The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

First, a quick reminder: We’d love to get to know more about our readers, hear your thoughts on Firstlinks and see how we can make it better for you. Please complete this short survey, and have your say.

****

Regular readers will know that dementia has become a topic affecting me personally with both my parents being diagnosed with the condition in recent months. Sadly, it’s part of a broader trend.

New figures from the Australian Bureau of Statistics show dementia has overtaken heart disease as the leading cause of death in Australia. This is a big deal because heart disease has been our largest killer each year since 1968.

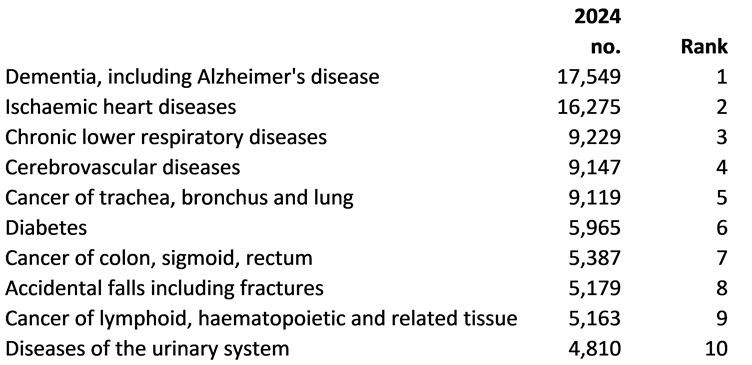

In 2024, 17,549 people died from dementia, including Alzheimer’s disease, accounting for 9.4% of overall deaths. Heart diseases were the second leading cause of death, accounting for 8.7% of deaths.

Heart disease peaked at 30% of overall deaths in 1968 and has been coming down ever since. 2024 was the lowest mortality rate for heart disease since that high water mark.

Chronic lower respiratory diseases were the third leading cause of death in 2024, well behind the top two, though.

Meanwhile, Covid-19 hasn’t gone away. It was the 12th leading cause of death last year, after ranking ninth in 2023 and third in 2022.

Interestingly, the ABS segregates different forms of cancer in their statistics, though if you included all cancers together, then it would be the top-ranked cause of deaths.

Top 10 leading causes of death in Australia

Source: ABS

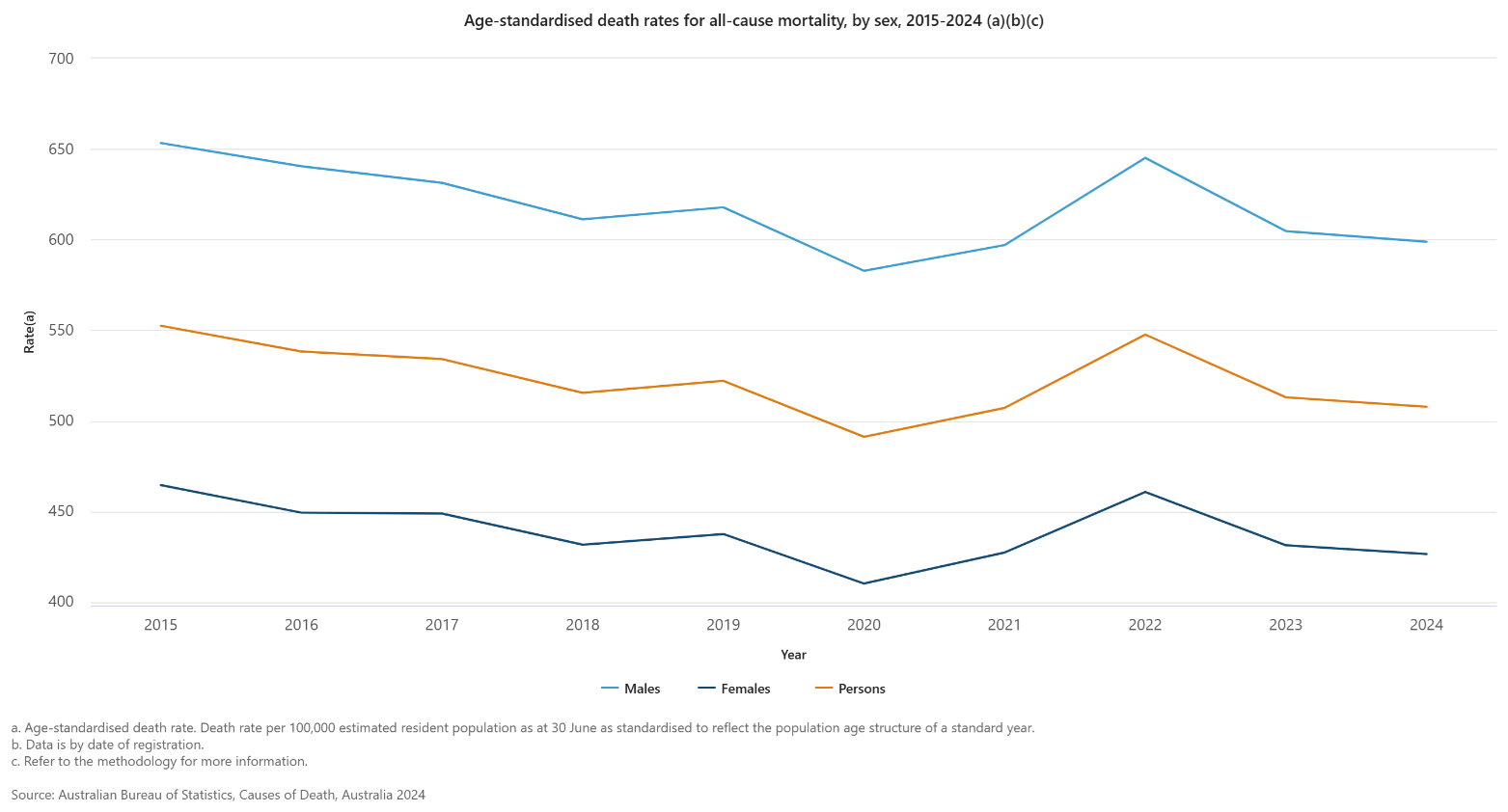

Overall, there were more than 187,000 deaths in Australia in 2024, an increase of around 4,000 from the previous year. However, when adjusted for age-structure and population size, there were 508 deaths per 100,000 people, down from 513 deaths in 2023.

Longer trends

As mentioned, heart disease has been the leading cause of death from 1968 to 2023. Public education campaigns on how to prevent the disease have contributed to the steady fall in deaths from heart disease (think of the ‘Jump rope for heart’ campaigns back in the 1980s and 1990s). Technological advances such as pacemakers have helped too.

In 1968, dementia contributed to just 0.2% of all deaths, compared to 9.4% in 2024. Dementia first appeared in the top five leading causes of death in 2006. And deaths from dementia have risen by 39% over the past decade.

Deaths from accidental falls have also increased over the past 10 years. They’re up 39% over the period and are now ranked the 8th leading cause of death.

Meantime, influenza and pneumonia last appeared in the top five leading causes of death in 1970. While deaths for these have remained relatively stable, their relative contribution to mortality rates has declined, thanks largely to improvements in health care.

Transport-related accidents used to be one of our biggest issues, being in the top five leading causes of death between 1968 and 1978. Now, they’re ranked 33rd. A key reason for the slide was the introduction of compulsory seat belts in cars in the early 1970s.

Men versus women

Dementia is far likely to impact women than men. Women account for almost two-thirds of deaths from dementia. And dementia has been the leading cause of death for females since 2016. A lot of this can be put down to women living a lot longer than men (life expectancies of 85 years vs 81 years).

Heart disease was the second leading cause of deaths among women. However, the death rates for heart disease have dropped by 42% for women over the past decade.

Meanwhile, breast cancer was the sixth leading cause of death for women last year. And it was the leading cause of premature death among women.

For men, the statistics read very differently. Heart disease is by far the leading cause of death among men still (10,153 deaths compared to dementia’s 6,602 in 2024). But the gap between the two leading causes of death has slowly narrowed over the past decade.

Prostate cancer was the sixth leading cause of death among men.

And suicide was the 11th leading cause. Over three-quarters of people who die from suicide are men.

Causes of death for an ageing population

Because we’re living longer, patterns of death are changing. In 2024, 68% of deaths were of people aged 75 or over. That’s up from 66% a decade ago, and 63% two decades ago.

The causes of death for those 75 years and over are similar to the population overall. However, people are often living longer with multiple chronic conditions. Around 80% of people aged over 75 years had more than one disease or condition listing as contributing to, or causing, death.

Prevention is key

The statistics on dementia are alarming, and there’s little doubt that more can be done to address brain health.

In a previous editorial, I wrote about a recent study from the Lancet Commission which found that 45% of dementia cases could be prevented or delayed by addressing 14 risk factors starting in childhood.

Prevention programs are beginning to address brain health. Overseas, in Scotland, the ‘My Amazing Brain’ program has reached thousands of primary school children, teaching them how to best protect themselves against dementia.

In Australia, Dementia Australia has useful tools, including a free Braintrack app as well as the CogDrisk program – a short assessment to help people understand their risk of dementia.

There are also several drugs reaching the market that may slow the decline in memory and thinking functions.

James Gruber

In this week's edition...

Kaye Fallick thinks it's time we ditch the concept of a linear path in retirement. Why? Well, it's usually anything but linear, with dramatic life changes - health, work lost and found, love lost and found, and unexpected windfalls - often forcing us to change course. Kaye thinks retirement planning ought to take these sorts of things in to account, and tells us how it can be done.

Why are fertility rates reaching record-lows in Australia? An oft-quoted reason is that it has become too expensive to raise children here. Ben Phillips says it’s not that simple and there are likely other factors at play.

Passive ETFs are surging in popularity just as markets, particularly in the US, hit lofty valuations. For disciplined, long-term investors, ETFs remain a sensible choice, but anyone buying to chase short-term performance may be in for a rude awakening, according to Greg Canavan.

Hugh Dive says Australia’s Big Four banks shrugged off doomsayers once again with their recent results, posting low loan losses, solid margins, and rising dividends. Regional banks lagged behind, constrained by higher costs and smaller scale. Strong results underscore the resilience of the major banks, but Hugh believes that lofty valuations mean it’s time to be selective.

VanEck's Brad Livingstone-Foggo thinks AI is the new gold rush, and like the 19th-century miners, the biggest winners may not be the AI companies themselves but the “picks and shovels” that power them. Nuclear energy, once shunned, is surging as a reliable, low-carbon source to meet AI’s massive electricity demand. With rising regulatory support and strategic investments, Brad suggests uranium and nuclear power are quietly becoming the backbone of the AI boom and a potential opportunity for investors.

After the RBA held the cash rate at 3.60% in November, speculation about the next move is already running wild - one cut, two cuts, or even increases. However, Jackson Hrbek says history shows that economic forecasts, even from the RBA, are rarely spot-on, often swayed by assumptions that change faster than anyone predicts. In a world of uncertainty, he suggests the real value of forecasts isn’t precision but in understanding the range of possibilities and planning for them.

After 23 years in Australian philanthropy, Peter Winneke says it’s clear that most wealthy families don’t ask “how much is enough?” and our giving culture remains far below its potential. He reckons that if we want a bigger, better philanthropic sector, we need frank conversations, stronger role models, and a commitment to using wealth to create lasting, positive impact.

Two extra articles from Morningstar this weekend. Brian Colello looks at whether there are signs of an AI bubble in Nvidia's earnings, while Tyger Fitzpatrick explores opportunities for income investors in 2026.

Lastly, in this week's whitepaper, Fidelity International expects a selective, structural super-cycle in commodities, and looks at the best ways to play it.

***

Weekend market update

US stocks enjoyed a solid bounce on Friday with the S&P 500 notching a 1% gain – though the blue chip gauge did finish well off session highs – narrowing its weekly loss to about 2%.

Dovish utterances from New York Fed President John Williams spurred a bull-steepening Treasurys move with two-year yields dipping four basis points to 3.51%, while WTI crude fell below $58 a barrel.

Gold remained in consolidation mode at US$4,062 per ounce, bitcoin rebounded towards US$85,000 after briefly testing $80,000 this morning and the VIX settled at 23.5, down nearly three points on the day.

From AAP:

Australia's share market crumbled to its lowest level since June, as concerns about stretched valuations meet a reduced outlook for interest rate cuts. The benchmark S&P/ASX200 lost 136.2 points on Friday, down 1.59%, to 8,416.5.

The top-200 has tumbled more than 7% after hitting an all-time high of 9,115.2 in mid-October, and has fallen each of the past four weeks.

The raw materials sector led the losses, sinking almost 4% on Friday, as all 11 sectors traded into the red. Gold stocks sold off as expectations of higher for longer interest rates weighed on the precious metal's price outlook. Mixed miners, rare earths producers and lithium plays also fell as investors tempered their expectations for an artificial intelligence revolution. Iluka was one of the top-200's second-worst performers with a loss of 11% to $6.32.

Energy stocks dropped sharply, down 3.1% ahead of potential peace talks between Ukraine and Russia's leaders, while jitters around the AI narrative weighed on uranium producers. Coal stocks were broadly lower with Whitehaven, Yancoal and New Hope Corporation down between 2% and 4.2%.

The heavyweight financials sector slipped 0.7%, as CBA offered a modest, 0.04 per cent glimmer of hope while its big four competitors grinded lower. CommBank shares are still down more than 12% since its $2.6 billion first quarter profit failed to wow investors earlier in November.

Interest rate sensitive stocks were hit hard, with real estate (-2%), IT stocks (-1%) and consumer discretionaries (-1.3%) and industrials (-1.0%) all under selling pressure.

Online retailer Kogan lifted 0.7%, despite posting a more than 30% reduction in earnings over the first four months of the current financial year.

The defensive health care and consumer staples segments performed best, trading roughly flat on Friday as Ryman Healthcare outperformed the market, lifting 5.4% to $2.54. Mayne Pharma tanked by almost 25% after federal Treasurer Jim Chalmers scuppered a $627 million takeover plan by US healthcare giant Cosette, on advice from the Foreign Investment Review Board.

Shares in logistics technology company WiseTech Global rallied 2.4% after the company reaffirmed forward guidance, but its price is still down more than 50% since the same time last year, following a raft of controversies and multiple board resignations.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website