After a long hiatus, the resurgence of inflation has become a key concern for investors over the past year. We also face falling real incomes dampening consumer spending, rising input costs eroding profitability and higher discount rates hurting the present value of future cashflows. This article considers the effects that inflation has had on equity valuations in the past and review ways to build resilience into equity portfolios. Looking ahead, dividend-income investment could play a more important role in the total return of a portfolio.

Inflation is not necessarily bad news for equity valuations. Some inflation can be beneficial for companies’ bottom lines as it allows them to raise prices and protect profitability in ways they may not have been able to do in recent years. It also helps banks and commodity-linked companies that have struggled in a low inflation, low interest rate environment.

Equity returns during inflation

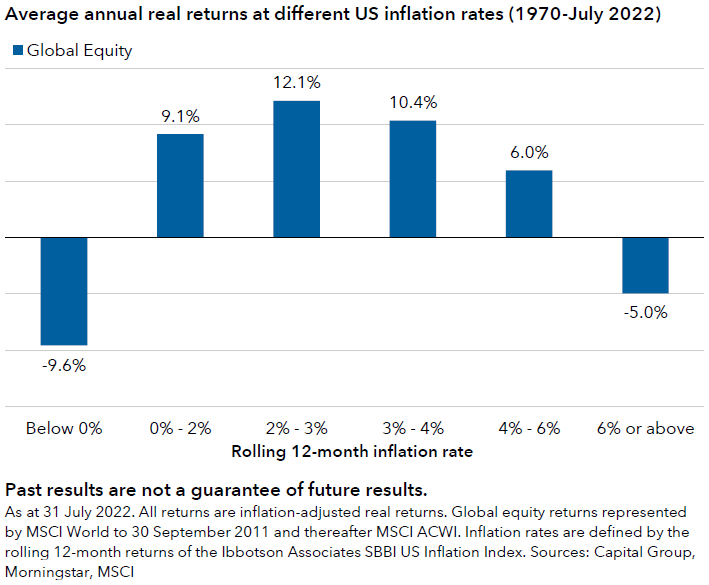

Even during times of higher inflation, stocks have generally provided positive real returns (see chart below). Global equities have historically provided an effective inflation hedge when US inflation is between 2-6%, powered by real earnings growth and real dividend growth.

It’s mostly at the extremes (when inflation is above 6% or negative) that global equities have tended to struggle. However, sustained periods of elevated inflation are rare. The ultra-high inflation of the 1970s was a unique period, while deflationary pressures, such as during the Great Depression, have often been much more difficult to tame.

The relationship between inflation and stock prices is not linear

The impact of inflation on earnings can be quite positive in nominal terms, especially over the longer term. However, it can create short-term headwinds for corporate cash flows, particularly for companies that report earnings on historic cost accounting (using the original price of assets), rather than on a current cost basis. With earnings being overstated, the need for working capital increases as companies must meet higher corporate taxes, sparking the risk of a short-term valuation de-rating. The net impact of these factors varies from cycle-to-cycle and industry-to-industry.

The impact of inflation on valuations varies depending on the level of interest rates and the economic environment. When rates are high, future earnings get discounted back to a lower price, suppressing valuations. However, as interest rates decline, future earnings get discounted back to a higher price and hence valuations increase. Additionally, if the economy is in distress, valuations decline sharply reflecting the poor outlook for earnings, whereas, if the economy is relatively robust, valuations have followed a more linear path.

Impact on sector behaviour can vary

History shows that some companies and industries have delivered consistent relative returns during past inflationary environments, while others are more of a mixed bag.

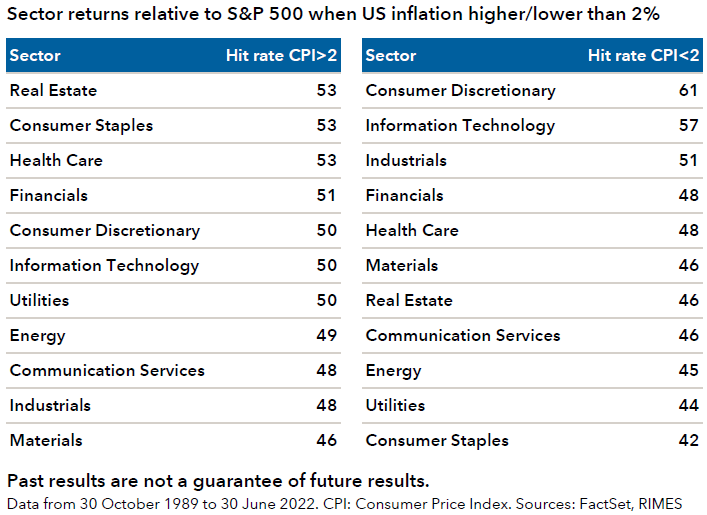

The chart below shows how different US equity sectors have performed during periods of higher inflation (above 2%) and during periods of lower inflation (below 2%). The ‘hit rate’ is the percentage of periods when a sector achieved a return higher than the Standard & Poor’s 500 Composite Index (S&P 500).

While the hit rates are within quite a narrow overall range, there do appear to be some trends. During periods of higher inflation, real estate, consumer staples and health care outpaced the S&P 500 in more instances than other sectors. Whereas, consumer discretionary and information technology outpaced more when inflation was low (below 2%).

The channel through which inflation impacts sectors can vary widely and often the impact is through second derivative effects such as growth and interest rates.

Sometimes sector behaviour is a direct impact of inflation:

- Consumer discretionary. Consumers’ discretionary spending is likely impacted by higher borrowing rates and also energy prices (specifically, gasoline). As the consumer burden decreases (falling inflation), the outlook for consumer discretionary can improve relative to the broader market.

Sector behaviour can also be driven by the impact of inflation on the economy:

Consumer staples. When the economy moves into distress and consumer spending declines, the consumer staples sector, which generally benefits from stable consumer spending patterns through a cycle, can do well relative to the broad market. Similarly, when inflation starts to decline and the economy recovers (along with consumer spending recovering), other sectors can recover and consumer staples may lag.

And other times sector behaviour is driven by what is happening to interest rates:

Life insurance companies and banks. Companies for which interest income is a meaningful part of their business will benefit in a period of higher interest rates which generally accompanies higher inflation.

A positive characteristic in an inflationary environment is companies whose top line can ‘inflate’ at a higher rate than their costs.

Addressing a higher inflation and interest rate environment

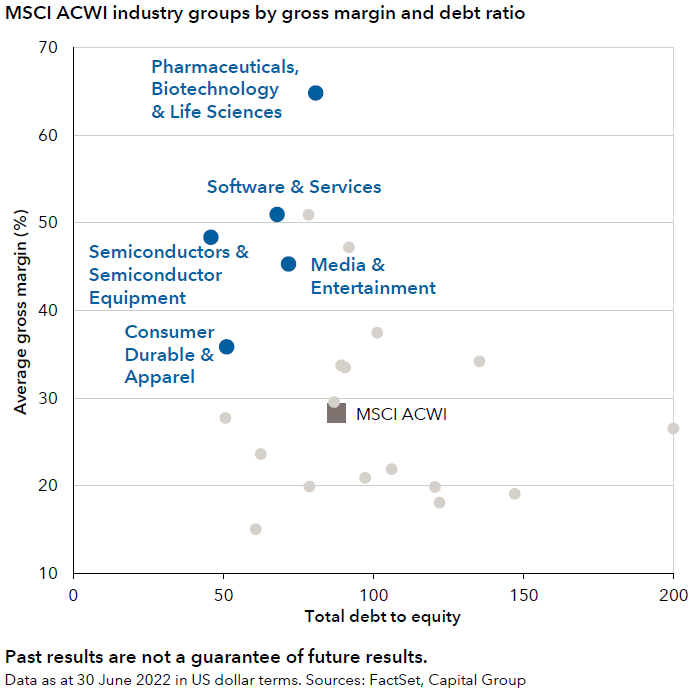

It is likely that rising costs will linger in the months ahead. Companies with high average gross margins and low debt may be better suited to weather this new environment.

Companies that could succeed in such an environment include:

- Businesses that provide essential services, like health care giants Pfizer, UnitedHealth Group and Abbot Laboratories. The average gross margin in the Pharma/Biotech sector tends to be around 65%, as shown in the chart above.

- Companies with quality products. Tesla’s technological lead in electric vehicles has allowed it to pursue a highly dynamic pricing strategy. In March 2022, Tesla increased prices across its entire range by as much as 10% (source: Reuters, 15 March 2022).

- Companies enabling lower costs. Companies offering products and services that improve cost bases are likely to be in high demand. Cloud infrastructure and software-as-a-service have seen strong uptake as network and scale effects drive structural reductions in unit costs.

- Companies in industries with favourable supply and demand dynamics. Semiconductor and chip equipment makers like TSMC and ASML are experiencing huge demand with limited supply. TSMC's pricing power was evident in August 2021 after it announced it would raise chip prices by as much as 20% (source: Reuters, 23 October 2021). While TSMC and ASML have been caught up in the recent sell-off of growth stocks, their supply and demand dynamics should help protect them against rising inflation.

- Businesses serving customers who are relatively insensitive to changes in price, like luxury goods companies LVMH and Kering.

Sustainable dividend growth can offer inflation protection

Companies whose top line can ‘inflate’ at a higher rate than their costs are more likely to improve their capital allocation by expanding return on equity for shareholders and consequently improving dividend payouts.

Last year, 2021, saw global dividends recover strongly, more than making up for the cuts made during the worst of the pandemic in 2020. Of the 242 companies that either suspended or cut their dividend in 2020, 98 have reinstated payments and only three companies cut their dividend in 2021.

Global companies paid out a remarkable US$1.9 trillion of dividends for the 12 months ended 31 May 2022, which is a 20% jump from the prior 12 months. Dividend growth records were broken in a number of countries in 2021, including the US, China and Sweden though the pace of expansion was fastest in those parts of the world that had seen the biggest declines in 2020, especially Europe, the UK and Australia.

Looking ahead, dividend-income investment could play a more important role in the total return of a portfolio. Dividend-paying stocks provide a combination of income along with the potential for capital appreciation, especially since the valuations of many of these companies appear reasonable. However, it’s important to be cautious on companies with heavy debt loads or excessive leverage on their balance sheets in a rising rate environment.

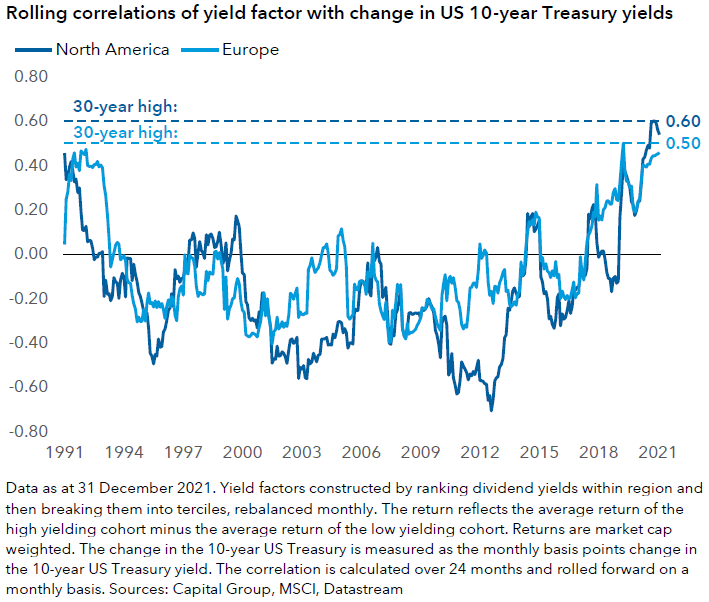

For the past few years, the relative returns of high dividend-yielding stocks have exhibited a positive correlation to changes in US Treasury yields, reversing 30 years of being negatively correlated (see chart below). If this trend continues, a rise in US interest rates may not dampen prospects of dividend stocks as it has in the past.

The financials, energy, materials and health care sectors represent a substantial chunk of the dividend-paying universe. A confluence of factors support the case of rising dividends from each of these areas:

Financials. Banks have been building up excess capital on their balance sheets since the GFC and most are now well-capitalised, having undergone a number of regulatory stress tests. Some banks in the US and Europe are poised to redeploy surplus capital in the form of regular and catch-up dividends after facing regulatory limitations during the pandemic.

Energy and materials. A surge in post-pandemic demand for various products and services has led to a rise in the prices of commodities on which these products and services rely, and an increase in demand for the energy needed to produce them. Supply chain disruptions further exacerbated the increase in commodity prices.

Large integrated oil companies have long been good sources of consistent dividends for income-oriented investors. They’ve also become more disciplined on supply, having curtailed investment in existing reserves and pursuing new sources of oil. Over the past couple of years, European oil majors BP and Royal Dutch Shell have cut their dividends amid their transition to investing in renewable energies that are capital intensive and where the return on invested capital is still uncertain. Having reset their dividends to lower payout ratios, the European oil majors have left sufficient room to increase dividends over time.

Health care. Pharmaceutical companies historically have exhibited relatively strong pricing power. While the industry has faced political pressures on drug prices, more innovative pharmaceutical companies will likely be positioned to raise prices at modest levels.

Major pharmaceutical companies recognise that a sizeable portion of their value proposition is the dividend payout. It gives confidence in equity income when combined with a robust pipeline over the next few years at several major companies.

In addition, some companies, particularly in highly cyclical industries such as mining and energy exploration and production, are adopting innovative approaches to balance their business needs and a commitment to dividend payouts. Dividend payouts are determined by a formula tied to operating metrics, resulting in a variable dividend yield over time. This gives companies an enhanced ability to manage their balance sheet and cash flows in a sustainable manner through multiple commodities cycles, helping them to avoid excessive stock price volatility. A similar approach is also being observed within the semiconductor and chip equipment industry.

Move to dividend growers

We are in the early stages of an equity market that is starting to show more breadth after a heavy focus placed on technology-related growth stocks in the IT, consumer discretionary and communication services sectors, especially those in the United States.

As market volatility increases due to monetary tightening, elevated levels of inflation and geopolitical tensions, dividend-income investment could play a more important role in the total return of a portfolio. Historically, dividend growers have tended to generate greater returns than other dividend strategies, while also keeping up relatively well with the broader market. Dividend growers can also offer a measure of resilience against higher inflation and interest rate hikes, mainly due to their stronger earnings.

Christophe Braun is an Investment Director, based in Luxembourg, with Capital Group, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any person.

For more articles and papers from Capital Group, click here.