The health of the consumer is arguably the single most important factor driving equity market performance in developed economies today. From retail giants like Walmart and Amazon to tech innovators like Apple and Tesla, consumer spending directly impacts corporate earnings, sector performance and overall market sentiment. For sophisticated investors, understanding the consumer’s role is essential — not just for identifying risks, but also for uncovering opportunities in an evolving economic landscape.

Why consumer health matters to equity markets

1. A key pillar for economic growth

In the US, personal consumption constitutes over two-thirds of GDP1, making it the lifeblood of the economy. With the US accounting for 70% of the MSCI World Index2, the health of US consumers has global consequences for equity markets. While other developed economies like Europe and Japan may rely more heavily on industrial production or trade, consumption remains comfortably more than half of economic activity.

2. Consumer spending drives corporate revenues

Consumer-facing companies, particularly in discretionary sectors, are directly impacted by changes in spending patterns. A slowdown in spending disproportionately affects cyclical exposures —new cars, patio furniture, travel and leisure or other “nice-to-have” items — while staples or essentials have typically held up better and outperformed these other sectors.

Lower consumer spending can trigger ripple effects across industries, from manufacturers to transport companies, and even lead to cuts in advertising budgets, compounding the pressure on revenues across the market.

Regional perspectives: Consumer health across the globe

United States: Resilience amid complexity

US consumers have shown remarkable resilience, supported by robust labor markets, healthy household balance sheets and favorable debt positions. Fiscal stimulus continues to support corporate margins, reducing the likelihood of layoffs — a key factor in sustaining consumer spending. The US consumer is not a homogeneous group, and approximately 40% of consumption is driven by the top 25% of wage earners3, who remain healthy.

However, there are emerging signs of pressure. Higher interest rates are starting to erode disposable income for lower-income cohorts reliant on credit cards and personal loans. Additionally, house prices may be beginning to soften in certain regions, which could weigh on consumer confidence. At the same time, however, lower energy prices provide a reprieve for households, while ongoing fiscal stimulus indirectly supports consumer spending by maintaining corporate profitability. Profitable companies tend not to lay off workers.

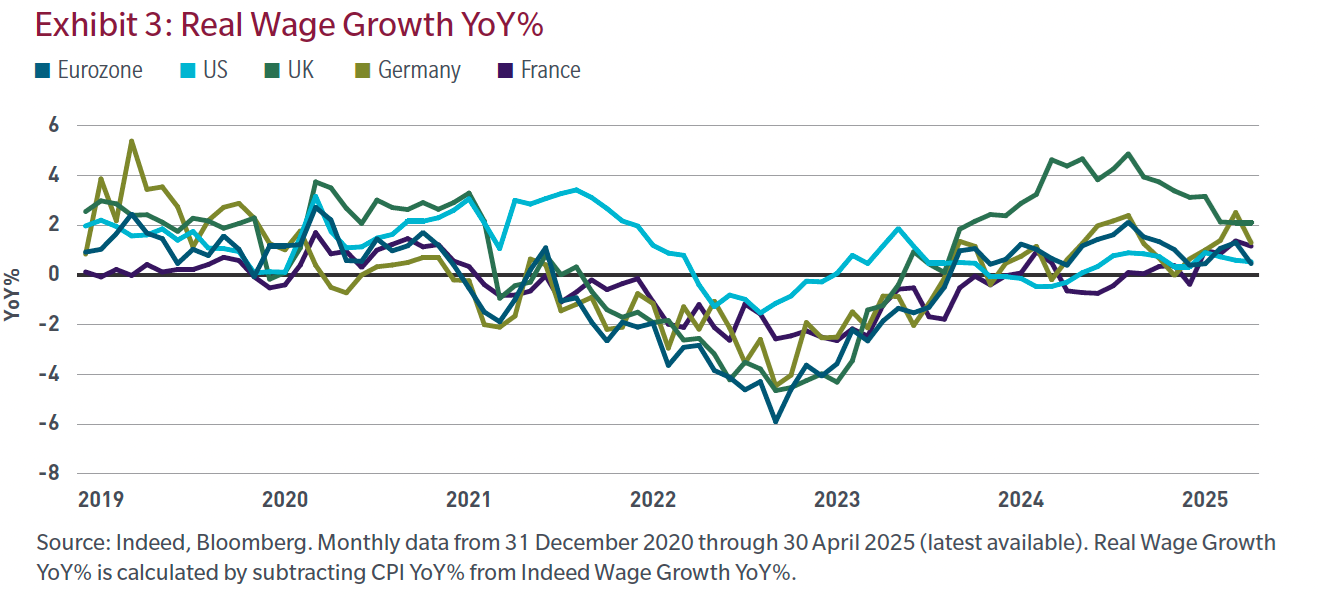

The current slowdown in immigration may also act as a hidden support for real wage growth, keeping the US consumer in relatively good shape despite near-term challenges.

Europe: A consumer recovery

European consumers have faced stagnant economic growth, inflationary pressures and an energy crisis, exacerbated by the abrupt halt of Russian gas supplies after the invasion of Ukraine. Unlike the US, Europeans are more sensitive to interest rate changes because they don’t have access to long-dated fixed- rate mortgages.

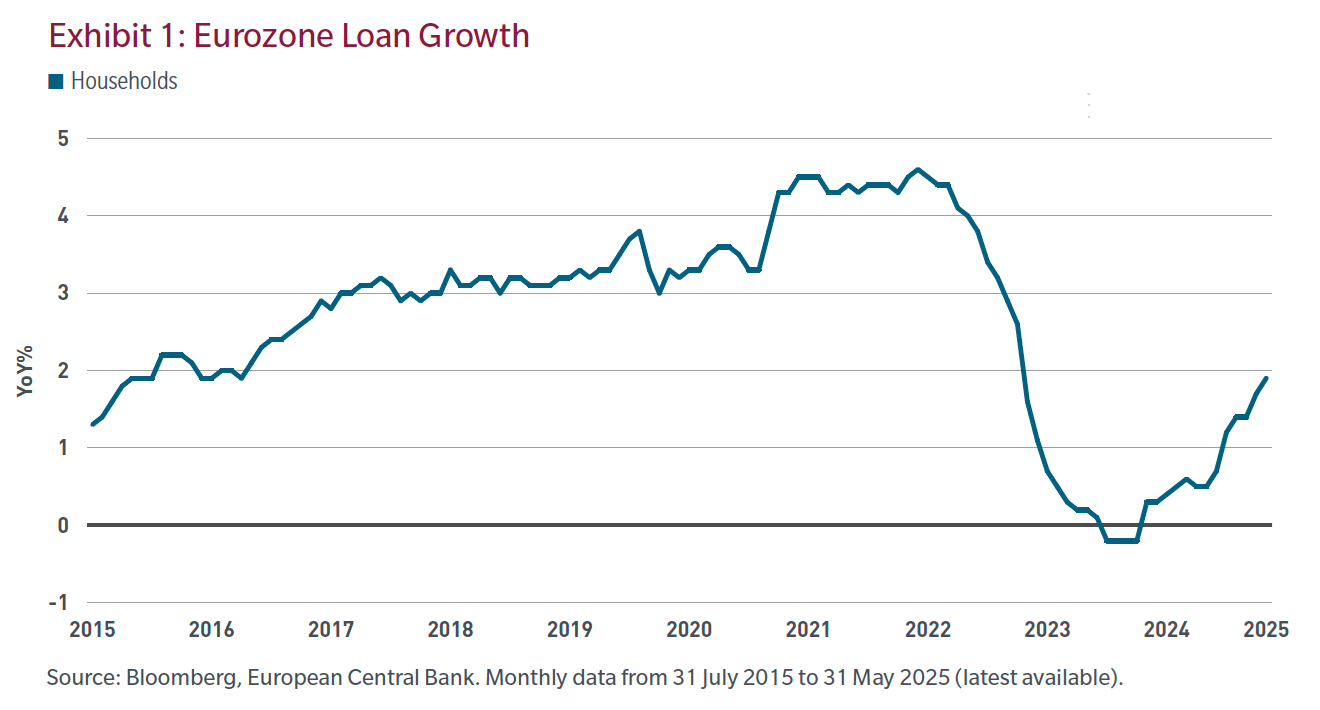

Despite these challenges, improving house prices, strong equity markets, stronger loan growth and recovering consumer confidence could see European consumers surprise on the upside, offering a potential catalyst for non-US equity markets.

Japan: A turning point

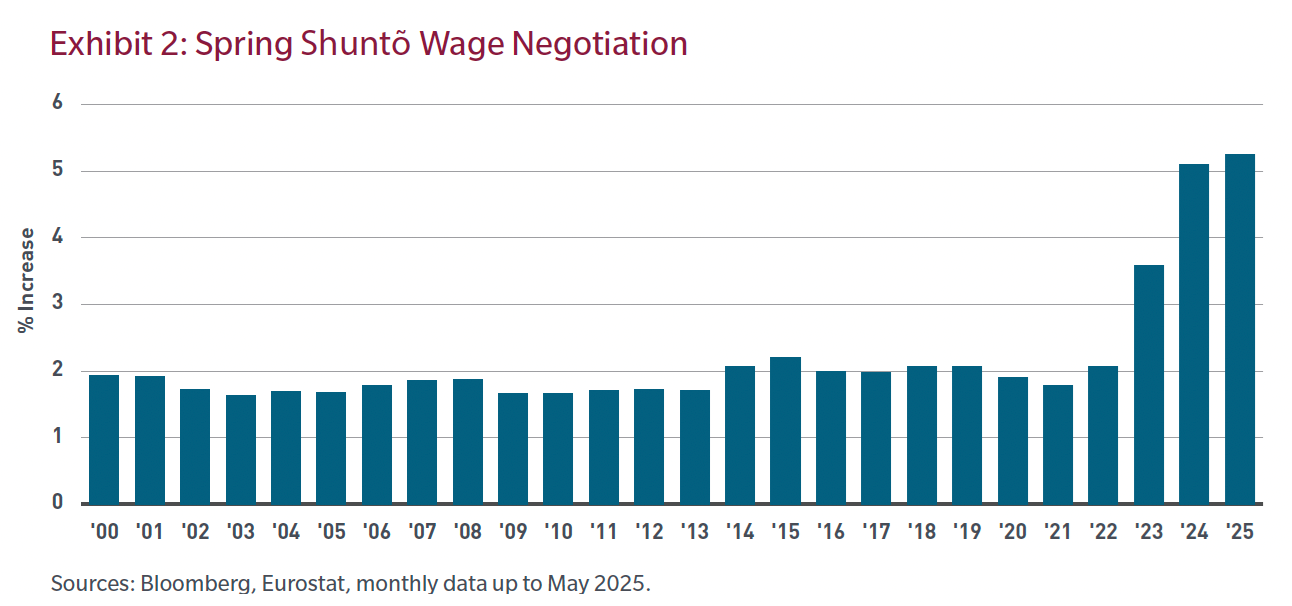

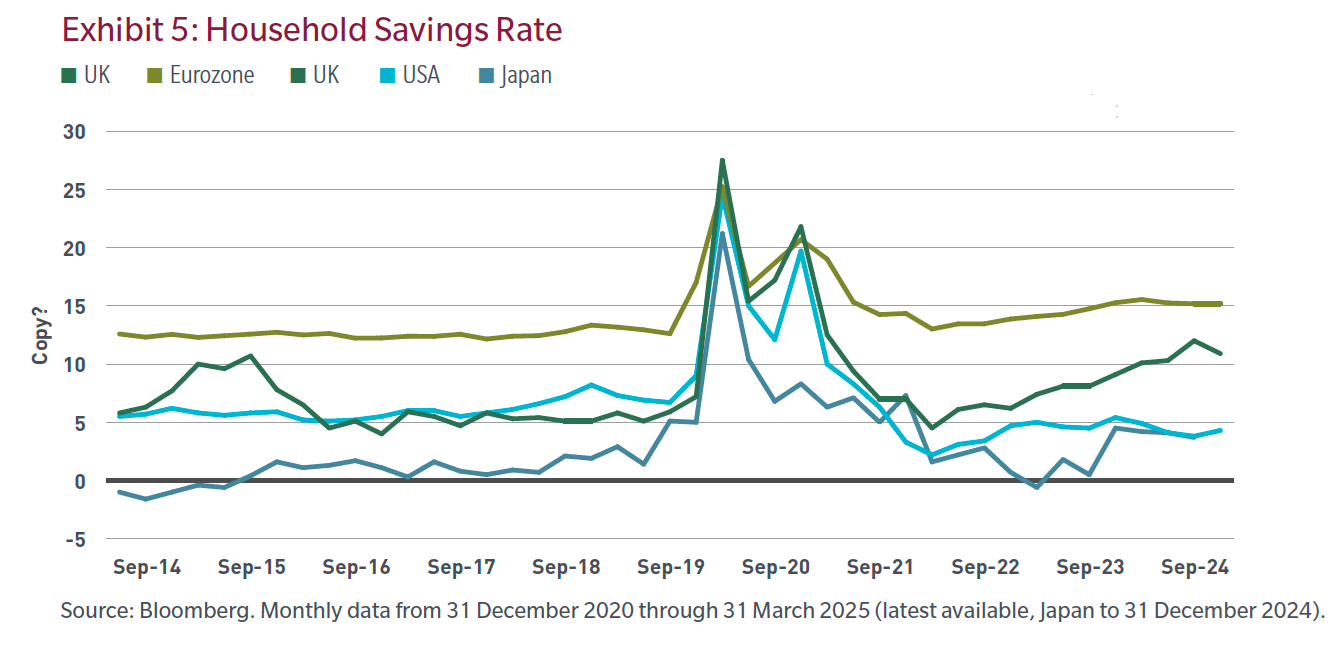

Japan’s stock of savings is high, but savings rates remain low. Low Japanese savings rates have been a function of an aging population, shrinking labor force and stagnant real wage growth for many years. Despite soft real wage data, the job market remains tight, and the spring Shuntõ wage negotiations have seen large Japanese companies raise wages by over 5.25% this year — the largest increase in 34 years. The result of this has been a recent uptick in savings (Exhibit 5).

Inflation has picked up over the last year, and though rising, wages remain negative in real terms despite the Japanese government seeking 1% annual real wage growth to drive consumption and boost economic growth. Ongoing labor shortages are likely to keep upward pressure on wages, which is positive for consumption. However, the increasingly aging population continues to be a drag on consumption growth. Since the Fukushima nuclear disaster, Japan has become increasingly reliant on imported energy and while they remain susceptible to energy shocks, low energy prices are currently working in their favor.

Tracking consumer health

For investors, monitoring a few key indicators is critical to understanding consumer health and its impact on equity markets.

- Real wage growth: Positive wage trends, as seen in Europe and the US, support spending.

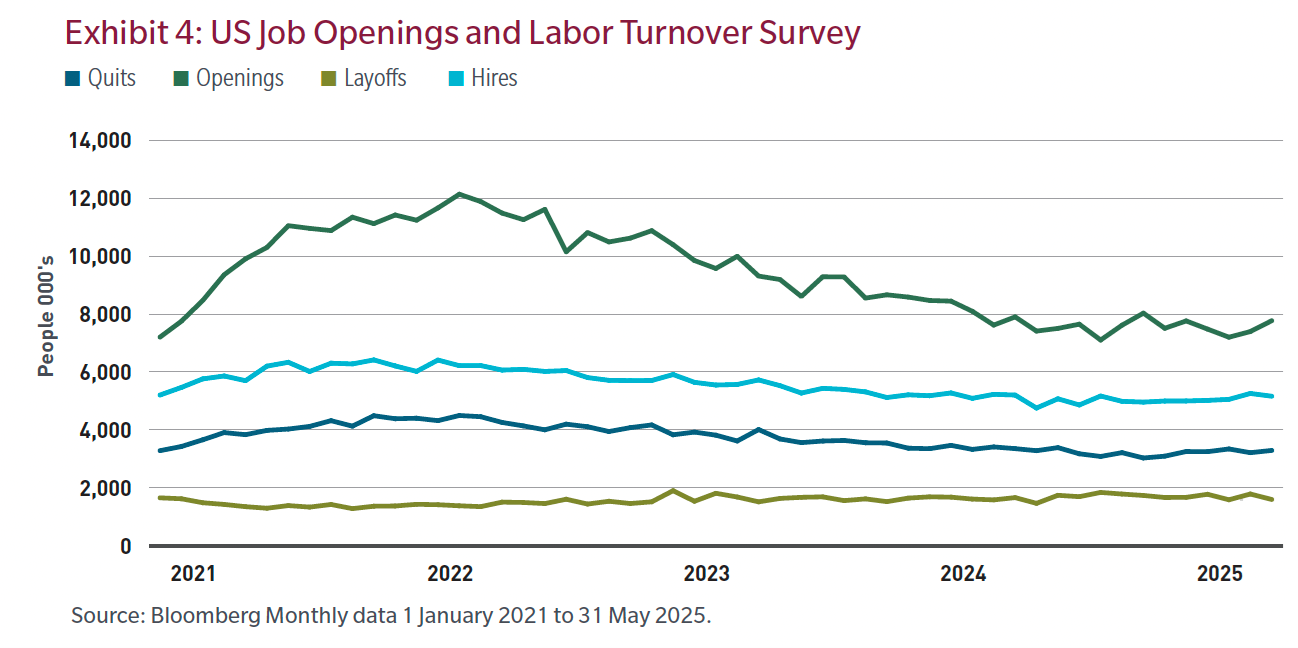

- Unemployment metrics: While unemployment is a lagging indicator, other metrics like job openings and quit rates provide a clearer and more reactive picture of labor market stability. Based on these metrics, the US consumer looks stable. Openings may be down, but layoffs remain stable, as does hiring, while people are less comfortable quitting to find new roles. Across both Europe and Japan, labor markets remain tight.

- Disposable Income: Higher-for-longer interest rates and cuts to programs like Medicaid and SNAP could reduce spending power for vulnerable, lower income cohorts. Mitigating this is the wealthier cohorts driving the largest slice of discretionary pending.

- Household savings rates: Shifts in savings behavior, particularly in Europe, could signal changes in spending patterns. Europe is exhibiting signs of lower savings.

Why should investors care?

Our base case is a softer US consumer, but with ongoing resilience. That said, the impact of tariffs has yet to be fully felt and remains a concern. A slowdown in consumer spending typically impacts cyclical sectors the most. Staples and other defensive sectors such as essential services — including health care and utilities — typically perform well, whereas sectors that are not exposed to consumer whims, such as defense, are usually unaffected.

However, there will be shifts in behavior and differences to consider within all sectors. For example, during slowdowns some consumers trade down from premium to affordable brands, or postpone elective surgery. The second-order effects on industrials, energy and other sectors also need to be considered as they will ultimately be impacted if end demand softens.

As such, it pays to be selective in the face of a consumer slowdown. We believe better-managed companies with strong balance sheets are likely to outperform in a deteriorating consumer environment as investors seek higher quality stocks.

Global opportunities

Outside the US, consumer spending has been weaker, but there is potential upside in Europe and Japan as conditions improve, which could in turn improve consumer confidence and consumption. That should support an earnings recovery in non-US consumer discretionary companies for things like travel and leisure and apparel, as well as industries like alcoholic beverages and beauty. This would also be supportive of premium brands as consumers trade up.

In our view, investors should be selective, as many European consumer companies are global with large US footprints. Tariffs add another layer of complexity, and investors need to understand where consumer goods sold in the US are sourced from. Similarly for Japan, the key is understanding how the demographics and acute labor shortages impact consumer behavior alongside ongoing corporate governance and balance sheet rationalisation considerations.

Navigating consumer trends for equity market success

The health of the consumer is a silent, yet powerful, engine driving equity markets. While US consumers remain resilient, regional differences in consumer behavior highlight opportunities and risks for investors. By focusing on leading indicators like wage growth, unemployment trends and disposable income, sophisticated investors can position themselves to capitalise on consumer-driven market dynamics.

1 US Bureau of Economic Analysis via FRED® (68.3%)

2 Bloomberg: US represents 70.5% of MSCI World Index

3 Bureau of Labor Statistics

Ross Cartwright is Lead Strategist, Strategy and Insights Group at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. It has been prepared without taking into account any personal objectives, financial situation or needs of any specific person. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.