Recently, sitting at lunch among reputable, intelligent and enormously-successful fund managers, there was one thing we all agreed on. Prices for many listed and unlisted companies have reached insane levels.

I listed the worst offenders:

- Wisetech, on the same market cap as Qantas of $8.5 billion but earning 2% of Qantas’s revenue.

- At 60 times earnings, Appen must have the smartest AI shareholders in the world because Appen’s US-based and private equity-owned competitor, Lionbridge, wants to list here too.

- The printed circuit board (PCB) software designer, Altium, is on a PE of 57 times, putting it on the same market cap as JB Hi-Fi, Metcash or Air New Zealand. But while the latter three each earn revenue of between $4 billion and $14 billion, Altium earns $177 million.

- After 12 years of operations, Xero has finally achieved cashflow break-even. In 2021 it is expected to earn a little over $20 million in profit too. It just has to be worth over $8.5 billion or 370 times forecast profits!

This will end badly, but when?

At that table, a lot of fundie experience with stock market corrections agreed that this ends badly. What we could not agree on, however, was how it ends, nor when.

But perhaps that latter question has an answer and in this article I’ll highlight a possible stumbling block for a continuation of heady valuations of profitless tech companies.

The calendar year 2019 is shaping up to be the busiest for new tech stock listings since 2000. I was working at Merrill Lynch in 1999 when analysts were concocting new ratios to justify billion dollar market valuations for companies (nay ‘projects’) with no revenue. Analysts told investors that the ability of these companies to transform e-commerce, for example, meant that almost ‘any price’ should be paid to acquire a piece of the action.

So far this year, 25 tech companies have IPO’d in the US raising US$19 billion. At the time of writing, the average gain on listing has been 34% according to Dealogic. The picture was a little different in 1999, when the first day gain for IPOs on the Nasdaq was closer to 90%. Perhaps conditions aren’t as crazy now.

But does that really matter? That would be like suggesting one patient in the asylum is slightly less insane than another. Neither of them should fly a passenger jet nor should they be put near an equity portfolio.

Most new listings are questionable quality

Of the 25 companies that have IPO’d this year, less than half can be classed as ‘major tech companies’. They are: Beyond Meat, which is up over 500% since listing, Zoom Video (+170%), PagerDuty (+120%), CrowdStrike (+110%), Pinterest (+45%), Chewy (+47%), Fiverr (+30%), Slack (+27%), Fastly (+10%) and Uber and Lyft (both negative).

Share price performance, however, doesn’t really matter. It cannot tell you what will happen next.

Aneet Chachra, is a Portfolio Manager at Janus Henderson Group. Chachra studied the history of 220 US technology IPOs from January 1, 2010 to March 31, 2018, focussing only on those with a 12-month trading history. Chachra observed:

“Statistically, if you can get into a tech IPO at the deal price, you are going to do well.”

Presumably he was referring to the final funding round deal price before IPO. Pitchbook’s 2018 study reaches a similar conclusion. Pre-IPO investors do better from the IPO ‘step-up’ than investors who buy on the first day of public trading.

This makes sense. PE investors will want to price their IPO so that all existing shareholders make money at the time of listing, and they will time the IPO to give their investors the best chance of achieving that outcome. In a 10-year bull market fueled by historically low rates that caused investors to spurn cash and migrate to anything and everything that might go up, including private equity, the study’s findings should not be surprising.

Two glaring issues for investors

The first is that if 10 years of declining interest rates has encouraged or forced high-net-worth and ultra-high-net worth investors to buy private equity and invest pre-IPO, who will be left to buy these stocks after they list?

Chachra’s and Pitchbook’s findings may reflect the fact that the exponential growth in the number of private equity firms globally since 2009 has attracted most of the money of high-net-worth investors leaving only ‘Mom & Pop’ investors to pick up the scraps.

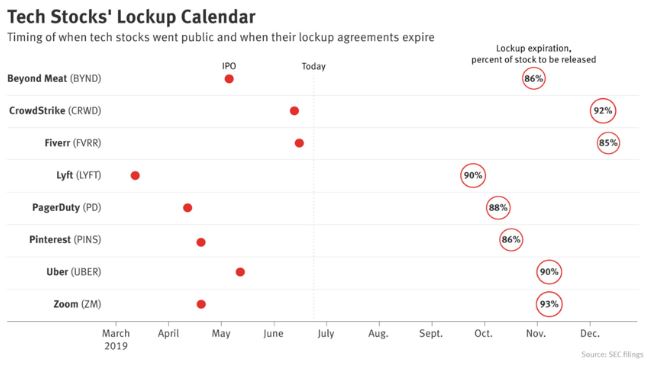

Second, of the largest tech stocks that have listed this year, only 10% to 15% of their scrip has been available to trade. A 180-day lock up (escrow) period for founders and backers means 85-90% of scrip is still waiting to be sold.

This overhang could easily become selling pressure if PE investors who have been locked in for a decade, such as with Uber, decide they want out. It’s the marginal seller that determines the price for everyone. If the Uber investors who bought in 2010 at much lower prices decide they want to sell, their trading will impact the market capitalisation for everyone.

And this transmission mechanism is perhaps another explanation for the poor post-IPO performance of the average tech float.

Beyond Meat will see an additional 86% of its scrip released for possible sale in November 2019. CrowdStrike will see 92% of its scrip released in December, Fiverr (85% in December), Lyft (90% September), PagerDuty (88% October), Pinterest (86% October), Uber (90% November) and Zoom (93% November). And a record number of IPOs this year will ensure the pressure doesn’t let up until next year.

Tech IPO investors in Australia won’t be immune from the impact of the 2019 US private equity exit.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.