Despite months of predictions for a global recession, consumer activity and corporate earnings are holding up surprisingly well. We believe that global long-term interest rates probably peaked in October last year, and we are now observing encouraging signs of the start of corporate earnings re-acceleration.

Clearly, we are not completely out of the woods yet. Inflation is still sticky and further rate hikes are expected over the next few months, but when we look under the hood at the companies we research, resilience stands out.

This global resilience has been surprising to all of us. In Europe, consumers seemed to sail through a severe energy crisis last winter, and in the US, consumer activity in both discretionary and staples has far exceeded most expectations at the beginning of the year.

What’s going on?

Higher global interest rates and inflation have impacted the consumer, but tight labour markets have tempered any slowdown. With global unemployment projected to be around 5.3% this year (according to the International Labour Organisation), and lower than it was pre-pandemic, anybody who wants to be employed generally is. It also means employers may need to pay employees more to retain them.

Projections for a US recession remain. However, companies that sell to the consumer on a daily basis, and have been watching and waiting for a slowdown, have not seen it materialise over the past 18 months. Clearly, consumption has been more resilient than expected, especially around the trends of health and wellness.

Corporate earnings improving

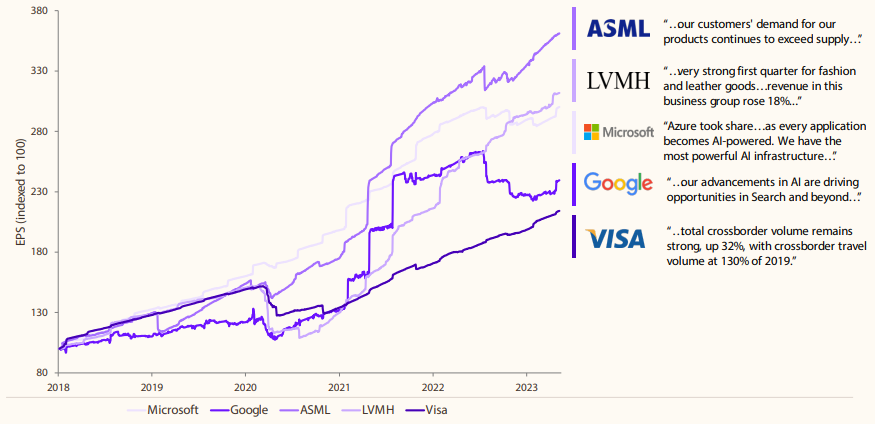

Stocks are not the economy – Q2 sees a return to earnings growth

Source: Company earnings calls, Bloomberg Finance L.P. 8 May 2023

As a result of this better-than-expected consumption, the market has been returning to a more normalised environment, where share prices follow earnings. This has been particularly the case with the big US tech companies like Microsoft and Google (parent company Alphabet), which reported late July.

Microsoft and Google both reported approximately 8 per cent revenue growth on an organic basis. And despite the dip in Microsoft's share price following its announcement, these companies - arguably two of the best managed businesses in the world - have forecast for potentially higher growth in the second half. Over the past three years, management teams have focussed on two things – de-risking the businesses and improving discipline around expenses.

This combination of corporate resilience and consumer resilience has resulted in earnings resilience which gives us confidence for a strong second half of the year and robust 2024.

AI developments

The start of an artificial intelligence (AI) super-cycle will also likely accelerate the rate of innovation across many industries for years to come. This is the other factor that underscores our confidence in the market. The advancements that started with the launch of ChatGPT in November 2022, will radically change a wide range of industries, and speed up the innovation cycle.

When announcing his company’s latest results, the chief executive officer of Microsoft, Satya Nadella, said that customers are not just asking how they can use AI but how quickly they adopt AI to tackle the biggest corporate opportunities and risks that they face.

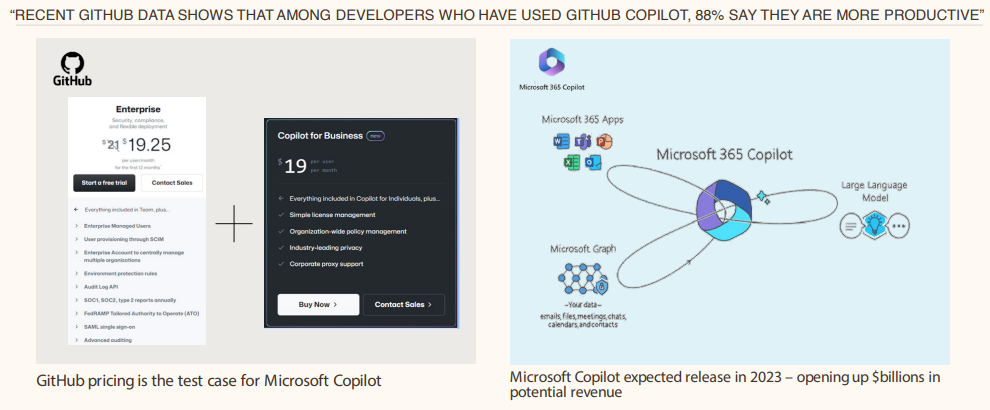

Microsoft case study

Pricing power for AI applications

Source: Microsoft company earnings call, May 2023.

Microsoft is an example of how the value of AI on earnings can be quantified. The company is about to add the AI co-pilot as an add-on to Windows Office 365 suite, at an approximate cost of $30 a month per user. Assuming a small initial discount, that’s an annual user cost of approximately $US300. Suppose a quarter of Microsoft’s current 400 million users sign up to the co-pilot version of Windows Office. In that case, that translates to roughly $US30 billion increase in revenue. Plugging that into consensus expectations for the company represents about a 10 to 15 per cent lift on the earnings per share for the company in financial year 2026.

While Microsoft’s multiple has re-rated in recent months, we believe the consensus earnings are still significantly underestimating the impact that AI will have on the company’s earnings. Based on our estimates, the stock is trading below 25 times June 2025 earnings, which we think is cheap for the leading AI cloud infrastructure and software application company on the planet.

Not all companies will be able to leverage AI in the same quantifiable way as Microsoft, but we do think over the next two to three years we are going to see meaningful earnings upgrades coming from AI.

Looking forward

The more normalised market environment we’ve been observing – of share prices following earnings - bodes well for our investment process of looking for earnings growth opportunities backed by a structural tailwind. Our portfolio is exposed to many different idiosyncratic growth drivers - AI, high performance computing, resilient consumers, as well as industrial companies benefiting from decarbonisation.

AI is the most obvious example of a structural tailwind, and potentially one of the most significant this century, but high-performance computing is another. It is a focus in our portfolio, and we are invested in semiconductor exposed companies, like semiconductor designer Nvidia.

In the accelerated computing market, we believe Nvidia has close to an 80 per cent market share. This places it in a strong position to capture the earnings upside available in the sector, not only from re-tooling data centres to boost the capacity requirements that multiple AI applications necessitate, but also by providing accelerated computing solutions to new data centres being built.

We also anticipate positive performance from the industrial companies driven by spending plans in the US, including the Inflation Reduction Act, which promotes the production of clean energy, and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act.

Qiao Ma is a Partner and Portfolio Manager with Munro Partners, a specialist investment manager partner of GSFM Funds Management. GSFM is a sponsor of Firstlinks. Munro Partners may have holdings in the companies mentioned in this article. This article contains general information only and has been prepared without taking account of the objectives, financial situation or needs of individuals.

For more articles and papers from GSFM and partners, click here.