The dollar appears to be under significant pressure, in our view. Not only in the near term, but also in the context of global investors’ strategic asset allocations. The only silver lining is that we do not believe that the dollar will lose its status as the primary reserve currency in the foreseeable future. Against this backdrop, we believe that the case for global diversification is as strong as it has ever been. Looking ahead, asset classes in the rest of the world — including non-US equities, European fixed income and emerging market debt — may stand to benefit from the ongoing pressures on the USD.

The tactical view: Further risks for the USD in the near term

The current macro and market backdrop points to further downside risks to the USD, in our view. First, looking at growth fundamentals, we believe that the risks of slowdown are more pronounced in the US than for most of its major partners. To a large extent, this reflects the uncertainty surrounding the growth impact of the immigration freeze and trade tariffs, two major policy initiatives undertaken by US authorities over the past few months. While we do not foresee a major risk of US recession, the outlook does nonetheless point to a growth slowdown. In contrast, other regions such as the eurozone are now enjoying a growth recovery phase. This diverging growth outlook between the US and the rest of the world is one of the key negative drivers for the USD.

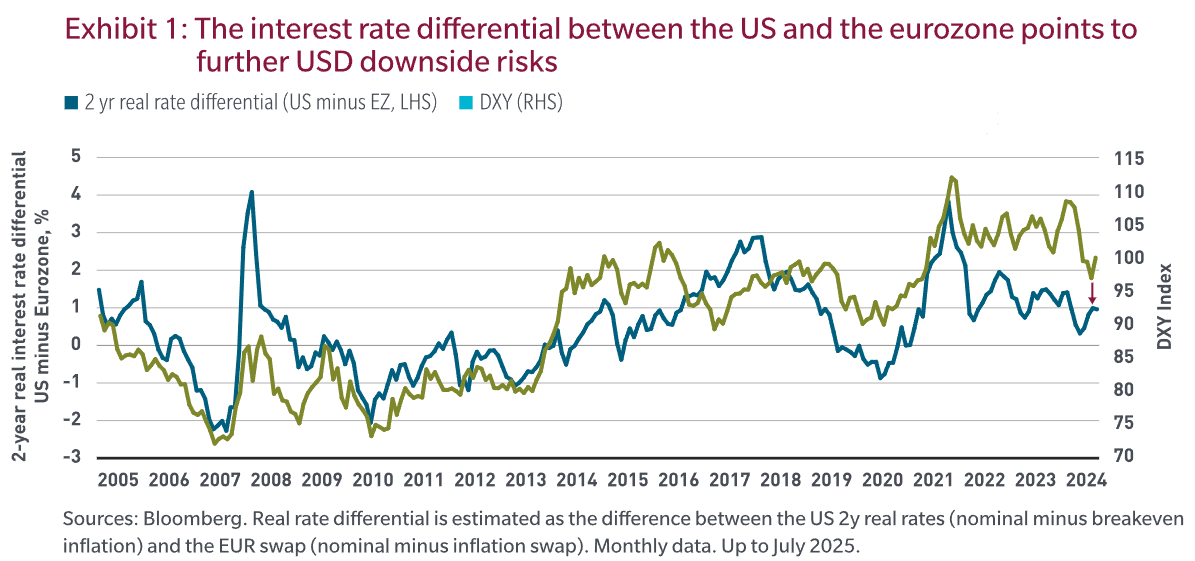

The outlook for relative interest rates also suggests that the USD may weaken in the period ahead. At this juncture, it is highly likely that over the next few quarters, the US Federal Reserve will lower its policy rate by more than most of the other major central banks. In contrast, the European Central Bank is near the end of its easing cycle, while at the same time, the Bank of Japan is likely to consider further tightening in the period ahead. It strikes us that the global monetary policy cycle is much less synchronized than a few quarters ago. This all means that the interest rate differential between the US and its partners is likely to compress further, thereby applying additional downward pressure on the USD. As illustrated by Exhibit 1, the dollar has recently been trading against the euro at stronger levels than what would be implied by the real interest rate differential with the eurozone. But this may course correct going forward with the Fed resuming its policy rate cuts.

We believe that the current policy backdrop in the US represents an additional risk. For a start, concerns over excessive fiscal largesse may undermine the global investor’s appetite for USD-denominated assets, as this may cause long-end rates to rise, triggering a correction in both US fixed income and equities. The credibility of the broader US macro policy framework also appears to be challenged amid a significant increase in political pressure on the Fed. We view central bank independence as one of the foundational principles of a credible macro-policy system. In fact, a number of emerging market countries have learned that lesson the hard way in the past, with the subordination of central bank policy to political concerns strongly correlated with poor inflation-fighting records and elevated capital outflow risks.

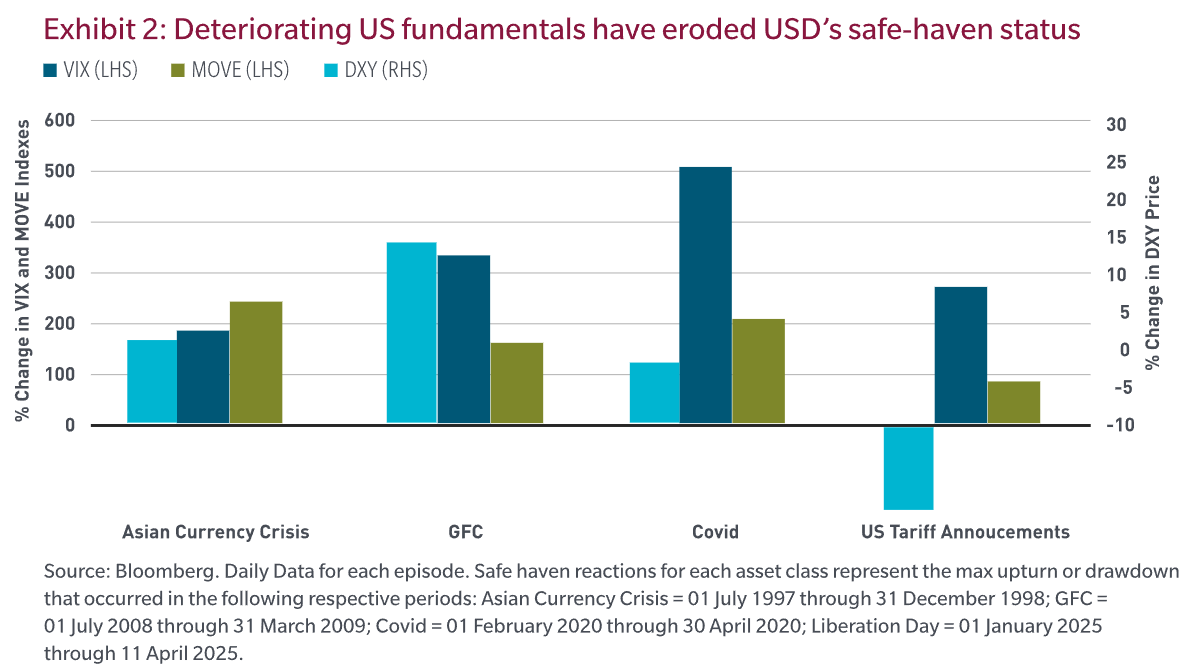

Against this backdrop, the dollar has recently experienced some erosion of its safe-haven attributes. This was particularly evident in early April when the trade war escalated. At the time, the resulting severe aversion shock was associated with a large downward dollar move (Exhibit 2). Likewise, the dollar weakened in tandem with US equities in early August following the release of the poor July nonfarm payroll data, signaling that it was behaving more like a risk-on currency. It is worth stressing that historically, the dollar has benefited from shocks to risk appetite, with US Treasuries typically acting as the ultimate safe-haven asset.

Our quant investment team model does not point to near-term USD appreciation. Our quant process relies on a diverse set of indicators to allocate across developed currencies. The model includes value and carry factors, which are more persistent in nature, as well as shorter horizon signals like momentum and sentiment. The USD screens as overvalued, but carry remains attractive. The short horizon signals are mixed but have been leaning short, although it should be noted that these factors experience higher turnover. In all, the tactical factors are neutral to slightly short USD and not strongly supportive of near-term USD appreciation.

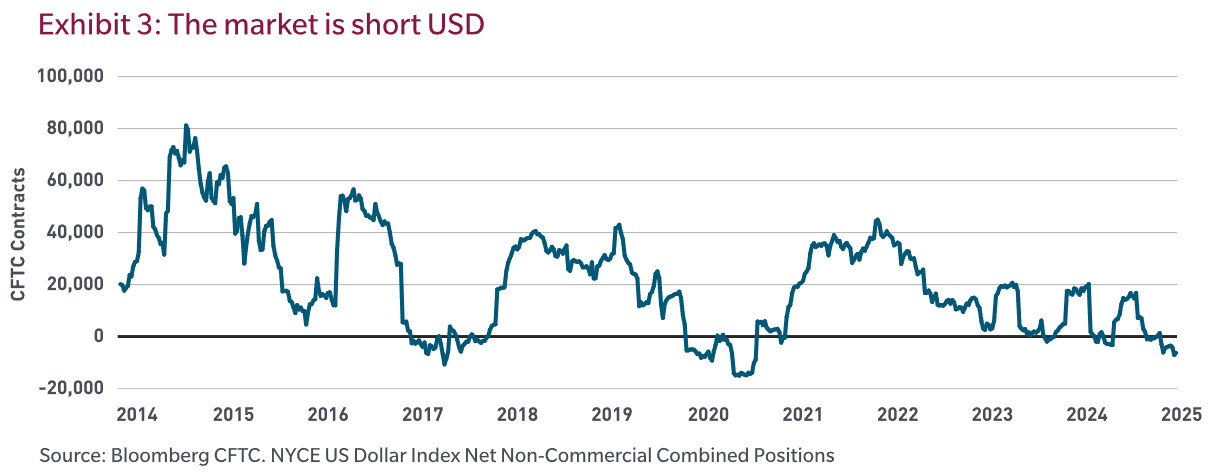

The only factor supportive of the USD in the near term are technicals. Specifically, being short the USD is amongst the most crowded trades at this juncture. The market is as net short the USD as it has been since 2021 (Exhibit 3). While this favorable technical backdrop may trigger some volatility and even possibly a temporary USD bounce, we believe that going forward, unsupportive macro fundamentals will likely prevail as the primary driver of the dollar.

The strategic view: Valuation and global investor behavior are not USD supportive beyond the near term

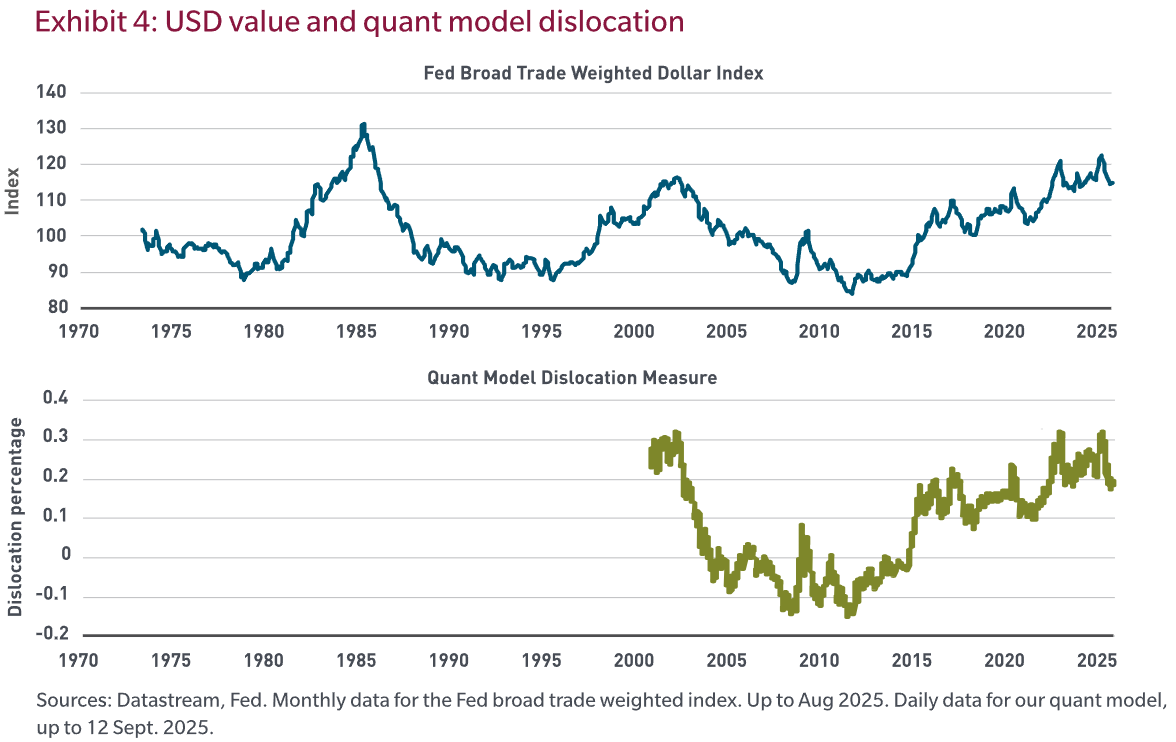

By historical standards, most currency valuation metrics point to the dollar being overvalued by at least 10%. For instance, measured since the 1970s, the Fed’s real dollar index currently stands some 13% above its long-term average. Looking back, it appears that the strong dollar cycle peaked in January 2025. The combination of an expensive dollar and the fact that the currency has started to demonstrate signs of weakening may exert significant influence on global investor behavior.

The quant behavioral equilibrium exchange rate (BEER) model generates a similar result. The BEER model calculates currency fair value, starting with long-term real exchange rates. These rates are adjusted for current differentials in productivity and terms of trade, which helps account for deviations from long-term averages. An overvalued currency may be supported by relatively strong economic fundamentals. Using a narrow trade-weighted index of G10 countries, the BEER model suggests an 18.7% dollar overvaluation, implying that even after accounting for economic differentials, the dollar is expected to continue to weaken (Exhibit 4). Furthermore, currency value plays a role in future equity returns — and the forecasted cheapening of the dollar may act as a headwind for US equities.1

Two key investor behaviors may drive further dollar weakness in the near term. These behaviors relate to global allocation and currency hedging. In terms of global allocation, there is a risk that investors in their strategic asset allocation may elect to diversify away from USD-denominated assets. That rebalancing would in turn trigger a reduction to USD exposure, benefitting the rest of the world. To a large extent, this phenomenon has already been observed over the past few months, but it may well persist if the macro and market backdrop — as discussed above — remains unsupportive. We believe that global investors have been substantially over-indexed to US markets, so this rebalancing may take some time, given the investment processes of large institutional investors.

Currency hedging may put additional pressure on the dollar. Between 2022 and 2024, the high cost of hedging dollar exposure — due to the rise in US interest rates from 2022 onward — led some Asian and European institutional investors to lower their hedge ratios. Specifically, the Bank of Japan indicated that the hedge ratio for major Japanese life insurers declined from about 60% in 2021 to 40% in 2024.2 Looking ahead, this behavior is now likely to reverse. As highlighted by the Bank for International Settlements (BIS) in a June 2025 report, currency hedging by non-US investors holding US assets appears to have contributed to dollar weakness over the past couple of months.3 Technically, it is the adjustment in the dollar hedge ratio that creates the biggest risk to the dollar, as opposed to the purchase of a USD asset on an FX-hedged basis. Against this backdrop, monitoring the FX hedging strategy of the large global investors is going to be critical going forward.

The structural view: The role of the USD as a reserve currency

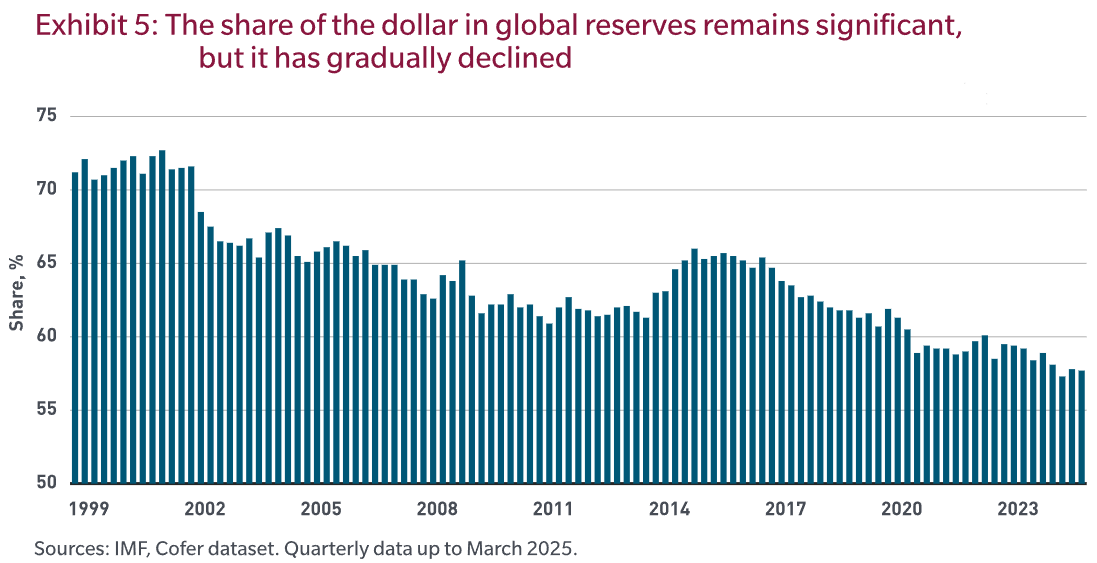

Looking at the longer term, particularly the status of the US dollar in the international financial system, the prospects are considerably more positive. We do not believe that the USD will face a severe challenge to its role as the primary reserve currency. It is true that the share of the dollar in global reserves has gone down over time. According to the latest IMF data, the USD accounts for about 58% of global official reserves,4 down from about 70% 20 years ago (Exhibit 5). We do not foresee any major competition to the dollar’s status, however. With a share of about 20% of global official reserves, the euro is a distant second, followed by the Japanese yen with 5.8%. It is probable that the share of the US dollar will continue to fall in the period ahead, but this is likely to be a slow, gradual process. The main obstacle for potential competitors is market size and liquidity. Whatever your view on US Treasuries is these days, the reality is that the market is more than 10 times bigger than that for German bunds. In terms of the average daily volume — a useful measure of liquidity — the US Treasury market’s liquidity is 30 times as large as its European peer. In other words, the dollar and the US Treasury market are here to stay as critical global investment vehicles.

Investment implications: The case for global diversification

The case for global diversification has been reinforced by the negative outlook for the US dollar. One of the key lessons we have learned so far in 2025 is the importance of global diversification. Due to perceived US exceptionalism in recent years, global investors were perhaps over-allocated to the US, but that narrative is now facing significant challenges, which is likely to be reflected in some rotation away from the US. Looking ahead, asset classes in the rest of the world such as non-US equities, European fixed income and emerging market (EM) debt may stand to benefit from ongoing pressures on the USD. In particular, we believe that the stars are aligned for EM local currency debt. By construct, EM local debt offers substantial country diversification. Indeed, the main reference index — the J.P. Morgan GBI EM Diversified — includes 19 countries across Asia, EMEA and Latin America. More importantly, while the global macro environment remains critical for the asset class, local macro drivers, especially central bank policy and domestic inflation, tend to have a major influence on local market performance.

1 Our quant developed equity allocation model uses currency value as one of its factors. With the dollar overvaluation, the factor is currently recommending non-US equities.

2 Source: Bank of Japan, Financial System Report (April 2025)

3 Source: The Bank for International Settlements (BIS), BIS Bulletin, No 105, 20 June 2025.

4 Source: IMF, IMF data brief: Currency Composition of Official Foreign Exchange Reserves, 17 July 2025

Benoit Anne is Senior Managing Director, Strategy and Insights Group at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. It has been prepared without taking into account any personal objectives, financial situation or needs of any specific person. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

MSCI World Index measures stock markets in the developed world. Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its af?liates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.