The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

One question that I am repeatedly hearing from investors is this: in an expensive market, where can I find opportunities? My answer has surprised them: look at quality stocks. Here’s why.

Let’s first define what quality stocks are. MSCI indices say they’re shares with attributes such as high returns on equity, predictable earnings growth and low debt levels.

The attributes make sense. A high return on equity suggests a company has a competitive edge that allows them to earn significant profits on the shareholder money invested in the business. Predictable earnings also denote an edge that is sustainable and repeatable. Finally, low debt levels imply a company that can grow without taking on too much leverage – and lower leverage makes earnings less volatile and reduces overall business risk.

Global quality has lagged

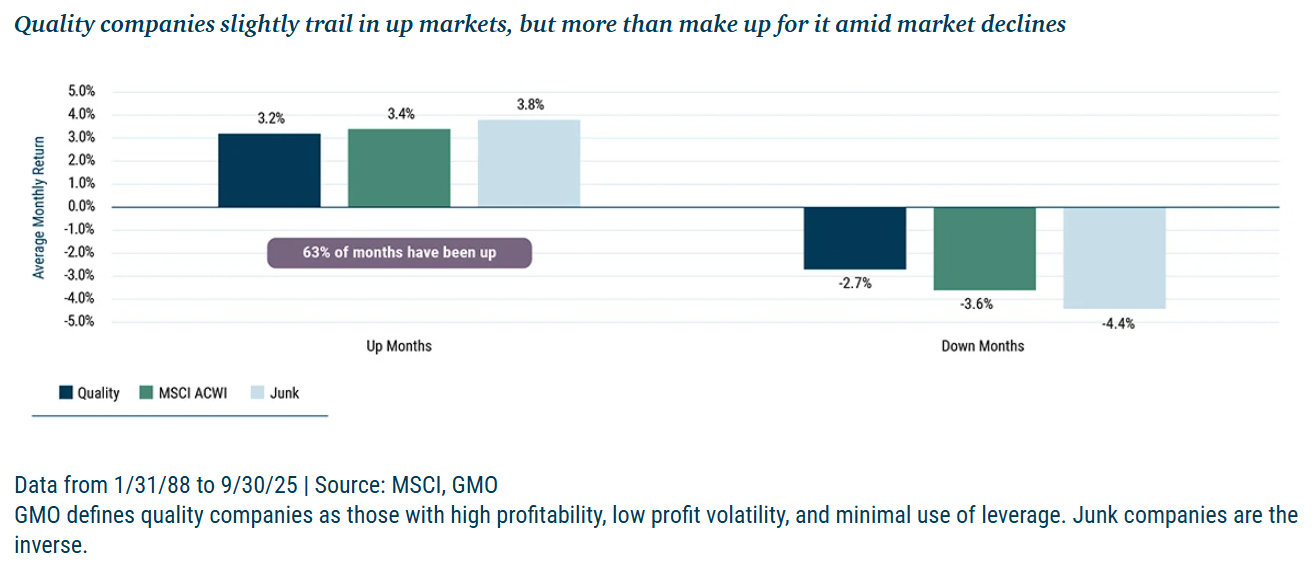

Globally, only one in five companies qualify as quality stocks. Over the past four decades, these stocks have handily beaten global indices and other types of investing such as value and growth. And they’ve done it with less volatility.

Click to enlarge

For this reason, quality stocks have historically been highly priced, at a premium to the market.

That’s less so today as quality stocks have trailed the market over the past year. In 2025, quality trailed global stocks by around 6%, and in developed markets, it was closer to 15%. These stocks were left behind as investors bid up more speculative stocks.

Australian quality stocks have trailed too

Defining quality stocks in Australia is a little fuzzier. There are three indices that track quality shares here – the Solactive Australia Quality Select Index, the S&P/ASX Quality Index, and the MSCI Australia IMI Quality Index.

In 2025, total returns from these indices differed markedly: Solactive’s rose 12%, S&P’s 5% and MSCI’s 3% (this was price only as they don’t give total returns).

Why the big gaps in performance? Well, each of them filters different characteristics for quality stocks, and I’m not sure any of them get it close to right.

For instance, Solactive’s Australian Quality Select Index has the following stocks in the top 10.

Source: Solactive

Perseus Mining shouldn’t be in a quality index, in my view. It’s a capital intensive gold miner that has a mixed track record through mining cycles.

Also, the inclusion of banks like ANZ, NAB and Westpac are questionable too. They sell commodity products and have low returns on equity (ROEs). For instance, ANZ’s ROE was just 8% in its most recent 12 month results, which is below its cost of capital and lags the ASX 200’s ROE of close to 10%.

So, Solstice’s quality index defines quality very differently to what I would.

The returns from quality stocks in Australia over the past 12 months are more likely nearer those of the S&P and MSCI indices. This makes sense because the ASX 200’s total returns were 10% in 2025, with resources up 36%, financials higher by 12%, while industrials increased by just 4%. Most of what I would deem as quality stocks fall into that industrials category.

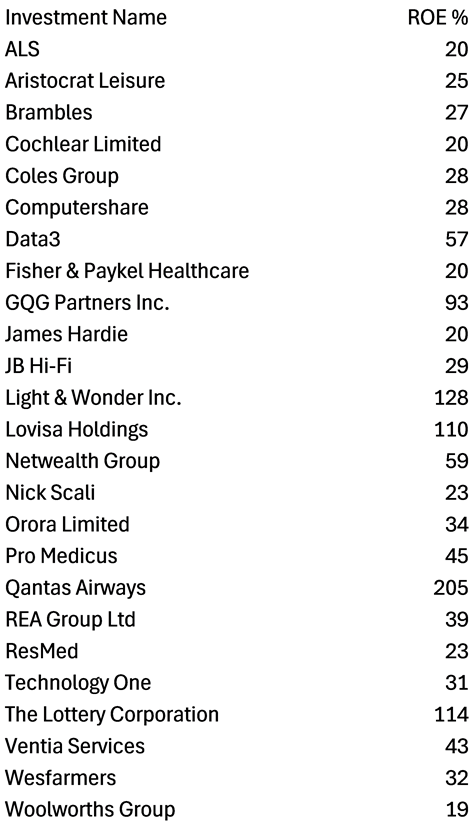

For example, if I screen for ASX 200 stocks with ROEs above 18% in 2025, it comes up with the following list, excluding mining-related companies.

Source: Morningstar

Just about all these stocks would fit my definition of quality, barring Qantas (capital intensive), Orora (no competitive edge?), and perhaps James Hardie (management is doing its best to destroy a fine business).

Many of these stocks significantly underperformed the ASX 200 index in 2025:

- REA -21%

- GQG -16%

- Aristocrat -15%

- Pro Medicus -12%

- Technology One -11%

- Woolworths -4%

- JB Hi Fi +4%

- The Lottery Corporation +4%

- Resmed +5%

*Price terms only

Among these stocks, and other quality ones, may lie some great, even generational opportunities for investors. From the list, REA, Resmed, Aristocrat, Woolworths, and The Lottery Corporation look most interesting.

The best ways to invest in quality stocks

What are the ways to get access to quality stocks? Of course, you can buy the shares directly.

Many prefer to own ETFs nowadays. VanEck’s MSCI International Quality ETF (ASX: QUAL) invests in quality shares outside Australia. Betashares Global Quality Leaders ETF (ASX: QLTY) invests worldwide in quality. Meanwhile, VanEck’s Morningstar Wide Moat ETF (ASX: MOAT) owns quality stocks in the US.

For Australia, the options are more limited. Betashares has the Australian Quality ETF (ASX: AQLT) but it’s based on the aforementioned Solactive Australia Quality Select Index, which I view as having serious limitations.

I think fund managers who invest in quality stocks, and have consequently underperformed of late, may be worth considering too. Aoris Investment is an Australian-based global fund managers with a great long term track record of investing in quality stocks. Airlie Funds Management focuses on Australian stocks and has smart minds running it. There’s also AFIC, a listed investment company that had a terrible year yet owns a portfolio full of quality stocks, many of them mentioned above.

Disclosure: VanEck is a Firstlinks sponsor, as is Airlie via Magellan Investment Partners.

****

Rob Almeida of MFS grabs onto a similar theme as my editorial above, suggesting that while cyclical stocks are hogging the headlines, 'compounders' may be on sale, and their resilience should shine through in the long term.

****

In my article this week, I look at Ray Dalio's unique take on 2025 - dominated by a collapse in the value of money and a move away from US assets - and what he thinks it means for markets this year and beyond.

James Gruber

Also in this week's edition...

Some industry experts suggest Division 296 may double-tax franking credits but Tony Dillon says that's not the case, and explains why.

Auscap's Tim Carleton says Macquarie is becoming a significant competitor to the Big 4 banks in home loans and that brings earnings risk to the majors that isn't currently priced into the market - a stark warning for anyone who owns any of the Big 4, which includes just about every Australian.

There's been a lot written about AI but less about what the economic consequences could be from a boom, bust, or something in between. Schroders' David Rees breaks down the diffferent scenarios for the US and global economies.

When investing in A-REITs, many people think they're owning passive rental vehicles. But Quay Global Investors says that's mistaken, as development and funds management companies increasingly dominate the index, resulting in greater cylicality and volatility.

We care a lot about the price of milk at the supermarket, yet think little about the industry behind the products on the shelves. Harrison Stewart says dairy farming deserves greater attention as an alternative asset class.

Two extra articles from Morningstar this weekend. Meta has struggled lately amid AI spending concerns and Ananya Chag asks whether it's worth buying now, while Matthew Dolgin reports on Netflix's earnings result.

Lastly, in this week's whitepaper, Neuberger Berman identifies five themes that will drive markets in 2026.

***

Weekend market update

US stocks on Friday cruised through a flat showing to wrap the holiday-shortened week slightly lower on the S&P 500, while Treasury yields ticked down by one to two basis points across the curve. WTI crude jumped above US$61 a barrel, gold advanced another 1.5% to the doorstep of US$5,000 an ounce, bitcoin remained at US$89,400 and the VIX settled just above 16.

From AAP:

Australia's share market ended the week lower as easing geopolitical worries could not counterbalance sluggish interest rate-sensitive stocks after local economic data pointed to incoming rate hikes. The S&P/ASX200 gained 0.13% to 8,860. The top-200 was down roughly 0.5% since Monday after surprisingly robust jobs figures narrowed market bets on incoming Reserve Bank interest rate cuts.

The big four banks all traded lower on Friday as concerns about the sector's frothy valuations persisted, sending investors elsewhere looking for growth.

Raw materials rallied 1.4% on Friday as gold stocks charged higher, while BHP was the best of the iron ore giants with a 0.7% boost.

Alcoa shares fell 0.8% despite a strong finish to 2025, with improved production and higher alumina prices.

The energy sector shed 0.2% on Friday but ended the week 3.7% higher, tracking with a lift in oil prices as US-EU tensions eased and a positive run for most coal producers and uranium stocks.

The ASX tech segment topped the bourse in the final session, lifting almost 4% as tracking Software Life360 rocketed 27%, propelled by solid earnings and a guidance upgrade.

Zooming out, however, IT stocks were down almost 0.7% for the week.

Droneshield was the top-200's weakest performer on Friday, easing 5.5% after a strong prior session, but the defence technology stock still ended the week higher.

From Shane Oliver, AMP:

Global shares fell over the last week on fears of a trade war between the US and Europe over Trump’s desire to get Greenland. While shares rebounded once he backed down this still left them lower for the week with US shares down 0.4%, Eurozone shares down 1.1%, Japanese shares down 0.2% and Chinese shares down 0.6%. Reflecting the global uncertainty Australian shares also fell by 0.5% for the week, which is not bad given they rose 2.1% the week before. The falls in the local market were led by financial, property and consumer shares offsetting gains in utility and resources stocks. Bond yields were flat in the US but rose elsewhere as a rise in Japanese bond yields reverberated globally with US rates initially coming under some pressure from fears Europe would allocate away from US bonds.

The surge in geopolitical risk around Greenland and ongoing concerns around a US strike on Iran, on the back of threats to Fed independence saw gold and silver pushed to more new record highs. Gold is now just below $US5,000 for the first time ever. While they are getting overbought and vulnerable to a correction the broad trend in both is likely to remain up as investors demand a hedge against ongoing geopolitical risks, worries that Trump will weaken the Fed risking higher inflation and associated downwards pressure on the $US. Bitcoin fell though not helped by the weakness in shares. Oil prices rose on renewed concerns about a US strike on Iran and metal prices also rose, but iron ore prices fell slightly. The $A surged higher as the $US fell and Australian strong jobs data added to expectations that the RBA will hike rates.

The past week was dominated by Trump’s grab for Greenland and then another TACO back down. Inspired by his intervention in Venezuela, Trump threatened additional tariffs on eight European countries unless Greenland is transferred to the US. The motivation was unclear.

Japanese bond yields surged pushing up global bond yields on concerns the “Japanese carry trade” (borrow cheaply in Japan and invest in bonds in other countries) might reverse. This followed the calling of a Japanese election for 8th February and Japan’s PM announcing fiscal stimulus measures including a temporary cut in consumption tax on food which led to concerns about a further blowout in Japan’s budget deficit and debt levels. While this is a valid concern the main driver of rising Japanese bond yields is a normalisation of nominal growth in Japan partly associated with higher inflation. The surge in yields settled down a bit in the last few days but may have further to go as the BoJ continues to gradually raise rates.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website