The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Weekend market update

US stocks powered higher in their final session of the week, bolstered by strong corporate results and hopes for a US-Russia agreement to end the fighting in Ukraine. The S&P 500 rose 0.8% to 6389.45, closing just shy of a record. The Nasdaq Composite reset its record closing high for the 18th time this year, up almost 1%. Apple leapt another 4.2%, extending its three-day rally to 13.3% for its best week since 2020. Nvidia rose 1% to a record high, lifting its market cap to $US4.46 trillion.

From AAP:

The S&P/ASX200 edged 0.28% lower on Friday, unable to push higher after breaking records two days earlier.

The top 200 was up about 1.7% for the week, but has struggled since soaring to a new intraday peak of 8,848.8 on Wednesday and finds itself in sync with other global indexes hovering close to their peak, including Wall Street's S&P500, the Nasdaq and London's FTSE.

Only four sectors finished significantly higher on Friday, led by the raw materials sector, which rallied 1.4% and was the week's best performer with a more than 5% lift.

Iron ore giants BHP (up 0.9%), Fortescue (up 1.8%) and Rio Tinto (up 1.1%) finished the week strongly along with Australian goldminers, with support from commodity prices.

Gold is knocking on the door of new highs as risk-off sentiment continues to draw investors to the haven, helping WA-headquartered Northern Star slingshot more than 18% higher since last week.

Consumer discretionary stocks faded but were up almost 4% since Monday, while the financial sector weighed on the bourse, slipping 1.1% and wiping out most of its weekly gains.

All big four banks were in the red on Friday, with the Commonwealth Bank, NAB and Westpac each shedding about 0.9%.

Insurers also sold off, led by an 8.8% slump in QBE, after some analysts questioned the inclusion of previous years' reserves in its half-year result.

The strong performance in consumer discretionaries was underpinned by Bunnings and Kmart owner Wesfarmers, up 6.7% for the week after a five-session winning streak.

The group will release its full-year earnings at the end of August.

Energy stocks are up 2.5% for the week despite a net decrease in oil prices as Whitehaven and Santos edged higher.

Coal producers also did some heavy lifting for the sector, with Yancoal up more than 7% since Monday to $6.66, thanks in part to better-than-expected coal export data earlier in the week.

Healthcare stocks have continued to struggle amid concerns about incoming US tariffs on pharmaceuticals, slipping 2.5% in two sessions.

Next week will likely be a huge one for markets, with a Reserve Bank interest rate cut expected on Tuesday, key labour data due on Thursday and a host of company earnings including CBA, Telstra, JB Hi-Fi, Origin, AGL and IAG.

****

"Once a bull market gets under way, and once you reach the point where everybody has made money no matter what system he or she followed, a crowd is attracted into the game that is responding not to interest rates and profits but simply to the fact that it seems a mistake to be out of stocks. In effect, these people superimpose an I-can’t-miss-the-party factor on top of the fundamental factors that drive the market. Like Pavlov’s dog, these 'investors' learn that when the bell rings–in this case, the one that opens the New York Stock Exchange at 9:30 a.m.–they get fed. Through this daily reinforcement, they become convinced that there is a God and that He wants them to get rich."

This is a Warren Buffett quote from November 1999. Back then, Buffett was dismissed as a has-been. Someone who wasn’t up with the new technology and didn’t understand the extraordinary potential of the Internet. We know what happened soon after.

Fast-forward to today and he’s receiving similar jibes.

The quote above was published on LinkedIn this week and it got the following response from a former Managing Director of Merrill Lynch and Morgan Stanley in Australia:

“That's ironic quoting Warren Buffet [sic]. The man most wrong in 2025 and still sitting idle on $300bn of cash.”

The MD was wrong in at least one respect: Buffett’s Berkshire Hathaway is actually holding US$344 billion in cash and cash equivalents. That’s up from US$109 billion at the end of 2022. If the current cash pile was a company, it would be the 20th largest in the S&P 500.

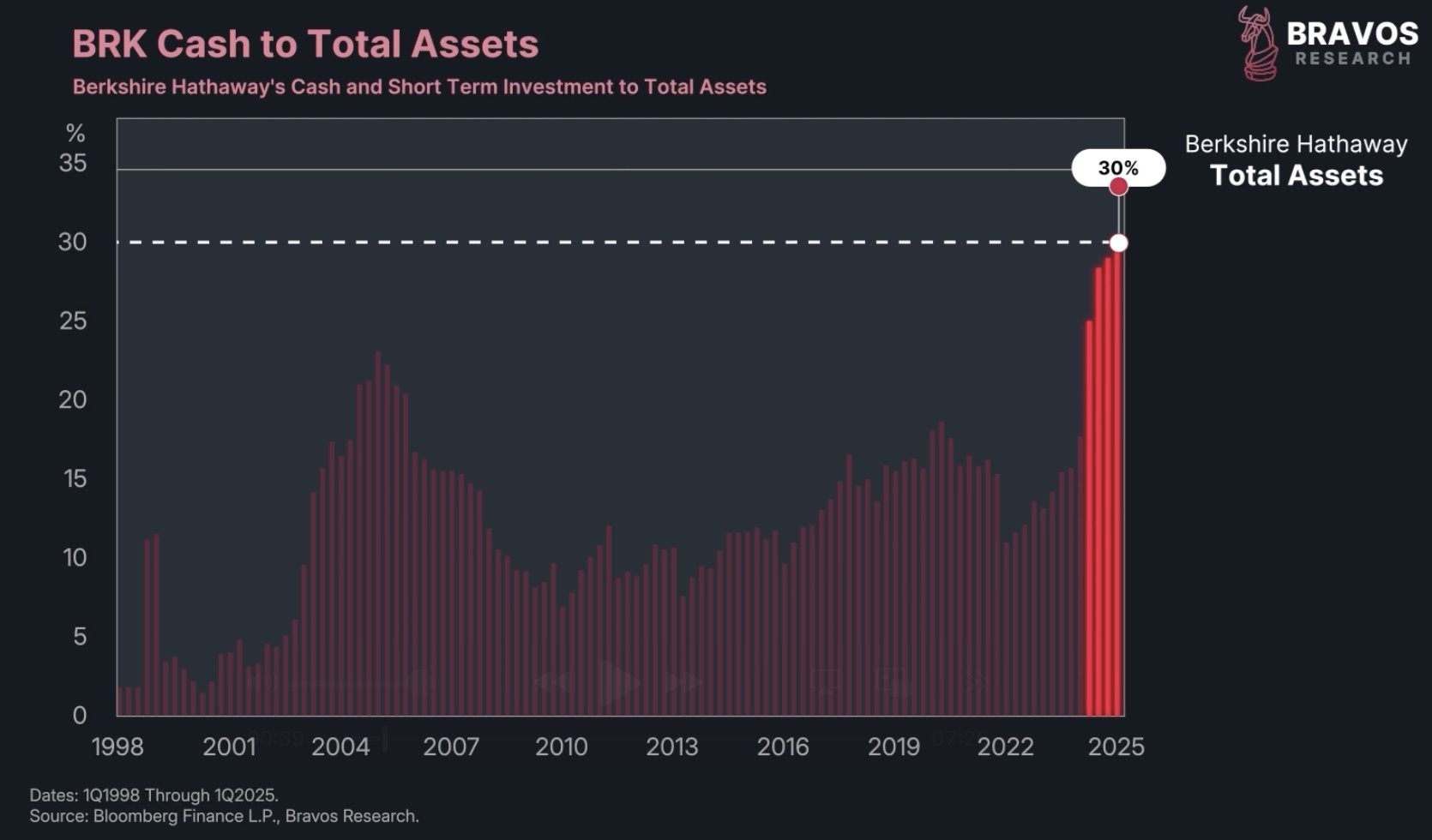

Berkshire’s cash as a percentage of total assets stands at 30%, the highest percentage in its history.

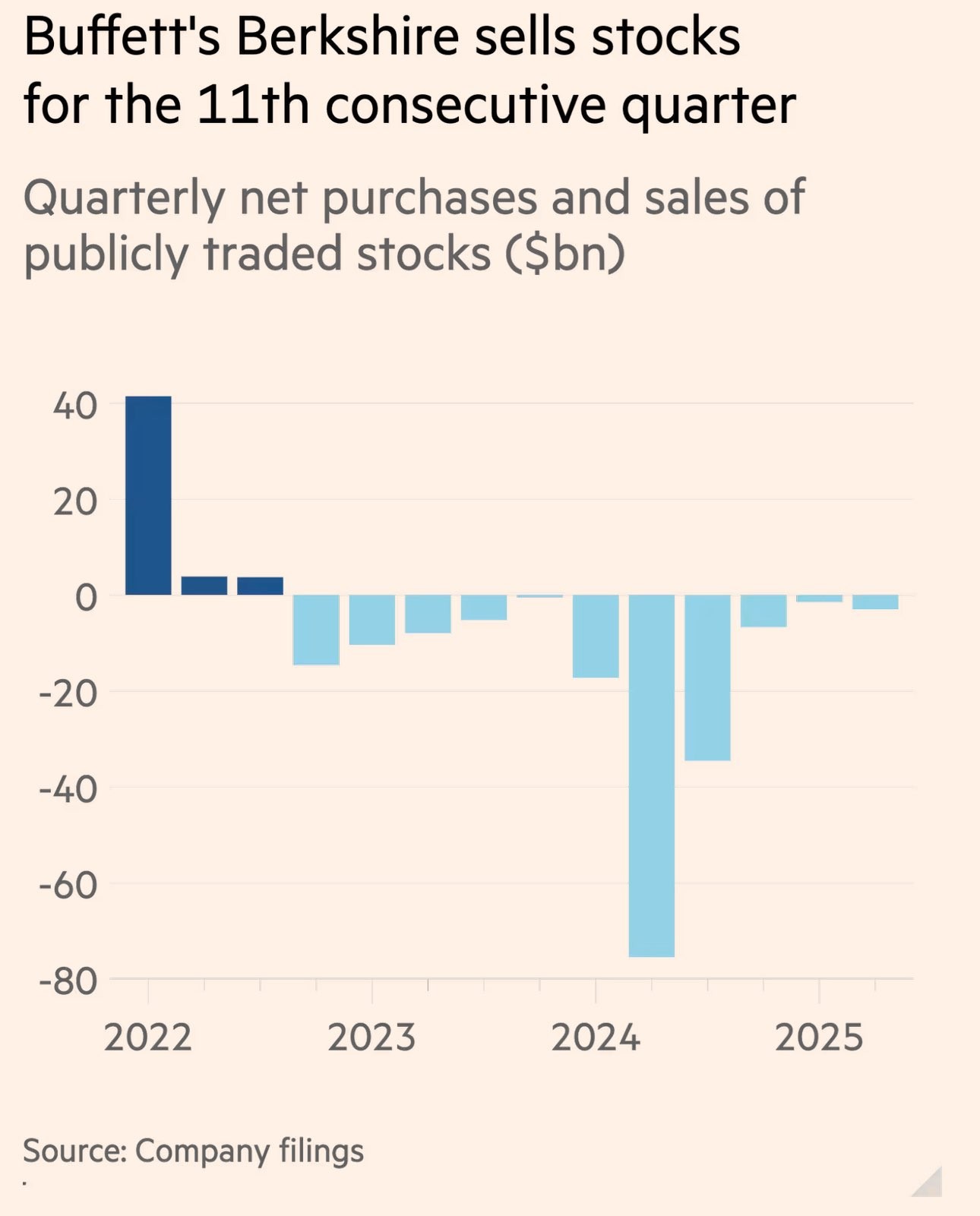

Second quarter results from Berkshire this week also showed that Buffett continues to be a net seller of stocks.

Source: FT.

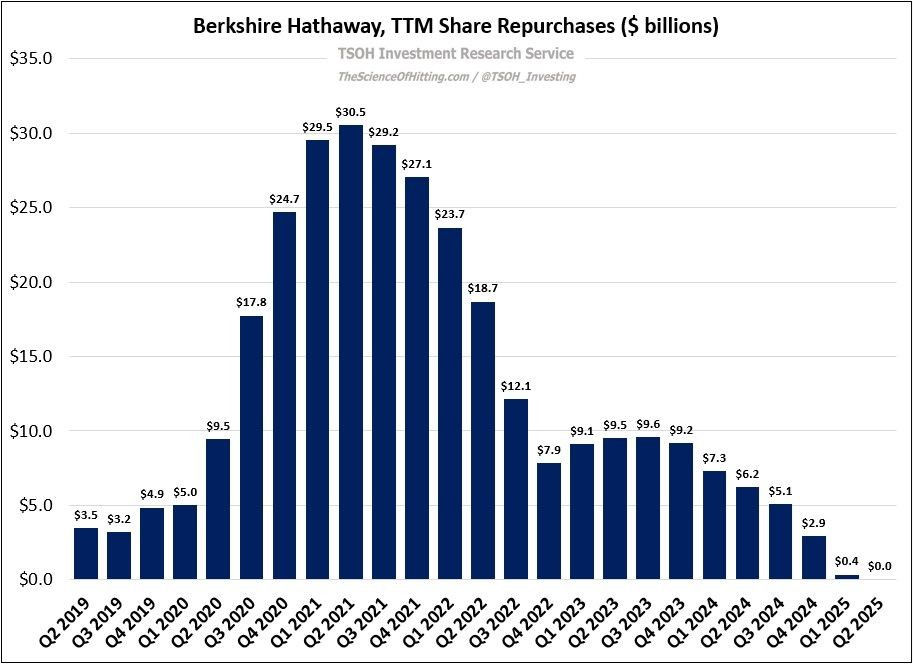

And for the first time in a long while, Berkshire isn’t repurchasing its own stock, indicating that Buffett thinks his company isn’t cheap anymore.

It’s clear that Buffett isn’t in love with current market valuations and he’s waiting for a “fat pitch” to deploy his immense cash pile.

That fat pitch could come soon. One of Buffett’s largest companies is rail operator, Burlington Northern Santa Fe. He acquired it for US$44 billion in 2010 and with net profit of US$5 billion last year, it would be worth close to US$100 billion now. Burlington dominates freight rail in Western USA along with Union Pacific (NYSE: UNP).

Recently, Union Pacific announced an US$85 billion merger with Norfolk Southern (NYSE: NSC). Given Norfolk’s dominance of east coast US rail freight, it will create a transcontinental rail force.

The other major east coast rail freight operator, CSX (NYSE: CSX) is undoubtedly now ‘in play’ and Burlington would be an obvious potential suitor.

Though a deal would make strategic sense, whether Buffett thinks it’s additive from a value standpoint is debatable.

He certainly has the cash to splash on CSX, whose current market capitalization is US$66 billion.

The problem for Buffett is that he would know that time is ticking to deploy his cash.

He’s stepping down as CEO at the end of this year, replaced by Greg Abel. Buffett will stay on as Chairman of Berkshire and will undoubtedly still have a large role to play, though Abel will have the final say on company matters.

Even if Berkshire chooses to take over a company that is as large as CSX, it will still leave a lot of cash on the firm’s balance sheet. Surely, stock repurchases and possibly dividends - which Buffett never paid - are on the agenda in the not-too-distant future.

Will we ever see another Warren Buffett?

This got me thinking about Buffett’s legacy and whether we’ll ever see another investor like him.

His investing record is one of the greatest ever. Since 1964, Berkshire Hathway has returned 5,500,000%. A $10,000 investment in 1964 would be worth about $550 million today. That compares to a ~39,000% return for the S&P 500 over the same period. In other words, Buffett has outperformed the S&P 500 by over 140x from 1964 to today.

Sure, Buffett’s best years were in the 60s and 70s, and his outperformance has diminished, especially this century. However, that can be mostly put down to the size of the assets he’s ended up managing at Berkshire. It was much easier to make a return on the US$66 million in assets that Berkshire had in 1965 compared to the US$1.16 trillion in assets it has today!

There are plenty of investors who’ve achieved similar annual returns to Buffett, but no one has done it over such a long period and with a large stash of assets.

Will we ever see another investor like Buffett? We undoubtedly will. Even now, there are investors that are achieving extraordinary returns and the question is whether they have the appetite and skills to sustain it over a 60-year period as Buffett did.

However, the next Buffett is unlikely to be like the current one. That’s because markets evolve and investors need to evolve with them.

One of Buffett’s great strengths was his ability to adapt. He went from being a deep value investor in the 50s and 60s to more of a ‘growth at a reasonable price’ type investor from the 70s onwards. And he invested in Apple when he had previously put tech stocks in the too-hard basket and outside his circle of competence.

His biggest legacy

Buffett’s biggest legacy may not be his investment record.

Think about if Buffett achieved the same returns yet never spoke publicly about his investments and process.

He would still be spoken of as an investment legend, albeit a mysterious one.

This hints at what may be his greatest legacy - teaching. Buffett’s ability to communicate the complex world of investing in ways that ordinary people could understand may be what he’s most remembered for.

It’s as a teacher of investing that we may never see the likes of Buffett again.

****

Though Buffett has sold down a chunk of Apple, the company remains Berkshire's largest listed investment. However, Platinum's Jimmy Su questions Apple's competitive edge as innovations in AI threaten to make the iPhone obsolete.

****

In my article this week, I look at the best way to get rich and retire early.

James Gruber

Also in this week's edition...

As markets rip, Roger Montgomery sees speculative froth emerging and suggests now may good time to strategically rebalance your portfolio.

Meanwhile, Daniel Taylor and Ben Zhao from Man Numeric ask whether today’s expensive AI stocks are the next market leaders or just another bubble waiting to burst? They look through history to see whether today's tech valuations make sense.

Which generation had it toughest? It's a loaded question but Mark McCrindle delves into the data to find an answer.

Capital Group's Haran Karunakaran thinks that with central banks treading carefully and growth softening, things may finally be turning for bonds. He suggests higher yields and negative equity correlations make the case for renewed allocations to global fixed income.

What's driven up housing costs? Cameron Kusher cites eight key factors, including skewed migration patterns, banking trends and housing's status as a national obsession.

Two highlights from Morningstar for you this weekend. Joseph Taylor asks if Warren Buffett will be forced into this $80 billion acquisition, and Roy Van Keulen highlights a pricey ASX share that could be on thin ice with regulators.

Lastly, in this week's whitepaper, Magellan explains why infrastructure should be part of your portfolio.

Curated by James Gruber, Joseph Taylor, and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website