Brief weekend update: While global markets had another strong week despite poor COVID-19 news, with the S&P500 up 2%, Australia fell 2.3%, driven by worries about the Victorian lockdown. Worldwide COVID cases now exceed 200,000 a day, although the death rate is down significantly from a few months ago. Chinese shares are on a run, up 14% in two weeks on optimism about a strong economic recovery.

***

The stock market and its many participants deserve admiration for hanging on to recent gains in the face of complete uncertainty. The S&P/ASX200 is only about 10% below its level at the start of 2020, and economic conditions and the outlook are clearly far worse. The Reserve Bank wrote this week:

"Uncertainty about the health situation and the future strength of the economy is making many households and businesses cautious, and this is affecting consumption and investment plans. The pandemic is also prompting many firms to reconsider their business models."

Then Gareth Aird of CBA's Global Markets Research acknowledged economists themselves are struggling. Anyone who thought Australia had flattened the curve and was heading for a V-shaped recovery has been jolted by events in Victoria. He wrote:

"Economists are having a torrid time trying to forecast the economic outlook as a whole host of unusual dynamics play out. Many traditional economic models are of little use right now as policymakers globally continue to grapple with the trade-off between limiting the spread of COVID-19 and the negative impact on the economy from restrictions on what people can and can’t do."

Amid the uncertainty, some stocks are enjoying the best rally of their listed lives. It's easy to forget that a $70 stock like Afterpay listed only a few years ago at $1, closing the first day at $1.25. We lead this week with a look at Afterpay's success and investment lessons from a stock that ignores normal valuation techniques.

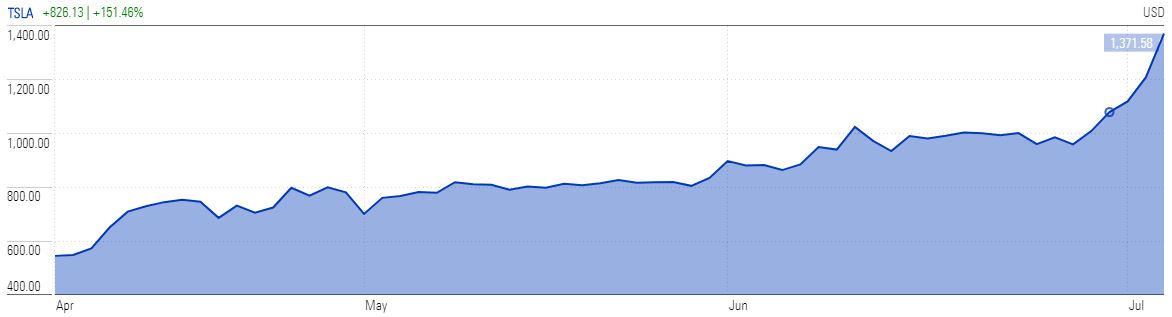

Similarly in the US, Tesla is on a tear after posting a first quarter profit for the first time. Elon Musk is laughing at the shorters. The market does not even care that its main plant in California was closed for a few months, as Morningstar Strategist David Whiston reports:

"If a recession can’t stop Tesla then virtually nothing will, and we expect the company to remain a leader in autonomous technology and range. Tesla is also gaining scale and its ability to make desirable vehicles while generating free cash flow and net profit is far better than it’s ever been."

This week, Ashley Owen reviews the Australian stock markets in FY20 by major sectors, placing the numbers in recent context and checking how much returns have relied on dividends in the past.

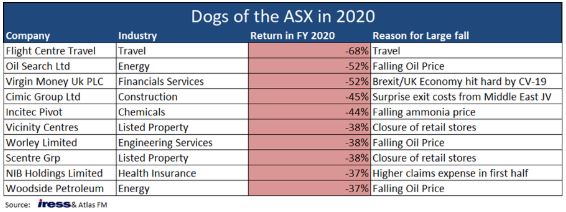

Then Hugh Dive looks ahead to the most uncertain August reporting season for a decade, as well as compiling this chart of the market dogs of last year.

The value versus growth debate is ongoing, and Stephen Bruce checks the conditions necessary to give value a better run, and whether the pandemic leans into this change. Then Angus McLeod looks ahead to five industries facing the profound and perhaps permanent impact of COVID-19, especially as we now know it will not go away until there is global availability of a vaccine.

Michael Recce identifies six types of 'big data' we need to watch, emphasising that the ability to interpret the numbers and integrate them into an investment process is vital to adding performance.

Jonathan Rochford called it 'madness' when investors trusted Argentina with a 100-year bond in 2017 but they have done it again with Austria. This time, it might not be credit risk but the price loss from small rises in rates is extraordinary over such long terms.

Finally, two articles on growing market segments. Richard Montgomery shows why not all ethical ETFs are the same, while David Zipparo and Tim Davis explain what to look for in private debt as it faces special challenges and opportunities this year.

In this week's White Paper, AMP Capital's Shane Oliver gives his review of FY20 and his views on FY21 amid the turmoil.

Now that's a packed edition worth reading over a slow cup of coffee.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website