The global credit market is being quietly but fundamentally re-priced. There are signs the long, comfortable era in which the US dollar’s reserve status has helped to inflate the size, depth and relative pricing of US corporate credit, is beginning to fray.

Much like the 80 years it took to entrench US dollar dominance in the world’s economy, the shift away from it won’t happen overnight. It’s more like turning an ocean liner than flipping a switch – slow-moving but hard to reverse once underway. Nonetheless, it marks a clear change in direction and is part of a long-term, capital flow story already unfolding – one that will produce both winners and losers.

This is not a disorderly rush for the exits. But even modest and sustained outflows from an over-allocated US investment-grade (IG) market can be a powerful tailwind for non-US$ markets – particularly those like where spreads still offer fair compensation for risk.

And Australia, with IG spreads still sitting at, or above, long term averages while US spreads sit materially below, is looking increasingly like one of the winners. The features of our credit market – a AAA rated economy (one of only a few left), stable political and legal system and a transparent regulatory environment – are all strong drawcards for global investors seeking diversification beyond the US dollar.

The world is over-allocated to US$ and investors are re-evaluating

A number of powerful dynamics are converging to create the ‘de-dollarisation’ investing theme emerging in credit markets.

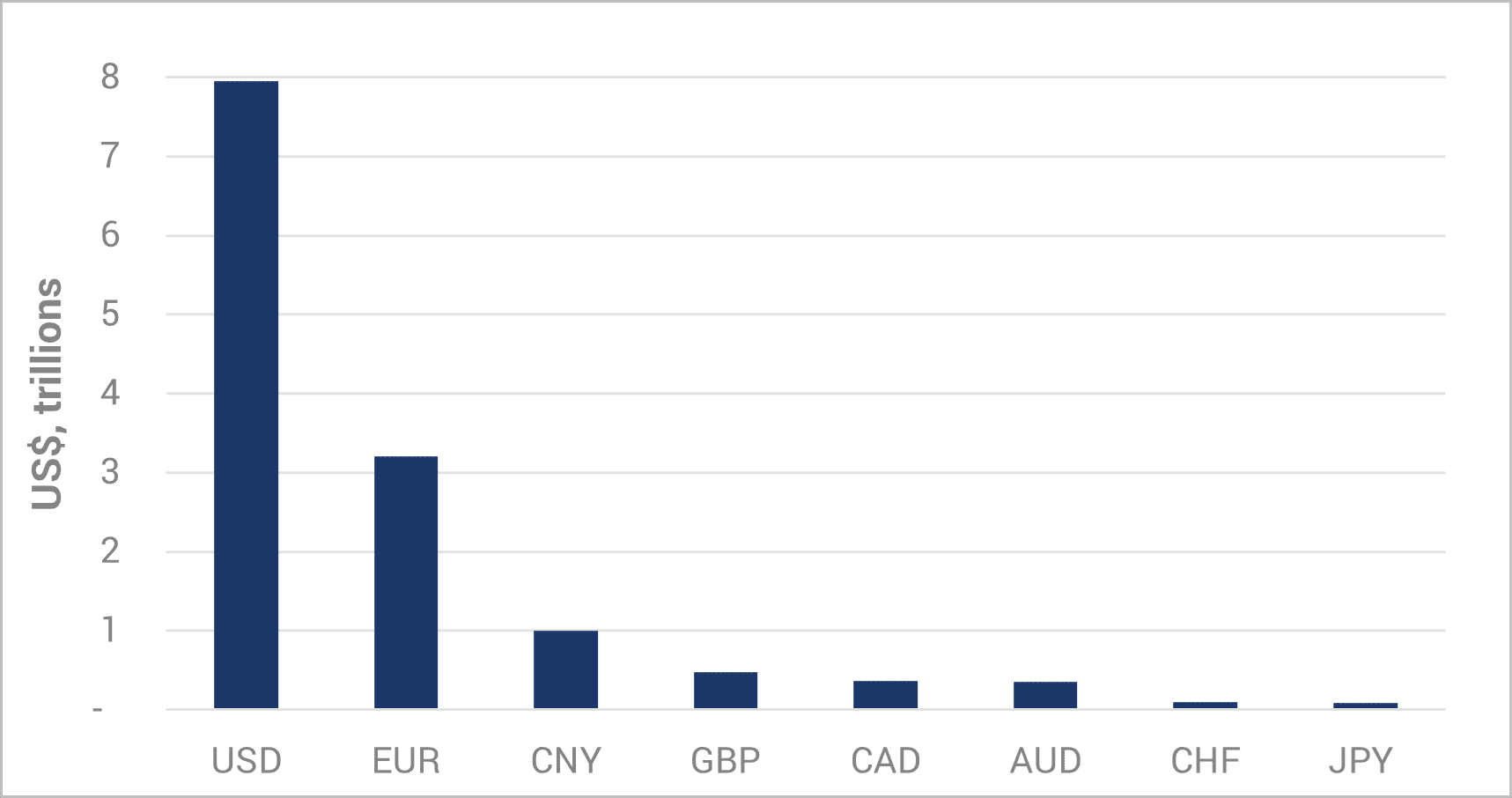

The fact remains that investors have been structurally over-allocated to US dollar assets for decades. Recent research from Deutsche Bank estimates the US investment-grade credit market is ~US$3 trillion larger than fundamentals would suggest, with outstandings at ~30% of GDP. Contrastingly, Australia’s sits alongside Canada as the fifth or six largest public credit market globally (refer Chart 1), but its outstandings represent ~20% of GDP. Investment in US IG corporate credit has long outpaced the size of the US economy. That imbalance is a function of history: the US dollar’s reserve currency status has long supported demand for US$ credit, irrespective of valuation.

Chart 1 – Face Value of IG Corporate Debt (US$)

Source: Deutsche Bank, Bloomberg, YCM Jun 2025.

But the drivers of that status – liquidity, depth, geopolitical dominance – are now being re-evaluated. Foreign investors, central banks and sovereign wealth funds are gradually diversifying away from US$-denominated credit, often by reinvesting maturing capital into other markets rather than engaging in outright selling.

This orderly approach is reflected in Deutsche Bank’s analysis which suggests average monthly outflows of around US$9.3 billion from the US investment-grade credit market[1] – roughly 15% of average monthly net supply since 2020. In other words, not a disorderly rotation, but still directionally significant.

The political backdrop is contributing to the shift. A more inward-looking US policy stance – characterised by rising tariffs and ballooning deficits – weakens the rationale for concentrated US$ exposure. If the US is less willing to import, fewer dollars circulate globally. That naturally reduces the need for other countries to hold US$ assets. In turn, demand for currency diversification increases, with a portion of those additional flows then allocated to A$ assets.

Why Australia stands out on the global credit stage

Importantly, de-dollarisation is not a like-for-like switch from US credit into another market of equal size. While the US market remains enormous at over US$10 trillion, this creates an opportunity for smaller, fundamentally sound credit markets such as Australia. Despite its smaller corporate bond market, Australia still offers a spread premium while investment-grade spreads, including major bank Tier 2 and BBB corporates, remain at or above their long-term averages. By contrast, US credit spreads are trading below these historical averages.

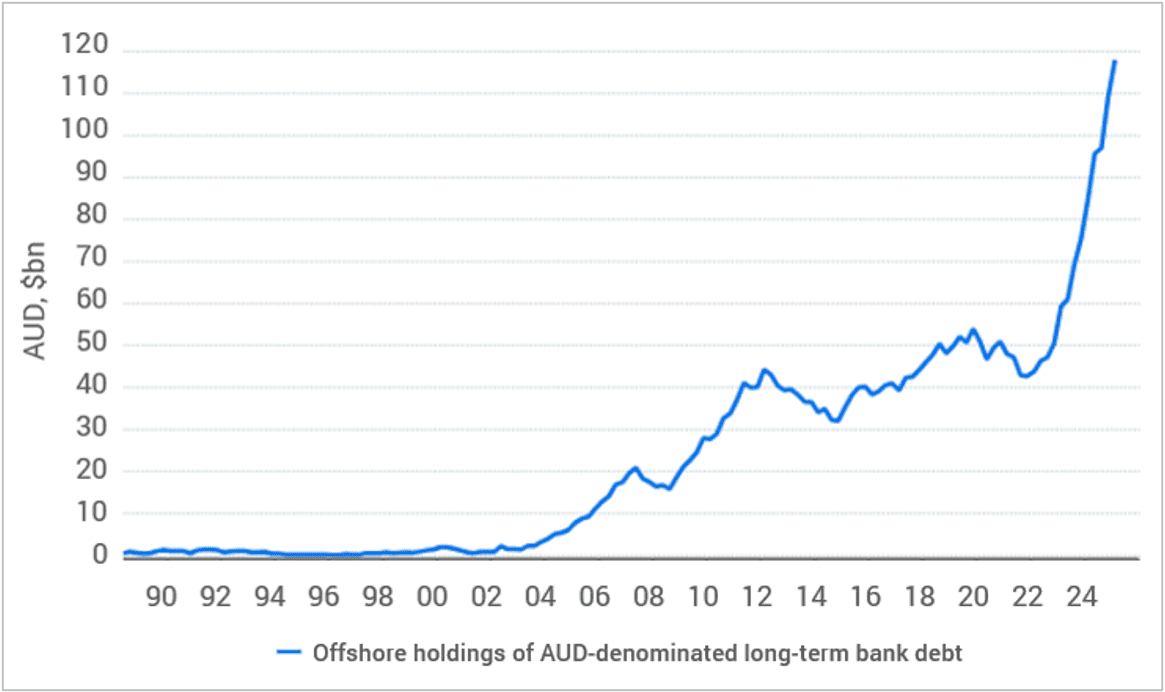

If even only a modest slice of the global de-dollarisation flow turns up here, two important things will occur to lift both the performance and the profile of the Australian market, which has undergone rapid growth in recent years to become an important destination for foreign capital (refer Chart 2).

Chart 2 – Offshore Holdings of AUD Bank Paper

Source: ABS, Macrobond, ANZ Research.

Firstly, capital inflows into Australian credit are likely to support relative outperformance, prompting spreads to tighten compared to the US market – delivering investors stronger total returns.

Secondly, and more structurally significant, is market growth. Increased demand will incentivise a broader set of issuers, both domestic and offshore, to come to the A$ market. That means greater diversity, more liquidity, and a deeper, more investable opportunity set.

The recent 8-times oversubscribed A$500 million sale of BBB-rated Dyno Nobel bonds is a clarion call to Australian issuers – who have rarely issued in A$ but are frequent issuers in US$ – to bring some of their funding requirements back home.

As the Dyno Nobel bond sale confirms, the A$ credit market can now meet the term and volume requirements for a diverse range of issuers. This cohort includes the likes of Brambles, Orica, CSL, BHP, Rio Tinto, Santos, Woodside, Amcor and BlueScope, as well as increased issuance of A$ bonds by offshore issuers.

We expect the expansion of the A$ credit market to occur more independently of the growth rate of the Australian economy – driven not by local funding needs, but instead by foreign demand for exposure to the A$ and the high quality of our credit market. In this context, the fact that most Australian credit segments (outside of private debt) still offer spreads at or above their long-term averages gives investors an attractive entry point.

Even modest reallocation away from US$ credit can become a powerful tailwind for those under-owned, and relatively undervalued markets. And unlike the US, where investment-grade spreads are well below long-term averages, Australian credit continues to offer spreads at or above historical norms – meaning investors are still being paid to take risk.

This is a high tide moment. And just as a rising tide lifts all boats, increased global interest in the A$ credit market driven by de-dollarisation could mark not just a cyclical uplift but an important structural turning point.

For a market often overlooked due to its size, this next phase of global capital reallocation presents a rare opportunity and quite possibly an important moment of maturity for the Australian fixed income landscape on the global stage.

[1]Deutsche Bank AG Research, ‘Decoding De-dollarization’, Published 2 July 2025.

Phil Strano is Head of Australian Credit Research at Yarra Capital Management, a sponsor of Firstlinks. This article contains general financial information only. It has been prepared without taking into account your personal objectives, financial situation or particular needs.

For more articles and papers from Yarra Capital, please click here.