Weekend market update: On Friday in Australia, the S&P/ASX200 lost 0.6% on the news of the Victorian lockdown, which was the same 0.6% fall for the week overall. In the US, the S&P500 added 0.5% on Friday to take the week's gain to 1.2% supported by good earnings announcements. China was up a strong 5.9% and most other countries gained. Bond yields continued to drift up.

***

At any time in the investing cycle, a strong case can be made for both buying and selling equities. There are no absolutes. Even as markets look overvalued at the end of a bull run, the optimism could play out for years to come. Investors hate to sell and then watch their shares continue running, and the FOMO of daily headlines about record highs become increasingly irritating.

The added complication for investors at the moment is the unlimited liquidity the central banks are pumping into the system. The TINA trade is real. In the past, switching to term deposits at 5% was a reasonable choice, but many feel There Is No Alternative to holding equities when bonds and deposits do not even cover the inflation rate.

This is the biggest dilemma facing investors. Christine Benz analyses the tension and says retirees should watch their portfolios have not become too aggressive, especially those who have not rebalanced and equities are now overweight.

The biggest names in global investing continue to issue warnings. As Howard Marks noted in a recent Bloomberg interview:

"Fear of missing out has taken over from the fear of losing money. If people are risk-tolerant and afraid of being out of the market, they buy aggressively, in which case you can't find any bargains. That's where we are now. That's what the Fed engineered by putting rates at zero.

"We are back to where we were a year ago - uncertainty, prospective returns that are even lower than they were a year ago, and higher asset prices than a year ago. People are back to having to take on more risk to get return. At Oaktree, we are back to a cautious approach. This is not the kind of environment in which you would be buying with both hands. The prospective returns are low on everything."

Regardless of the expertise brought to the discussion, it's a personal decision. Nobody knows the future, but we do know that central banks and governments have discovered a stimulus nirvana and the market is ignoring the inflationary consequences. Who does not want to enjoy the equity party?

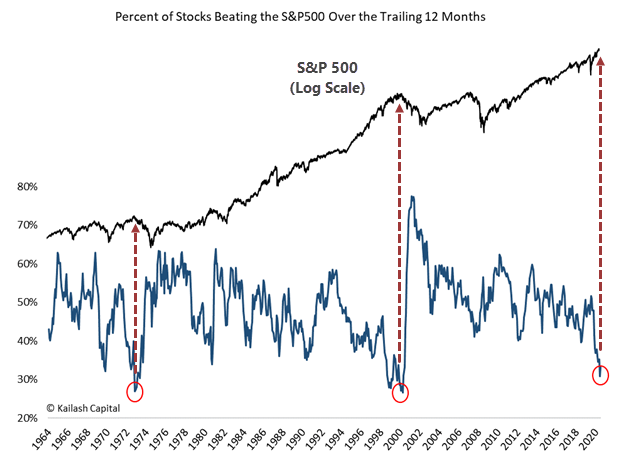

Adding to the difficulty of selecting shares, as the following chart shows, only about 30% of companies in the S&P500 beat the index over the last 12 months, close to a record low. It's no surprise that investors are flocking to index ETFs, as our first article explains, when the prices of most shares cannot match the index. Stock picking is not as easy as it looks.

Source: Sentimentrader

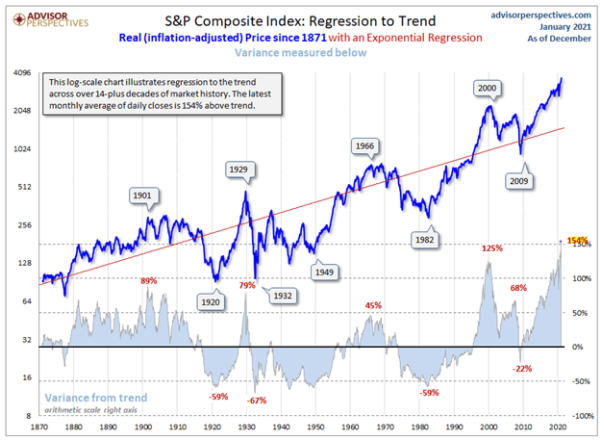

And, yes it's true that we often publish charts showing equity markets are expensive, and then they rise again next month. In the US, this chart from Advisor Perspectives showing the S&P Composite Index is further above (at 154%) its long-term trend line than at any other time in history. As we said above, these trends can persist for years, but they do point to lower long-term returns from equities with this expensive entry point.

Plenty of people think these levels are justified by record low interest rates and central bank spending, and Andrew Mitchell asks what would happen to equity prices if bond yields rise. As my old colleague Satyajit Das writes in the AFR this week, low rates feed asset price inflation, encourage mispricing of risk and distort financial activity. Why do we assume this can go on forever?

There are few places to hide that produce decent returns, and one alternative is private debt as explained by my co-founder, Chris Cuffe, last year. Simon Petris from Revolution Asset Management has a good sporting analogy and provides charts showing how an allocation to private debt can improve a portfolio. It's a sector increasingly in the spotlight, and Metrics Credit Partners is a manager of $6 billion in this sector and they join Firstlinks as a sponsor this week.

One consequence of asset price inflation is that those with the assets - especially shares and property - are doing well while inequity rises. Dr Rodney Brown explains the downside of low rates and says investors should prepare for the day when governments need to address the fiscal and monetary imbalances.

Finally, two thought-provoking articles. Andrew Podger AO doubts superannuation funds can provide the ‘optimal’ drawdown arrangements proposed by the Retirement Income Review and he suggests another way forward. Then Michael Collins looks at Germany's attitude to Europe and the euro, and for those hoping the continent's problems will be fixed by a fiscal and political union, he gives five reasons this is unlikely to occur.

For anyone who missed my editorial on GameStop last week, we now include it as an article with some new paragraphs. There is also an interesting comment which supports my view that those who claim the Reddits beat Wall Street do not know who was on the other side of the trade. To quote from the comment:

"I'm aware from my industry contacts of some very large hedge fund (or private office) investors who believed that the short side guys simply had it wrong and they were long. They loved it!"

For the record, at time of writing, GameStop shares are down to US$50 from US$500. How many young Reddits suffered from a lack of 'diamond hands'?

This week's White Paper from Neuberger Berman continues the theme of taking a steady rather than aggressive approach to investing in a report from its most recent Asset Allocation Committee. What does the global team think?

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website