The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

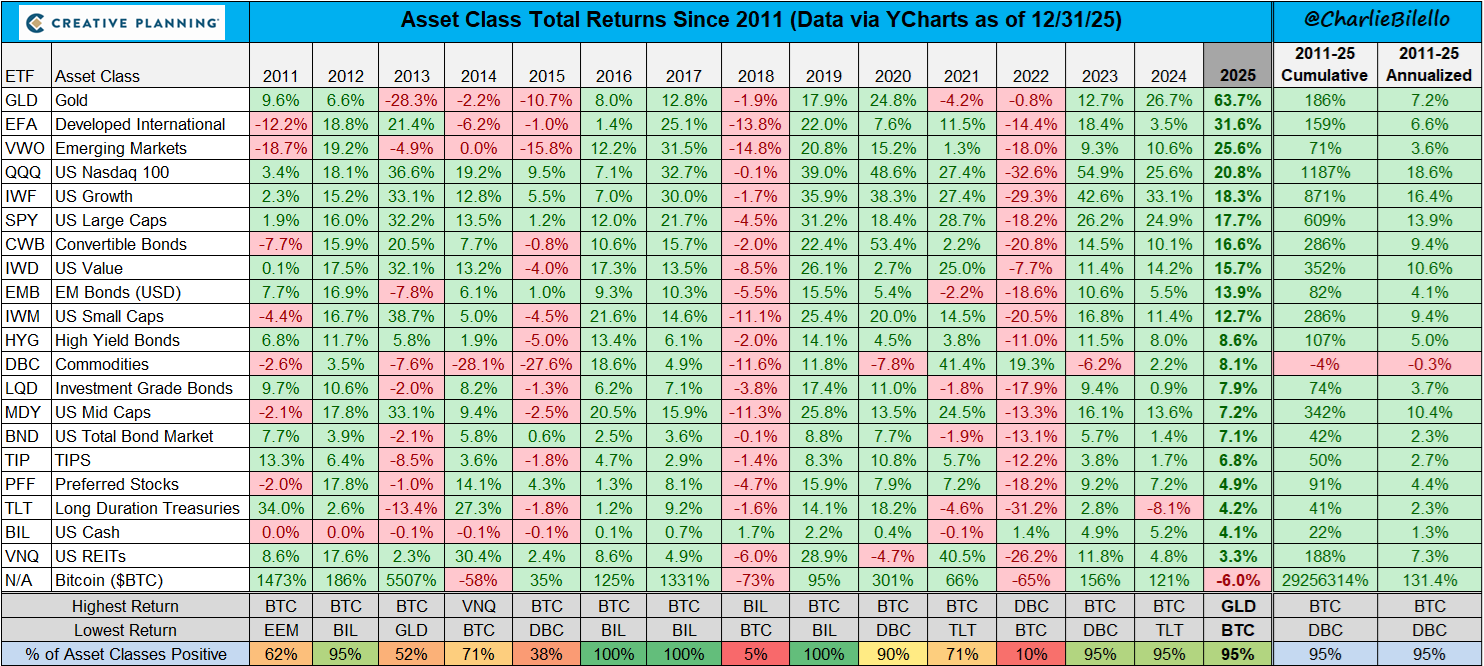

As an investor, it was hard not to make money in 2025. The “everything bubble” gathered steam as almost every asset price went up, similar to 2023 and 2024. Interestingly, bitcoin was the only major asset that fell last year.

Note: returns in USD.

Gold was the standout performer in 2025, up 64% in US dollar terms. The sharp fall in the US currency helped its cause, as did growing concerns about the US budget deficit and easy money. It’s capped what’s been a stellar decade for the yellow metal.

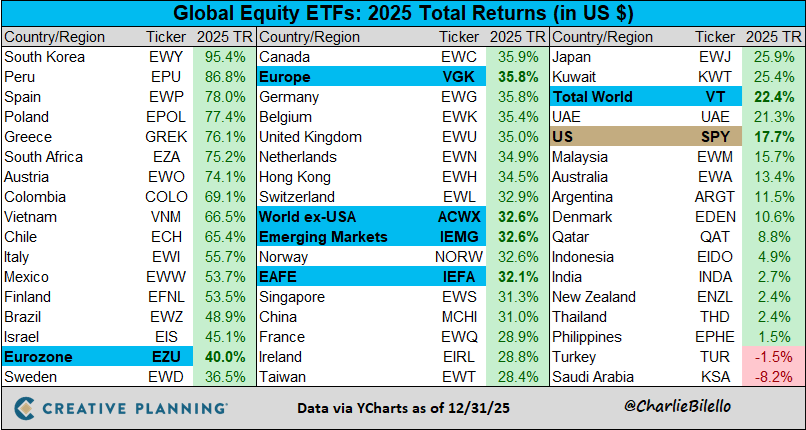

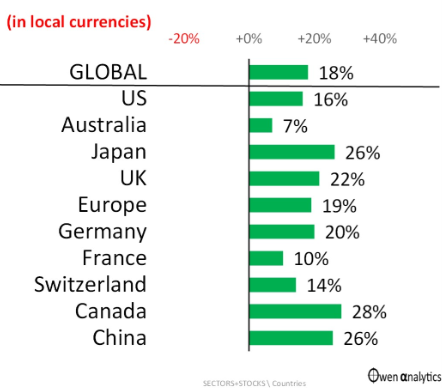

The performance of international stocks also stood out. At this time last year, the biggest mantra in markets was US exceptionalism and seemingly every investor was board. That didn’t pan out as planned with the S&P 500 return of 18% trailing the world index’s 22%, emerging markets’ 33% and Europe’s 35%.

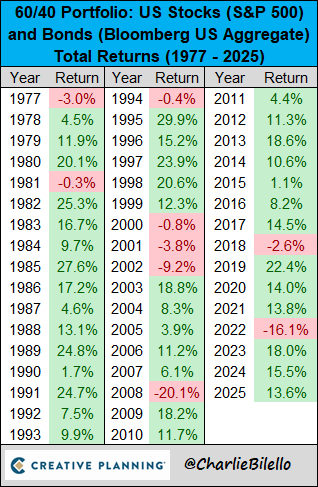

Bonds have been much maligned, though bounced back last year. That led to solid performance for 60/40 stock-bond portfolios.

As seen in the first chart, it’s the third year in a row that 95% of major asset classes have delivered positive annual returns.

Bitcoin was the only asset to finish in the red this year. Its extreme volatility during the April dip quietened talk of it being a ‘safe haven’ or ‘digital gold’.

Stocks: Europe and Asia fly, Australia lags

Breaking down stocks by country, South Korea was the best performing major market, rising 95% in US dollar terms in 2025. The likes of Spain and Greece weren’t far behind.

Overall, the Eurozone was the standout, but Asia also did well. Major Asian markets such Singapore and Japan were up 31% and 26% respectively. Even China, deemed ‘un-investible’ by many at the beginning of last year, bounced 31% to trounce both the World Index and US stocks.

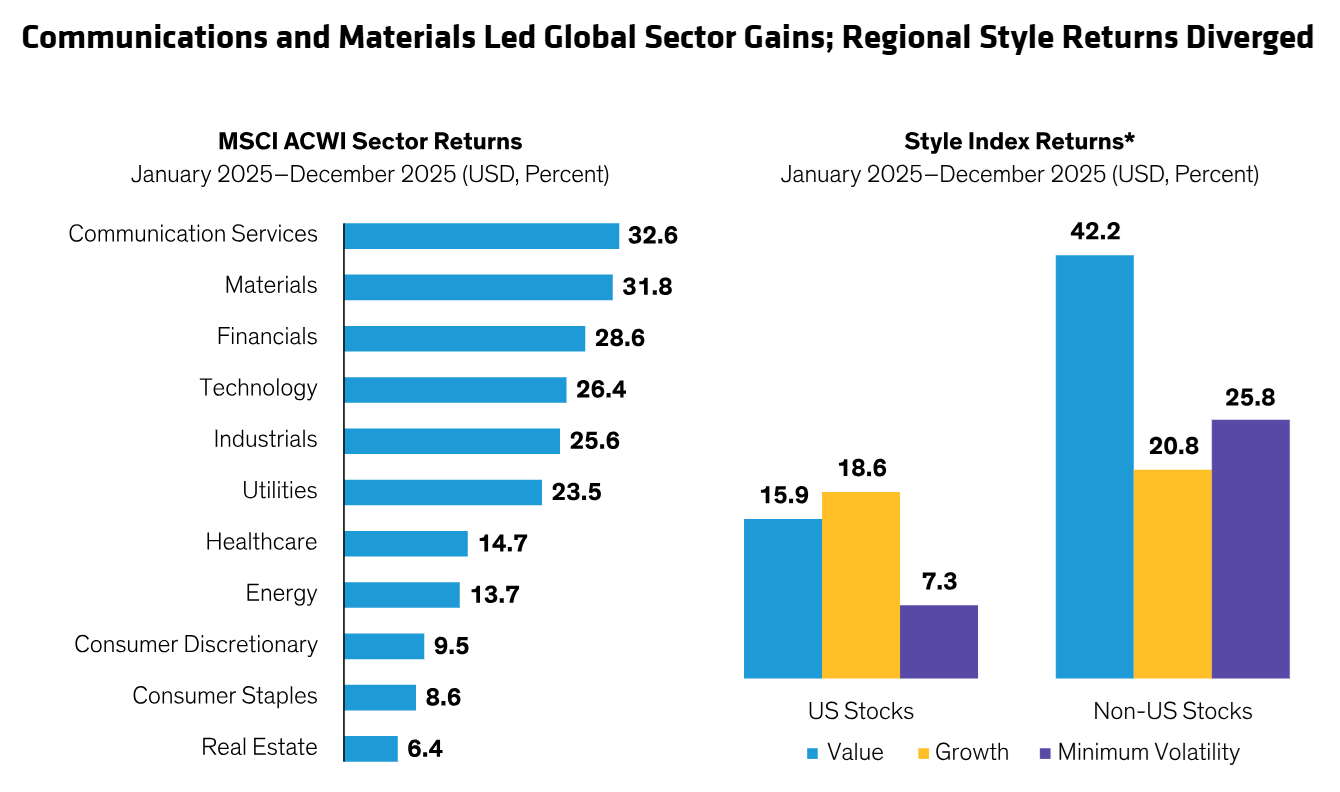

In terms of which styles of stock investments worked best, there was a marked difference between the US and the rest of the world. Outside of America, value stocks beat growth. In the US, it was the opposite.

Source: Alliance Bernstein

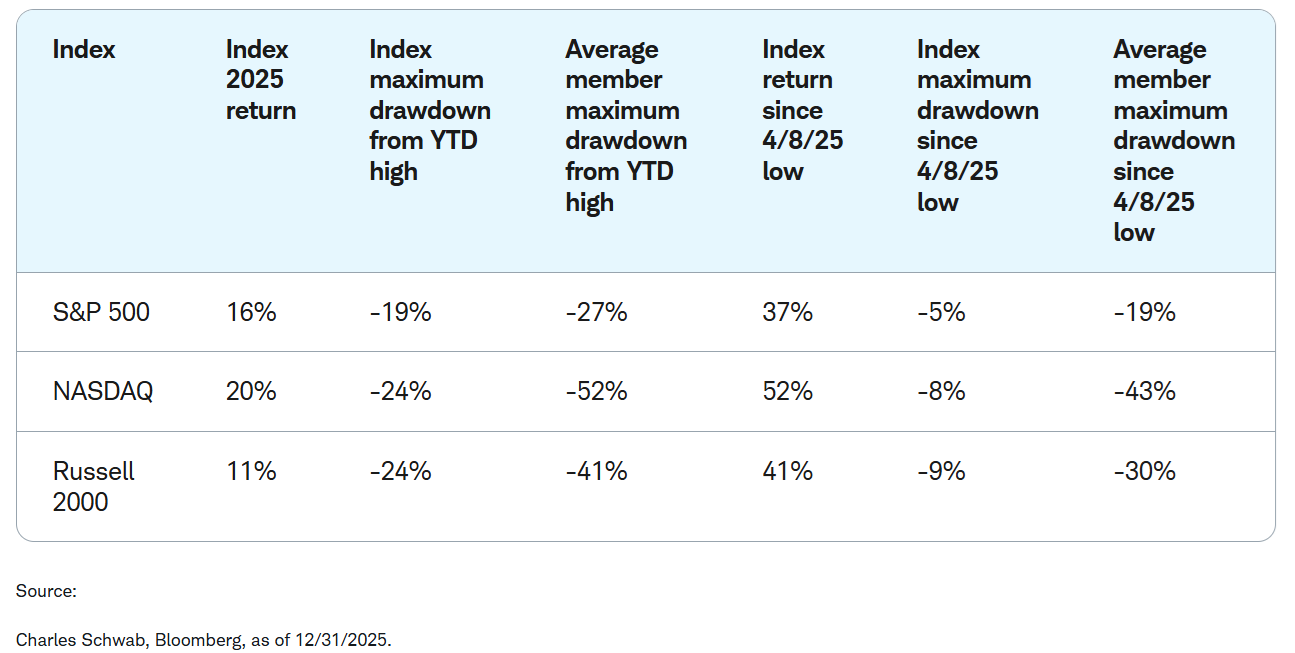

In the US, it’s hard to believe but the S&P 500 and Nasdaq were down 19% and 24% respectively for the year through to lows in April. That’s before both came roaring back by year end. Amazingly, the Nasdaq gained 52% from the lows.

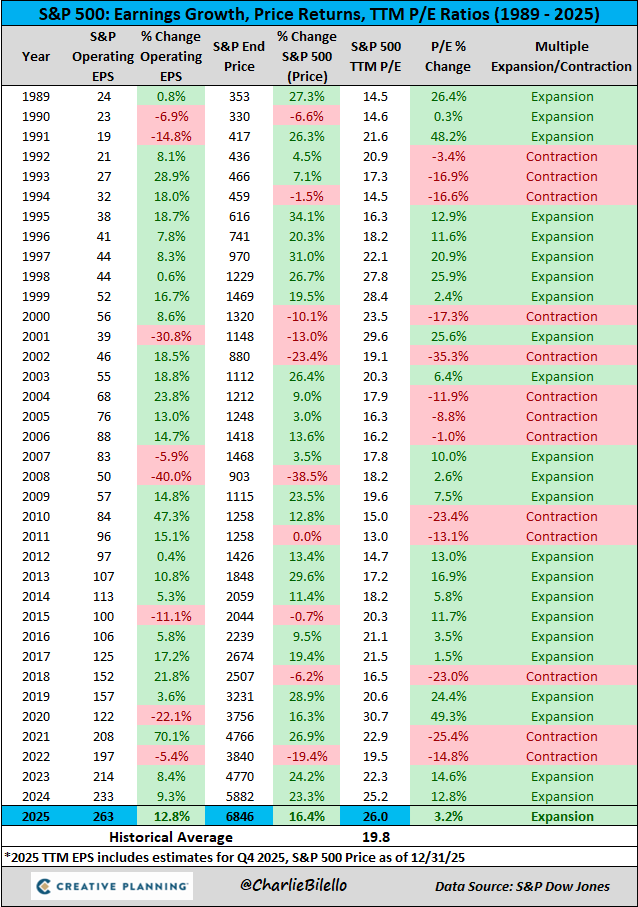

What were the key drivers in the US? Company earnings came in better than expected, rising 13% for the year. The rest of the gains came from valuation multiple expansion.

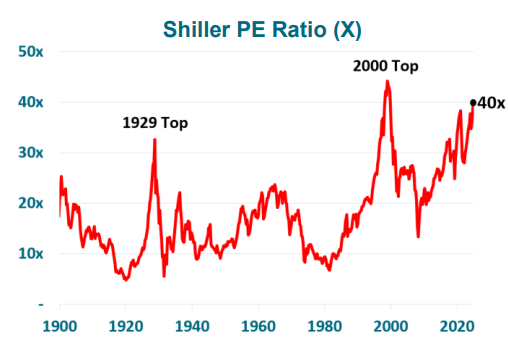

The S&P 500’s trailing price to earnings (P/E) ratio of 26x is well above the historical average of 19.8x. The current multiple was last seen in 2020-2021 before the correction of 2022, and in 1998-2001, when a bear market then followed.

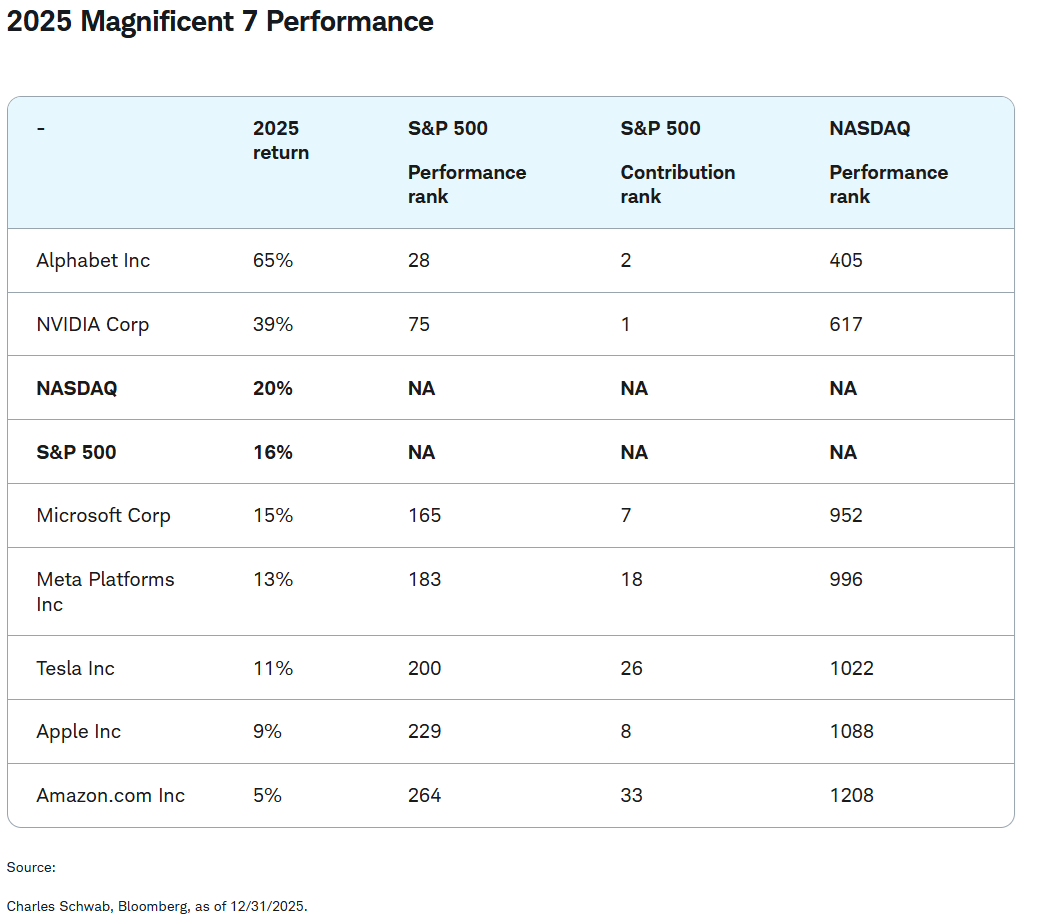

The ‘Magnificent 7’ stocks were frequently quoted in 2025, though their performance didn’t live up to the hype. It was really the Magnificent 2 as only Alphabet and Nvidia outperformed the index.

Alphabet rocketed as the market realised that the extent of its AI capabilities, dampening fears that AI would take out its cash cow, the search business. Meanwhile, Nvidia continued its ascent as demand for its chips showed few signs of slowing down.

Tesla did ok considering its auto volumes continued to shrink as Chinese competitors gained share in electric vehicles.

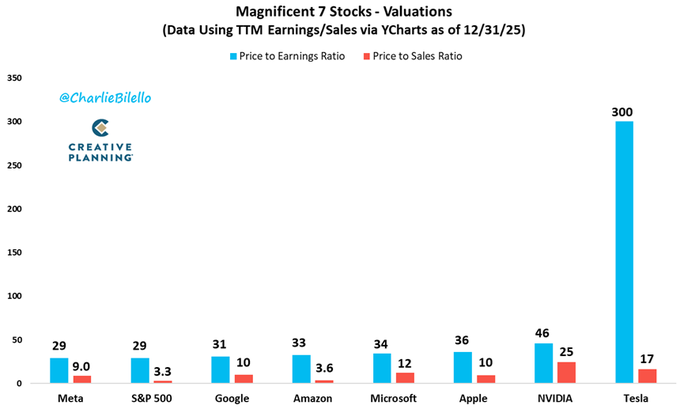

Valuations for these Magnificent 7 stocks still look punchy.

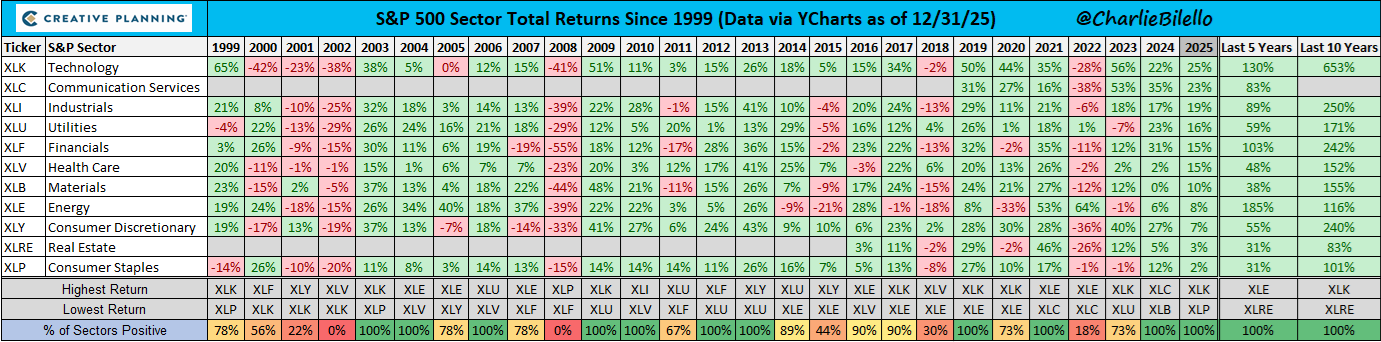

Despite the mixed performance of the Magnificent 7, technology was still the best performing sector in the US. Notable sector laggards included real estate and consumer facing sectors.

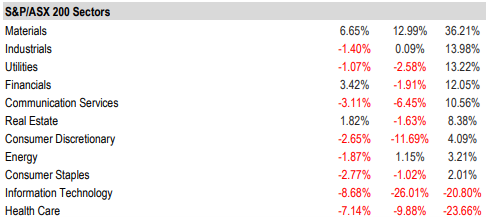

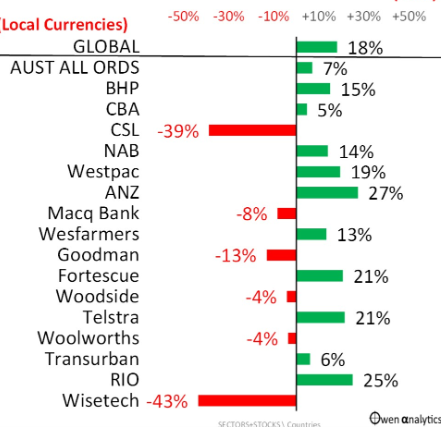

In Australia, stocks underperformed the rest of the world. The ASX 200 rose 7% in 2025, 10% including dividends. That 10% looks poor compared to the returns of other markets, though it’s still in line with the long-term returns from the ASX index.

Delving deeper, it was mid and small caps that thrashed larger stocks, up 18% and 26% respectively. A lot of that outperformance was due to the continued rise in gold equities, and the comeback of lithium plays.

Source: S&P Global

Across the board, materials were the big winner in 2025, while tech and healthcare were the big losers.

Source: S&P Global

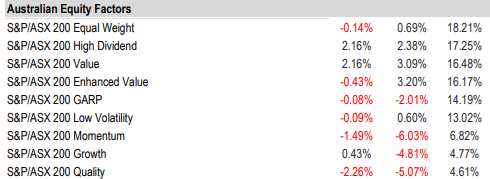

Unlike in the US, growth and momentum stocks performed poorly in Australia. Interestingly, quality stocks also trailed the pack.

Source: S&P Global

Quality businesses like CSL, Goodman, REA and CAR Group didn’t live up to expectations. In the case of CSL, that was self-indicted, and in the other cases, it was likely excessive valuations coming back to earth (somewhat).

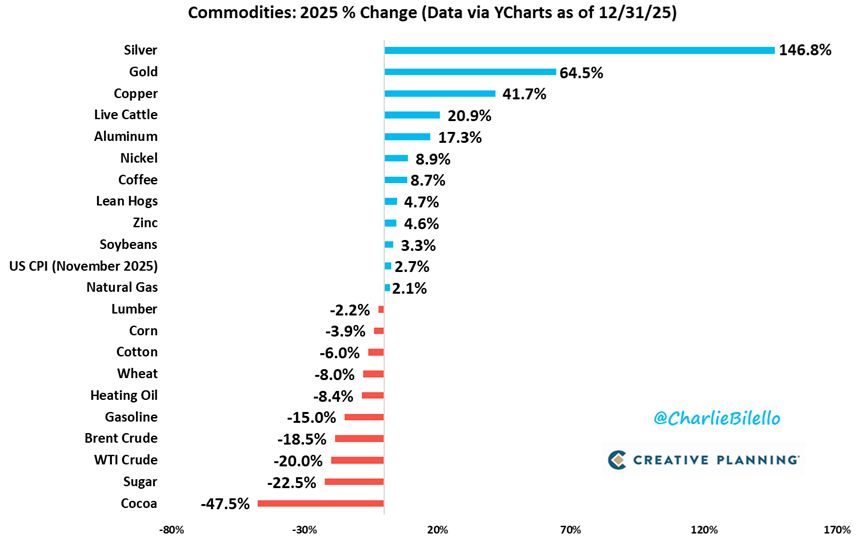

Commodities: up, up and away

Australian resource stocks were helped by the surge in many commodity prices. In 2025, silver even outdid gold, rising an astonishing 147%. Copper also did well as investors fingered it as a key AI and data centre beneficiary.

On the flip side, oil prices went south as a supply surge overwhelmed tepid demand, leaving large excess inventories.

With the notable exception of beef, agricultural commodities also underperformed.

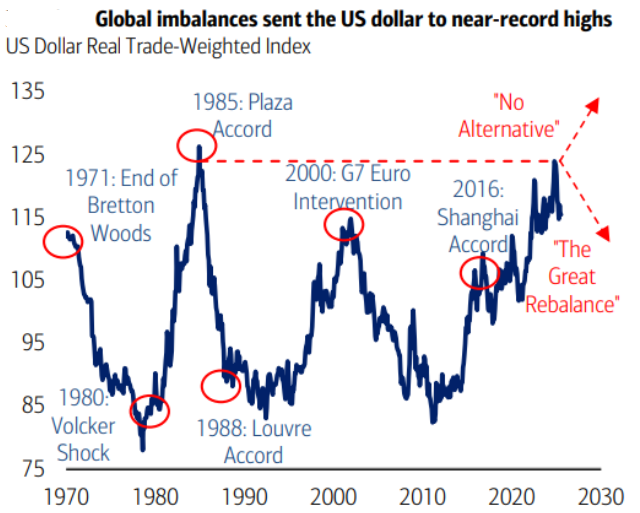

King dollar no more?

The rise of the US dollar took an abrupt about-turn in 2025. The USD finished the year down 10% on a trade-weighted basis.

Source: Bofa

The Aussie dollar started the year near 62 cents to the US dollar and finished above 67 cents. That was driven by changing expectations for interest rates and inflation. The market now forecasts rate rises in Australia this year. Conversely, in the US, consensus suggests rate falls, especially with a new Trump-friendly Federal Reserve Chairman replacing Jerome Powell by mid this year. Given the differing paths for rates, it wouldn’t surprise to see a further rise in the Aussie versus the USD.

2026 outlook

At this time last year, I suggested that investors should seek to diversify their stock holdings beyond the US and Australia. The primary reason being that other major markets like Europe and Asia were considerably cheaper. That suggestion paid off, not that many Australian-based investors listened as they continued to pile into American markets. I see no little reason why the outperformance of non-US stock markets can’t continue.

American equities have had a remarkable 16 year bull market, with stocks up close to 16% per annum (p.a.), well above their historical 10% p.a. returns. The average US market has lasted around 18 years, which would indicate that we may be in the last leg of this bull market. Most importantly, every valuation metric for US stocks is near or at record highs. Whenever the Shiller PE and trailing PE for America have been at current levels, it’s resulted in flat to low single digit returns on every single occasion throughout history.

Source: Alliance Bernstein

In other words, if you’re betting on the US stock market, you really do think this time is different, and that spectacular recent performance can continue. I’m on the other side of that bet.

Where does that leave the ASX? If commodities continue to their ascent, there is a good chance that Australia outperforms the US this year (yes, you read that right). And given my expectations for low single digit returns from US equities over the next decade, I believe the odds favour ASX stocks handily beating their American counterparts over that period.

Drilling down on the ASX, I wrote at the start of last year that a rotation out of banks into miners could happen soon and resource outperformance may then persist for many years to come. That rotation happened in 2025, and I think there’s a high probability for it to continue. The reason being that the banks remain steeply priced and many miners have lagged the rise in commodity prices.

What about bonds and cash? It’s hard to be bullish. Major countries around the world have enormous debt loads and higher inflation is the easiest way to bring these debt levels down to more reasonable levels. And in Australia, interest rates are on the way up, not down.

On the flip side, investor positioning and flows show bonds remain the most hated of the major asset classes. It wouldn’t take much for this to change.

Overall, you’re likely to see pedestrian returns from bonds for 2026 and beyond.

For 60/40 portfolios, that’s not a bad thing, as it should deliver solid overall returns.

James Gruber

In this week's edition...

Just before Christmas, the federal government released revised draft legislation for its $3 million super tax. Over the holidays, Meg Heffron has had a thorough look through it and says while it's better than the original legislation, there are some stings in the tail.

Tim Farrelly has been around markets for a long time and each year he provides his 10 fearless forecasts for the 12 months ahead. His 2026 predictions include US government bonds will beat gold, US market performance will be underwhelming, and dividends will outstrip growth as a source of Australian equity returns.

The media talks endlessly about our ever rising population, but little is said about the infrastructure that will be needed to cater to more people. Ross Elliot has written a great piece breaking down how many hospitals, schools, and so, that we'll need in future. The numbers are eye opening.

Is the world's safest currency - the US dollar - actually the riskiest? Orbis' Nicholas Purser says it may be, and outlines the case why.

Dementia has become Australia's biggest killer and I've documented my family's recent battles with it. Ashley Owen went through it with his mother and he details his extensive experience with aged care homes and what he learned along the way. Separately, Ashley himself has recently developed cancer and Firstlinks wishes him and his family well.

China has flooded the world with electric cars and solar panels to offset the economic drag from a weak domestic property market. How long can this go on, and what are the implications for commodities and Australia? Greg Canavan gives his take.

Elon Musk’s trillion-dollar Tesla pay deal looks like excess, but its structure may be one of the strongest examples of alignment between a CEO and shareholders. Strip away the outrage and Lawrence Lam thinks it becomes a blueprint for how long-term, high-risk incentives can drive founder-style ambition rather than reward inertia. And, ASX companies should take note.

Two extra articles from Morningstar this weekend. Tyger Fitzpatrick outlines three of Morningstar's top rated ASX stocks for 2026, while Malik Ahmed Khan looks at an undervalued US cybersecurity giant.

Lastly, in this week's whitepaper, Vanguard sees upside to economic growth but risks for stock markets in 2026.

***

Weekend market update

In the US on Friday, stocks enjoyed a strong bid to wrap up the week with the S&P 500 notching a 0.7% advance, while Treasurys flattened with the 2-year rising five basis points to 3.54% and the long bond dipping to 4.82% from 4.85% Thursday. WTI crude ticked toward US$59 per barrel, gold reached US$4,508 an ounce, bitcoin edged lower at US$90,300 and the VIX settled south of 15.

From AAP:

The Australian share market finished flat on Friday in a relatively dull session. For the week, the ASX200 dropped 0.1%, in its second straight week of losses.

Four of the ASX's 11 sectors finished higher and six finished lower, with utilities flat, on Friday.

Energy was the biggest mover, rising 2.1% as oil prices rebounded. Woodside gained 2.8% to $23.59, Santos added 3.5% to $6.15 and Karoon Energy climbed 5.1% to $1.535.

In the mining sector, Rio Tinto plunged 6.3% to $143.06 announcing it was in preliminary talks to acquire Glencore in an all-share transaction that push it past BHP as world's biggest miner. BHP gained 0.8% to $47.72, while Fortescue dipped 0.2% to $22.71 and Northern Star added 0.5% to $24.72.

BlueScope Steel rose 2% to $30 after its largest shareholder, AustralianSuper, said it supported the board's decision to rebuff a $13.2 billion takeover offer from SGH and Steel Dynamics.

"Based on our current valuation, we would only support a transaction that was materially higher than the price of $30 per share currently proposed," said AustralianSuper, which on Tuesday spent around $75 million buying another 2.6 million BlueScope shares, upping its stake from 12.5% to 13.5%.

Elsewhere, all of the big four banks finished lower, with ANZ dropping 0.6% to $35.45, Westpac declining 0.3% to $37.90, NAB dipping 0.2% to $41.02 and CBA edging 0.1% lower at $153.22.

Codan was the biggest gainer in the ASX200, soaring 16.9% to an all-time high of $36.89 after the South Australian metal detector and walkie-talkie manufacturer said it expected to announce $394 million in revenue for the first half, up 29% from a year ago.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website