The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Undoubtedly, your email inboxes are full of market predictions for the year ahead. Yet, forecasting the short term is exceeding difficult. I’ve found that it often helps to zoom out and look at long-term data to guide investment decisions.

A new report from Deutsche Bank, aptly titled ‘The Ultimate Guide to Long-term Investing’, can help with that. It explores data from 78 countries over more than 200 years to see how different asset classes and countries have performed.

Here’s what the report found:

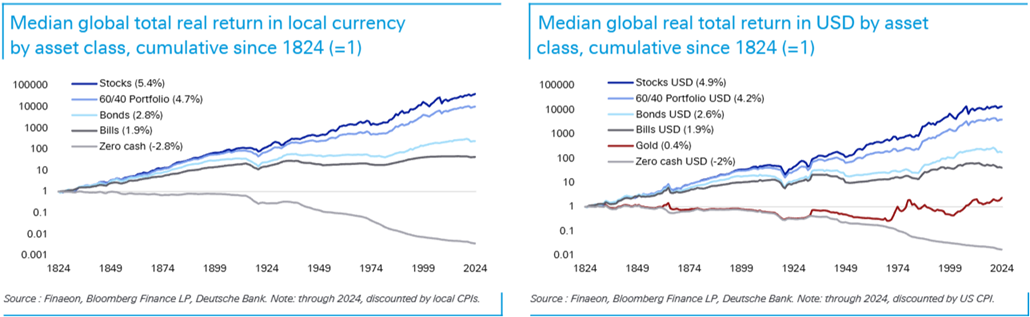

1. Investors have been consistently rewarded for taking risks and compounding dividends and coupons from equities and bonds. Global inflation-adjusted returns in US dollars over the past 200 years show equities returning 4.9% per annum, government bonds 2.6%, gold 0.4%, and cash -2%.

2. The 60/40 portfolio has delivered strong performance, close to that of equities, over the long term. Deutsche says this is due to the imperfect correlation between stocks and bonds, which provides diversification benefits. Also, bonds offer more stable returns, which enhances the compounding of returns, especially in periods when equities suffer from bear markets.

Along with the US and Denmark, Australia has had the highest 60/40 returns, at 5.5% in real US dollar terms over the past century.

3. Gold has beaten inflation but badly trailed stocks and bonds. Gold has returned 0.4% in real US dollar terms over the past 200 years. This century, though, it’s been the best performing asset, returning 7.45% p.a. in real terms, bettering the likes of US equities (5.8% p.a.) and US government bonds (0.9%).

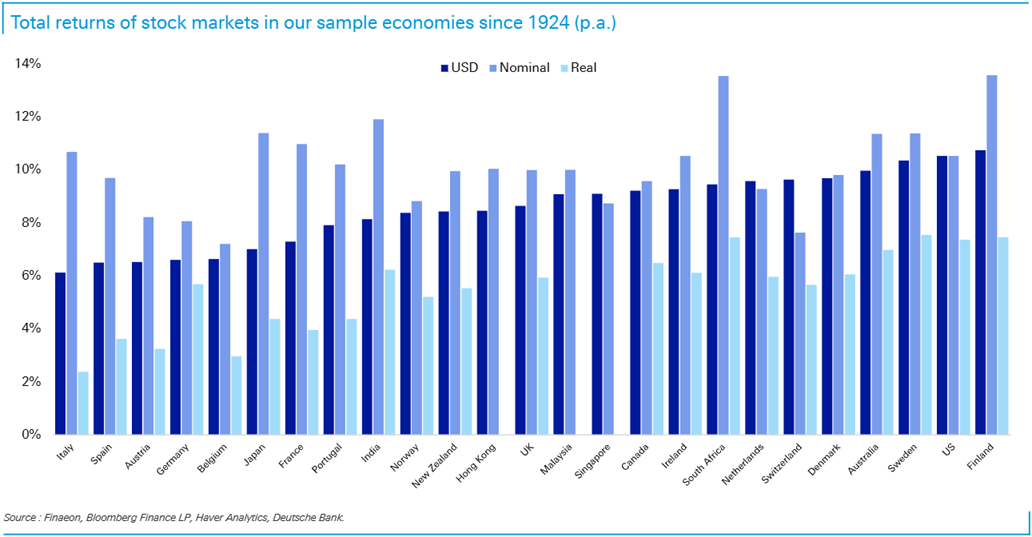

4. Globally, the best countries to have invested in over the past century were some of the most stable. Over the last 100 years, Sweden has delivered the highest stock market real returns (7.5%), followed by the US (7.2%) and Australia (6.9%). By contrast, Italy has had the worst equity returns of 2.5%. Interestingly, though, Italy has been the best performer in developed markets over the past five years, with 12.2% real returns.

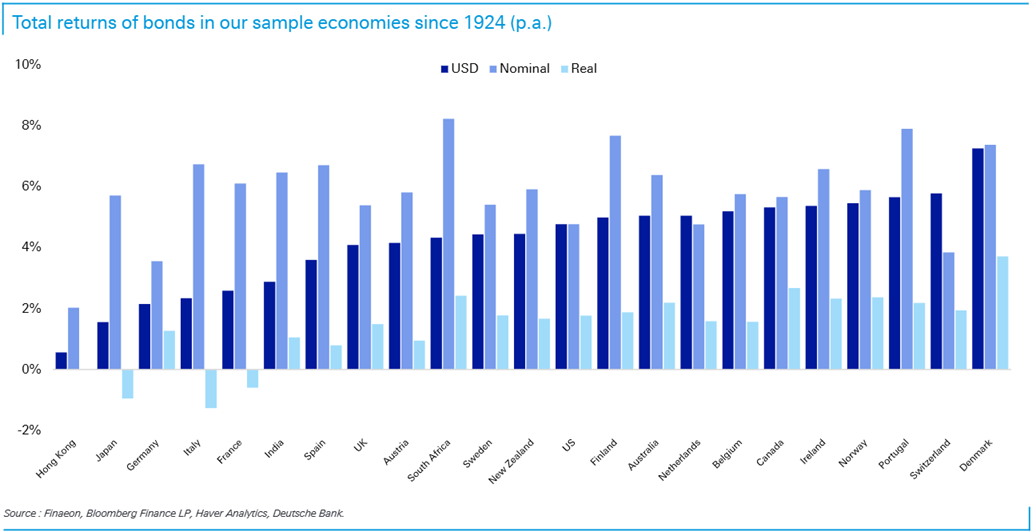

5. Bonds have lost money in real terms in some countries over the past 100 years. Italy (1.1%), Japan (1.1%), and France (-0.5%) are examples. What do these countries have in common? They’ve all carried some of the highest debt burdens.

Meanwhile, Australian bonds have returned 1.9% in real US dollar terms over the period.

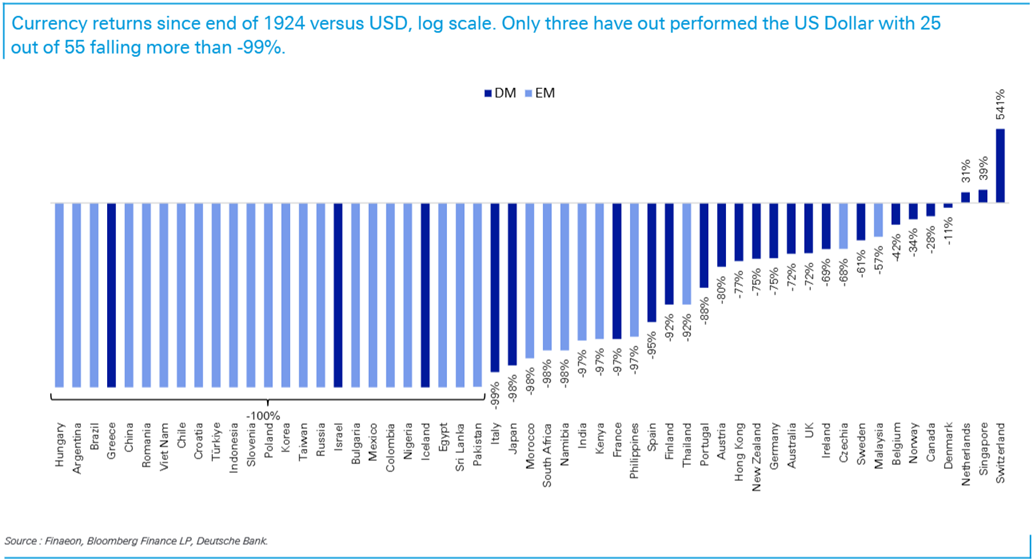

6. Only three countries — Switzerland, Singapore, and the Netherlands — have currencies which have strengthened against the US dollar over the past century. The currencies of 25 counties have declined by more than 99%.

Australia’s currency has fallen 72% over the period!

“In nearly all cases, inflation has led to long-term depreciation of those currencies against the [US] dollar,” Deutsche says.

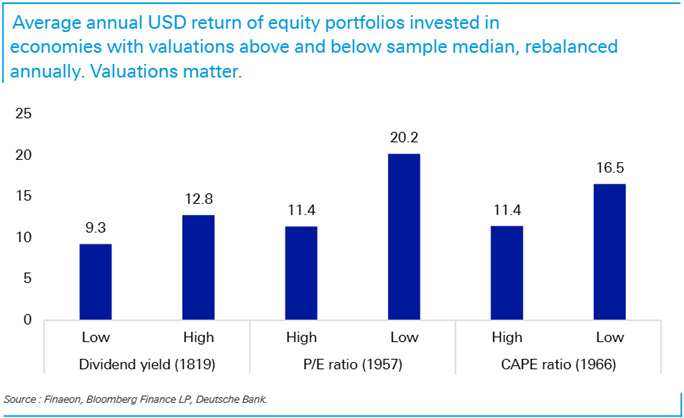

7. Starting valuations matter a great deal to long-term returns. The first chart on the right below shows that low price-to-earnings ratio at the start of a 25 year period are predictive of higher real stock market returns.

Interestingly, high starting interest rates and bond yields also precede strong equity returns. This may be due to both normally being associated with lower equity valuations.

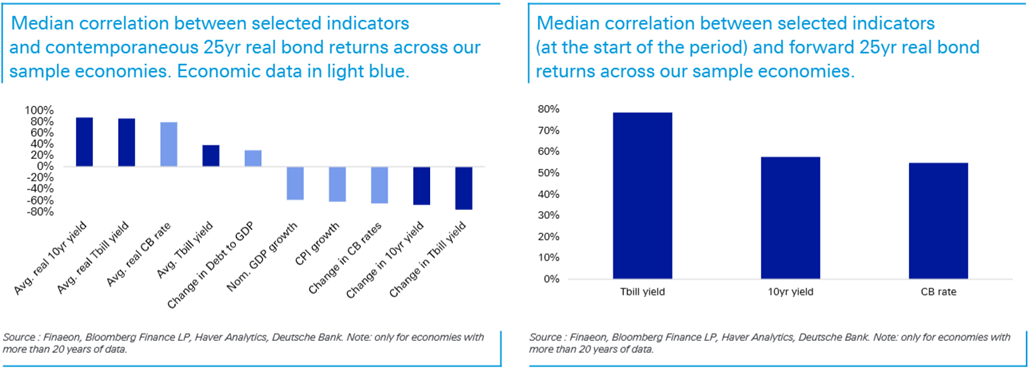

For bonds, the picture is similar. Higher interest rates and bond yields precede stronger real bond market returns.

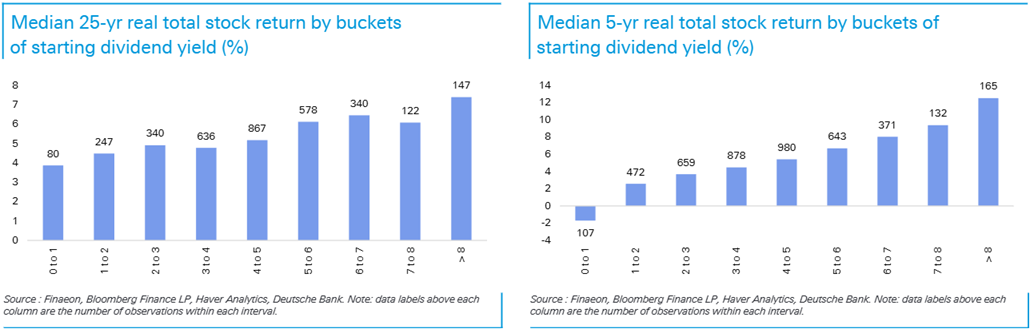

8. Higher starting dividend yields are also equated with stronger stock market returns.

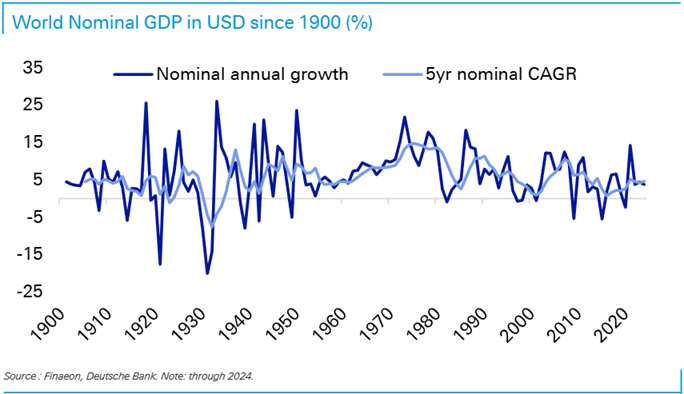

9. Nominal GDP growth drives asset-class returns. It impacts corporate earnings, household incomes, interest rates, and government revenues. Therefore, asset prices ultimately reflect claims on nominal GDP growth. But how that growth is distributed between equities and bonds depends on the mix of inflation and real economic growth.

The good news is that the IMF forecasts global nominal GDP growth of 5% in US dollar terms through to 2030 – largely in line with the 4.8% since 1900, excluding the abnormal high growth rates from 1960-1989 (which was marked by strong population growth and high inflation).

10. We seem to be in a structurally higher inflation world. Global inflation started to rise from the early 1900s as the world gradually loosened its ties to gold-based money. Those ties were severed in 1971, and since then no economy has managed to keep average inflation below 2% per year.

11. Historically, stocks have provided a good hedge against inflation.

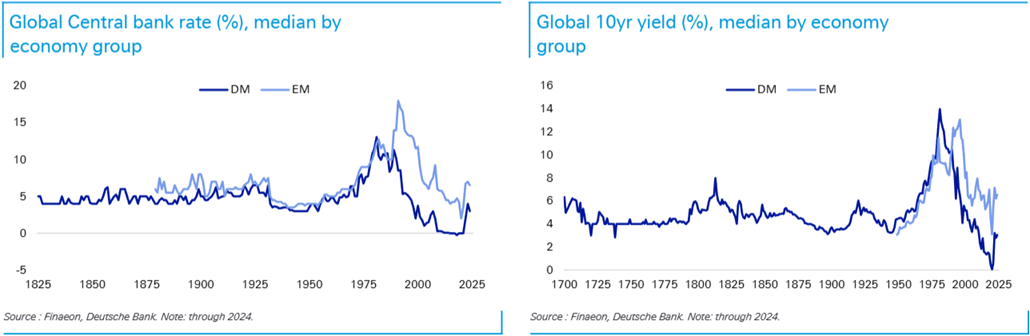

12. Interest rates and bond yields in developed markets remain low versus history.

13. Stocks and bonds have tended to have a positive correlation – their prices have moved together, rather than inversely. That changed in recent decades as globalization deepened and economies became more intertwined. With globalization starting to reverse, we’ve seen stocks and bonds becoming positively correlated again.

I hope this gives you some things to consider as we head into the Christmas break.

Speaking of the break, Firstlinks will be taking next week off, and returning on January 1. See you in the new year, and stay safe.

****

In my article this week, I revisit my 2023 piece, 'Australian stocks will crush housing over the next decade,' and look at where things stand today. The performance of stocks versus real estate since then may surprise you.

On the topic of comparing stocks to property and which is best, Noel Whittaker also offers a practical guide on the pros and cons of each asset class. As usual with Noel, it's written in an informative, yet easy-to-understand way.

James Gruber

Also in this week's edition...

Orbis' Alec Cutler boldly asks: what if Trump is right? By this he means that Trump could well be correct on two important global trends: nations rebalancing from aspirational wants towards foundational needs and from dependence on global support to being self-reliant. Alec explores the implications of these trends for global sectors and stocks.

Gold is set for its best annual returns since 1971. Can the good times continue? Shaokai Fan runs through the primary drivers which will shape the outlook for gold in 2026 and beyond.

In a series of Firstlinks articles this year, Clime's John Abernethy has questioned many aspects of defined benefit pensions for Commonwealth public servants. Paul Lindwall offers an attempted rebuttal to John, suggesting these pensions aren't the problem they're made out to be.

Demand for global air travel remains strong, yet it's being held back by a lack of new planes. That constraint should soon ease, and First Sentier's William Thackray thinks airport stocks will be long-term beneficiaries.

What is the future of search in the age of AI? Magellan looks at the swiftly changing landscape for Google search as AI innovates. It believes there's plenty of room for both search and AI to thrive.

Two extra articles from Morningstar this weekend. Roy Van Keulen explores the latest mishaps at ASX Ltd, while Angus Hewitt thinks the market may be too pessimistic on Treasury Wine.

Lastly, in this week's whitepaper, Orbis explores six key questions investors should be asking for 2026 to test their assumptions and sharpen their thinking.

***

Weekend market update

A major options expiration resolved in bullish fashion, with the S&P 500 rising nearly 1% to flip back into positive territory for the final full trading week of the year. Treasury yields ticked higher by two to three basis points across the curve, while WTI crude crawled towards US$57 a barrel. Gold edged higher at US$4,338 per ounce, bitcoin climbed to about US$88,000 and the VIX collapsed by two points to settle south of 15.

From AAP:

Australia's share market clawed back some losses but still snapped a three-week winning streak as energy stocks had their worst week since April. The S&P/ASX200 rose 40 points on Friday, up 0.47%, to 8,628.2. Over the week, the top-200 fell 0.8%.

ASX-listed tech stocks and financials led eight of 11 local sectors higher on Friday, while raw materials dipped 0.6% on weakness in mining giants BHP and Fortescue.

Gold miners were broadly higher as the precious metal hovered near all-time highs, but it didn't help Northern Star, which fell more than 3%.

Energy stocks snapped a four-session red streak, but dropped 5.7% since Monday, its worst week since April when US Liberation Day tariff announcements pummelled equities markets and global growth expectations. Oil prices are hanging on at seven-month lows, as investors weigh a global supply glut against ongoing conflict in Ukraine and a US naval blockade on Venezuelan oil tankers.

Uranium stocks bounced back on Friday after suffering for most of the week, laser enrichment technology Silex Systems and miner Paladin Energy each up more than 9% and taking out two of the top-200's best three performances on Friday.

Australia's heavyweight financials sector returned to form, securing its highest weekly close in a month as three of four big banks traded higher, led by a 2.8% boost to CBA shares to $157.75. ANZ slipped less than 0.1%, as the Federal Court tacked an extra $10 million onto a record $240 million fine for widespread misconduct and systemic failures. Investment giant Macquarie Group traded 1.5% higher despite its Macquarie Securities arm copping a $35 million fine for misreporting millions of short sales over several years.

ASX-listed tech stocks outperformed the broader market, the sector lifting 2.2% as WiseTech, Xero, Technology One and Life360 surged. Data centre player NextDC bucked the trend with a 1.7% drop, tracking with lingering concerns about artificial intelligence returns.

It was a mixed week for consumer-facing sectors with staples fading 1.5%, while discretionaries clawed back 0.8% but remains on par with its value in May after a weak fourth quarter.

Droneshield was the top-200's best performer, up 11.7% on Friday and more than 33% for the week, as dip buyers pounced on a $50 million contract announced on Tuesday.

Elsewhere in defence, Austal sailed 5.7% higher after winning a contract extension to build two additional Evolved Cape-class Patrol Boats for the Australian Border Force.

Healthcare stocks had their first positive day in a week, as 4D Medical soared more than 20% after a major US medical centre adopted its CT scan technology.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website