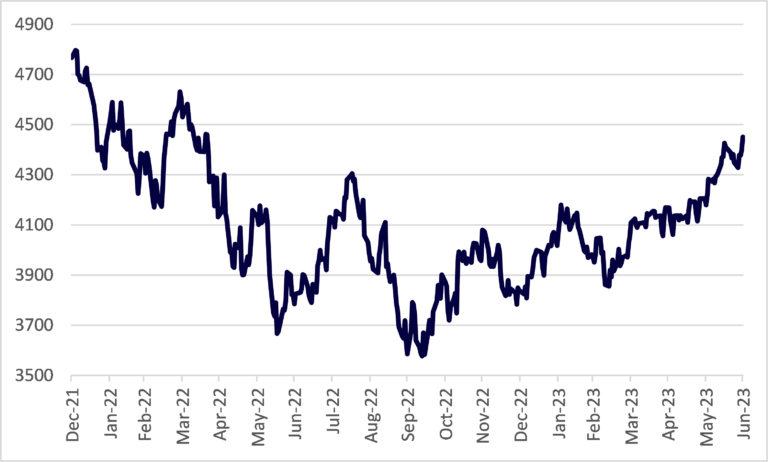

The sharp rise in equity markets this year has been nothing short of astounding. Many investors had written off stocks after last year’s heavy falls and amid fears around central bank rate hikes and the threat of a global recession as we entered 2023, but the S&P500 rallied into a bull market.

S&P500 Index from 1 January 2022 to 30 June 2023

Source: Bloomberg

For the first six months of the year, the index was up 16%, its best performance since the first half of 2019. The tech-heavy Nasdaq Composite index surged 32%, its best first half in four decades.

Just a few soaring stocks have driven almost all of the market’s rebound. Together Amazon, Microsoft, and Alphabet contributed nearly 30% of the gains made by the S&P500 in the first half of the year.

We previously identified these three owners of the ‘hyperscaler’ cloud computing platforms as the clearest and most certain winners from the AI revolution.

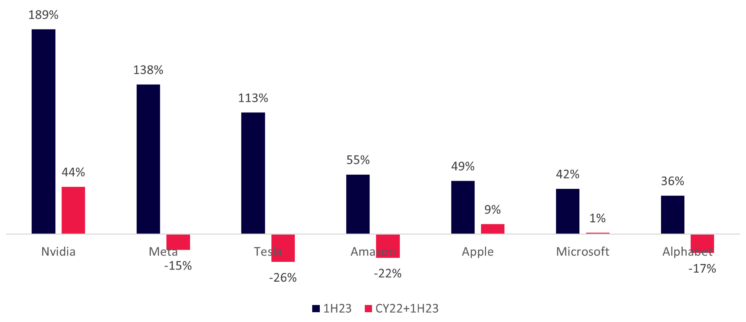

Adding Nvidia, Meta Platforms, Apple, and Tesla, this exclusive group of just seven AI and technology winners accounted for almost 80% of total index gains, despite representing just a quarter of the value of the index. Such phenomenal performance so quickly from the largest companies has led some investors to wonder if these stocks have run too far and whether they should take profits by selling.

While investors might be tempted to sell these top performers to take quick profits and look for better returns elsewhere, we believe that could be a costly mistake in the long run. In fact, we think the best days for these stocks are still ahead, and holding onto them will be extraordinarily rewarding. There are compelling reasons why several of these big-tech winners have much further to go in the years ahead, and investors who hang onto them will be richly rewarded.

Zooming out puts rallies into perspective

If we look at the recent rallies over a short timeframe, it looks like stocks have run too hard and too far. But if we step back and look at the longer-term picture, it shows that, despite the exceptional run-up in share prices this year, most have not fully recovered from last year’s large drawdowns.

The group of seven big-cap technology winners is a case in point. Yes, they rallied hard in the first six months. Yet when we look at the last 18 months – including all of 2022 and the first half of 2023 – their performance is mostly negative.

Over the longer horizon, the weighted average share price performance of the group was negative 3%, compared to positive 63% over the shorter period. Only Nvidia and Apple posted positive results over the last year and a half. Microsoft was flat, and the other four stocks are still down significantly from the start of 2022.

The same can be seen with stocks outside this group, too. Spotify, the world’s largest music streaming service, made astronomical leaps, with its stock price more than doubling in the first half. However, that’s still almost a third below its price at the beginning of last year.

Share price performance of select stocks across time periods

Source: Bloomberg

Zooming out paints a much more complete picture of stock price performance and helps investors avoid becoming trapped into thinking that share prices have risen much higher than they have.

Improving businesses and AI upside still not factored into share prices

What’s more, while the share prices of industry leaders, including big-tech winners, have posted strong gains in the first half of this year, their stock prices still haven’t caught up to huge improvements in their businesses, which suggests the rally has further to run.

1. Amazon

Amazon’s cloud business, AWS, recently made several new high-powered AI capabilities available to customers, including its own specialized chips for training and inferencing machine learning models, a new managed service to access first and third-party AI models, and an AI-assisted coding program.

Amazon has also been making large strides outside its cloud business. The e-commerce behemoth redesigned its US fulfilment network to operate a regional model with lower costs and faster shipping times for consumers. It also built the third largest digital advertising business in the world by selling ad space on its website and media properties that grab the attention of hundreds of millions of shoppers.

Despite these game-changing improvements, Amazon’s stock is down 22% from the start of 2022.

2. Microsoft

Earlier this year, Microsoft’s Azure cemented its place as an AI pioneer by deepening its partnership with OpenAI to provide customers access to the machine learning models behind ChatGPT and DALL-E, powered by Azure’s cloud platform.

Last quarter, Azure OpenAI customers jumped 10-fold.

Microsoft also announced a new ‘Copilot’ AI assistant, which combines OpenAI’s machine learning models with Microsoft’s proprietary data to improve the productivity of Office applications like Word, Excel, and PowerPoint.

Copilot versions of these programs should command a premium price and expand the appeal of Office beyond its current 382 million users.

Yet Microsoft shares trade roughly flat relative to the beginning of 2022.

3. Meta

Meta may be an even more striking case study.

Following the disruption from Apple’s app ad tracking changes, and white-hot competition from TikTok’s short-form videos over a year ago, Meta has executed a successful business turnaround underpinned by substantial AI investments.

Powerful AI capabilities have allowed Meta to overcome headwinds. It has regained its ‘share of engagement’ with AI-recommended content in ‘Reels’ short-form videos, and AI-enabled chatbots promise to expand its $US10 billion message-based ads business.

Yet Meta’s share price is down 15% compared to 18 months ago when the company was grappling with a perfect storm – and that’s after gaining 138% in the last six months.

4. Blackstone

A similar situation can be seen away from the world of tech companies, in the staider financial services sector.

Blackstone, the world’s largest alternative assets manager, has built a team of hundreds of salespeople and partnered with major banks and brokers, establishing itself as a first mover in the $195 trillion private wealth channel.

The money-manager has also made major inroads to service the $45 trillion insurance market while continuing to raise larger funds among its traditional institutional clients that represent a $65 trillion market.

Meanwhile, Blackstone’s share price is almost 30% cheaper than it was at the start of 2022, including its 25% rally this year.

Hold on to the winners

The public equity markets can have a way of tricking investors in the short term. It’s important to zoom out from recent stock price charts and to look forward at improving business fundamentals and new opportunities.

While stock prices of some of the world’s best companies are up a lot this year, they are only just getting back to where they were at the beginning of last year. Meanwhile, their underlying businesses are much better positioned than they have ever been and keep getting better. These are companies that can multiply in value many times over by the end of this decade.

Selling out to bank ‘profits’ from a 50% or even 100% turnaround following a big drawdown might well look like a big mistake if these stocks increase four or five-fold in the years ahead. Investors have an opportunity to make extraordinary gains if they can stay the course with winning companies as they transform industries and create value over time.

Chris Demasi is a Portfolio Manager at Montaka Global Investments, a sponsor of Firstlinks. This article is general information and is based on an understanding of current legislation.

For more articles and papers from Montaka, click here.