Last week, a Liberal Party insider told me a bank royal commission was “one major stuff-up away”. While this does not fit with the denials by both the Prime Minister and the Treasurer (who said the call for a royal commission was a “populist whinge”), there is no doubt the major banks’ refusal to pass on the recent 0.25% reduction in the cash rate to borrowers was fuel on the fire. The issue has become more politically charged since the election. Regardless of the merits of CBA’s $9.45 billion profit and Chief Executive Ian Narev’s $12.3 million take-home pay last year, the headlines did not help the banking industry’s case.

My view is that a royal commission would be counterproductive. This might come as a surprise to anyone who has read my original bank ‘whistle-blower’ book, Naked Among Cannibals. The sub-title was, ‘What Really Happens Inside Australian Banks.’ It gave a blow-by-blow description of how banks price products and set fees, and many of the questionable practices continue 15 years after the book was published. Notwithstanding, I set out 10 reasons why a royal commission is not required.

We have included a survey at the end of this article for you to provide your opinion, or use the comments section.

Public support for royal commission grows

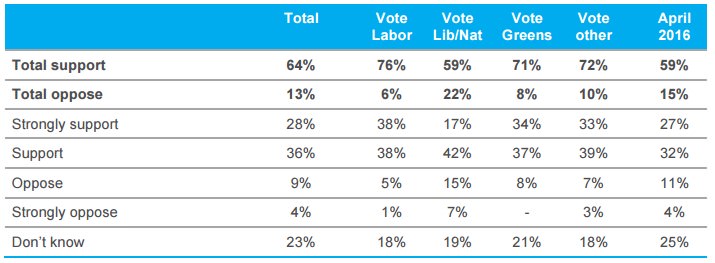

Between 12 and 15 August 2016, Essential Media conducted a survey which included the question in the table below. The results suggest 64% support a royal commission, up from 59% in April 2016, and only 4% strongly oppose. Other data collected shows those most likely to support the royal commission were aged 65+ (70%) and those earning over $2,000 per week (70%).

Research on public support for a royal commission

Question: Would you support or oppose holding a royal commission into the banking and financial services industry?

Research on public opinion on royal commission

Source: Essential Media. For details on methodology, see full report.

The politics is worsening for the banks

When Malcolm Turnbull recently called for banks to pass on the full cash rate reduction, he again reminded the banks of their social responsibility:

“They operate with a very substantial social licence and they owe it to the Australian people and their customers to explain fully and comprehensively why they have not passed on the full rate cut and they must do so.”

Labor’s Bill Shorten clearly thinks he’s on a winner with the demand for a royal commission, hitting all the right political notes when he said:

“There is a culture in banking which puts the profits of banks, big profits, billions of dollars of profits, ahead of the national interest and interests of mum and dad mortgagees, small businesses and people with large credit card interest rate debts.”

Of course, the royal commission issue is not primarily about failure to pass on the rate cut. That simply shows how every headline affecting the banks triggers the debate. The original calls were driven by the Senate Inquiry two years ago which recommended a royal commission to investigate “forgery and dishonest concealment of material facts” in the financial planning arm of CBA. That was followed by the delay or denial by CommInsure in paying out insurance claims based on medical definitions that played out badly on ABC television’s Four Corners. A bank can never win an argument in the media about the definition of a heart attack while the victim lies in a sick-bed.

The election result made the likelihood of a royal commission even greater. Fairfax Media has done a headcount in the Senate and estimates that 43 of the 76 senators favour a royal commission, while the Government would control the numbers in the Lower House. However, a royal commission is an executive (cabinet) inquiry, not a parliamentary inquiry, and the government can ignore motions from either house.

Reasons a royal commission would be detrimental

While a royal commission may not have the rate cut issue in its terms of reference, the two issues have become joined due to the community expectations and bank culture issues which have resurfaced since the election. I have previously discussed these points in this article.

Here are some arguments against a royal commission:

1. There are already enough regulators, inquiries and committees

Banking is already the most regulated industry. Global and domestic regulators set rules across most aspects of banking including liquidity, capital, maturity mismatch, loan growth and dozens of other obligations. Banks are subject to monitoring and oversight by the Australian Securities & Investments Commission (ASIC), the Australian Prudential Regulation Authority (APRA), and, to a lesser extent, the Australian Competition and Consumer Commission (ACCC) and the Reserve Bank of Australia (RBA). There are many other interested government bodies such as the Banking Ombudsman, the Credit and Investment Ombudsman and the Superannuation Complaints Tribunal. The Financial Ombudsman Service Australia (FOS) is currently under a review with detailed terms of reference on the dispute resolution and complaint framework for the financial system.

The Financial System Inquiry reported on 7 December 2014 and the Government released its response on 20 October 2015. A Senate Inquiry into the performance of ASIC spent considerable resources investigating financial advice, and especially Commonwealth Financial Planning. The Future of Financial Advice (FoFA) legislation has been argued and changed and debated for at least the past five years. Allegations of misconduct by CommInsure led to intense public scrutiny. The Productivity Commission is studying the costs and benefits of vertically integrated financial advice, and bank CEOs are now required to appear before the House of Representatives Economic Committee each year to answer questions over a wide range of topics.

No doubt there are others. Many senior bank executives spend their careers bouncing from one crisis, public review, regulator meeting or inquiry to another. Policy or regulatory changes can be imposed on the banks without a royal commission, and major culture changes must come from within.

This week, Moody’s Investors Services reaffirmed Australia’s Aaa sovereign issuer rating, stating: "Australia's monetary policy and banking regulation and supervision are vigilant and responsive to economic and financial conditions."

2. Banks have many stakeholders and can’t keep everyone happy

Much of the discussion about bank ‘stakeholders’ revolves around the trade-offs between depositors, borrowers and shareholders. Other stakeholders include the government, the community and even staff. It’s a fine balancing act every time a bank makes a major decision.

The most vocal defence of banks in face of recent criticisms came from CBA’s Narev at his profit announcement. One of his slides was headed, “Depositors and shareholders fund our lending to borrowers”, and he noted that CBA has over 11 million deposit customers and only 1.9 million home loan borrowers. CBA has 800,000 shareholders, and almost every adult with any form of superannuation would have exposure to the major banks. The banks comprise a weighting of about 30% of all shares listed on the ASX. The one million SMSF trustees have a particularly heavy weighting to Australian equities and banks. Millions of Australians depend on the dividends from the banks, with over $4 billion paid annually to households by CBA alone. It is the country’s largest taxpayer and employs around 45,000 staff, while it contracts services from over 6000 small- and medium-sized businesses.

3. An exercise in bank bashing

Daily news stories of banks mistreating people does not help confidence and stability in our financial system, where the banks hold prime position. In an industry managing the money, loans and transactions of 20 million customers, there will inevitably be those that should have been treated better, and victims are always eager to tell their stories. Banks certainly need to be held accountable to these people, but the GFC showed how fragile the banking system can be. A regular news feed from a royal commission would undermine trust in the banks.

4. The majority of customers are satisfied with their bank

While banks cop a lot of public criticism (and I’ve voiced more than my share), Roy Morgan Research reports consumer banking satisfaction is close to an all-time high, and certainly far higher than levels a decade ago. While there will always be performance issues such as delays reaching call centres, the customer interaction experience in branches, internet, mobile, and telephone services is better than it has ever been.

5. Bank profits may have already peaked

Most bank share prices have fallen in the past 12 months as the market realises the golden days for bank profits are probably over. The regulatory requirement to hold more capital and liquidity, the passing of the low point in the cycle of bad and doubtful debts, the increasing competition for loans and deposits, and the gradually rising threat of fintech, especially in payments systems, all weigh on the sector’s outlook.

Recent bank profit results were mediocre. CBA’s full year rise disguised second half weaknesses, while ANZ’s cash profit fell in the last quarter. As banks struggle in coming years to hold their dividends and profits, it’s likely that claims of greed will become less vociferous. Having said that, it would clearly help if CEOs were not paid 153 times average weekly earnings. But the claims of ‘greedy banks’ may be more difficult to sustain as profits steady or fall.

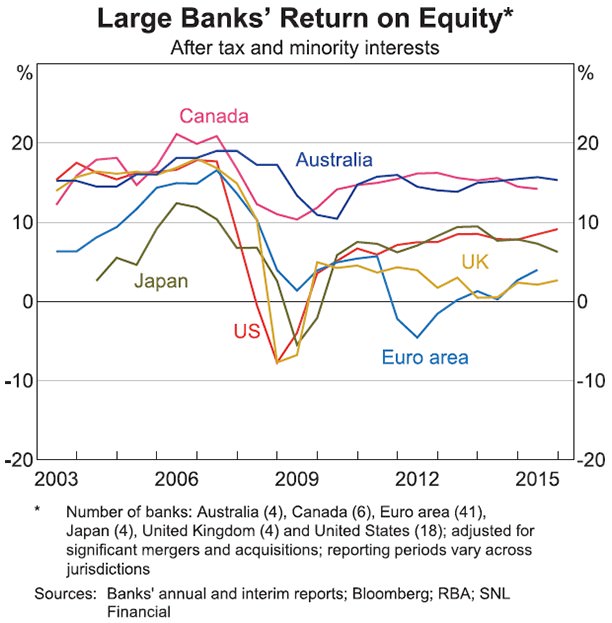

6. A strong economy needs strong banks

As the table below shows, Australian banks are among the world’s most profitable, especially since the GFC of 2008. This is a double-edged sword: during times of economic stress it’s important to have strong banks that earn good profits to maintain their capital, but at what point has it gone too far? I believed when I wrote my book that in recovering from the recession of 1991, the bank culture went too far in promoting profit and shareholders at the expense of other stakeholders. I still see many examples of bank activities that should embarrass its executives, but a royal commission would do little to change that.

Source: Reserve Bank Bulletin, March 2016.

There is also an argument that, with far more depositors than borrowers, there is a stimulatory impact on the economy from higher deposit rates, whereas low mortgage rates receive all the media attention. Mike Hirst, the Chief Executive of second-tier Bendigo and Adelaide Bank, explained the failure to pass on the full rate cut to borrowers by emphasising the need to remain competitive on deposits.

7. Vague notions of what a royal commission would achieve

We know banks can be bastards, but we don’t need a royal commission to tell us that.

There is nothing resembling a terms of reference to let the public know what questions will be addressed. Bill Shorten has talked about vertical integration, whistle-blower protection and remuneration structures, but these are issues already being addressed. Do we really want the satisfaction of a bruised and battered industry disliked by even more people and a range of recommendations about changing corporate culture? Do we want arrogant CEOs humiliated in public, like the George Pells of business? Do we seriously think most of the public will understand the complexities of banking and how decisions are made? The vast majority of people do not have a clue what bank capital adequacy is and the implications of tighter rules.

Inside the banks, they would steadfastly go about considering the needs of all their stakeholders. As bank profits struggle, there may even be more of a community desire for banks to remain strong and well-capitalised, and maintain their dividends, as pass on a rate cut.

8. It would be expensive and last for years

Initial estimates for the cost of a royal commission are $50 million over at least two years. While that is not a large number in the scheme of things, little more than four times Ian Narev’s remuneration last year, the far higher cost would be within the banks themselves. Consider the inquiry into Commonwealth Financial Planning (CFP): the project management and investigation has required a team of over 600 people and tens of millions of dollars in expenses inside CBA. Of course, CBA and CFP have a case to answer and brought many of these issues on themselves, but a royal commission would absorb incredible resources and management time when there is a major business to manage.

9. The recommendations may be bad for economic growth

Following two years of sad customer stories and revelations of bad culture, the only way a royal commission could create change is by introducing a new set of rules and regulations.

What might they look like? New taxes on banks, limits on credit growth, government bureaucrats involved in decision-making, formal controls over deposit and lending rates, directions to lend to certain industries, instructions on how to allocate resources? It could go anywhere.

And when these decisions are placed in the hands of the government rather than competitive forces (even in a strong oligopoly), unregulated industries prosper outside the banks. Taxpayers take the losses on inappropriate loans done for political purposes. Interest rates are set so that banks cannot attract deposits and loans are not priced properly. Bank money is used to prop up failing industries. When access to credit is compromised, business is stifled and good projects lost.

Many of these measures would limit economic growth. The banks already claim that ongoing political and public criticism reduces foreign investors’ appetite to invest here. The banking system is the plumbing through which the economy functions. Block the plumbing and we’re all in a mess.

10. Like democracy, what’s a better alternative?

The banking system and the banks are far from perfect, but it’s like the Westminster System and democracy. As Winston Churchill said: “Democracy is the worst form of government, except all those others that have been tried.” Be careful what we wish for.

Please take our survey on whether a royal commission into banking and financial services is required, linked here.

Graham Hand is Editor of Cuffelinks. He worked in the banking industry for 20 years including sitting on three bank pricing committees before becoming a consultant and writing for major publications, plus having two books published. He then moved into wealth management for 15 years.