Key takeaways

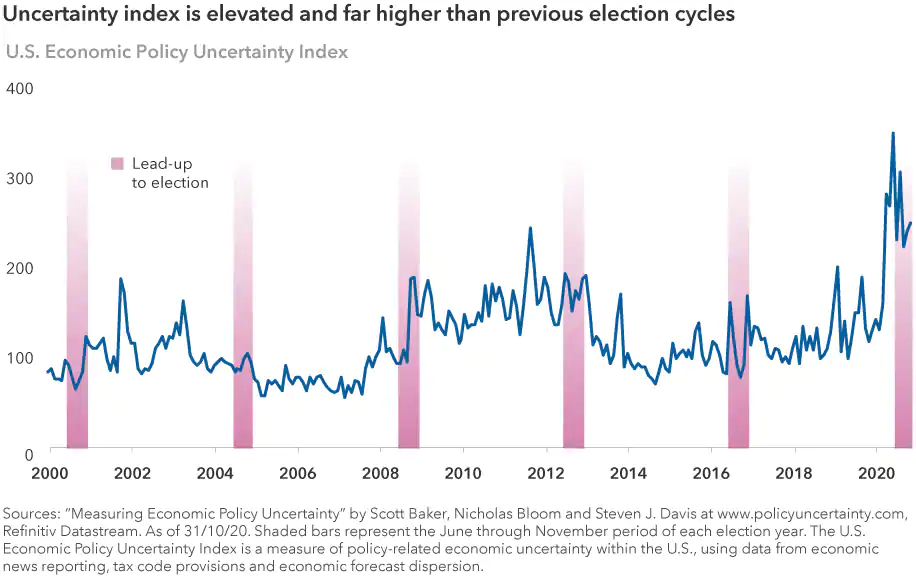

- Investors should prepare for higher market volatility in the aftermath of Election Day.

- Patience is key as the outcome of the U.S. presidential race may not be known for days or weeks.

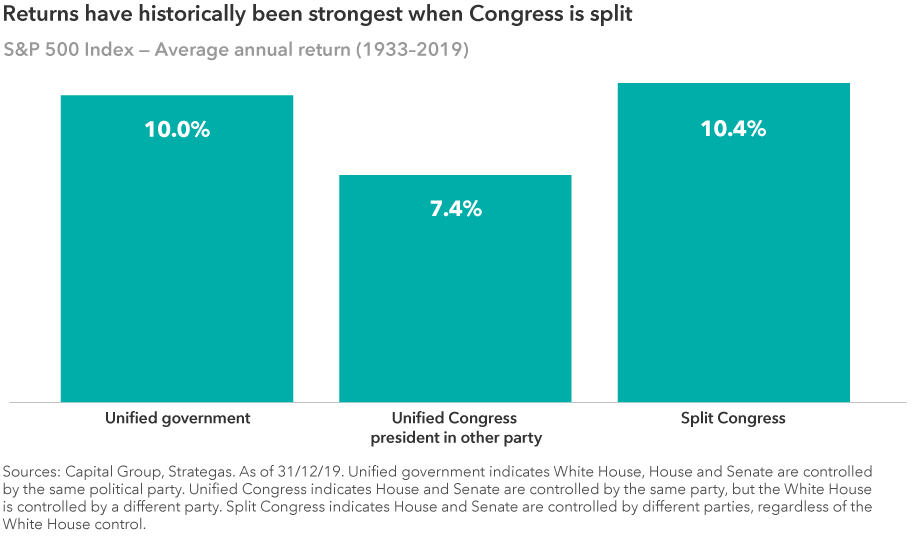

- Republicans will likely hold the Senate, resulting in a split Congress, an outcome that has historically resulted in higher market returns.

- Despite the uncertainty, investors should remember that company earnings, not elections, drive the stock market.

The uncertainty of 2020 continues.

After turning out in record numbers on Election Day, U.S. voters have yet to see a winner declared in the U.S. presidential election. In a race that has proved to be much closer than many polls had predicted, the final outcome may remain unknown for days or even weeks.

“Patience will be the key to getting through this period of political uncertainty,” says John Emerson, Vice Chairman of Capital Group International and a former U.S. Ambassador to Germany. “There are literally millions of votes that have yet to be counted — including a large number of mail-in ballots — so a delay is not that surprising. We’ve been warning about this scenario months.”

From an investment perspective, it is likely that market volatility will persist at elevated levels until President Donald Trump or former Vice President Joe Biden is declared the winner. U.S. equity markets staged a strong rally on Election Day, with the S&P 500 Index rising 1.8%. Treasuries rallied, partially on the view that a split government could curtail prospects for excessive fiscal stimulus.

“There’s understandably a lot of anxiety right now,” Emerson adds, “But investors should think hard about adhering to their long-term investment goals, rather than reacting to near-term political events. That is often a mistake.”

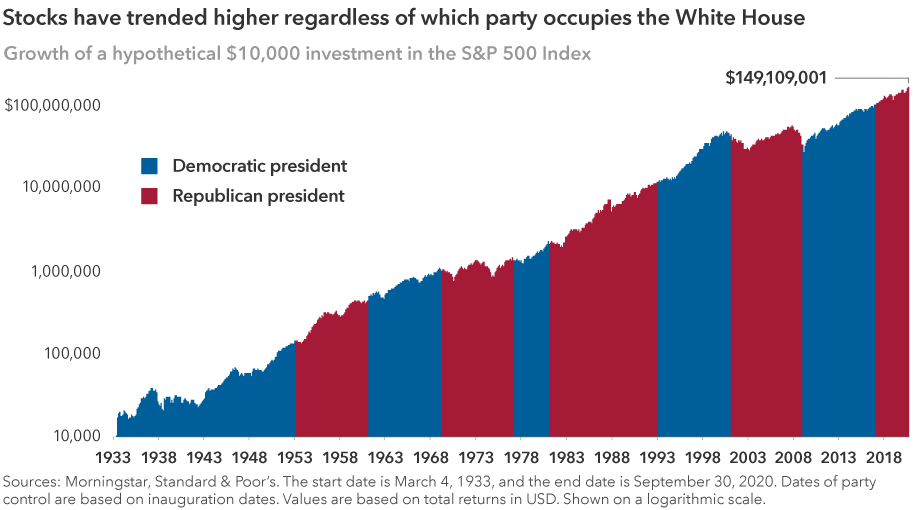

Over the course of history, markets have powered through contested presidential elections, deadly pandemics and economic recessions — usually not all in the same year — but they have powered through, nonetheless. Whether a Democrat or a Republican occupies the White House has made little difference to overall long term investment returns.

Where do we go from here?

The stage has been set for vote-counting battles, and a flurry of lawsuits, in swing states that have not yet been called for Biden or Trump. Those states include Pennsylvania, Nevada, North Carolina and Georgia, according to The Associated Press.

“Thursday or Friday is probably the earliest we will know the preliminary vote results for each state, depending on the looming litigation,” says Matt Miller, a political economist and policy analyst with Capital Group. “The presidency could go either way in the fraught period ahead.”

The nation essentially remains just as divided as it was four years ago when Trump unexpectedly won the 2016 election. Miller notes, “Whoever wins this election will have the daunting task of trying to bring unity and healing to a nation that is split right down the middle.”

In other races, it appears that Republicans will continue to hold a majority in the U.S. Senate, Miller says, while Democrats will maintain control of the House of Representatives, resulting in a split Congress. That’s been the case since the 2018 midterm elections when Republicans lost the House. Coincidentally, according to our analysis, markets have performed best under a split Congress.

Two key issues in the race

The U.S. economy and the coronavirus outbreak were the top two issues in the presidential contest, according to most polls. Trump was generally viewed unfavorably for his handling of the pandemic, while voters gave him higher marks for his economic policies. The U.S. fell into a recession earlier this year, as government-imposed lockdowns brought economic activity to a near standstill.

However, in the most recent measure of U.S. economic activity — released just five days before the election — U.S. GDP growth bounced back sharply, rising at a 33.1% annual rate, benefiting from pent-up consumer demand and massive government stimulus measures. A key driver has been U.S. home sales, which have benefited from rising demand and historically low mortgage rates.

Despite extreme volatility during the year, U.S. equity markets also have trended upward. On a year-to-date basis to October 30th, the S&P 500 Index gained 2.8% as technology and consumer-tech stocks rallied amid the lockdowns.

“The near-term performance of the economy and the markets may have played a role in this election but, realistically speaking, presidents get far too much credit when things go right and far too much blame when things go wrong,” says Capital Group economist Darrell Spence. “For the most part, the dynamics that contribute to economic growth and market returns are put in place long before the election and they remain long afterward.”

“As investors, we try to focus on the underlying fundamentals that are driving the economy and corporate profitability,” Spence notes. “That often has very little to do with who happens to win an election.”

John Emerson is Vice Chairman, Capital Group International. Matt Miller is a political economist and Darrell Spence is an economist and research director at Capital Group, a sponsor of Firstlinks.

For more articles and papers from Capital Group, click here.