The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

As we head into an election year, the cost-of-living crisis will be at the forefront of voters’ minds. The good news for the Government is that cost inflation is continuing to ease.

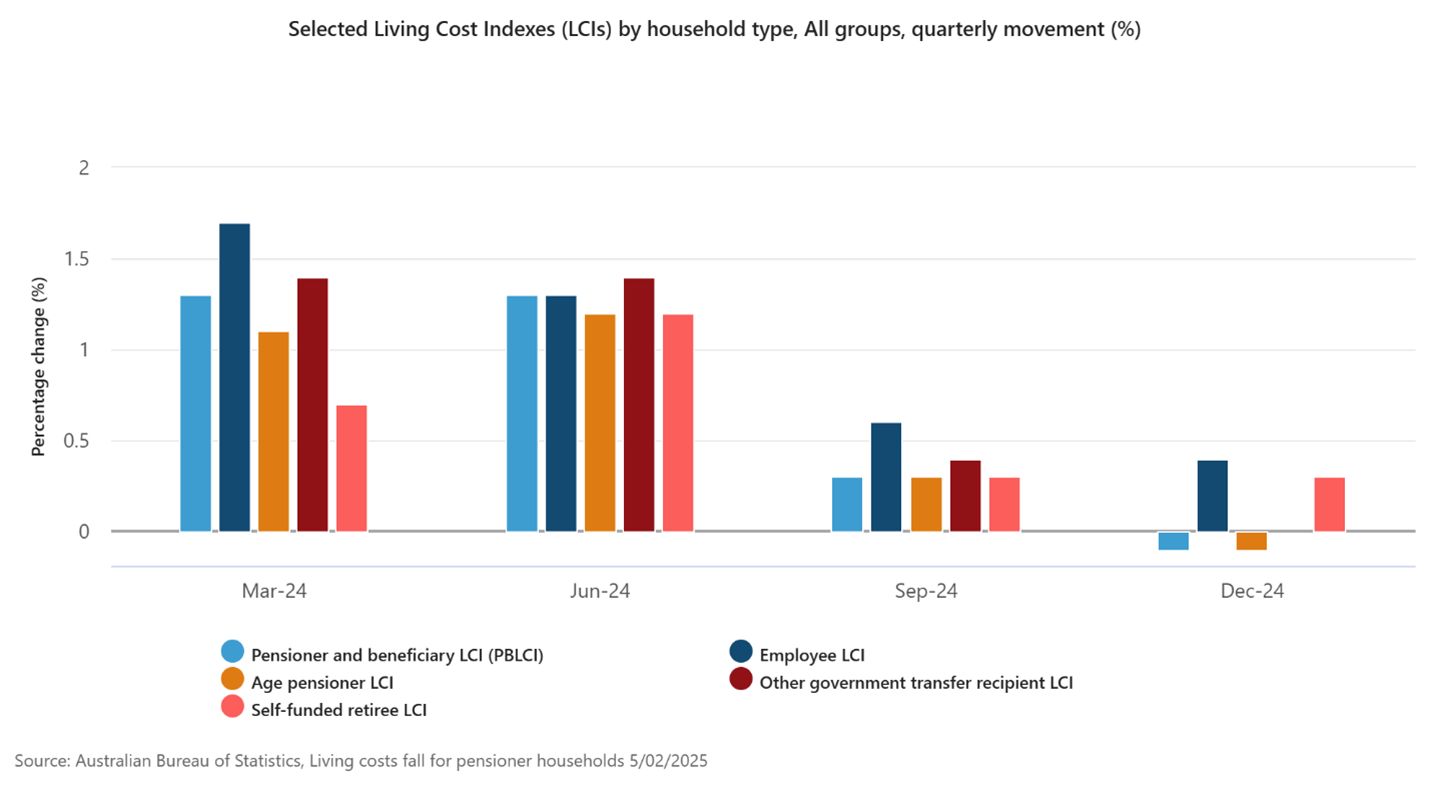

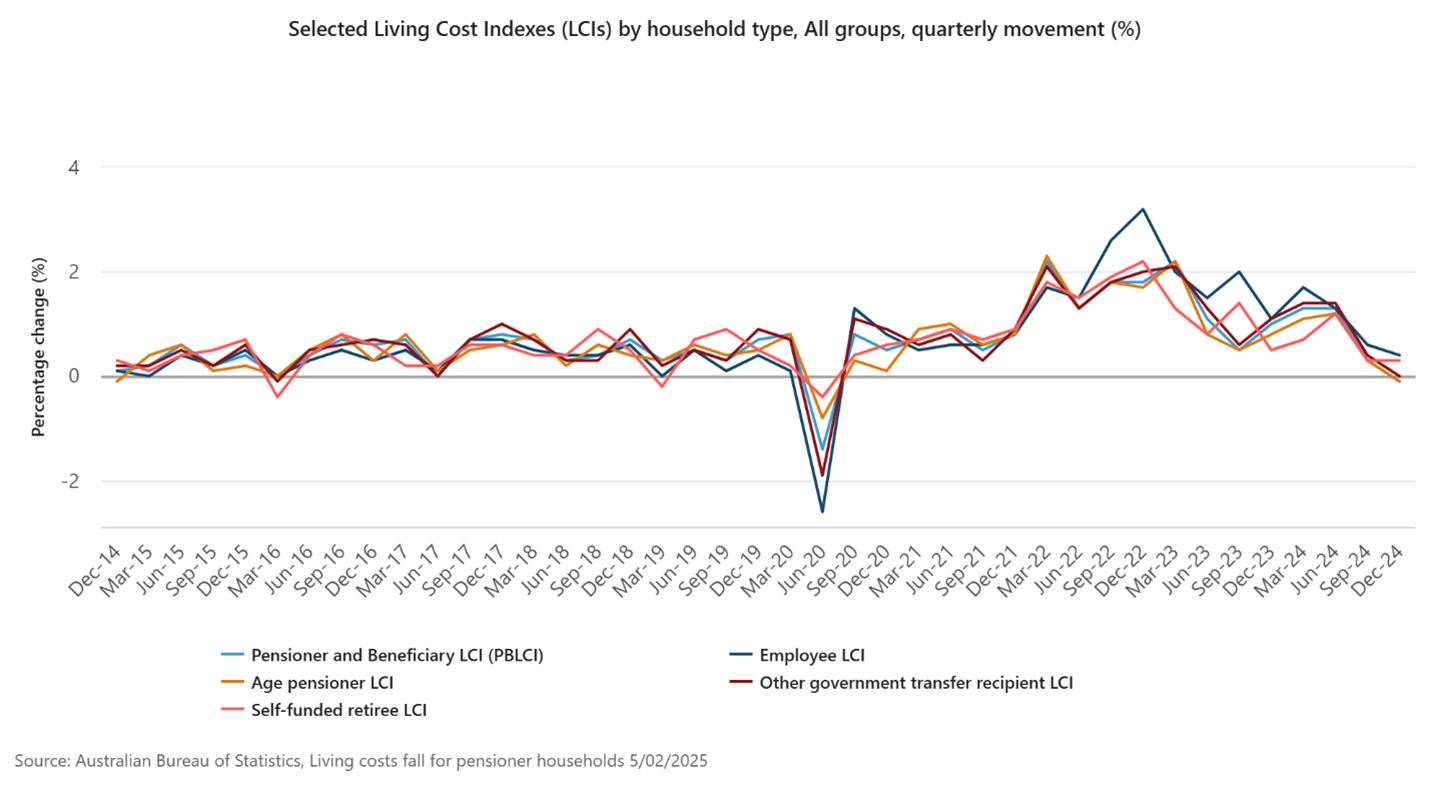

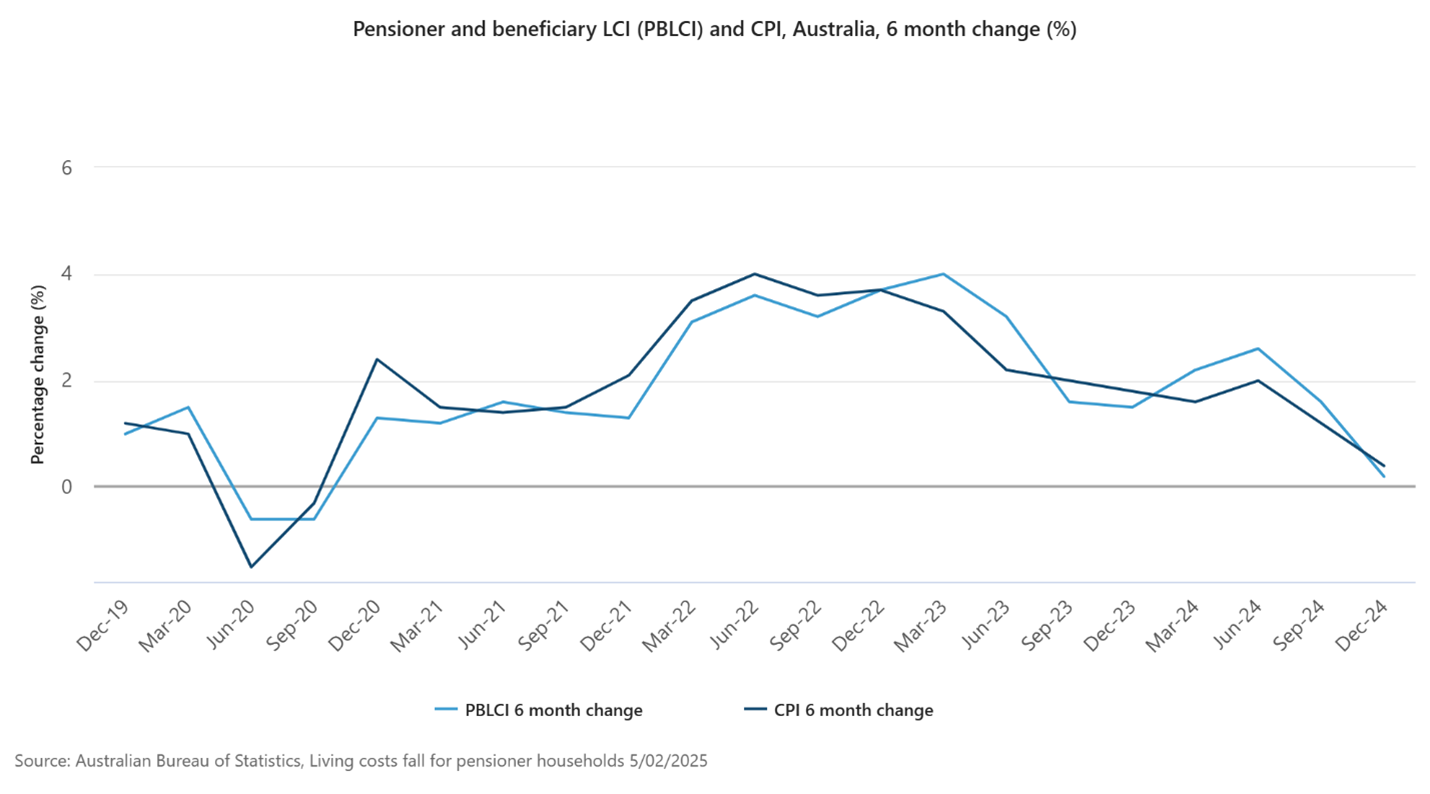

The Australian Bureau of Statistics’ (ABS) cost-of-living indices show living costs for age pensioner and pensioner and beneficiary households fell by 0.1% in the December quarter. For these groups, it was the first fall in quarterly living costs since the height of the Covid crisis in mid-2020.

They were helped by two things. First, lower prices for electricity due to the 2024-25 Commonwealth Energy Bill Relief fund rebates. Second, an increase in Commonwealth Rent Assistance in the quarter, especially for age pensioner and pensioner and beneficiary households. This increased assistance reduced the amount of rent payable by eligible households.

So-called ‘employee households’ didn’t fare as well. Their living costs went up 0.4% in the December quarter due to this group being more impacted by higher mortgage interest charges, partly from the continued rollover of expired fixed rate mortgages to higher variable rate mortgages.

However, living costs increases for workers for the December quarter were still considerably lower than the 0.6% and 1.3% recorded in the September and June quarters of last year.

In the year to December, there was also progress. The ABS says it was the lowest rise in annual costs in more than two years. Households benefited from declines in electricity and fuel, as well as slowing growth in food prices, insurance premiums and mortgage interest charges.

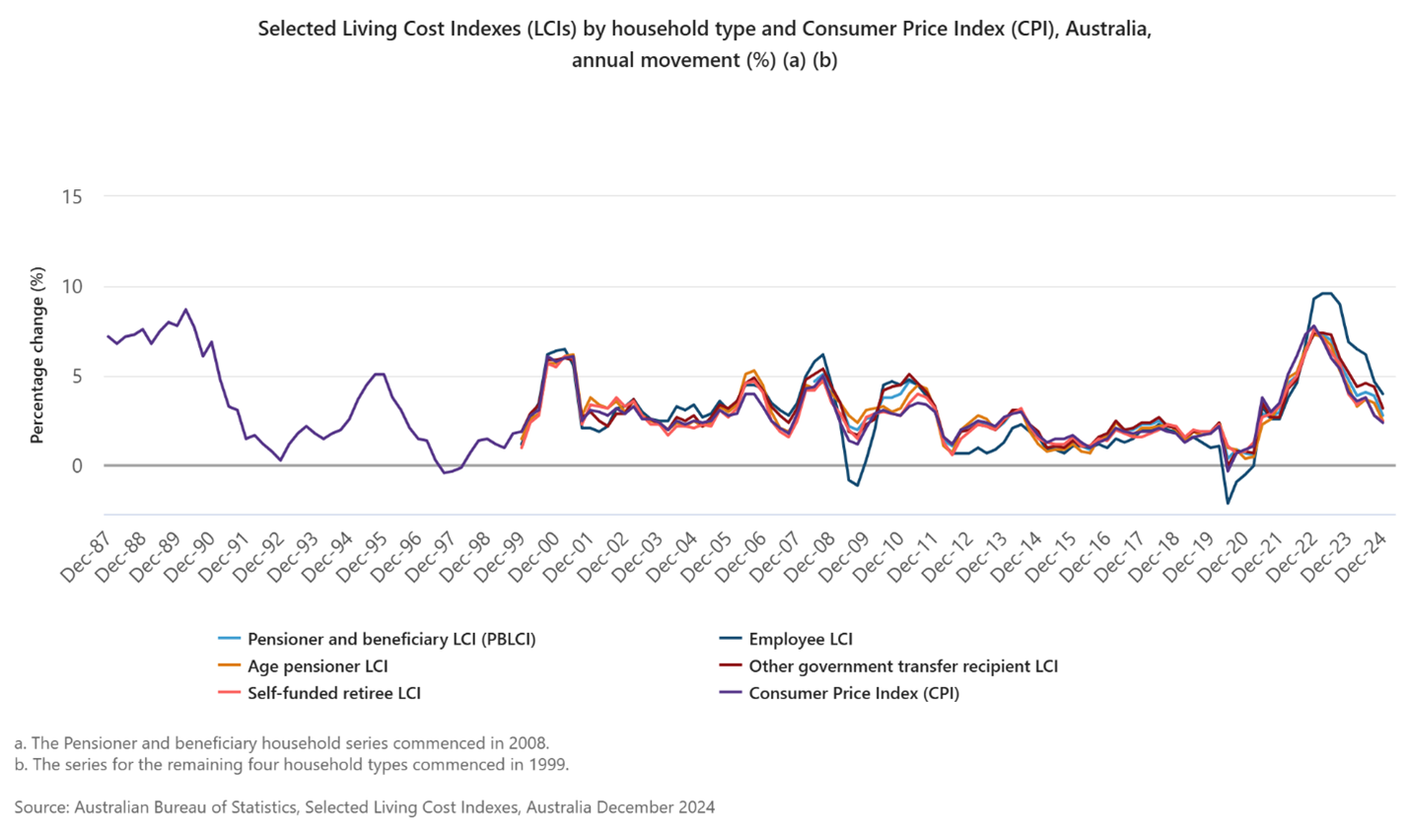

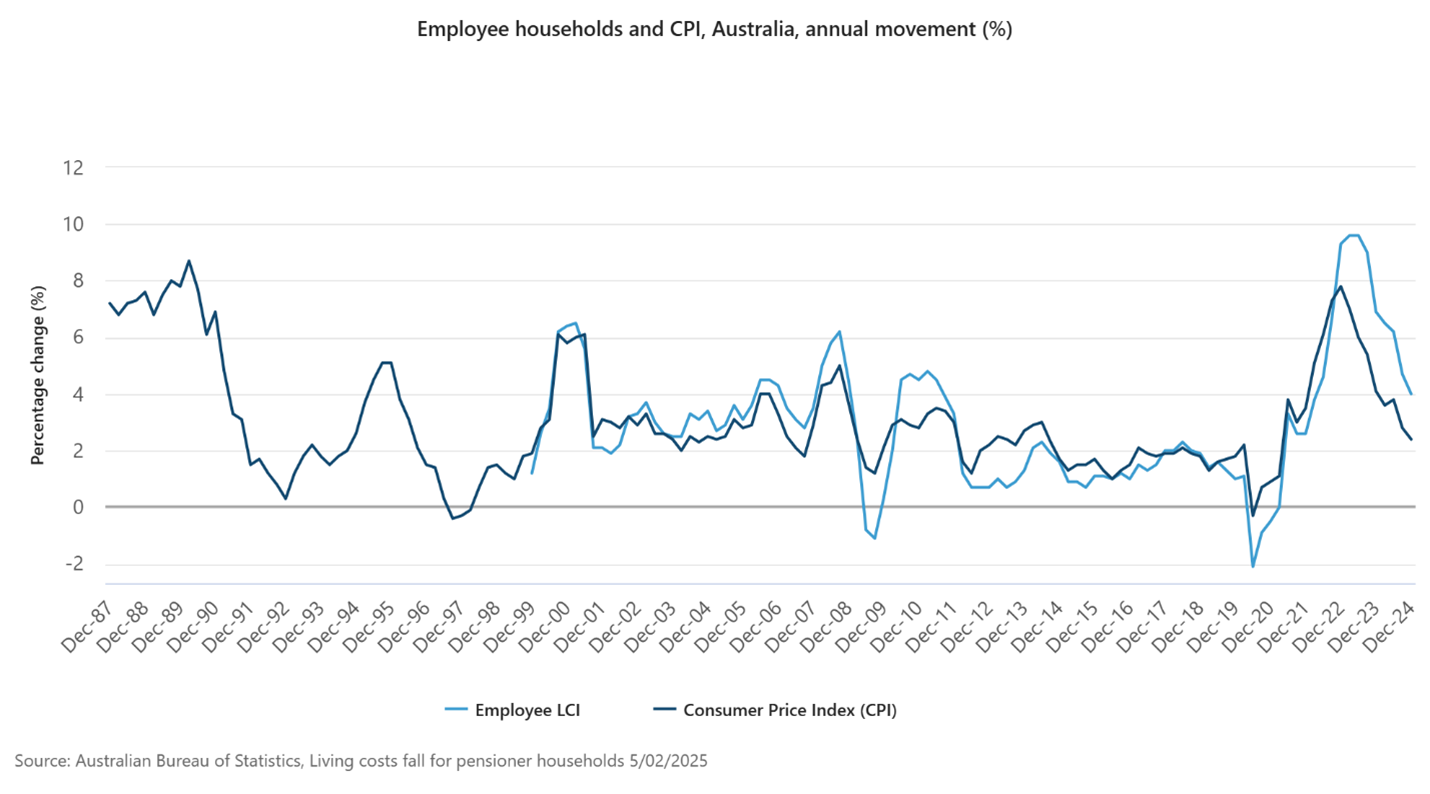

Despite slowing increases, annual costs for each group were still above official CPI figures. Worker household costs rose 4% in the year to December, while those of pensioner and beneficiaries were up 2.8%, and aged pensioners and self-funded retirees were both 2.5% higher respectively – compared to the 2.4% increase in annual CPI.

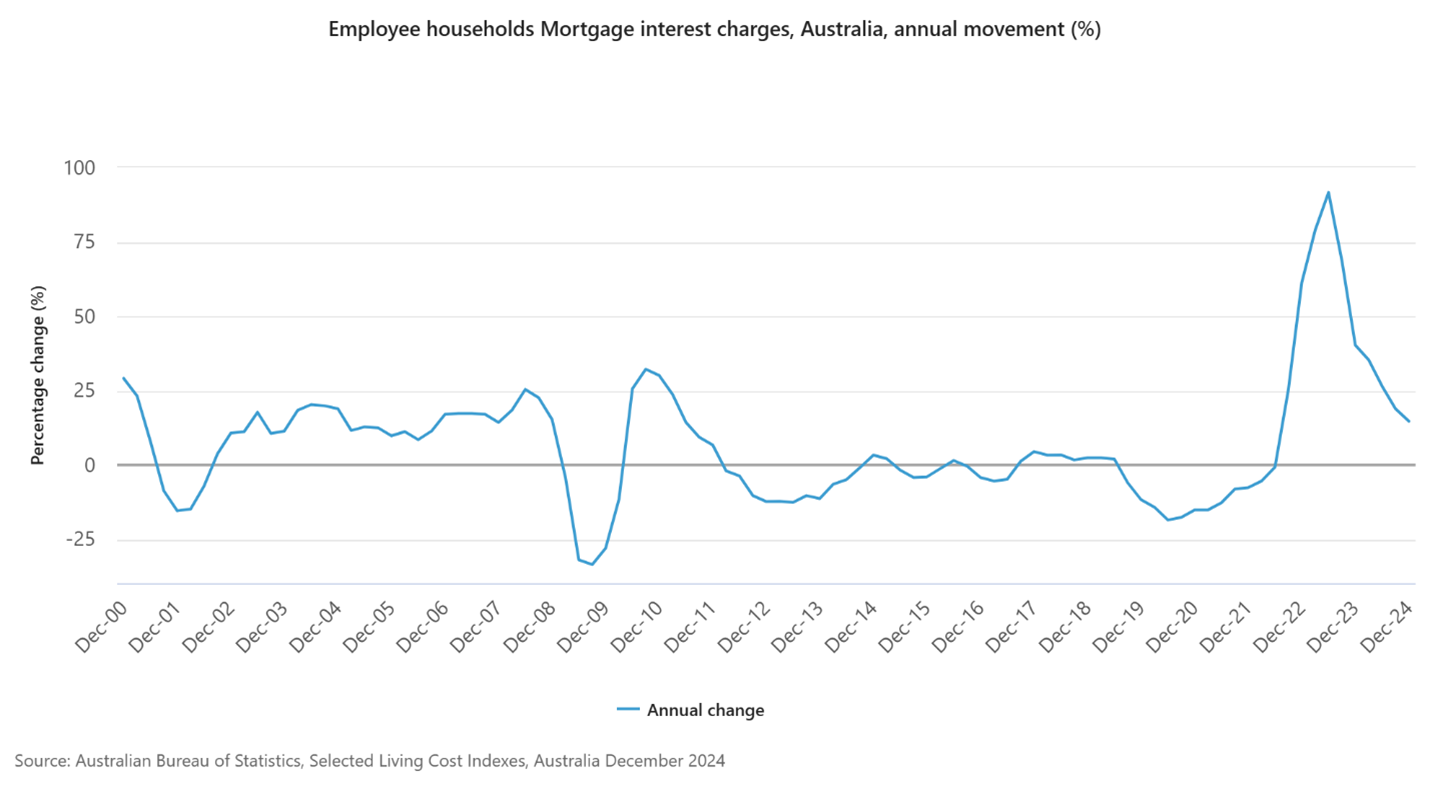

The cost-of-living increase for workers was higher principally because of mortgage interest charges. These charges went up 14.7% for the year. Though worker cost growth of 4% was high for the year, it was still well down from the 6.9% recorded the previous year.

Age pensioners and self-funded retirees saw the smallest annual rises in living costs due to mortgage interest charges and rents, both of which rose over the year, making up a smaller proportion of spending for these households.

It’s positive for the Government that the cost-of-living crisis is largely in the rearview mirror. The problem is the cumulative inflation that’s happened over the past few years. In the three years to December 2024, the CPI is up 15.3%, but the living costs for workers has risen 21.2%, while for pensioners it’s up 16%, and for other groups it’s been largely in line with official inflation. For all the different households, there’s been a significant increase in costs over a short period.

Unfortunately for the Government, people don’t celebrate when costs don’t rise as fast as they once did. Instead, they remember that the $5 that they paid for a coffee a few years ago is now $6.

Let’s see how it plays out in the upcoming election.

*For the un-initiated, the ABS cost-of-living indices are a useful alternative to the wide-quoted consumer price indices (CPI). While the CPI measures price changes, cost-of-living inflation is the change in spending by households required to maintain a given standard of living. The main difference between the CPI and the living cost indexes is that ‘living costs’ include interest paid on mortgages whereas ‘consumer prices’ do not.

----

In my article this week, many assume that with rate cuts pending, house prices will again rebound after tepid growth last year. I crunch the numbers on housing affordability and suggest that it's likely to cap further price rises.

James Gruber

Also in this week's edition...

How do you start accessing your super funds when you stop working, or maybe even before you stop working? Vanguard's Tony Kaye provides a primer on moving into pension mode.

Glenn Davies and Chris Evans examine the capital gains tax main residence exemption and declare that it's no longer 'fit for purpose', due to its inequities, inefficiency, and complexity. They suggest ways that the concession could be adapted or curtailed.

Schroders Group CIO, Johanna Kyrklund, says investors face two key risks this year: the potential for higher bond yields to threaten equity valuations and any slip-up from the Magnificent Seven tech stocks given the market's heavy reliance on these companies. She outlines how to position your portfolio to meet these challenges.

There's been a lot of talk in the media about 'Big Super' and the systemic risks that it may pose. David Bell and Geoff Warren detail how these risks are likely overplayed and that we're better off having the mega super funds.

DeepSeek has hit the share prices of data centre companies, including Goodman Group and DigiCo. Resolution Capital's Andrew Parsons says data centre operators aren't just an AI story, and he remains optimistic on the industry outlook.

Gold was the best performing major asset class in Australian dollar terms last year. Ray Gia looks at what's in store for the yellow metal in 2025.

Two extra articles from Morningstar this weekend. Shane Ponraj reacts to an ASX healthcare leader’s solid results, while Joseph Taylor dissects a simple approach to investing suggested by Warren Buffett.

Finally, in this week's whitepaper, RQI Investors investigate market concentration and its implications for equity investors.

****

Weekend market update

US equities closed broadly lower on Friday after the economy added fewer new jobs last month than expected, and a survey found consumers increasingly worried about rising prices, bolstering the case for the Federal Reserve to hold rates steady for longer. Also, President Donald Trump said he plans to announce reciprocal tariffs on many countries early next week. The S&P 500 fell 0.9%, the Dow Jones declined 1%, while the Nasdaq Composite shed 1.4%. The yield on US 10-Treasuries lifted five basis points to 4.5%. Gold settled at US$2,888 an ounce, up 0.4%, after touching a new all-time high earlier in the day.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Quarterly ETFInvestor (ETF Market Data) from Morningstar

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website