The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

UnitedHealth is a US mega cap stock that isn’t well known in Australia even though it’s had an astonishing fall from grace over the past few months. The medical insurer had been a market darling and a top 20 company in the S&P 500 index, having risen more than 6x over the decade to early April. Then it plummeted.

Source: Morningstar

Greater Government scrutiny of its business practices and the departure of senior executives led to the stock falling almost 60% in just five weeks.

The question that many institutional investors are asking is whether the company is now a buy or not.

History gives them some reassurance as UnitedHealth fell more than 80% from highs in the 1980s and dropped 72% during the GFC, only to bounce back in better shape on both occasions.

More broadly, there are many recent examples of stocks having had major falls which have turned into extraordinary buying opportunities for investors.

Think of Nvidia, which lost two-thirds of its value in 2021-2022, only to catapult 11x higher from the lows.

Source: Morningstar

Or Meta, which lost 76% during the same period and was on the nose with investors, only for it to come roaring back, up around 7x since.

Source: Morningstar

On the flip side, there are also plenty of examples of former blue-chip stocks that have never fully recovered from losses. Think of Intel, Sears, Dell, Blackberry, and so on.

The history of drawdowns and recoveries

Rather than just rely on anecdotal evidence, renowned investment author, Michael Mauboussin, has done us all a favour by looking deeper into the drawdowns and recoveries of individual US stocks form 1985-2024.

Here are the findings from his latest research:

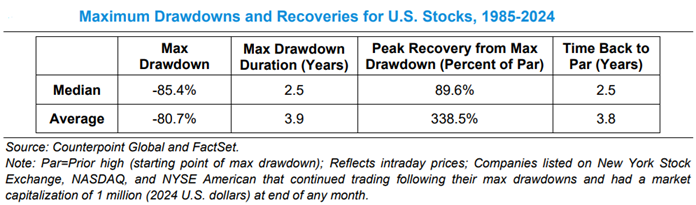

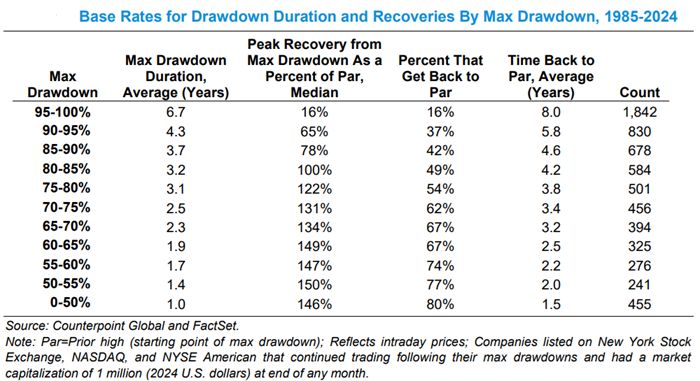

- The median drawdown, from peak to trough, was an eye watering 85%.

- It took 2.5 years from highs to lows, and another 2.5 years for stocks to recover to previous highs.

- 54% of all stocks never recover to their previous highs.

- Only 16% of stocks with +95% drawdowns ever return to par.

- Larger drawdowns of +95% average 6.7 years from peak to trough, and then more than 8 years back to breakeven. A 15 year roundtrip!

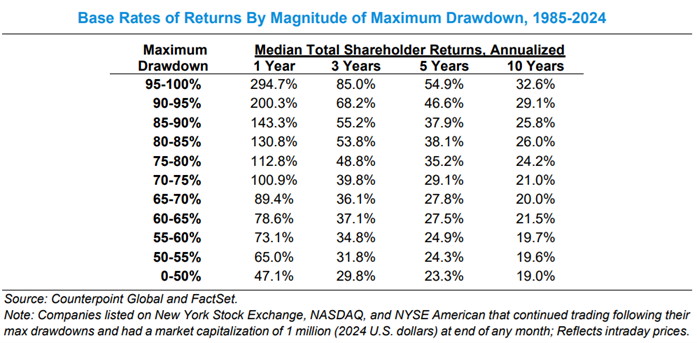

- While most stocks never get back to breakeven, the percentage recovery off the lows can still be spectacular.

- The average recovery vastly exceeds the median due to extreme positive outliers. In other words, it’s the 10x+ recovery of a few stocks that skews the results of the averages.

This last point on ‘skewness’ or the asymmetry of returns builds on previous research from academic, Henrick Bessembinder, which showed that only 4% of firms account for all of the net shareholder wealth creation in the US since 1926.

What to look for at the bottom

After large price declines, how can investors identify potential winners and avoid losers? Mauboussin says there are six questions that investors should consider:

1. Are the fundamental issues cyclical or secular?

Some industries go through cycles, with ebbs and flows in demand, and the down phases can lead to significant share price declines. Other industries, however, are in secular decline, where demand will never recover.

Mauboussin goes through the example of Nvidia versus Foot Locker to demonstrate this. With Nvidia, the semiconductor industry has gone through many capital cycles, where demand surged and businesses built more and more capacity, until that eventually led to overcapacity and a subsequent bust in industry demand, only for it to recover in ensuing years. With Foot Locker, its decline in the 1990s reflected a secular decline in its operations as its retail format, along with others like Sears Roebuck and K-Mart, fell out of favour with consumers.

Going back to our initial example of UnitedHealth, investors need to consider whether the issues are cyclical or secular. Will increased Government scrutiny of the company and industry impair future profits? If so, by how much? Will the impact be temporary or permanent? What are the risks of further Government regulation?

2. What does the basic unit of analysis tell you about the business?

This looks at how a company makes money and whether its economics will stack up in future.

3. How lumpy are the investments of the business?

All companies must invest money before making sales and profits. If the investments are large, businesses can run into trouble before they generate sales or profits. This has happened with casinos here and abroad of late.

It’s easier to scale down small investments than large investments.

4. Is there sufficient financial strength?

Does the company have a lot of debt? What are the maturities of the debt? Does it have the cashflow to see it through a crisis?

5. Is there access to capital if needed?

A lack of liquidity can become a problem. A run on a bank is an example of where a solvent institution can fail because of a liquidity problem.

Any time a business uses short-term funding for long-term investment, it puts itself at risk.

6. Is management clear-eyed about the challenges?

This reminds of the shareholder letter written by Amazon’s Jeff Bezos in 2000, following the dot-com crash. It began:

“To our shareholders:

Ouch. It’s been a brutal year for many in the capital markets and certainly for Amazon.com shareholders. As of this writing, our shares are down more than 80% from when I wrote you last year. Nevertheless, by almost any measure, Amazon.com the company is in a stronger position now than at any time in its past.”

Bezos then went on to detail how the business was in better shape than the previous year, even though its stock had been belted.

It was clear-eyed and outlined a way forward.

Lessons for investors

Here are my four key lessons from Mauboussin’s study:

- Drawdowns are the price of admission. Large drawdowns aren’t an anomaly; they’re the norm. You need to be prepared for this reality.

- Investing is hard and investing in turnarounds is even harder.

- Predicting which specific beaten-down stocks will be the extreme positive outliers is very difficult.

- It’s much easier to build a portfolio that will survive catastrophic periods and capture the rare massive winners that drive long-term market returns.

James Gruber

Also in this week's edition...

The $3 million super tax has caused an almighty scuffle, but for SMSFs the big question is: what do they do now? Meg Heffron outlines the options for those who want to withdraw assets from their funds.

Ron Bird says the super tax debate around indexation and unrealised gains has diverted attention from the real issue: that the tax concessions were always bad policy and remain so. He digs deep into what he terms a "huge waste of taxpayer money" and what can be done about it.

Noel Whittaker enjoyed the drama of the recent Papal Conclave and it got him thinking about many families that go through their own kind of conclave after the death of a parent. A family conclave may be far less public but it can be just as fraught and Noel explores ways to make it a smoother journey.

Super contribution splitting is a common enough strategy though it's not used nearly enough. UniSuper's Brooke Logan details its rules and benefits, as well as who it may be best suited for.

It's fair to say that Donald Trump and Federal Reserve Chair Jerome Powell don't see eye-to-eye. Trump has criticised Powell for not cutting interest rates fast enough, and while Powell hasn't bitten back, it's clear he's more process driven and waiting for more data before deciding whether to drop rates further or not. Neuberger Berman's Brad Tank says the clash in leadership styles is unfortunate and both men need to find a way for the Government and central bank to work better together.

Gold continues to perform well and the general public is starting to notice. Is it too late to allocate a portion of your portfolio to gold? Shaokai Fan says it's not, and goes through the reasons why.

As Warren Buffett departs, it’s time to discover and follow some ‘new’ investment legends. Buffett acolyte Chris Bloomstan may fit the bill. Greg Canavan ploughed through Bloomstan's book sized annual letter and found some fascinating insights into what future market returns may look like and Bloomstan's issues with the extensive share buybacks conducted by US companies.

Two extra articles from Morningstar this weekend. Joseph Taylor looks at CBA’s baffling valuation relative to other banks and Jon Mills highlights two miners that can benefit from a recovery in lithium.

Lastly, in this week's whitepaper, Allianz and the National Ageing Research Institute look at the risks facing older Australians with insurance.

****

Weekend market update

In the US on Friday, stocks enjoyed a tidy 1% advance on the S&P 500, erasing Thursday's selloff and then some, while Treasurys came under broad-based pressure with 2- and 30-year yields jumping to 4.04% and 4.97%, respectively, up 12 and 8 basis points on the session. WTI crude advanced 2% to approach US$65 a barrel, gold ebbed to US$3,312 per ounce, bitcoin rebounded to US$104,400 and the VIX sank below 17.

The Australian share market on Friday slipped after again approaching its best-ever close, fading ahead of key US economic data and a long weekend in most Australian states. The S&P/ASX200 traded a tight range on Friday to finish down 0.27% to 8,515.7, as the broader All Ordinaries slipped or 0.3% to 8,741.9. The top 200 gained roughly 1% for the week but failed to hold above its record close of 8,555.8 for a second straight day, as investors took profits ahead of a trading break on Monday and two potentially volatile US sessions before the next ASX open.

Nine of 11 local sectors finished lower but energy shares offered some relief, up 0.7% as hopes of resumed US-China trade talks pushed oil prices higher.

Financials weighed on the bourse, down 0.4% as investors took profits on the banks. CBA was the big four's worst performer on Friday, fading 0.8% after hitting a fresh peak of $182 on Thursday. Zooming out, the sector was up 1.9% for the week and holding above its record close in February.

Liquidity rotation from the banks and glimmers of global trade hopes helped push BHP and Fortescue higher, but it was not enough to stop the materials sector from slipping 0.1% after a 1.4% gain for the week.

The brighter trade horizon weighed on critical minerals miners after China's export controls pushed them higher on Thursday, leaving Pilbara Minerals (down 5.2%) and Iluka Resources (down 3.8%) among the top 200's worst performers on Friday.

Goldminers were a mixed bag all week, as the precious metal continued to chop within a range.

Qantas was among the ASX's best-performing large cap stocks, up 3.5% to $10.76 as competitor Virgin Australia confirmed it would relist on the ASX on June 24 with an expected market cap of $2.3 billion.

Gold explorer and developer Ora Banda took the wooden spoon, down 14% after a production update failed to shine.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website