The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Every time I go to Canberra, I marvel at it being clean, green and generally upper-middle class. It’s been that way for a long time and it’s no accident. Obviously, it houses federal public servants and has benefited from increased government spending, federal and local, since it was created. A bet on most things Canberra has been a one-way bet for 100 years, and I expect that to continue for the next 100 years.

Why? Because increasing government spending is one of the few secular trends that you can bank on. The federal government is running budget deficits and is projected to run those deficits over the next decade.

It’s not only here. The US government is spending trillions each year, running deficits that are the largest in a non-recessionary, peace-time world. Europe is similar, and Japan too.

Overall, governments worldwide love to spend more money, and there are no signs that it will change any time soon.

The downsides of this government largesse are widely known. Less discussed are the potential opportunities, so let’s do that here.

Defence and policing

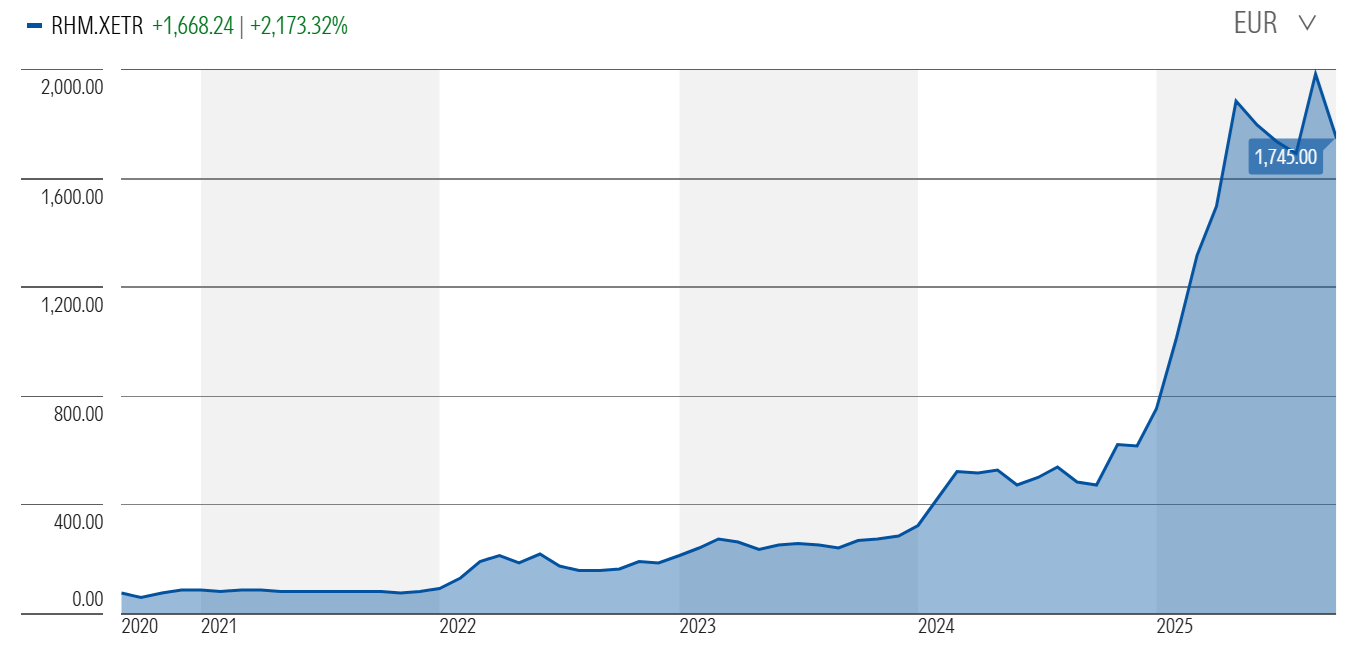

Defence is an obvious one. At the start of his second term as US President, Donald Trump made it clear that the US wouldn’t continue to be the world’s policeman and he pressured other countries, especially Europe, to lift defence spending. The European Union has committed to increasing defence expenditure from under 2% of GDP to 5%. Naturally, European defence stocks have since gone ballistic (have a look at the share price of German arms manufacturer, Rheinmetall AG below).

Rheinmetall AG share price

Source: Morningstar

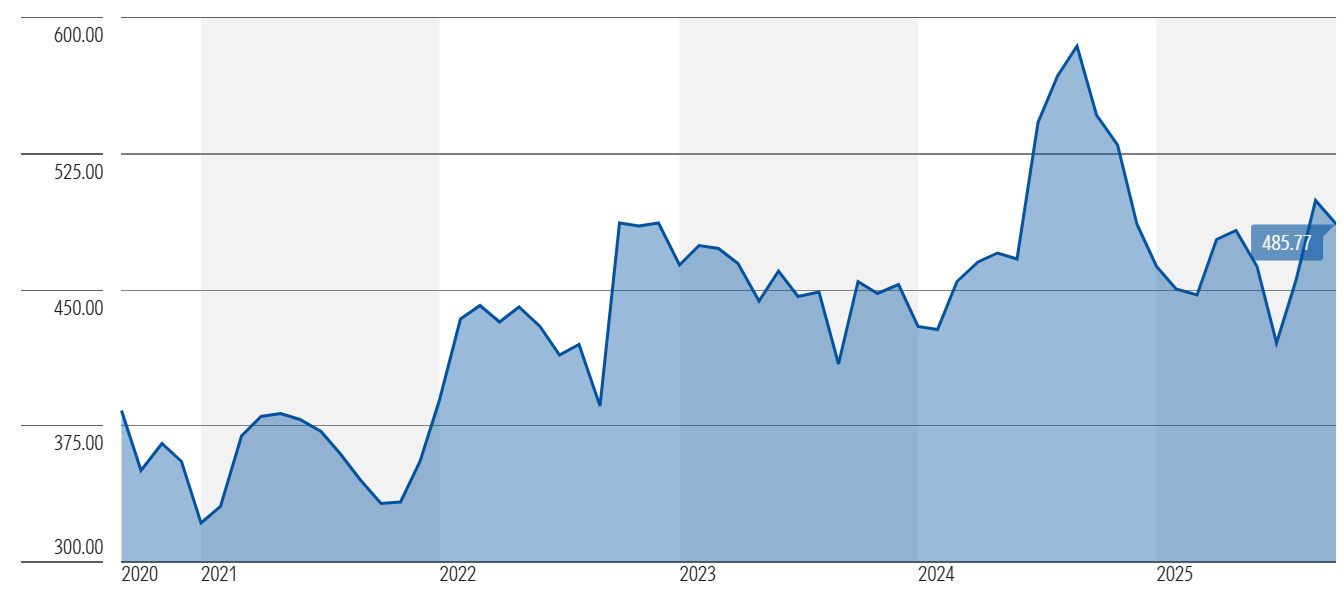

US defence stocks have lagged. If you believe that government spending on defence will continue to rise in the US, and that there’s the potential for increased major power conflict in future, ie with China, then stocks like Lockheed Martin, Northrop Grumman, and General Dynamics look reasonable value. The beauty of these stocks is that they’re also resilient, generally outperforming during market downturns.

Lockheed Martin share price

Source: Morningstar

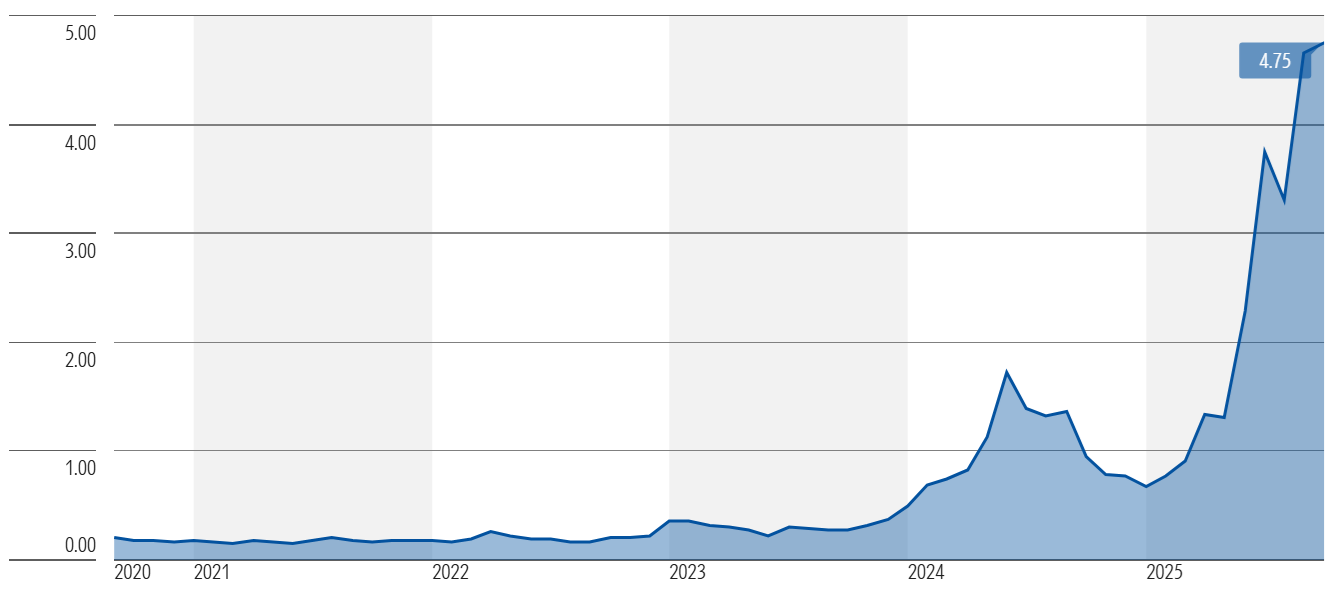

Australia has also committed to boost defence spending from around 2% of GDP to 2.4% by 2033-2034. Unfortunately, most of the stocks on the ASX have already factored in this news and positive headlines from overseas. Stocks like DroneShield, Electro Optic Systems, and Austal are worth monitoring, though.

Droneshield share price

Source: Morningstar

Defence is a trendy theme right now, evidenced by the VanEck Global Defence ETF being up 97% over the past year to September! However, there still seems to be pockets of opportunity.

Policing and public safety also benefit from government spending. In Australia, there aren’t any stocks that I know of which are exposed to these areas. In America, AXON Enterprise, which created the taser gun and provides things like body cameras for police, is one company that has successfully ridden this trend.

Software

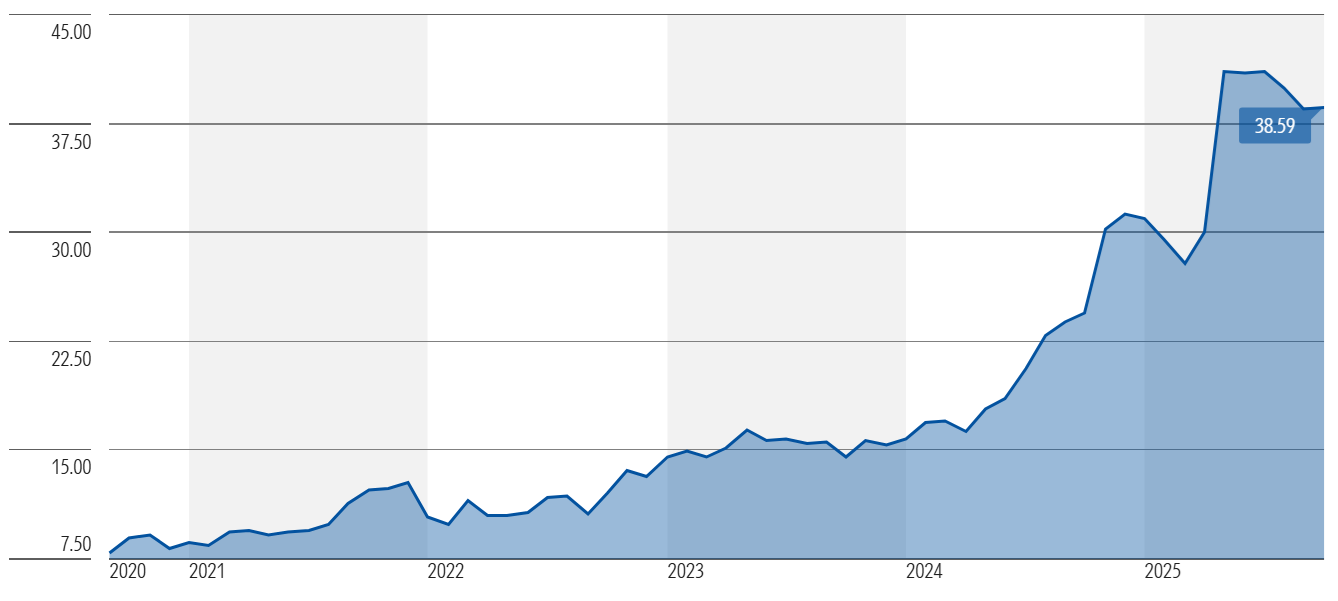

Software is a beneficiary of increasing government spending on technology. In Australia, Technology One’s enterprise software powers many local councils, and state and federal governments. The company has been a stellar performer on the ASX for a long time.

Technology One share price

Source: Morningstar

In the US, Tyler Technologies, a software company with 95% of revenue from governments, has also been an amazing business in recent decades.

The Olympic Games in Brisbane

Thinking laterally, the lead-up to the Olympic Games in Brisbane in 2032 will bring with it plenty of government spending on new stadiums, transport systems etc. Suppliers are one way to play this. Construction materials company Wagners and scaffolding business Acrow have large exposure to south-east Queensland and are likely winners from this.

Wagners share price

Source: Morningstar

Land lease communities

There are a growing number of retirees and housing is expensive, so more of them are taking up the option of land lease communities. With these communities, they own buy a home without the land attached, making it much cheaper. The businesses own the land, and get rent from the retirees, and the rent increases in line with the pension.

Stocks such as Ingenia, Lifestyle Communities, and Gemlife Communities offer exposure to this theme. Property developer Stockland is also aggressively growing its land lease portfolio.

Ingenia share price

Source: Morningstar

Infrastructure and construction

This is more of a US theme. The Biden Government, and now Trump, have committed to a massive public infrastructure program, via the US Infrastructure Investment and Jobs Act, CHIPS Act, and Inflation Reduction Act. That will drive demand for materials and engineering.

American stocks that should capitalize on this tailwind include Jacob Solutions, Fleur Corp, Vulcan Materials and Martin Marietta.

In Australia, housing is one to watch. We’ve all heard about how we’re not building enough homes. Over time, governments will incentivise more construction and that could benefit the likes of SGH, owner of Boral.

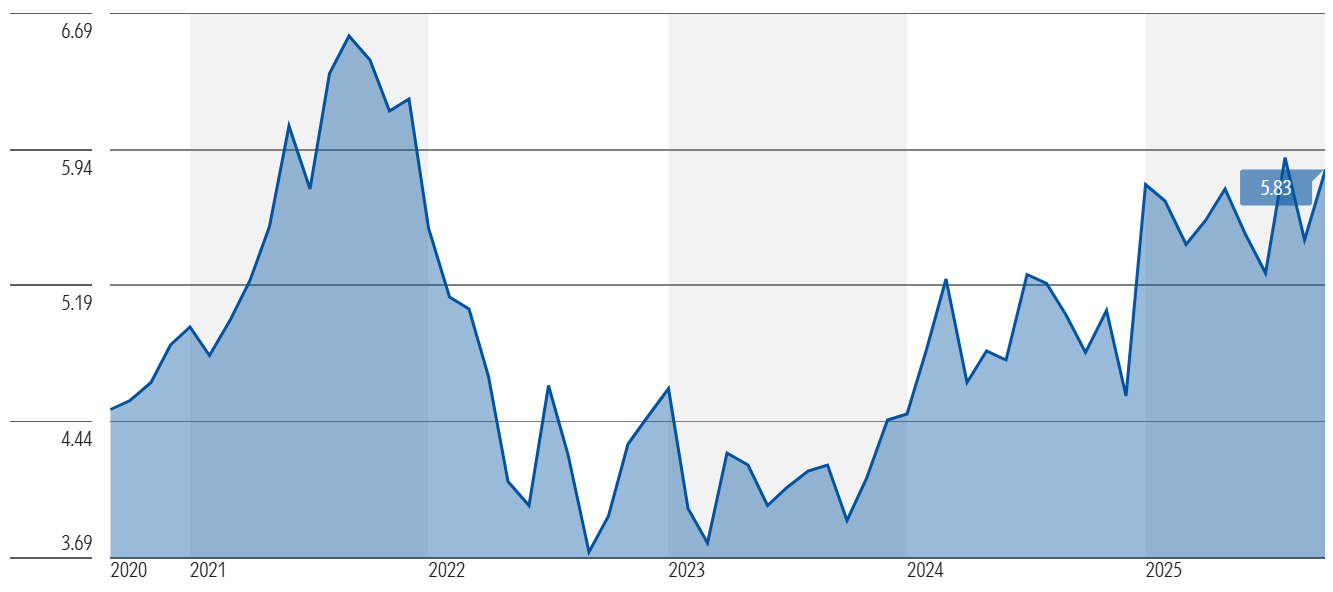

SGH share price

Source: Morningstar

Healthcare?

Australia’s population is ageing and that means more government spending on healthcare. However, the structure of many healthcare industries isn’t appealing. For instance, private hospitals and aged care suffer from burdensome regulation.

Healthcare insurers are potentially attractive, though the industry runs the risk of being restructured to allow more money to flow to private hospitals at the insurers’ expense.

There are lots of indirect beneficiaries from rising healthcare spending, like CSL and ResMed.

Overall, though, most of the healthcare industry gains from government spending though runs the risk of government intervention squashing returns on capital.

Ideally, you want the spending without the intervention.

****

I have two articles this week. First, I investigate LICs versus ETFs and which deliver the best returns. The answers are revealing.

Second, I've reprised my most popular-ever article, '18 rules for ageing well', written in November 2023. The rules include, 'the unexamined life lasts longer', 'change no more than one-eighth of your life at a time', 'nobody is thinking about you', and 'pursue virtue but don’t sweat it'.

James Gruber

Also in this week's edition...

Harry Chemay is back, this time with a piece on the growing debt burden of retiring Australians and the challenges, solutions and opportunities that presents.

The recent savage share price falls in CSL and WiseTech are a reminder that large cap stocks aren't risk-free. Yarra's Dion Hershan suggests these aren't isolated cases and the ASX 20 is full of broken blue chips. He thinks the days of simply holding blue chips forever is gone, and investors increasingly need to look elsewhere to grow their wealth.

My children love eating burritos and nachos from Guzman y Gomez, though that hasn't shown up in the recent share price performance of the company. Airlie's Will Granger has taken advantage of the price dip to top up his position in GYG, and here he explains why.

Factor-based investing, long the domain of institutions and active managers, is now accessible to everyday investors through ETFs. VanEck's Russel Chesler explains how these smart beta funds use defined rules to target specific drivers of returns, like quality, value, momentum, and low volatility, and offer low-cost and easy-to-trade alternatives to traditional active funds.

John West reviews recent best-selling book, Breakneck: China's Quest to Engineer the Future. The book's author, Dan Wang, contrasts China’s “engineering state” with America’s “lawyerly society,” showing how these mindsets drive innovation, dysfunction, and reshape global power amid rising rivalry. John says it's a simplistic view though the book offers many fascinating observations of the two superpowers.

Two extra articles from Morningstar this weekend. Shane Ponraj and Roy Van Keulen look at the bombs dropped at CSL and WiseTech this week and assess whether there is value in these stocks.

Lastly, in this week's whitepaper, the World Gold Council outlines how it's trying to grow the market for digital gold. It's an intriguing guide to the future of the yellow metal.

***

Weekend market update

In the US on Friday, stocks rebounded from Thursday's selloff with the S&P 500 advancing 0.3% and the Nasdaq 100 gaining 0.5%, while Treasurys were mixed as the two-year yield edged to 3.6% from 3.61% while the long bond rose two basis points to 4.67%. WTI crude remained stuck at close to US$60/bbl, gold hovered just over US$4,000/oz, bitcoin climbed back above US$109,000 and the VIX settled north of 17.

From AAP:

Australia's share market limped to the finish in a grim week for the bourse, as stock-specific shocks and a hot inflation report weighed on sentiment. The S&PASX200 was essentially flat on Friday at 8,881.9.

The local market underperformed most of its peers for October, eking out a roughly 0.5% gain as Japan's Nikkei and South Korea's KOSPI posted double-digit lifts and Wall Street's S&P500 and Nasdaq rallied to record highs.

Consumer discretionary and real estate stocks have been hammered this week, each down more than 4.5%, as investors repriced their expectations for interest rate cuts after hotter-than-expected September quarter inflation figures.

Seven of 11 local sectors improved on Friday, led by energy and communications stocks, while financials and raw materials also provided support as gold stocks rebounded.

Northern Star, Evolution and Newmont each surged more than 3% after spot gold bounced.

Iron ore giants Rio Tinto, BHP and Fortescue all softened in the last session, but locked in gains for the week on the back of iron ore and copper price strength.

Rare earths and critical minerals producers Lynas, Iluka and Liontown Resources caught a bid to round out a volatile fortnight for their respective segments, with trade deals, rumours and commodity price predictions sparking wild price action.

The big four banks were mixed on Friday, with Westpac and CBA pushing higher, while NAB traded flat and ANZ slipped 0.6% after announcing a more than $1 billion hit to second-half earnings across several significant items. The wider sector managed to scrape a 0.15% gain for the week, despite shifting investor sentiment.

Turning to insurers, broker Steadfast tanked almost 10% after announcing boss Robert Kelly would stand aside for an external investigation into a workplace complaint against him.

Energy stocks outperformed the bourse, up 0.6% and 1.4% for the week, buoyed by Woodside and uranium producers, after the US announced plans to boost its nuclear capacity.

The health care sector lost more than 8% over the week as investors dumped CSL shares to nearly seven-year lows after a second profit warning in as many months.

Mayne Pharma plummeted by almost a third on Friday after federal Treasurer Jim Chalmers flagged he would block US pharmaceutical giant Cosette's $672 million takeover bid for the company, citing risks to the economy.

Utilities stocks tumbled 1.1% at the end of the week, tracking an even bigger slide in Origin's price after its quarterly update failed to impress.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website