Moody’s downgrade of the United States’ credit rating to AA1 last month saw the last of the three major agencies drop America one rung below the top ranking.

Fitch Ratings issued a similar downgrade around 18 months earlier when it cut the US to AA+ from AAA in August 2023. Standard & Poor’s lowered its rating to AA+ back in 2011.

The latest major credit rating downgrade coincides with several headwinds for the US economy. For years, many economists have voiced concerns about the size of the nation’s federal debt burden. The Trump administration’s recently enacted One Big Beautiful Act (OBBA), including substantial tax cuts, further reinforces the view that the US budget deficit will likely remain around 7% of GDP. This remains well beyond the circa 3% target many believe is needed to stabilise the nation’s debt-to-GDP ratio.

At the same time, there is the very real prospect of the US Federal Reserve reversing direction and hiking interest rates. This further ratchets up concerns about America’s persistently high national debt.

More downside ahead

Until calm is restored on the political and economic policy fronts, volatility is likely to stay elevated across financial markets – both equities and bonds – which in our view supports an allocation to gold.

Focusing on equities, given the bruising moves in April, investors could be forgiven for thinking stocks must now be factoring in a lot of downside risk. In fact, US stocks are barely out of the starting gate when it comes to pricing in an economic downturn, as the US market was highly valued to begin with.

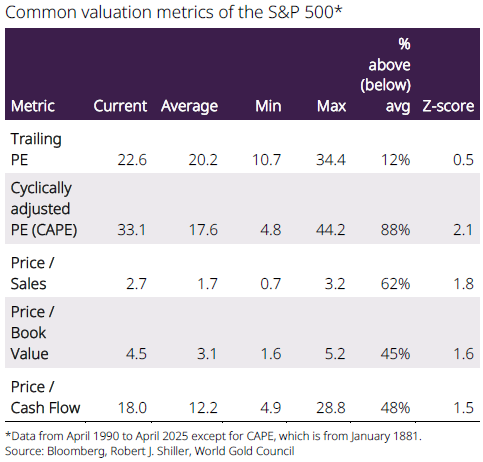

On all common valuation metrics, the S&P 500 remains more expensive than historical averages (Table 1). In this environment, as we entered 2025, expectations for the US economy were at their highest compared to the previous two years and there was widespread belief that strong growth and significant asset-price increases would continue in 2025.

And amid the trade onslaught, the probability of a recession has risen substantially. The future trajectory will depend on key indicators such as jobless claims, consumer spending and corporate profits. But a recession would be a particularly tough scenario for equities, and investors should keep in mind that considerable downside would be yet to come for the asset class, leading to greater safe-haven demand, notably gold.

Table 1: The S&P 500 looks expensive

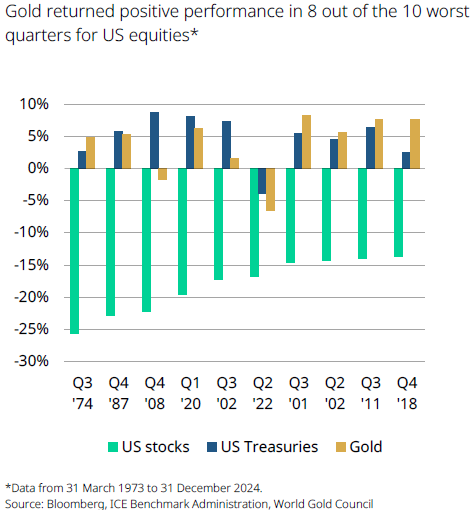

In fact, with few exceptions, gold has been especially effective during these periods of systemic risk, generating positive returns in 8 out of the 10 worst quarters of performance for the MSCI USA index (Chart 1).

Chart 1: Gold provides downside protection

The return of the bond vigilantes?

If one thing is true of the bond market currently, it is that, on the face of it, it looks attractive on a risk-adjusted basis. Current yields are well above long-term returns for many of the global fixed income sub-asset classes, which means that fixed income may be well positioned to deliver robust returns in the period ahead.

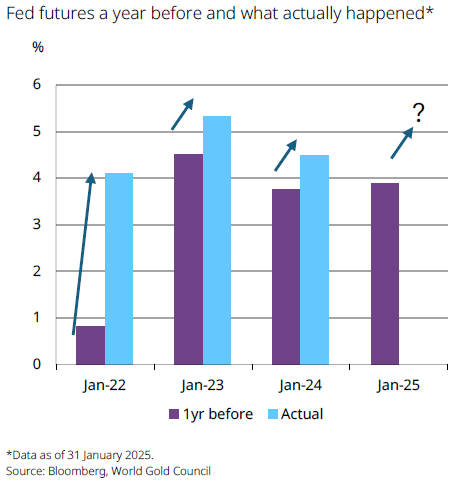

But markets have been continuously in a pre-COVID mindset of returning to ultra-low rates, hence under-pricing how hawkish the Fed would be, and we believe these dynamics could continue in the near term (Chart 2).

Chart 2: What if the next Fed move was up?

Moreover, the macro environment over the past several months (years) has been such that market pricing of central banks’ rates has been volatile. And we see plenty of reasons why yields could continue to be volatile and also come under pressure.

If Trump is successful in the large-scale reshoring of US manufacturing capacity, goods deflation in the US could come under pressure, making the inflation target more difficult to achieve and bond markets will have to take note. Besides, in an increasingly antagonistic geopolitical environment, foreign central banks seem likely to continue shifting their reserve holdings away from Treasuries towards other assets such as gold.

Finally, doubts about the appropriate level of term premia seem only likely to grow (Chart 3). The CBO (Congressional Budget Office) data below look frightening enough as it is – even before including the impact of extending Trump’s Tax Cuts and Jobs Act tax cuts.

Chart 3: Is the only way up?

The Fed’s big dilemma

And with tariffs looking likely to produce a stagflationary impulse, the Fed faces a dilemma: should it prioritise controlling inflation, which is set to rise, or support growth, which is expected to decline?

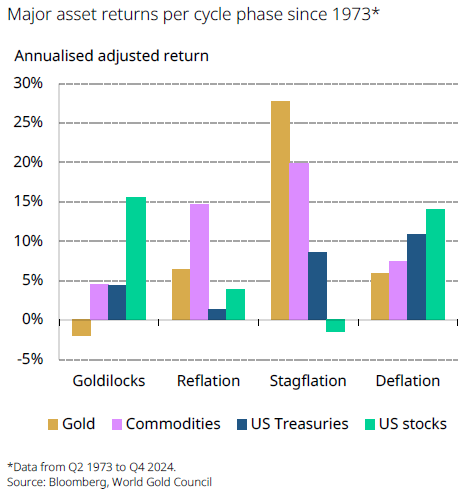

Unlike in 2024, the Fed is less likely to get ahead of any growth concerns. And a reactive Fed typically spells trouble for equities. More broadly, stagflation has historically been detrimental to equity returns and beneficial for gold returns (Chart 4).

Chart 4: Gold a clear winner in stagflation

All in all, maintaining a diversified portfolio can feel like chasing a moving target in today’s rapidly evolving market environment where bonds are now providing less of a diversification benefit than in the past, but also demand a higher portion of investors’ risk budgets.

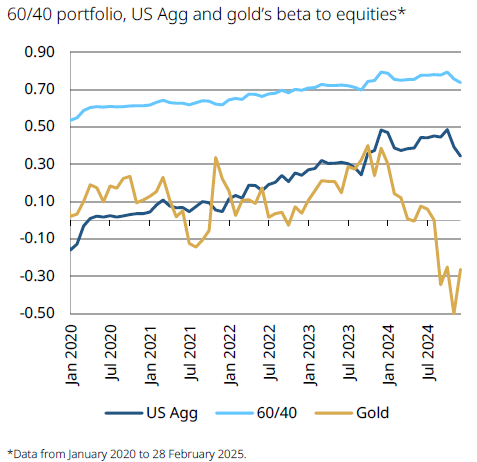

Chart 5 shows that today’s 60/40 portfolio beta – its sensitivity to overall market performance – is at among the highest levels in the past five years.

Meanwhile, bonds’ beta has also ratcheted higher. Therefore, bonds are now more stimulated by higher levels of overall market risk.

Chart 5: Bonds have become more sensitive to overall market fluctuations

Against this backdrop, we believe investors should consider alternative and complementary assets to high-quality fixed income assets, such as gold.

Conclusion

The current macroeconomic landscape is characterised by significant volatility and shifting dynamics. This presents numerous challenges for investors seeking stability and diversification.

In fact, maintaining a well-diversified portfolio in this evolving environment necessitates a strategic reassessment and adaptation to mitigate risks. Consequently, we believe investors should explore alternative and complementary assets such as gold.

Shaokai Fan is Head of Asia Pacific ex-China, at World Gold Council, a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.