The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

First, I'd like to ask a favour of you. Firstlinks has been nominated for a People’s Choice, Industry Media of the Year award at the Australian Financial Industry Awards. If our insights and reporting have helped your decision-making, please consider voting.

Cast your vote: https://ifpa.com.au/peoples-choice-australian-financial-industry-awards-2025/

****

Tim Carleton, CIO at Auscap Asset Management, has had success with his funds despite largely staying away from the banks and miners. And he sees no reason to pile back into the ASX’s two largest sectors any time soon.

He says that the Big Four banks haven’t grown earnings over the past decade and that trend may continue for the next 10 years. The reason? For the first time in a long while, the banks face a significant competitive threat – in the form of Macquarie Bank.

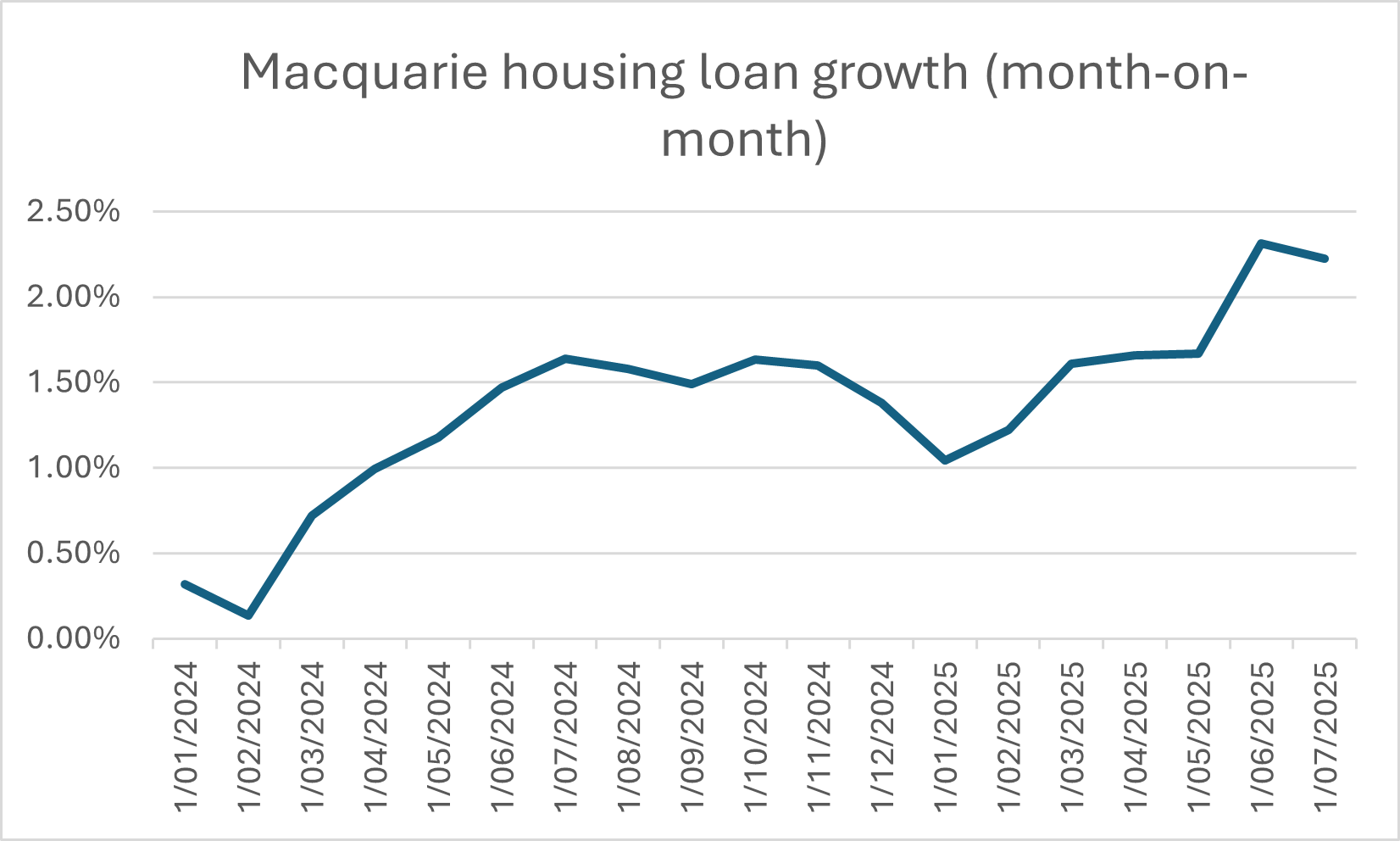

In July, Macquarie’s home loan book grew at 6.4x the average of the major banks to stand at $147.7 billion, according to APRA. It added $3.2 billion in new business over the month, representing 39% of the growth in total mortgage balances across all banks.

July was the strongest monthly performance for Macquarie in the home loan market since February 2021. Over four years, Macquarie has increased its mortgage business by more than 3x the pace of the broader banking system, lifting its overall share from 4.7% to 6.3%.

Source: APRA, Morningstar’s Nathan Zaia

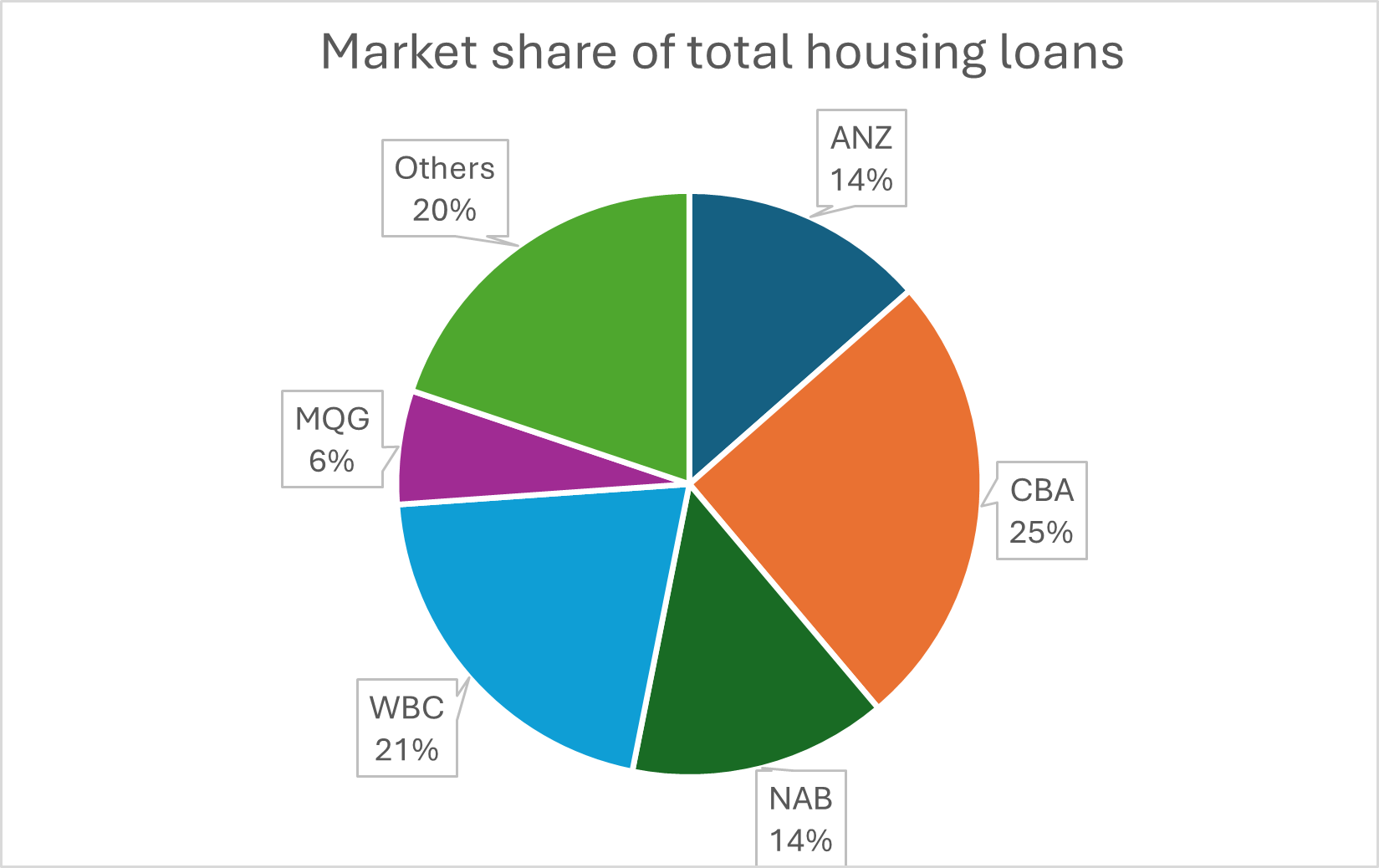

“We think this trend is going to continue and if you extrapolate their current rate of growth, they [Macquarie] will comfortably go past ANZ and NAB inside the next decade,” Carleton says.

Carleton believes the major banks are already selling a commoditized product because they’ve outsourced their customer relationships to mortgage brokers.

Now, they must compete against a lean and efficient Macquarie Bank. Unlike the Big Four, Macquarie has new IT systems and it doesn’t have a legacy cost structure – read: no bank branches. That means it has lower costs and can price loans aggressively, which is exactly what’s happening.

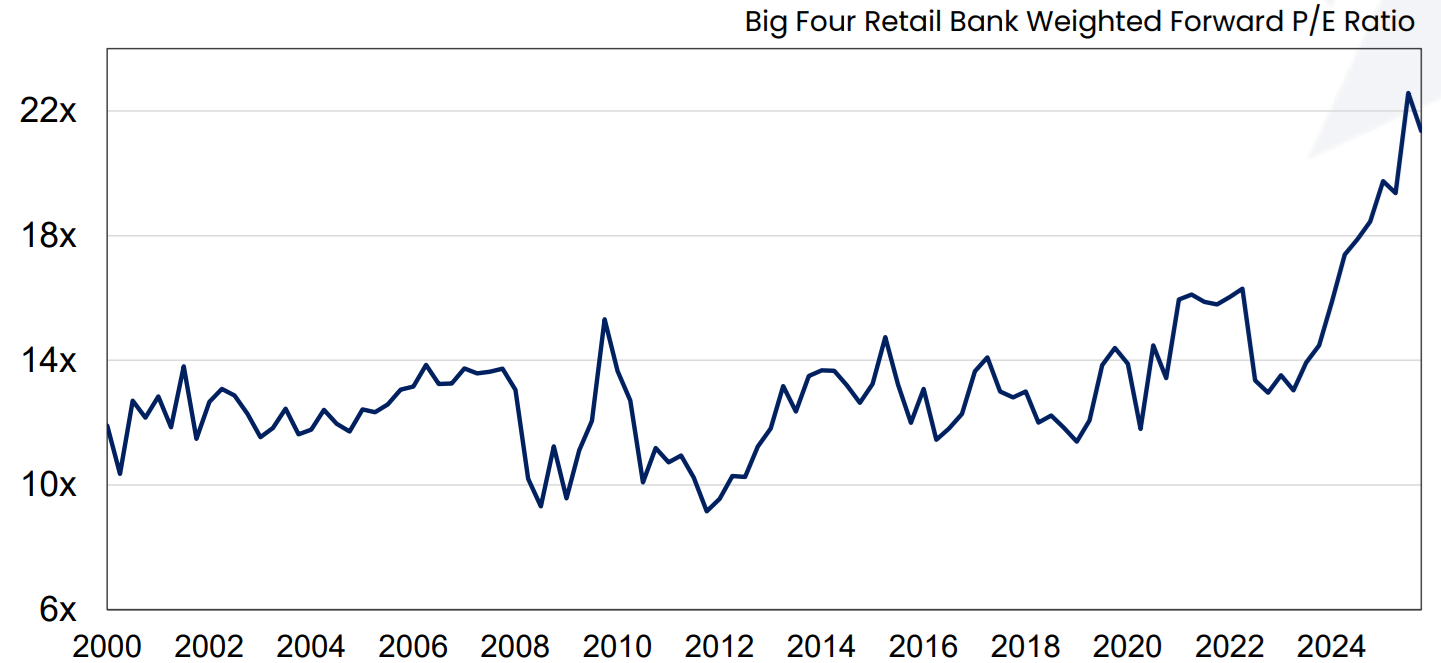

Carleton says this structural challenge comes at a time when big bank valuations are near all-time highs. And that doesn’t bode well for future returns.

Source: Factset. Auscap

Meanwhile, Carleton says the iron ore miners have structural challenges of their own. China accounts for 56% of steel consumption and its consumption likely peaked in 2020.

Reduced Chinese demand for steel is happening as iron ore supply is about to pick up. The massive Simandou project in Guinea is targeting first ore shipments by the end of this year, ramping up to 120 million tonnes per annum. That represents about 5% of global iron ore production.

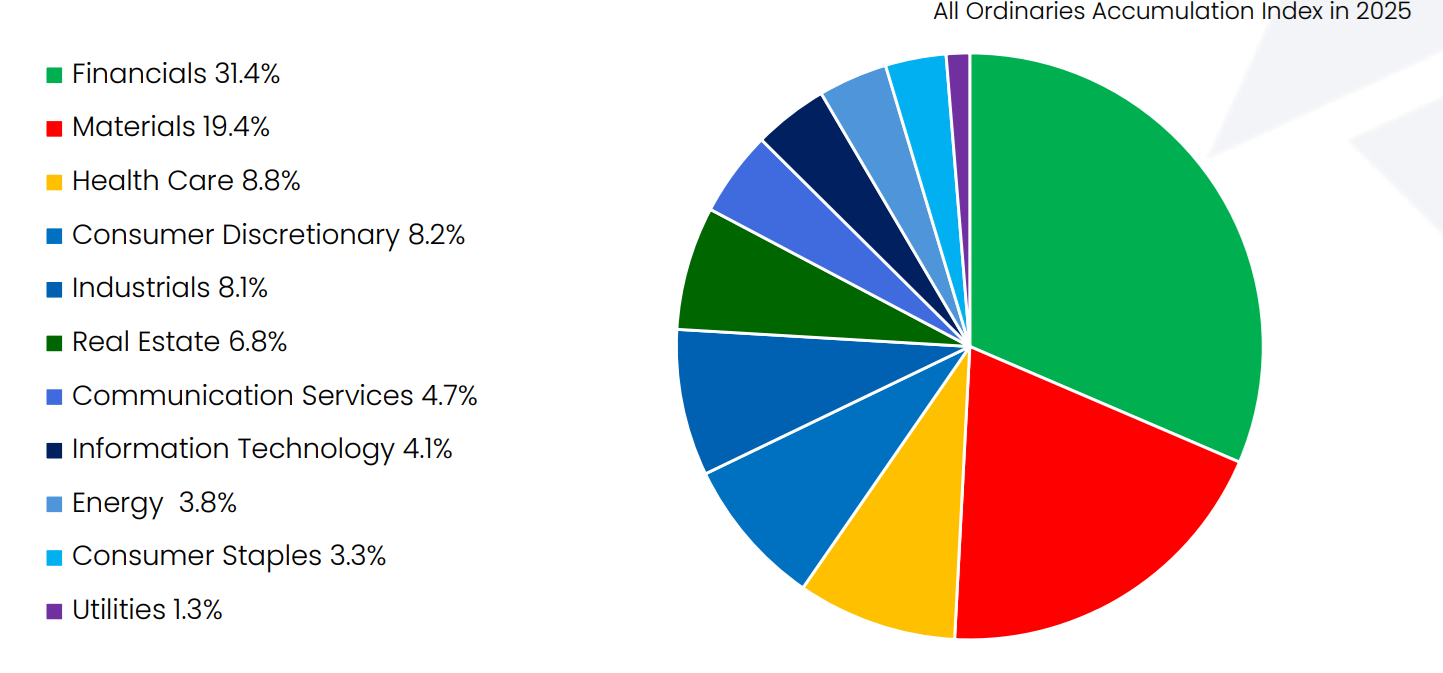

Carleton thinks the challenges for banks and miners are also challenges for the ASX more broadly, given that the two heavyweight sectors account for 50% of the All Ordinaries Index.

Source: Bloomberg, Auscap

If investors should stay away from the large-cap banks and miners, then where should they go?

Carleton doesn’t think the answer lies with small caps. He says the smaller end of the market is full of unprofitable companies and speculative resource shares.

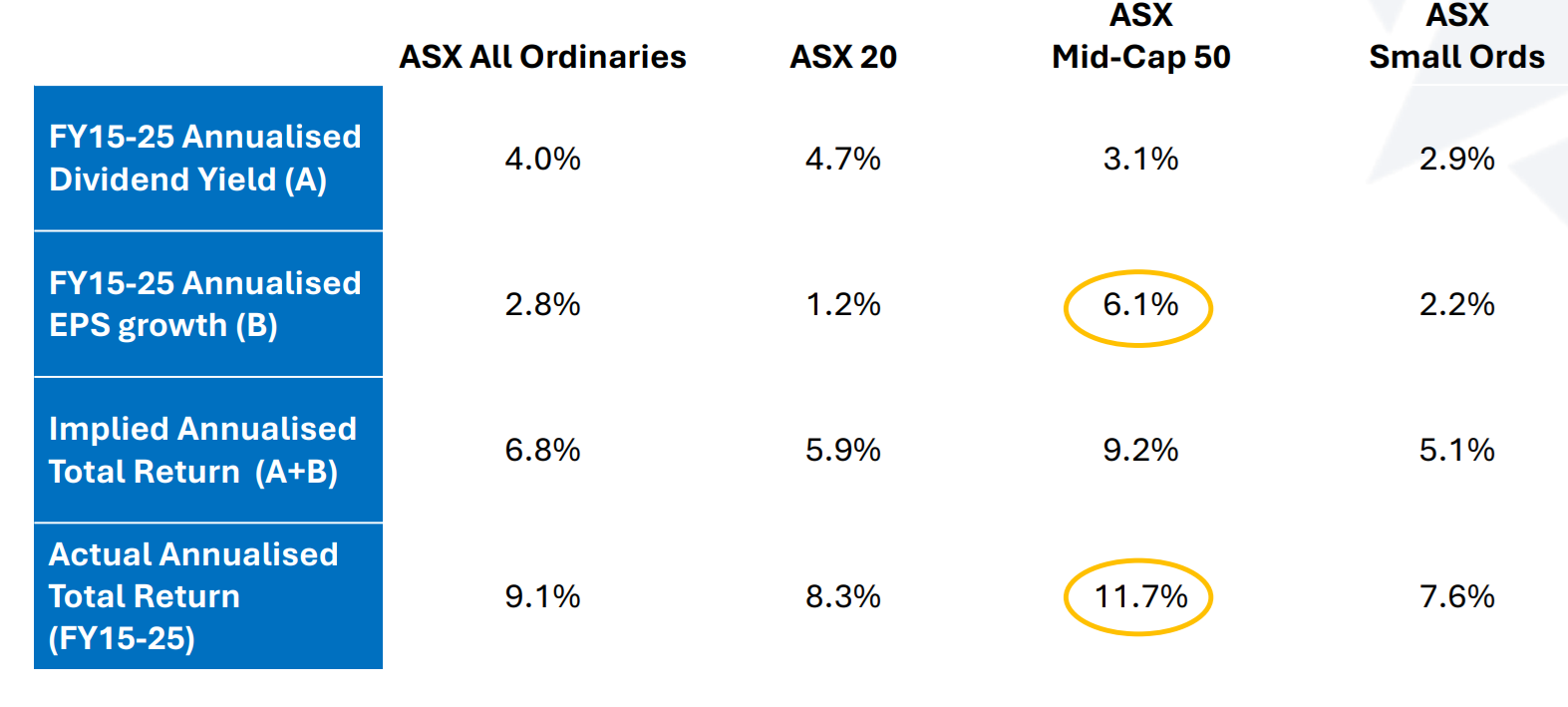

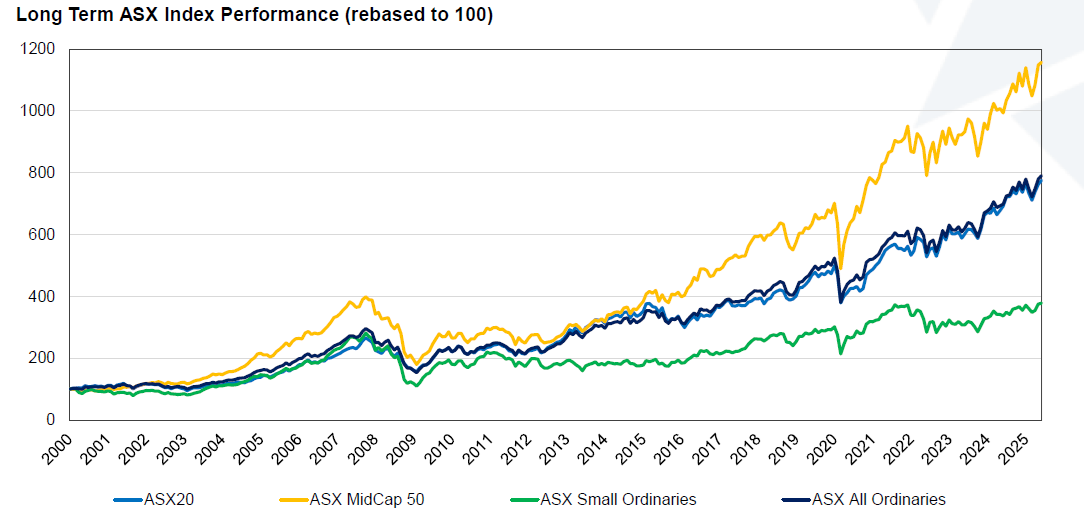

Instead, he reckons mid-cap stocks may be your best bet as they have a track record of faster earnings growth and superior share price performance.

Source: IRESS, Bloomberg, Auscap

Source: IRESS, Auscap

Carleton will have his critics. Whether Macquarie proves a genuine competitor to the Big Four banks remains to be seen as it’s mainly taken share from smaller banks so far. And he’s undoubtedly talking his own book by advocating mid-cap exposure.

Nevertheless, he makes some relevant points about how investors should think carefully about the construction of their Australian-based portfolios.

****

The number of AI sceptics seems to be growing and Firstlinks has featured a few of them in recent editions. So, it’s a good time to hear from one of the bulls.

Nick Griffin, the CIO of Munro Partners, has made a name for himself by backing major technological trends and the companies best exposed to them. When he speaks on tech, investors listen.

And Griffin thinks concerns about a bubble in AI are way overblown:

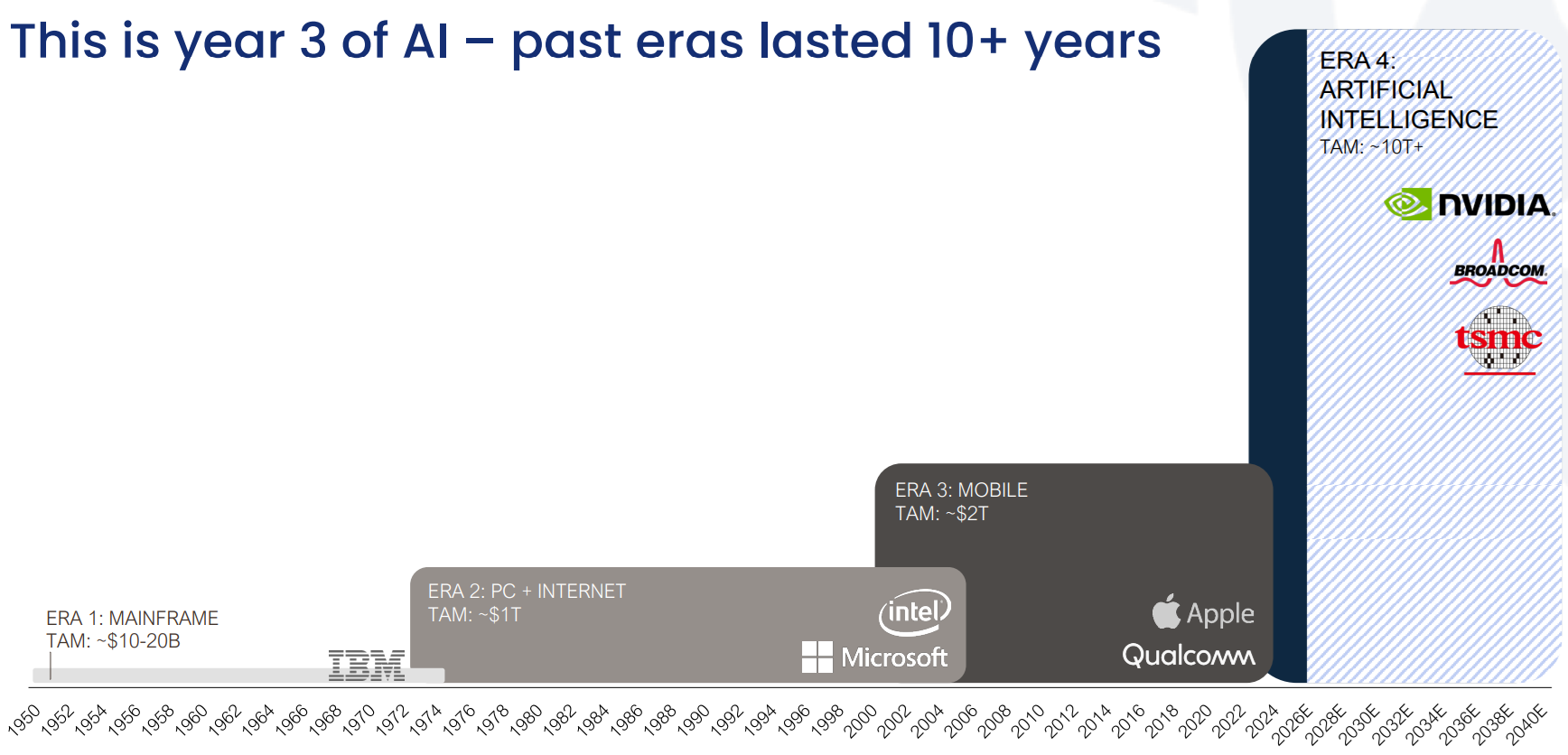

“This is not a bubble, this is a boom. This is a boom that’s literally two-and-a-half years old and it’s probably going to last for the next five to 10 years.”

Why does he say this? Because Griffin believes we’re witnessing an intelligence revolution. If the industrial revolution replaced muscle with machines, then intelligence revolution will augment your brain as well as the brain of every machine around the globe.

He says every company is going to take their data and put intelligence on top of it to get improved outcomes. And they’ll either do that using a so-called hyperscaler or via their own data centre.

Why do the trends last a long time? When the first PC came out, it was five or six years later that workplaces started to get PCs.

Similarly, only some people and businesses use AI right now. There are a lot more who will end up using it, hence why there is a long runway for growth.

For illustrative purposes, the companies shown may or may not be held in the Munro Funds. Numbers are in USD. TAM stands for total addressable market. Slide prepared September 2025.

It’s why Griffin isn’t concerned with the rapid construction of data centres. He quotes Nvidia which expects data centre capital expenditure of US$3-4 trillion by 2030, up from around US$1 trillion today.

And Griffin is also unfazed about returns from this massive capex bill.

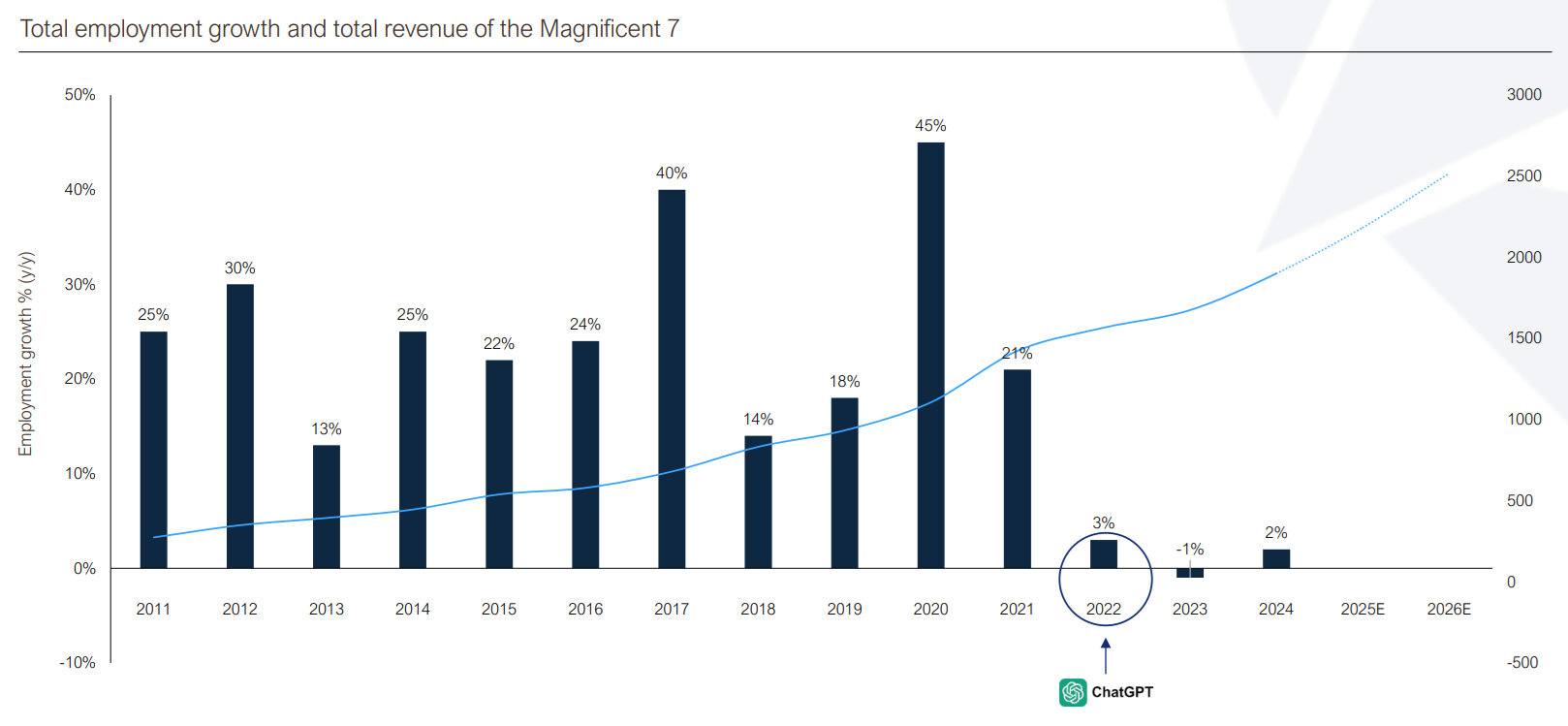

He says investors need only to look at the Magnificent Seven stocks to see where productivity gains will be made. He says AI has helped these companies grow revenue by more than 50% over the past three years, while keeping their headcounts relatively flat.

Source: Munro Partners and industry research as at 31 May 2025. Revenue ($b) is in USD. The companies mentioned may or may not be held in the Munro Funds.

He says what’s happened with the Magnificent Seven will spread to all sectors:

“Every company on the planet … right now is sitting around the boardroom saying how can we use AI to either reduce people, save time, or improve customer satisfaction, and all of that basically equals productivity.”

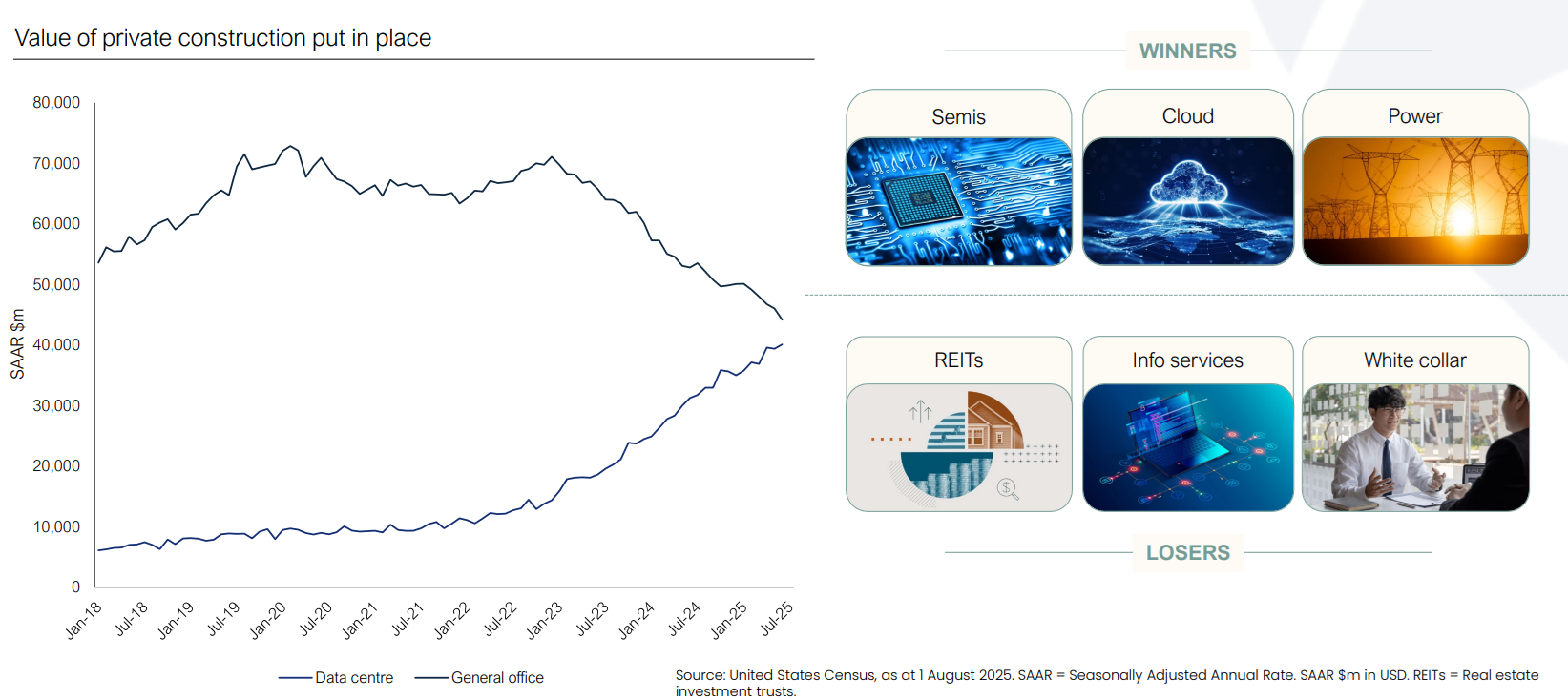

As to the best way to get exposure to AI, Griffin advocates buying the “shovels” to the boom, including semiconductor and cloud service companies. The largest holdings in his Munro Global Growth Fund (ASX: MAET) are Nvidia, Microsoft, Amazon, Meta, and TSMC.

For illustrative purposes, the companies shown may or may not be held in the Munro Funds.

The losers from the AI boom will include office property and white collar services, Griffin believes.

** Disclosure: Auscap and Munro Partners are affiliates of GSFM – a Firstlinks sponsor. Tim Carleton and Nick Griffin spoke at a recent media briefing hosted by GSFM.

James Gruber

In this week's edition...

Shane Oliver thinks five mega trends point to risks of a more inflation prone and lower growth environment than pre-pandemic. Taken together, and along with rich share market valuations, he says it will likely constrain medium term superannuation returns to around 5% per annum.

We hear a lot about supply being the key to fixing our housing affordability crisis though Nick Garvin believes that's too simplistic as tax incentives, easy credit, and expectations of capital growth also play a part. Treating housing as a wealth-building asset distorts prices far beyond what rent fundamentals suggest and real reform may require a cultural shift in how we view property, he says.

Vanguard's How Australia Retires 2025 report reveals younger Australians expect higher retirement incomes than current retirees receive and many remain financially unprepared. It also highlights a growing trend to work part-time in retirement, underscoring the need for holistic planning beyond just money.

Tony Dillon isn't impressed with Labor's climate targets. He says our climate policy focuses heavily on emission cuts despite its minimal global impact, while underinvesting in essential adaptation measures to prepare for inevitable climate effects. He reckons this imbalance risks economic harm and leaves communities vulnerable, highlighting the need for a better balance in how we tackle climate change.

UniSuper research shows a growing number of retirees want to stay engaged through part-time work or new pursuits. 'Practising' retirement while still working - through hobbies, study or reduced hours - is emerging as a valuable way to transition with confidence, writes Giacomo Tarantolo.

Yarra Capital's Phil Strano thinks the global credit market is quietly shifting as the US dollar’s long-standing dominance begins to erode, prompting a slow but steady reallocation of capital. He believes Australia’s AAA-rated credit market, offering attractive spreads and strong fundamentals, stands to gain.

While many are enamoured with AI's abilities, Dr Simon Cottrell and Chandra Krishnamurti aren't. They think much of its output is simply high-volume pattern replication rather than genuine insight. And the real risk lies not in sentient machines, but in AI’s potential to flood markets with noise, erode trust, and displace human judgment without accountability or understanding.

Two extra articles from Morningstar this weekend. Sarah Hansen looks at whether the AI boom in semiconductor stocks will continue, while Roy Van Keulen explains why he thinks ASX darling Technology One remains overvalued.

In this week's whitepaper, RQI Investors - part of First Sentier - outlines the lessons from 2018-2020 when quantitative funds underperformed and investigates whether another 'quant winter' could recur.

****

Weekend market update

On Friday in the US, stocks staged a solid rebound from recent weakness with a 0.6% advance on the S&P 500, while Treasurys steepened a bit with two-year yields ticking to 3.63% from 3.64% yesterday and the long bond rising two basis points to 4.77%. WTI crude stayed above US$65 a barrel, gold rallied to US$3,765 per ounce, and bitcoin consolidated its recent selloff near US$109,000.

From AAP:

Australia's share market finished the week with a shrug, closing roughly where it began after a mining sector rally dug the bourse out of trouble elsewhere. The S&P/ASX200 edged 14.7 points higher on Friday, up 0.17%, to 8,787.7.

Caution from the US Federal Reserve and a hotter-than-expected local inflation had investors recalibrating their expectations for interest rate cuts into year-end.

Four of the 11 local sectors closed higher on Friday, with the heavyweight financials, up 0.5% and mining stocks, up 0.9%, responsible for the positive finish.

BHP and Rio Tinto each surged more than 6% each for the week, thanks in part to a rally in copper prices after a landslide in Indonesia prompted a major supply disruption.

Silver topped a 14-year high as gold loomed roughly 1% below its fresh record of $US3,791 ($A5,800) an ounce set on Tuesday.

Health care stocks tumbled 1.4% ( down 2.6% for the week) after US President Donald Trump announced his 100% tariffs on branded or patented pharmaceuticals.

Shares in blood plasma giant CSL fell 1.9%, while Telix Pharmaceuticals and Mesoblast each tumbled more than 3% despite assuring shareholders they were exempt from the tariffs.

From Shane Oliver, AMP:

Despite a bounce on Friday US shares fell 0.3% over the last week as expectations for Fed rate cuts were wound back, but Eurozone shares rose 0.5%, Japanese shares rose 0.7% and Chinese shares rose 1.1%. Australian shares also managed a small rise of 0.2% which was their first rise in three weeks, with a rebound in resources shares, but with most sectors down for the week including healthcare stocks as CSL was dragged down by uncertainty around the impact of Trump’s pharmaceutical tariffs. 10-year bond yields rose including in Australia where expectations for RBA rate cuts were reduced after stronger than expected inflation data. Gold prices made another record high, metal prices rose and so did oil prices, but iron ore prices fell slightly. The $A fell as the $US rose on the back of reduced expectations for Fed rate cuts.

Australian inflation up again in August – does this mean limited scope for further RBA cuts? The August monthly CPI surprised again on the upside taking inflation to 3%yoy, its highest since July last year. This was largely due to a 24.6%yoy rise in electricity costs as various state rebates from a year ago dropped out. More concerningly though strong gains in a range of components including restaurant and takeaway meals, various services and stickiness or maybe even upwards pressure in new dwelling prices and rents raise the prospect that trimmed mean or underlying inflation for this quarter will come in around 0.8-0.9%qoq or so resulting in an annual rate of 2.7-2.8%yoy, which would be well above the RBA’s forecast for around 2.5%yoy. With inflation showing signs of stickiness above target this has led to concerns that the RBA may not be able to cut much more if at all.

Against this though there is a danger in reading too much into the monthly CPI to conclude that we may be at or near the bottom on rates:

- First, the monthly CPI is volatile and goes through hot & cold patches and as we have seen since 2022 and in other countries the fall back in inflation can be quite bumpy. In fact, compared to other similar countries we are doing pretty well. See the next chart.

- Second, while its measured slightly differently to the quarterly measure the monthly trimmed mean was 2.6%yoy and has averaged that since the start of the year which is effectively at target.

- Third, more monthly CPI items are continuing to see inflation rates below 2%yoy than above 3%yoy.

- Fourthly, economic growth remains fragile with the risks on the downside and similarly risks to the upside for unemployment given recent signs of softer jobs and uncertainty as to whether the private sector will take over from the public sector in driving employment.

- Fifthly, the current level of the cash rate is still judged by the RBA to be restrictive, with its most recently available research showing a mid-point of estimates for the neutral cash rate of around 2.9%.

- Sixthly, if the Fed continues to cut in line with market expectations and the RBA holds it will see the Fed Funds rate fall well below the RBA’s cash rate possibly putting substantial upwards pressure on the $A which will bear down on Australian growth and inflation putting pressure on the RBA to cut.

- Finally, money market expectations for RBA rate cuts this year have bounced around a lot. Lately they have been wound back but the next shock may see them raised again.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website