Top convictions for 2025

- US stocks are expected to outperform rest of the developed world on earnings

- Japanese shares still a strong bet as reforms improve returns

- Nerves over valuations make the case for income

Pound for pound, macro and monetary policy should deliver a positive environment for stock markets going into 2025. The business cycle will enter a new stage - but the year will also see geopolitics resound ever more loudly.

The trends we have seen dictate recent price moves may have further to run. But we can expect new directions and a broadening of areas of growth in markets. These are exciting times for equity investors.

Global trends

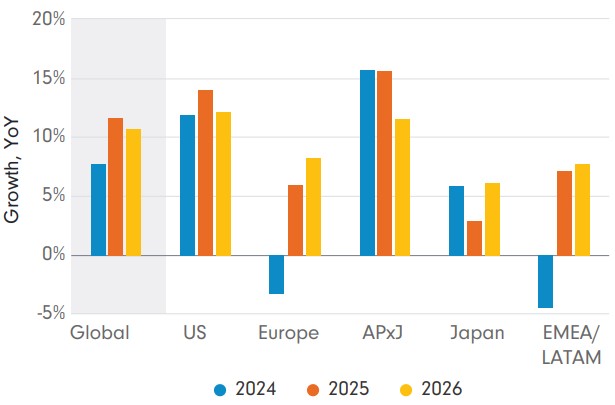

For good or bad, a landmark Republican election victory is likely to reinforce American exceptionalism. Even before November’s poll, we expected US corporate earnings to increase by more than 13 per cent in 2025, beating most other regions and the global average in terms of growth, return-on-equity, and the level of net debt.

The election has fanned optimism in the market that the coming year will prove pro-business, pro-growth, and pro-innovation. There are risks to some sectors from potential tariffs and further trade frictions between the US and China, but at least some of any resulting reflation will be helpful for earnings and ease fears over higher corporate valuations.

Figure 1: Regional views – Aggregate earnings growth estimates through 2026

Source: Fidelity International, October 15, 2024.

Nevertheless, investors will have to be more discerning in where they look this year. The artificial intelligence (AI) trend is a case in point. On the one hand there is a debate about valuations of the big tech companies; Nvidia and others are still hitting record highs and there may be further to run, but our attention is also turning to which companies are next in line to benefit.

Those who facilitate the use of AI are one obvious group but ultimately many less directly related industries and consumers will also be beneficiaries. Apple made a fortune from smartphones, but their arrival fuelled growth across a wide range of existing and new businesses.

Less than a third of companies have so far embedded AI and machine learning in their operations, but more than 70% plan to: its impact on the economy will broaden. It is an area where American leadership is unquestionable.

The other big structural trends of this decade will continue to play out in 2025 and will be worth watching. The breakthrough in anti-obesity drugs is significant but, like AI, Ozempic and others have the potential to change the game in areas well beyond the small list of healthcare index constituents currently profiting. There are already hints of knock-on effects in how people use hospitals and gyms, and other use cases are developing.

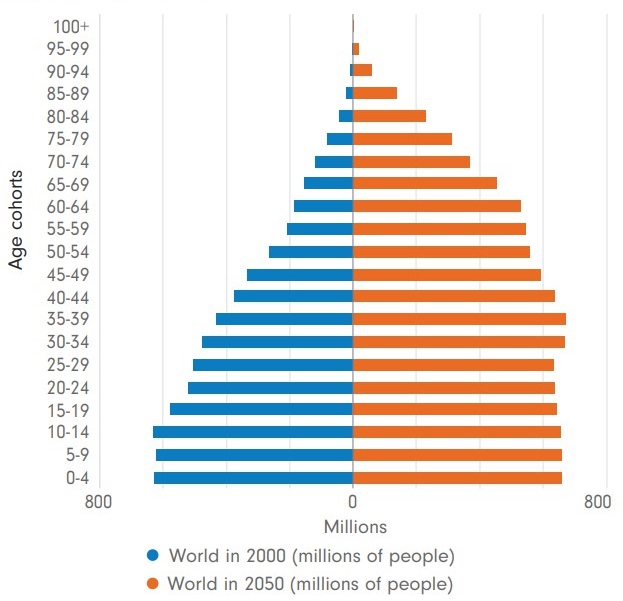

Healthcare has another notable structural driver: the global population aged over 65 will double by 2050 and the proportion of incomes we spend on keeping ourselves healthy will continue to grow.

Figure 2: An ageing world – Demand for healthcare will grow strongly in the decades to come

Source: Fidelity International, HSBC, UN Population Database, February 2021.

Homeshoring

While it’s widely expected that the Republicans may repeal some areas of President Biden’s Inflation Reduction Act including electric vehicle credits, manufacturing incentives should be more protected given a large proportion of investments are located in Republican-held districts.

The onshoring trend has gathered momentum and has bi-partisan support. We are seeing manufacturing activity driving growth and investment in middle-America and our research shows it will add 2-3 percentage points to the base growth rate of fixed investment in coming years.

The picture for small-and-mid-cap segments may prove more complex. An ongoing rally has put straight much of the discrepancy in valuations with the top end of the market, but the coming year will provide different impulses. Tax cuts are likely to benefit small businesses, as would lower financing costs. But the latter will evaporate if price rises force the US Federal Reserve to change tack and immigration and tariffs bring potential threats to growth and spending on the ground.

In general, both the soft landing or reflationary scenarios outlined by our macro team for the months ahead bode well for earnings of early cyclical stocks. And if the new administration reflates the economy and reduces regulation it should bode well for US financials and value sectors.

Trade risks

Going into 2025, we see sentiment and fundamentals metrics as supportive of Japan. It remains on track for reflation with strong wage growth, and capital expenditure and shareholder returns will increase steadily over time. The percentage of TOPIX companies outperforming the index has also been on the rise, as investors scout for beneficiaries of the country’s corporate governance reforms.

One caveat is that a strong yen combined with higher interest rates could hurt earnings later in the year, especially in the consumer discretionary sector, where overseas sales outweigh domestic demand for carmakers and durable goods exporters

On the other side of the developed world, there are significant challenges. Recent profit warnings by European industrial and automobile companies, as well as lacklustre sales by consumer discretionary names, signal that doubts over Chinese demand could weigh heavy on these shares. Our macro team’s modelling also suggests a partial implementation of the tariffs floated by Republicans would knock as much as half a percentage point off German and Eurozone GDP.

On the flip side, the arrival of a concerted campaign of monetary loosening should in theory be helpful for European cyclicals, but the cheaper and more defensive bet currently is income: returns from dividends and share buybacks combined in some areas of the market are running at as much as 8% and are better priced.

Asian potential

In China itself, we prefer sectors that are already high on the government’s policy agenda: technology, high-end manufacturing, consumer, and healthcare. We’re conscious that Chinese equities can be volatile, and that many companies have rebounded from depressed to fair valuations on the policy pivot. The good news is that there’s no shortage of stocks with clear paths to earnings growth in this massive market.

China is positioning to preserve, but not reignite, economic growth. Policymakers recognise the need to stabilise home prices; they are not about to jeopardise the hard-won progress they’ve made in reducing debt by reflating the housing market. An incremental recovery in Chinese equities is the most likely outcome.

Elsewhere in emerging markets, Indonesia has good growth and earnings momentum, but banks’ dominance makes the market vulnerable to interest rate cuts. While liquidity is much thinner for global investors, the Asean region widely stands to benefit from the secular trend of supply chain diversification and an increasing share of foreign direct investment from across the world.

India will again be a bright spot for long-term investors. Although some foreign flows are taking profit after the recent rally, and extreme weather is disrupting agriculture, the country’s prospects remain solid, underscored by advantageous demographics and investments in infrastructure and manufacturing. And that’s why domestic investors are still buying.

Earnings are everything

No one can know with certainty the future of US-China relations, or predict commodities' trajectory precisely, should conflicts in the Middle East escalate further. But with volatility comes both risk and returns.

The outlook for earnings growth globally remains robust and our view on equities going into 2025 is generally positive. However, with valuations high, smart money will be looking for the right homes as the economic cycle turns. Our approach is to stick to the fundamentals, while staying vigilant and disciplined on valuations. This will guide our thinking through 2025 and beyond.

Niamh Brodie-Machura is Co-Chief Investment Officer, Equities, and Marty Dropkin is Head of Equities, Asia Pacific at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

Read the full report and relevant disclaimers here.

For more articles and papers from Fidelity, please click here.

© 2025 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.