It’s often said that history doesn’t repeat itself, but it often rhymes. However, seeing our schools shut, offices closed, and neighbours in masks surely can make one wonder, maybe 'this time is different.' We are at a watershed moment: the level of disruption across global industries, and the speed at which markets have upended, is truly unprecedented.

However, as different as it may seem, the response to the crisis feels all too familiar. Human behaviour is remarkably consistent over time, and one of those behaviours, panic, is just as contagious as any virus. But we can take solace in knowing that disciplined diversification and a systematic process can remove decisions rooted in panic and position investors to take advantage of potentially significant long-term opportunities.

Speed of the crisis

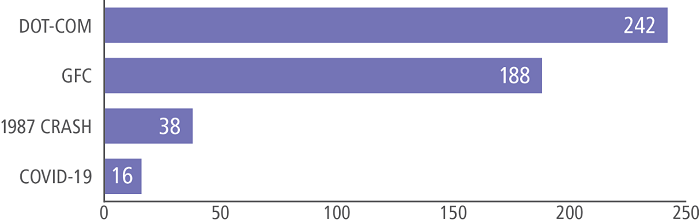

The speed at which the coronavirus has spread across the world has been a made-for-television moment. As the rate of contagion has accelerated, so too has the market’s reaction. We have seen one of the quickest falls into a bear market (defined as a greater than 20% decline) in US history, with the market plunging from an all-time high on 19 February 2020 into a bear market only 16 days later.

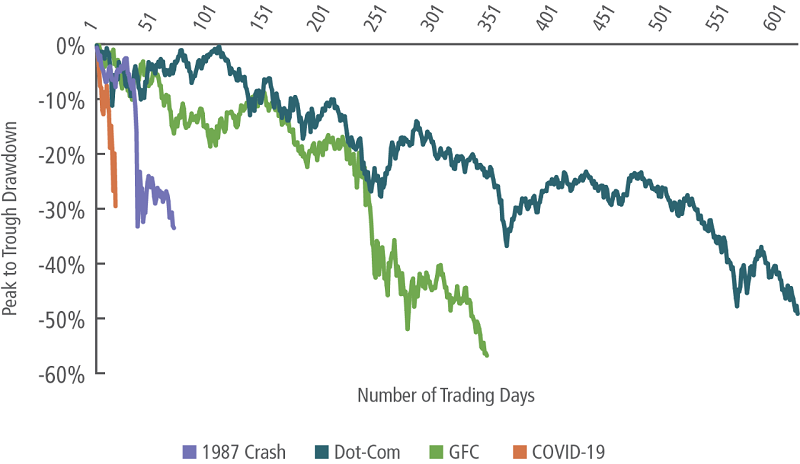

In prior crises like the dot-com bubble and the GFC, the bear markets came about much more gradually, over the course of half to a full year, as shown below in Figures 1 and 2.

Figure 1: Number of days from market peak to bear market

Source: Bloomberg, S&P 500 Index.

Figure 2: Market drawdowns

Source: Bloomberg, S&P 500 Index.

The level of disruption

During the GFC, investors were worried about the unraveling of the financial system and the potential for another Great Depression. But never during the GFC did people worry about their own physical health or that of their families. In fact, we would be hard-pressed to name a similar period of fear for one’s wellbeing for such a large segment of the global population since at least the second world war.

As a result of that fear we are witnessing unprecedented actions, including the complete shutdown of many industries within the global economy. Determining the full impact of this is little more than speculation, as there is no recent historical precedent and as the data points start to roll-in we will likely see numbers that would have been unthinkable a few weeks ago.

Why it’s not as different as we might think

It’s said that 'generals always fight the last war', and in our context it can be said that 'economists always fight the last recession', but it’s said for good reason. All crises - whether they be wars, depressions, or even pandemics - are inherently different from one another. However, people’s reaction to them is remarkably consistent, and there is no evidence to suggest that this has changed.

As the brain assesses a threat, it triggers a fight-or-flight response, anxiety rises, and logical processing and reasoning diminish. The infectious nature of the panic moves from individuals to crowds, which leads to herding behaviour. For example, even though grocery stores indicated no sign of supply disruptions, and governments made no threats of closures, panic buying of non-perishables and household goods soon became rampant.

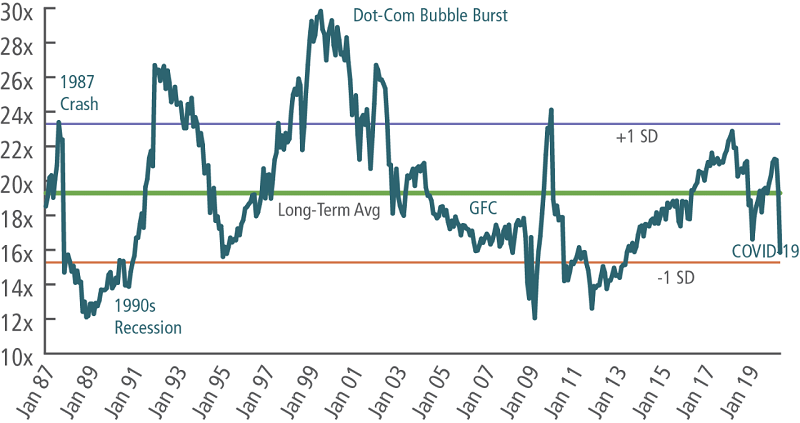

The same behaviour applies to sell-offs and run-ups in financial markets. While repricing of assets is likely necessary in light of this crisis, many investors overreact as panic and indiscriminate selling spreads. This can be seen time and again throughout history as people respond out of fear, in the fog of ‘now’, undoubtably making mistakes that will later seem all too obvious in the clear skies of hindsight. Figure 3 shows how the market pushes valuations to excesses well above long-term averages, followed by falls to the other extremes.

Figure 3: S&P 500 Trailing Price/Earnings Ratio

Source: Bloomberg, S&P 500 Index.

Waiting for the all-clear sign

News headlines from 6 March 2009 were dominated by one of the worst monthly jobs reports in US history as 744,000 jobs were lost in a single month. On 9 March, only a few days later, the US equity market bottomed and began its recovery despite the backdrop of a recession raging on.

Historically, this is not an isolated incident. Over the last 80 years, the market has bottomed on average 107 days before the end of a recession. While we hear various estimates of time until the market bottoms, days until virus outbreaks peak and the length of the impending recession, there will not be an ‘all-clear’ sign for when the market starts to recover and it’s ‘okay’ for investors to jump back in.

This raises the importance of two time-tested investment pillars - diversification, and a systematic investment process.

Diversification

Diversification protects investors from overreaction as a balanced portfolio should mitigate some of the volatility and drawdowns. In good times, investors place increased value on future opportunities and earnings, as an overzealous fear of missing out drives their decisions leading to outperformance of more cyclical portions of the market.

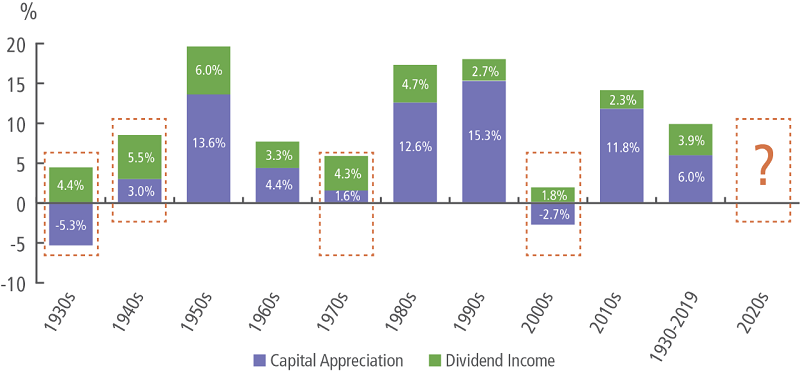

However, during more turbulent times, investors put an increased value on certainty, focusing on fundamentals such as dividend income, and earnings stability. In fact, looking back over time, one can see the importance of income versus capital appreciation in times of uncertainty and lower economic growth, as shown in Figure 4.

Figure 4: Contribution of capital appreciation and dividend income within S&P 500 returns

Source: Bloomberg, S&P 500 Index.

Systematic investment process

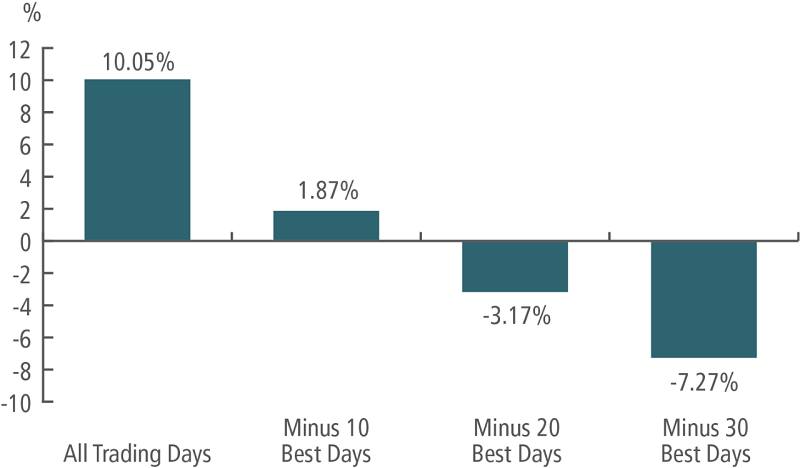

While diversification attempts to protect portfolios from overreacting during periods of crisis, a systematic process attempts to protect portfolios from underreacting during one. While we are confident that markets will eventually find a bottom, determining when will be challenging. So, as the desire to sit on the sidelines grows, missing out on a small number of days in the market could have a significant impact on long-term returns, as shown in Figure 5. In fact, some of the best days in the market have often followed the worst. Taking the emotion out of investor behaviour will ensure investors take advantage of large price swings and increased volatility.

Figure 5: The risk of missing out on a few trading days

20-Year Annualised Rate of Return, as of March 26, 2020

Source: Bloomberg, S&P 500 Returns.

Conclusion

This time feels different, and that’s because, in some ways, it is. The speed and scale of this crisis is truly unprecedented. Nevertheless, investor reactions are and will be the same. Human behaviour is consistent through time, and like many crises past, people and markets will panic, leading many investors to overreact, creating enormous volatility but also significant opportunity.

We take comfort in our playbook, with diversification and a systematic process as the bedrock of our investment approach. Mitigating emotion, even in the best of times, is not easy. But our process is our guiding compass in these turbulent markets.

Michael LaBella, CFA, is Head of Global Equity Strategy at QS Investors. This document is issued by Legg Mason Asset Management Australia Limited (ABN 76 004 835 839, AFSL 204827), a sponsor of Firstlinks. The information in this article is of a general nature only. It has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Forecasts are inherently limited and should not be relied upon as indicators of actual or future performance.

For more articles and papers from Legg Mason, please click here.