The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

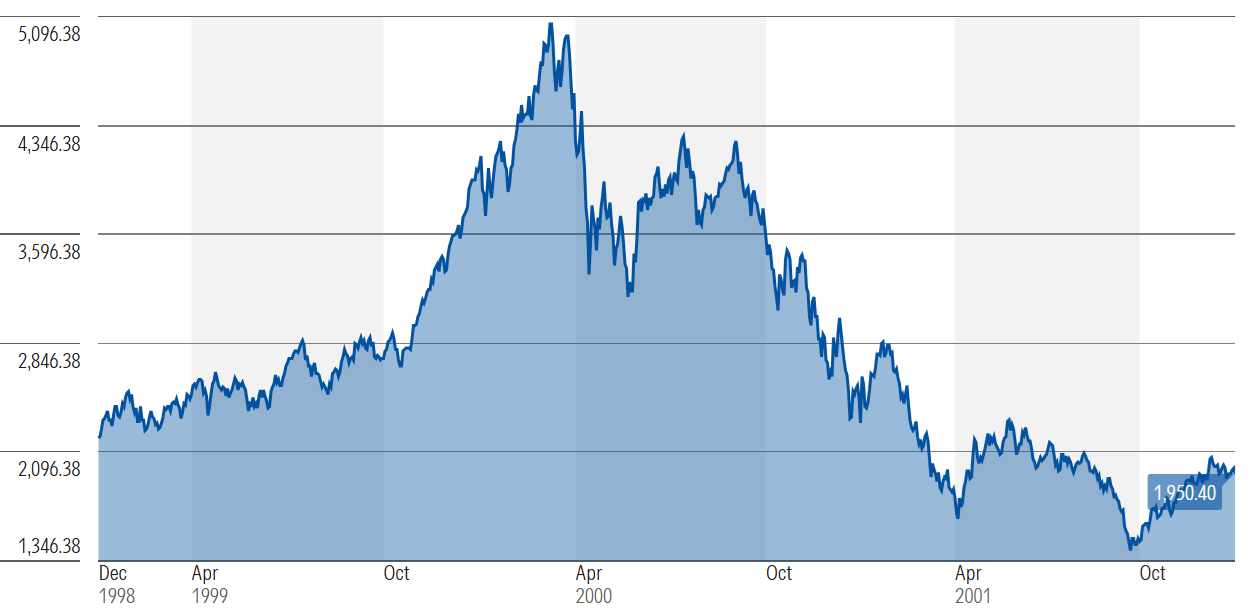

Markets are starting to party like it’s 1999. We’re not quite there yet, though. Between October 1999 and March 2000, the Nasdaq almost doubled. That makes today’s markets look tame, but perhaps another blowoff top is around the corner.

Nasdaq Index

Source: Morningstar

That’s especially the case as markets start to front-run the appointment of a new Trump-friendly Federal Reserve Chairman, who will undoubtedly cut rates – potentially a lot - by mid next year.

The parallels

The similarities between today’s markets and 1999 are becoming eerie:

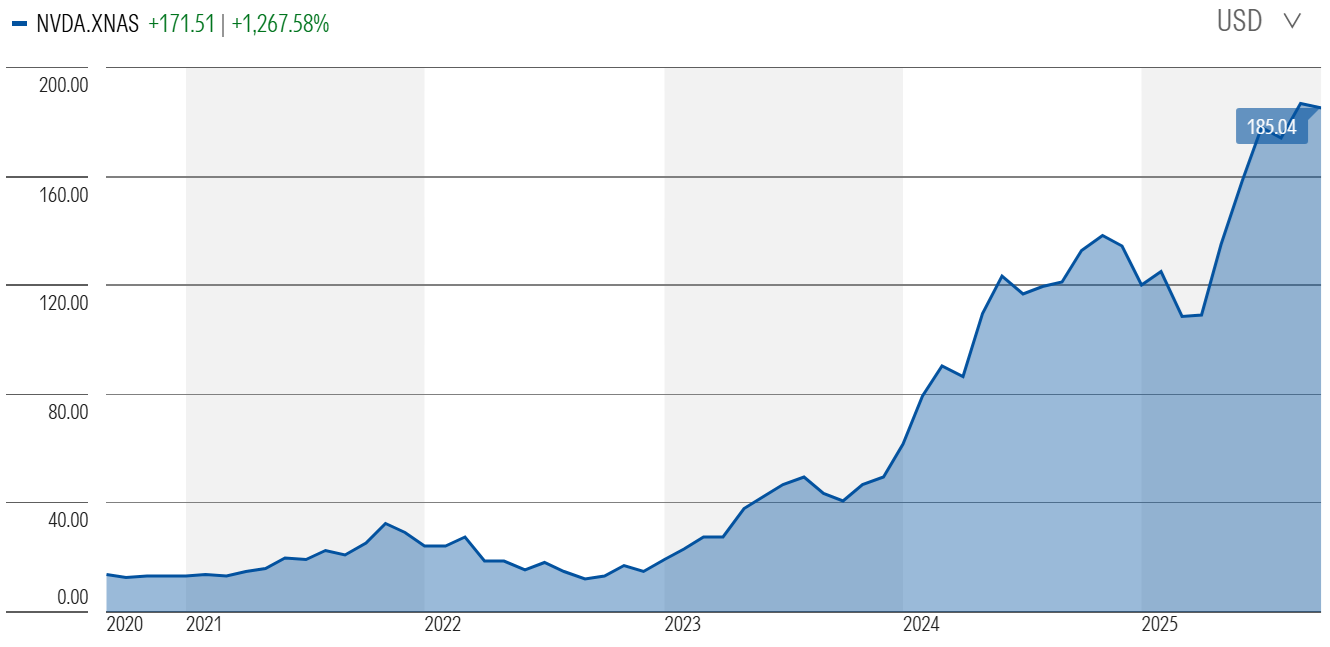

1. Market (over?) exuberance for anything tech. Just ten firms – including Amazon and Nvidia - have accounted for 55% of the rise in the S&P 500 since ChatGPT launched in 2022. Today, Nvidia is tech’s golden child, as CISCO was back in 1999.

Source: Morningstar

2. Bulging non-listed tech deals. In July, an AI start-up called Thinking Machines Labs raised $US2 billion in funding at a valuation of $US10 billion. Leading Silicon Valley venture capital firms led the deal, and the likes of Nvidia and, funnily enough, CISCO, also chipped in. The kicker? Thinking Machines doesn’t have a product or any revenue.

These types are deals are making the 90s look lame.

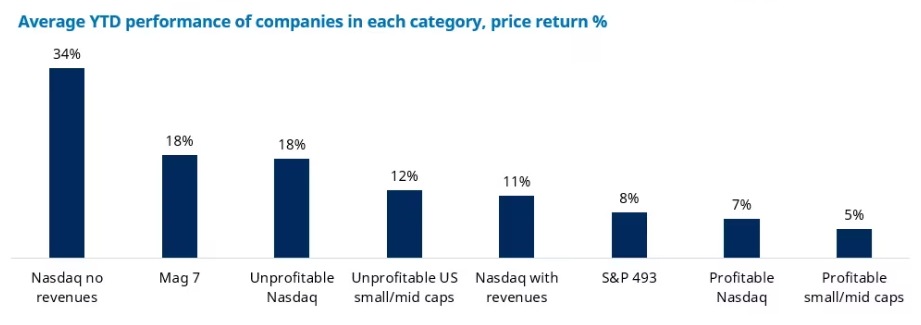

3. Lossmaking listed tech firms are booming again. In 2000, online retailer Pets.com listed at a valuation of $US1.2 billion despite generating only $US5.8 million in revenue.

Today, meme stocks are leading the charge, outperforming the index and even the Magnificent 7.

Source: Schroders

4. AI-related news is greeted with market exuberance, like tech/telecoms was in the 90s. In September, Larry Ellison briefly became the world’s richest man after AI enthusiasm prompted the share price of Oracle, his firm, to pop.

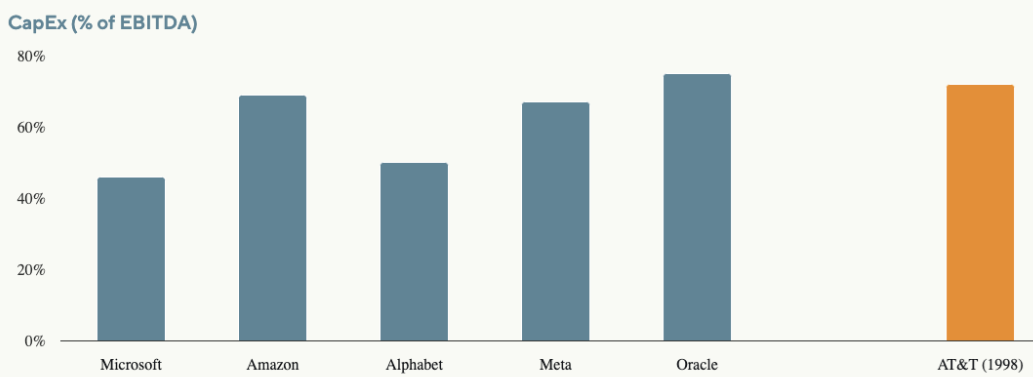

5. Spending on AI is skyrocketing, like it did with telecoms in the 90s. Morgan Stanley estimates that cumulative investment in new data centres will reach $3 trillion by 2028. That dwarfs current AI revenues of about $US50 billion and raises questions about the return on investment from AI spend and whether we’ll be left with ‘ghost’ data centres akin to what happened with telecommunications equipment in the dotcom period.

6. Funny ‘vendor financing deals’ are back in vogue. The largest of these deals is Nvidia’s US$100 billion investment in OpenAI. Under the terms of the deal, OpenAI pays for Nvidia’s powerful chips in cash, while Nvidia will reinvest that amount in OpenAI through non-controlling shares.

This has similarities to ‘vendor financing’, a 1990s tactic where companies lent money to clients to facilitate the purchase of their products.

7. Accounting gimmickry has resurfaced. Bookkeeping gimmickry is a telltale sign of a speculative boom. It might be happening again today.

Many of the tech giants have lengthened the depreciation schedule for their AI servers, which seems odd given the recent advances in chipmaking. Microsoft increased it from four to six years in 2022. Alphabet did likewise in 2023. Oracle altered it from five to six in 2024. And Meta moved from five to five and a half years in January this year.

Lengthening the lifetimes for servers decreases depreciation charges and boosts short-term profits.

Barclays estimates that using more realistic server depreciations schedules of three years would reduce earnings of Meta, Amazon, and Alphabet by up to 10%.

The differences

While there are undoubtedly similarities between today’s markets and those of the dotcom era, there are also some important differences:

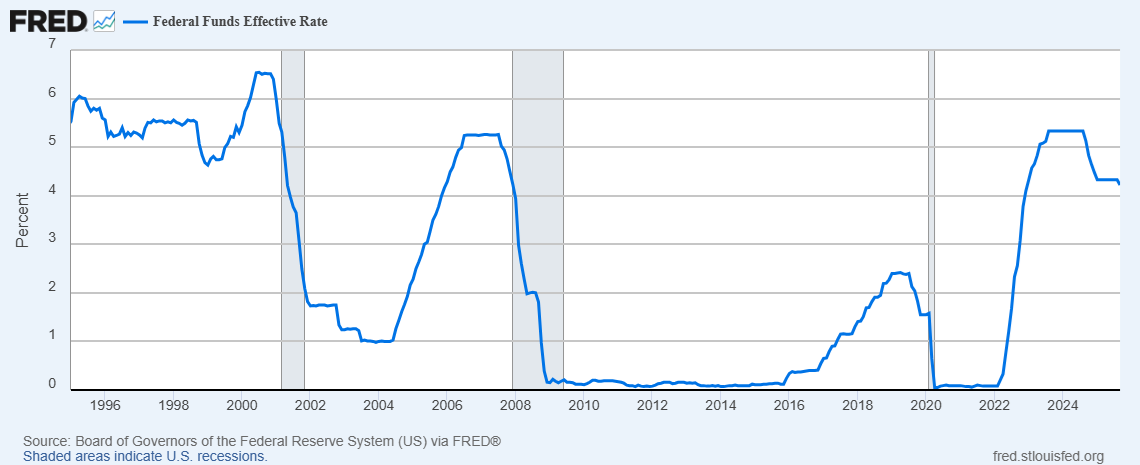

1. Rates are going down, not up. In 1999, the US raised interest rates three times to try to cool an overheated economy. Now, the Federal Reserve is cutting rates, with more to come.

2. Gold is at record highs. The contrast between the gold price in the late 90s and now is striking. Back then, as the stock market boomed, the gold price was in the process of bottoming after a 20-year bear market. Today, gold is surging to record highs along with markets.

Gold price (US$/oz)

3. Fiscal deficits and debt are exploding. This may have something to do with gold’s bull market. Western governments have been happy to rack up fiscal deficits and debt to prop up their economies over the past decade.

With the rise in interest rates from historic lows in 2021-2022, that’s become increasingly problematic. For instance, the US government now spends more on servicing its debts than it does on the military.

There are legitimate concerns that the US is now caught in a debt trap – a vicious circle of higher borrowing costs and larger deficits sending the stock of debt on an uncontrolled upward spiral.

It’s no wonder investors are turning to gold as a safe haven.

And it’s quite a different situation to the 1990s, when government debts were much lower.

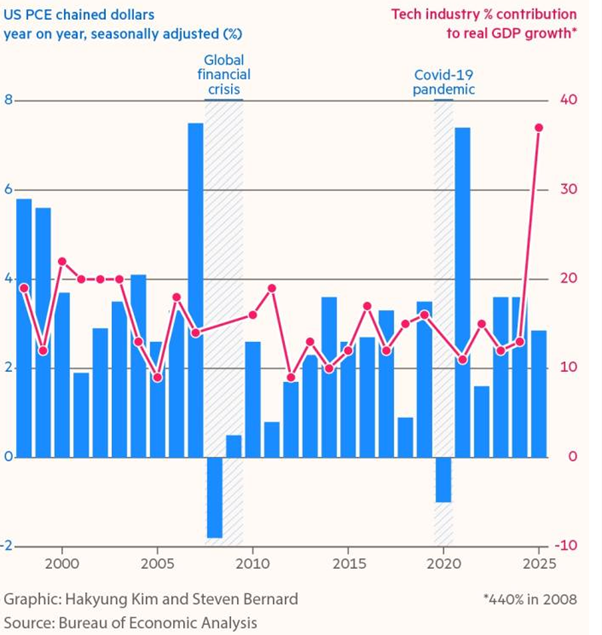

4. Economies are more exposed to tech today. When the dotcom bubble burst, it led to a short, sharp US recession in 2001.

Today, the US economy and perhaps many other economies are even more exposed to the tech boom. AI contributed almost 40% of America’s GDP growth over the past 12 months - an incredible number given the sector only accounts for about 2% of US output.

5. AI is producing extraordinary winners though ‘quiet’ losers too. The rise of the Internet transformed industries, though it feels like AI is creating even greater structural change.

We’ve all heard about the winners from AI, yet there has been little spoken of the losers.

I’ve been tracking data-related companies, some of which have been stellar stocks for decades. Lately, they’ve been getting hammered over concerns from the impact of AI.

FactSet, a prominent financial data and analytics company, is one of them, down 42% year-to-date.

FactSet share price (NYSE: FDS)

Source: Morningstar

Gartner, a leading ratings firm for tech products, has fallen 52% over the past year.

Gartner share price (NYSE: IT)

Source: Morningstar

The upshot

No two periods are the same, though today’s markets have a lot more similarities to the 1990s than differences.

Further rate cuts have the potential to provide further fuel for surging markets.

The concern is how dependent US economic growth has become on AI spending. Should that spending falter, the blowback for US and global GDP could be severe.

Buckle up, it could be a wild ride.

****

In my article this week, I commit heresy by suggesting that dividend stocks aren't a great means to build wealth, and offer an alternative strategy instead.

Meanwhile, Ausbil's Michael Price isn't as negative on dividend stocks and believes forecasts for lowly ASX dividends over the next 12 months may be too pessimistic.

James Gruber

Also in this week's edition...

Meg Heffron is back with an update on the $3 million super tax. Labor is reviewing the most contentious aspects of its proposed changes - namely, the lack of indexation and taxing unrealised gains. Meg says the former is small fry compared to the latter, and opponents to the tax should fight for comprehensive reform.

Damien Klassen says that while global share markets appear pricey on the surface, they're skewed by the hefty prices attached to mega stocks. Outside of these stocks, markets aren't expensive versus history and some sectors are even cheap.

The US dollar has bounced after a large fall in the first half of the year, though MFS' Benoit Anne thinks it may be shortlived. He outlines why he's bearish on the buck and which assets could benefit from further dollar declines.

Jet James reckons floating rate notes warrant greater investor attention. He explains how their stability, income, and protection against interest rate risk make them a valuable investment option.

The NRL and AFL footy finals are over with Brisbane proving triumphant and the minor premiers for both codes going out in straight sets. Tony Dillon casts his actuarial eye over the finals to reveal some fascinating numerical trends.

Two extra articles from Morningstar this weekend. Esther Holloway reports on Soul Patts' earnings, which were weighed down by Brickworks and coal, while Jon Mills looks at opportunities in an undervalued commodities sector.

Lastly, in this week's whitepaper, the market is always right, isn't it? Not necessarily, says VanEck, as it peruses the globe's asset classes for opportunities and risks.

****

Weekend market update

Stocks got smoked by 2.7% on the S&P 500 following a renewal of Sino-American trade tensions, with the blue-chip gauge settling at session lows for its worst day since April 10. Treasurys caught a vigorous bid with 2- and 30-year yields dropping to 3.52% and 4.63%, respectively, from 3.6% and 4.72% Thursday, while WTI crude cratered 4% to less than $59 a barrel and gold rebounded back above $4,000 an ounce. Bitcoin dropped below $116,000 while the VIX ripped higher by nearly six points to 22 and change.

From AAP:

Australia's share market finished the week lower, after easing commodity prices clipped the wings of a mining sector rally.

The benchmark S&P/ASX200 fell 0.13% to 8,958.3 on Friday.

The top-200 was down roughly 0.4% for the week, as data-starved investors grappled with the partial US government shutdown, and as local inflation concerns weighed on hopes of further Reserve Bank interest rate cuts.

Only three sectors finished lower on Friday, but a 2.2% sell-off in raw materials stocks levelled gains elsewhere as large-cap miners, gold plays and mixed producers tumbled.

BHP shares fell 2.1% to $42.22, while gold names like Northern Star, Evolution and Newmont lost between 2% and 3.8%.

Rare earths miners Iluka and Lynas each fell more than 3% after rallying earlier in the week on the back of Beijing's export control announcements.

Financials performed well on Friday, led by 0.6% gains in NAB and CBA.

Energy stocks fell 0.7% on Friday and lost 1.5% for the week, with oil prices edging lower as Israeli authorities approved the first stage of a Gaza peace deal.

Woodside shares lost 1.2% to $22.55, and coal producers were mixed as the Queensland government flagged extensions to its coal-fired power stations.

IT stocks outperformed the market, rallying 1.1% with strong showings by Xero, Technology One, Life360 and NextDC, while segment giant WiseTech edged higher after plunging almost 5% since Monday.

Consumer discretionary stocks caught a bid after a tough week, with JB Hi-Fi jumping 2.3% and Temple and Webster rallying 5.7% on Friday.

Looking ahead, the Reserve Bank will release its September meeting minutes on Tuesday, and Thursday's jobs data could give a hint at the road ahead for interest rates before the all-important quarterly inflation print later in October.

From Shane Oliver, AMP:

US and European share markets fell sharply on Friday in response to the latest threatened re-escalation in the trade war between the US and China. The 2.7% fall in US shares after Trump threatened additional tariffs on China left it down 2.4% for the week and Eurozone shares fell 1.8% for the week. Earlier Japanese shares had already closed up 5.1% for the week and Chinese shares had fallen 0.5%. Australian shares fell by 0.3% for the week after a 2.3% rise in the prior week with sharp falls in retail, IT, telco and property shares. 10-year bond yields rose in Australia but fell in the US and Europe in response to Friday’s risk off sentiment. Gold rose sharply pushing above $US4000 reinforced by safe haven demand on Friday, but Bitcoin was dragged down for the week with the fall in US shares. Renewed trade war fears also pulled metal and oil prices down for the week and this also dragged the $A back below $US0.65, with the $US rising.

Back to the escalating US-China trade war. President Trump’s threat to impose an additional 100% tariff on imports from China from 1 November after China announced controls on its rare earths starting in November would push the average US tariff rate back above 30% (before substitution), which would be back to around where it was after “Liberation Day”. This and his threat to cancel his planned 31 October meeting with President Xi along with China’s export controls look like classic negotiating ploys to boost each sides’ leverage, although its worth noting that the tariffs on China would have gone back up to 145% on 10 November anyway when the trade truce expires if no deal had been reached. Time will tell, but pressure on Trump to resolve this is now immense as Trump’s tariffs are very unpopular in the US so he needs to continue pivoting towards more market friendly policies going into next year’s mid-term elections.

Source: US ITC, Evercore ISI, AMP

Friday’s sharp fall in US shares provides a reminder that the risk of a correction is high given stretched valuations and numerous potential triggers including around: US tariffs and their impact; slowing US jobs data; public debt sustainability issues in the US, France, UK and Japan; the US government shutdown; geopolitical risks around the possibility of escalating tensions between Russia and NATO countries although another Israel/Gaza peace deal is good news; uncertainty as to how much the Fed will cut rates; and increased uncertainty around further rate cuts in Australia.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website