reports on global research showing Australians invest a higher proportion in equities versus bonds and cash relative to almost every other developed country.

This week's White Paper from NAB/nabtrade looks at the 2022 Federal Budget and its implications for investing.

I am taking a short sabbatical to recharge the batteries, and the coming weeks will be covered by long-time colleague, Leisa Bell, and a new editor at Firstlinks and Morningstar, James Gruber. James has written for several global publications and worked for many years as an equity analyst and portfolio manager, and it will be good to hear some fresh perspectives after a decade from me.

Graham Hand

Weekend market update

On Friday in the US, the market closed on a strong note with the S&P500 up 2.5% on the day, and NASDAQ even better at 2.9%. The bounce faces a test next week at the Federal Reserve's next meeting when further monetary tightening will be discussed. In 2022, each time the market has rallied in anticipation of an easier Fed stance, a strong inflation, employment or growth number has confirmed the resolve to increase rates rapidly.

From AAP Netdesk: The local share market snapped its four-day winning streak on Friday, with the mining sector suffering its worst losses in a month after a Brazilian iron ore giant posted lacklustre quarterly earnings figures. The benchmark S&P/ASX200 index closed down 59 points, or 0.9%, to 6,786. The ASX200 still gained 1.6% for the week and is up 4.8% in October.

Also on Friday, the Australian Bureau of Statistics reported exports dropped in the September quarter for the first time since 2020. Softer demand for iron ore from China led to a 16.9% drop in "metalliferous ores and metal scrap" exports, the ABS said.

BHP fell 5% to a one-month low of $37.48, Fortescue Metals fell 8.2% to a one-year low of $14.76 and Rio Tinto dropped 4.4% to $88.55.

Tech stocks were also under pressure after more subpar earnings results from US tech giants overnight, this time Apple and Amazon.

The heavyweight financial sector finished up 0.4%, with Macquarie having an up-and-down day despite beating first-half earning expectations with a $2.3 billion profit. The investment bank was up as much as 3.9% in morning trading before losing all of that and then some. CBA gained 0.8% to $103.22, NAB rose 0.3% to $32, Westpac added 0.9% to $23.99 and ANZ grew 0.9% to $25.21.

In healthcare, ResMed fell 5% to $33.91 as the medical devicemaker announced its revenue grew 5% to $950 million for the three months to September 30, compared to a year ago.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Monthly Funds Report from Cboe Australia

Plus updates and announcements on the Sponsor Noticeboard on our website