The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

As we near the end of the year, I thought I’d share my biggest lessons from 2025:

1. Good companies don’t necessarily make good investments

You can’t go wrong investing in good companies, right? It turns out, you can.

Globally, so-called quality stocks - characterised by high return on equity, stable earnings growth and low debt levels - have had one of their worst relative declines ever in developed markets, trailing the broader world market by almost 10% over the past year. In emerging markets, it’s been the worst-ever year for quality stocks on a relative basis, lagging the broad index by 17% over the past year.

Australia has witnessed some of the carnage in quality stocks. The likes of REA, Goodman Group, and CBA have badly trailed the broader market.

Source: Morningstar

The lesson? Good companies don’t necessarily make good investments. As for the reason why, let’s move to our next lesson.

2. Valuation matters

What the three Aussie blue chips have in common is that all of them were exorbitantly priced at the start of the year and REA and CBA arguably remain so.

In January this year, I argued that a rotation out of ASX banks into miners might be imminent, and mining outperformance versus banks could last for a long period. Many readers objected, suggesting quality banks like CBA would continue to perform and were worth holding onto.

Since then, the rotation into resource companies has begun.

From its high in late June, CBA’s share price has fallen 20%, bringing the company officially into bear market territory. Its price-to-earnings ratio has dropped from 28x to 24x, yet it remains the most expensive developed market bank in the world.

Valuation matters – always.

3. ETFs are creating market distortions

There’s been a long debate about whether ETFs are distorting the market. The price action in stocks such as CBA and the Magnificent Seven is intensifying that debate.

Legendary UK investor Terry Smith has no doubt that ETFs are influencing markets to a large degree:

“The effects are profound. More than 50% of assets are now invested through index funds, which are not actually passive; they are a momentum strategy [investing in assets with the best recent performance]. These funds cause significant distortions because they invest in companies in proportion to their market capitalization, regardless of their quality or valuation. Added to this is the impact of so-called active managers who copy the indices to preserve their careers. The result is a series of major distortions…”

I tend to agree. How it plays out from here, though, is anyone’s guess.

4. Bad management can wreck a great company

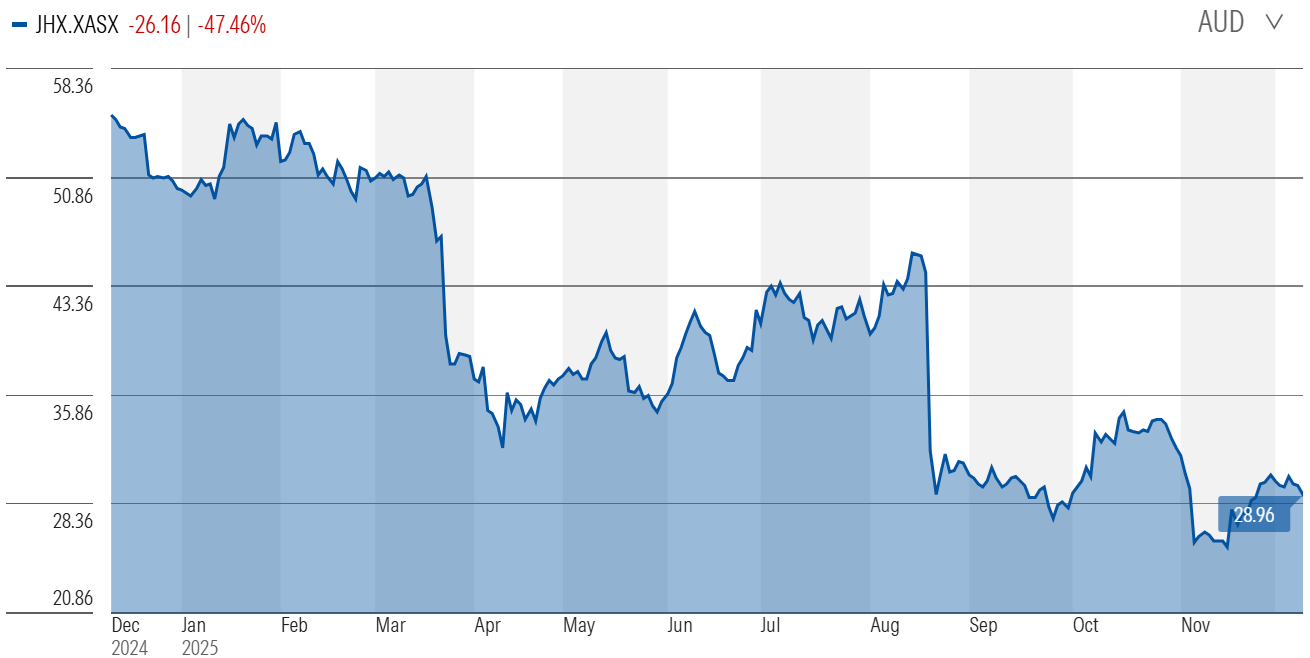

I give you exhibit A: James Hardie.

Source: Morningstar

Warren Buffett once advocated buying good businesses that “your idiot nephew could run.” In other words, the business mattered more than management.

I’m not so sure. In July, James Hardie bought Azek, a US-based manufacturer of outdoor decking and building products, for $8.4 billion. Two problems: it paid a pretty penny and used mostly debt to fund the purchase instead of its then expensively priced stock.

James Hardie shares are down 48% year-to-date, and the question now is whether management has temporarily or permanently damaged the company.

5. Dinosaurs die

Nowadays, if companies don’t innovate, they die.

In Australia, ANZ underinvested in technology for a decade and its earnings and share price largely went nowhere. A new CEO has come in to fix this, and the market is optimistic about it. Either way, it’s going to be a long haul for investors.

In the US, payment processing giant Fiserv was the bluest of blue chips, having grown earnings by 10% per annum for several decades. Recently, a new CEO admitted that the previous CEO had underinvested in its core banking processing platform. That led to downgraded earnings expectations and forecasts of higher investment, resulting in lower margins. The market is now worried that Fiserv technology has fallen well behind newer payment processing companies like Stripe and Block. And it’s subsequently punished Fiserv’s shares, which are down 68% this year.

Source: Morningstar

6. Capital flows to entrepreneurs and innovation…

You may not be a fan of Donald Trump or other aspects of the US (I’m not the biggest fan of their culture) but you’ve got to hand it to them: they encourage entrepreneurs and innovation. And that’s created enormous wealth for the country this century.

It goes to show that money will flow to countries and areas, such as San Francisco, that help rather than hurt businesses.

It’s a lesson for the rest of the world.

7. … meanwhile, in Australia

That includes Australia.

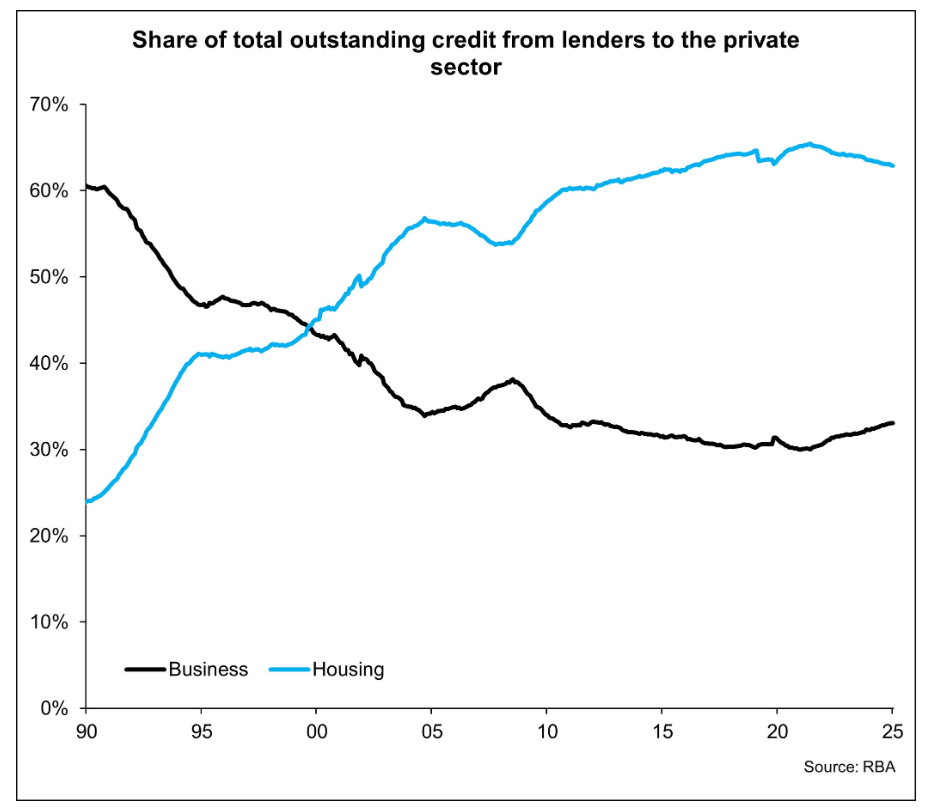

Around $14 trillion of our $18 trillion of this country’s wealth is tied up in two sectors: super and housing. Both are largely unproductive and are crowding out investments in more productive areas. Is it any wonder our economy isn’t growing in per capita terms?

The sad state of affairs is captured in the following chart:

8. Don’t fight interest rates

When interest rates fall, it puts more money in people’s pockets as they fork out less to service debt. That impacts spending and has a ricochet effect across the economy. And it’s usually positive for company profits and their share prices.

The lesson: when interest rates fall, the share market usually does well.

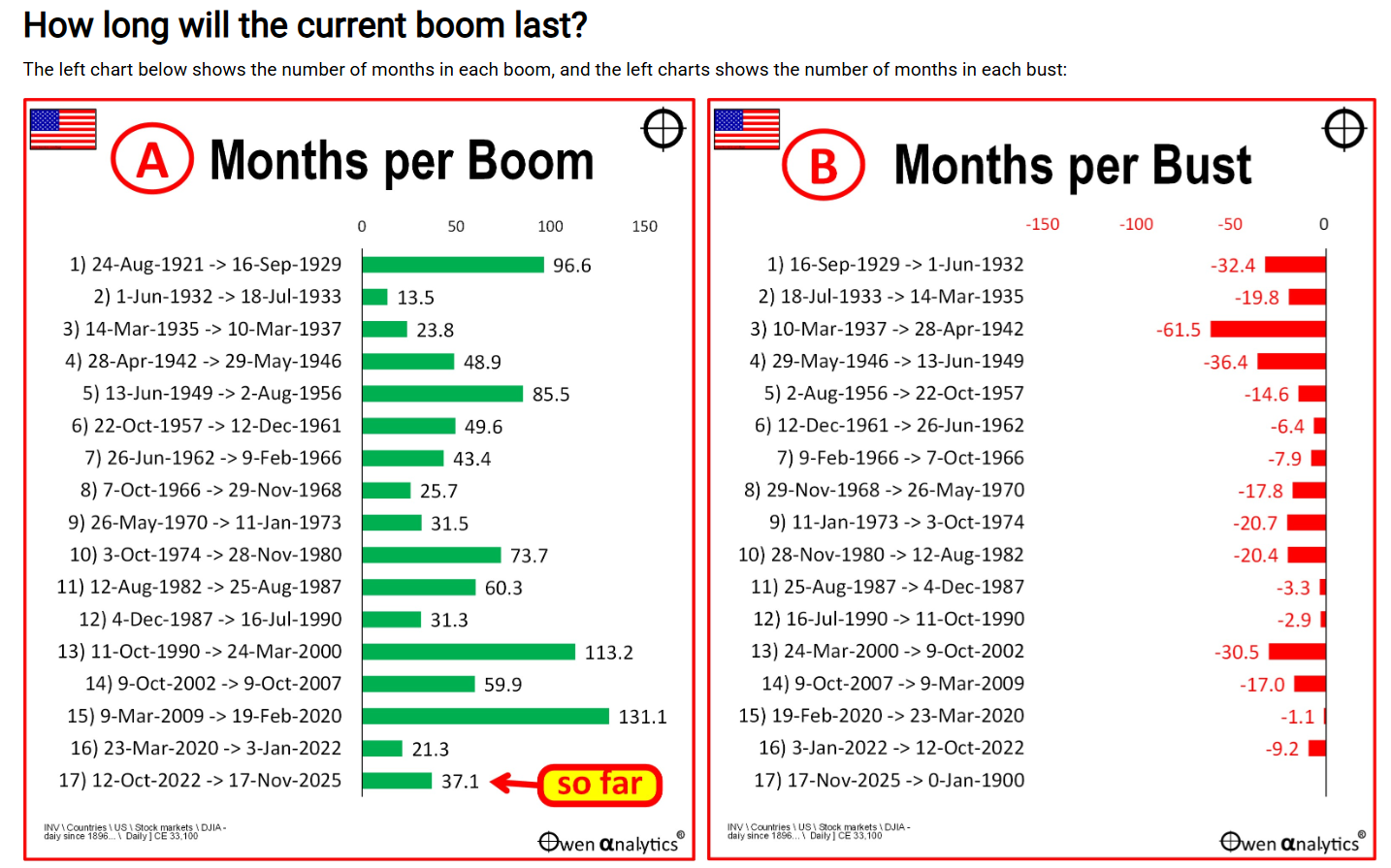

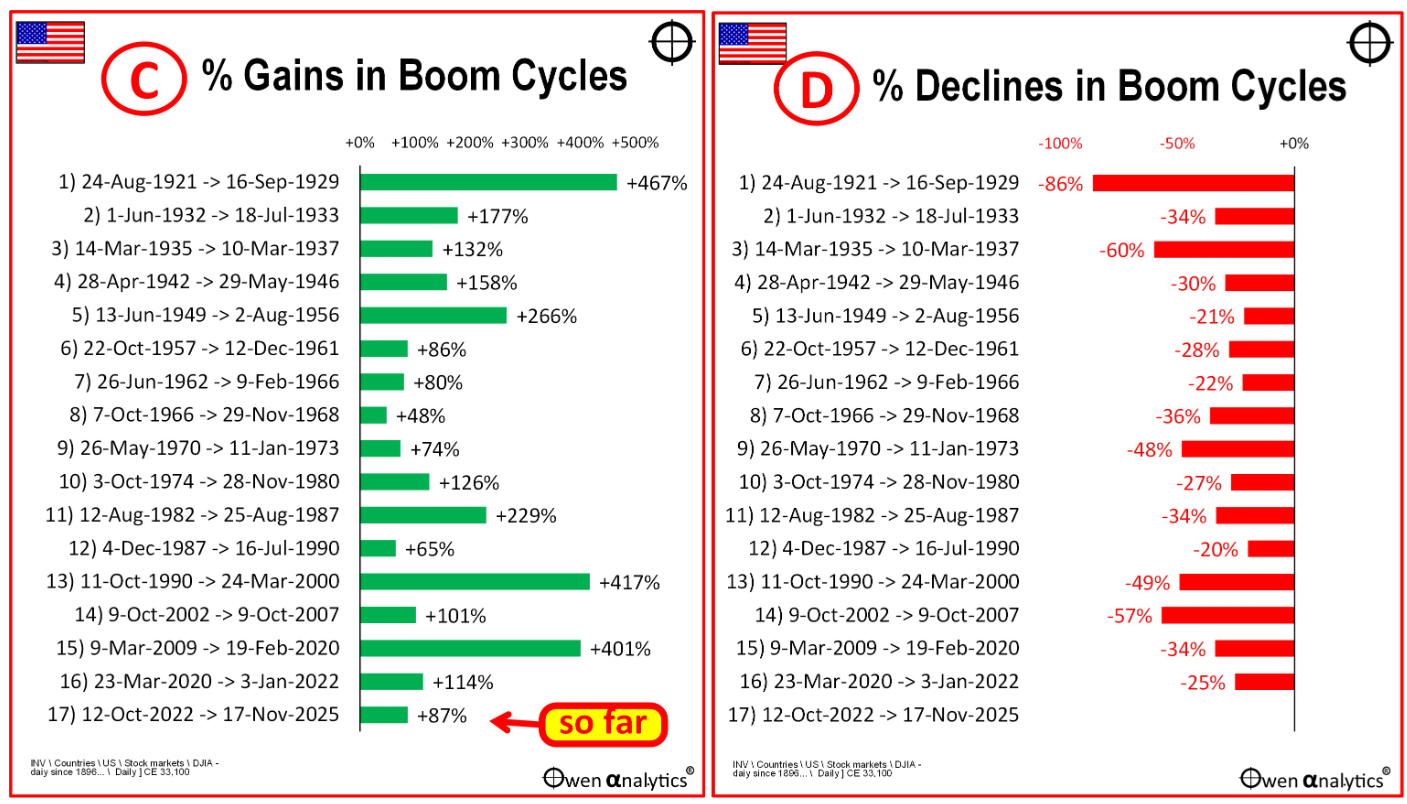

9. Bull markets always run longer than you think

We’re hearing endless talk of an AI bubble and echoes of the dotcom crash. It’s sometimes best to zoom out from the noise.

In an article in Firstlinks this week, Ashley Owen has some great charts on how long this boom could last. He suggests that the length of the current US market boom as well as the gains have been much less than prior periods.

I’d classify the current bull market a little differently from Ashley. I think the bull market began in 2009, and therefore it’s lasted about 16 years. That compares to the 20 year bull market of 1980-2000.

Either way you cut it, there might be more juice left in the current boom.

10. Look at what governments do, not what they say

Governments of all persuasions love to spend other people’s money, no matter what they say.

Labor may speak of ‘affordable housing’ yet it goes ahead with its 5% home loan deposit scheme which inevitably pumps up house prices.

It also promised to pare back the NDIS scheme to more manageable levels yet has failed to make a meaningful dent and the NDIS will continue to swallow a lot more taxpayers’ money going forward.

The latest controversy of the Communication Minister’s spending habits, then, shouldn’t come as a surprise.

I’m not sure if any politician would be as extravagant with their own money.

11. Baby Boomer wealth is driving our economy

Our country’s $18 trillion in wealth is skewed towards the old. The extent that Baby Boomers will drive spending in all sorts of areas still seems underappreciated.

I’m not just talking about the obvious like housing and aged care. Think in-home care, diabetes and other drugs, recreational pursuits such as golf and bowling, travel especially domestic, ageing houses and the need for renovations, plumbing, roofing and repairs, assistance with chores like lawnmowing and meals, the possibility of driverless cars catering to the needs of the elderly, and insurance, especially private health.

Businesses in these areas are poised to benefit from the powerful tailwind of Baby Boomer spending.

12. History is rhyming in real time

Lately, you may have heard of AI. You also may have heard about possible over-investment in AI that’s comparable to the over-investment in telecommunications in the late 1990s. Undoubtedly, there are similarities.

Going back further through history, it’s clear that exuberance over new technology has always bid up stock prices - from railways to air conditioners, to cars, airplanes, and the internet.

Two questions remain:

a) Will AI demand pick up enough to meet supply and prevent another historical bust in share prices?

b) Will AI prove enduring and transformative like other technologies through history?

No two periods of history are alike, and time will tell on this one.

13. Despite ‘uncertainty’, markets generally go up

At this time of year, you’ll be getting a lot of ‘2026 outlook’ articles about what’s going to happen next year. Many of them will refer to ‘continuing uncertainty’ and ‘volatility’.

It’s best to tune out such references. The fact is that every year is uncertain and volatile. There are always wars, political tensions, economic worries, and the list goes on.

Yet, share markets typically move higher, as has been the case in 2025. This year, the ASX 200 is up 9%, the S&P 500 has risen 18% while the Nasdaq Composite has climbed 23% (all quoted are total returns).

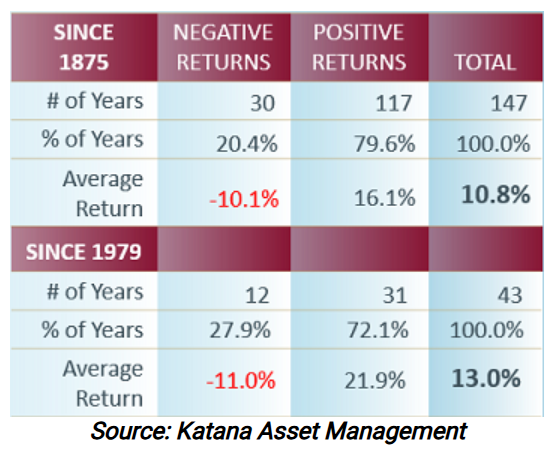

Since 1875, the ASX Accumulation index (in different guises pre-1979) has averaged a return of 10.8% per annum (total returns without franking) and has ended up about four out of every five years.

Which goes to show that the odds for share market success favour those who lean into optimism.

****

My article this week looks at renowned investor Howard Marks' stark warnings on AI. He says speculation and exuberance are rampant in markets, and some of it will be justified though much of it won't be. He also finds the outlook for employment “terrifying” because AI “may not be a tool for mankind, but rather something of a replacement.”

James Gruber

Also in this week's edition...

Evan Thornley is a professional residential property investor and he finds much of the endless commentary on real estate both amusing and bemusing. Today, he outlines the three biggest myths in Australia's biggest asset class, including, "we're in a debt-funded bubble headed for another crash" and "it's all the fault of negative gearing." Evan isn't shy of taking a strong stance against consensus views.

We have three articles on retirement this week. Stephen Huppert thinks the superannuation system has worked brilliantly to date, though the challenge ahead is recognising that different members now require radically different solutions. Meanwhile, Australia’s retirement system keeps urging people to “engage more”, yet Kaye Fallick believes the industry’s own sky-high savings targets may be the very reason so many tune out. What if the real barrier isn’t apathy at all, but the false promise that only a million-dollar nest egg can buy peace of mind? Finally, UniSuper's Annika Bradley follows up on her recent article on sequencing risk in retirement to look at the best ways to manage this risk.

Selling the family home has long seemed like the obvious way to fund aged care, but Rachel Lane says that recent rule changes mean that choice deserves far more scrutiny.

Retail real estate is outperforming as a cyclical upswing, robust demand and constrained supply drive renewed investor interest. Charter Hall's Steven Bennett and Sasanka Liyanage say one particular retail niche offers a lot more upside.

As investors seek to diversify their portfolios, more are looking at private equity to help them do that. Neuberger Berman's Gabriel Ng runs through the different types of private equity and their benefits and trade-offs.

Two extra articles from Morningstar this weekend. Brian Han outlines an ASX stock that is shrinking itself to greatness, while Tyger Fitzpatrick explores growth stocks outside the ASX 100.

Lastly, in this week's whitepaper, Man Group - a GSFM affiliate - explores how even a relatively modest allocation to gold has historically improved portfolio outcomes.

***

Weekend market update

Stocks advanced another 0.2% on the S&P 500 as the bulls erased a near 1% mid-morning dip with ease, while Treasurys steepened a bit with the 2-year yield dropping to 3.52% and the long bond settling at 4.79%. WTI crude crawled back towards US$58 a barrel, gold ripped higher by 2% to US$4,279 in apparent celebration of the Fed’s renewed asset purchases, bitcoin advanced above US$93,000 and the VIX dropped below 15 for the first time in nearly three months.

From AAP:

Australia's share market finished higher for a third straight week, with miners carving a path to victory after a string of weak sessions.

The S&P/ASX200 rose 1.23% to 8,697.3, as the broader All Ordinaries gained 1.19% to 8,983.3.

The top 200 ended the week 0.64% higher after losses in the first three sessions and something of a false start on Thursday when excitement about US borrowing costs gave way to worries about lofty tech valuations.

The raw materials sector charged 2% upward as gold surged to seven-week highs. Evolution and Ramelius Resources soared more than 4% each, while US-headquartered Newmont rocketed 5.7% to $150.06, getting an extra boost from its exposure to silver, which trounced its own record to top $US64 an ounce.

Major miners also performed well, with Rio Tinto jumping 2.5% as the Albanese government revealed a rescue bid for the miner's Tomago aluminium smelter, while BHP and Fortescue notched more than 1% lifts as iron ore futures hovered near $US106 a tonne.

Lithium producers ended the day slightly lower despite a mostly strong week, while rare earths stocks were broadly higher on a broadly rosier outlook for their underlying commodities and the resource sector.

The Commonwealth Bank led the big four banks higher, up 2.1% to $155.96 and helping the broader sector notch a 1.7% boost for the week to its highest value since mid-November. NAB was the second-best of the bunch, up 1.8% as leaders struck a conciliatory tone with shareholder activists at the bank's annual meeting.

It was a mixed five sessions for the healthcare sector, which ended the week lower despite a 1.5% rally on Friday.

Energy stocks edged 0.4% higher as oil prices firmed on supply concerns amid reports the US is preparing to seize more Venezuelan oil tankers.

Elsewhere in the sector, uranium producers Paladin and Deep Yellow posted gains of more than 4%, while laser enrichment company Silex Systems tumbled 4.4% as it continues its volatile ride after a sharp run-up in September-October.

Locally listed IT stocks had a rough week, down 4.7% over the five sessions, while consumer discretionaries and staples lost 1.3% and 0.4%, respectively.

From Shane Oliver, AMP:

Global shares were mixed over the last week. US shares were initially dragged lower by ongoing AI bubble worries but rose later in the week helped by lower-than-expected inflation data and a solid outlook from a key tech company, leaving them up 0.1% for the week. Eurozone shares rose 1.1% for the week to a record high but Japanese shares fell 2.6% as the Bank of Japan raised rates and Chinese shares fell 0.3%. Australian shares also fell 0.9% for the week on the back of the initial weak US lead and ongoing expectations that the RBA will raise rates again next year. Australian financial and consumer stocks saw small gains, but most sectors fell with big falls in resources, health and IT shares. Bond yields fell in the US but rose in Europe. They also rose in Japan & Australia on expectations for rate hikes.

The past week saw silver reach a new record high and gold continue to grind higher, but Bitcoin fell back to around its November low. Gold is likely to continue to trend higher, particularly on concerns that President Trump will seek to weaken Fed independence by nominating a new Fed Chair “who believes in lower interest rates, by a lot”. Metal and iron ore prices rose but oil prices fell to their lowest for the year helped by a glut of oil globally. The latter was despite a US blockade of oil tankers going into and out of Venezuela. It only produces about 1% of global oil production (despite having 17% of proven global reserves) but gulf states can easily make up any loss. The $A fell slightly and the $US rose slightly.

While shares saw some more wobbles over the last week our view is that this is corrective and that the rising trend in shares likely remains in place as global growth remains okay, the Fed has left the door open for more rate cuts, earnings growth is likely to remain strong in the US and looks to be picking up in Australia, Trump is moving towards more consumer friendly policies ahead of next year’s mid-term elections and we are in a period of seasonal strength for shares. Relative strength in consumer discretionary and material shares along with small caps, metals and the $A are positive signs from a cyclical perspective.

Out of interest the Santa rally normally kicks in around mid-December on the back of festive cheer and new year optimism, the investment of any bonuses, low volumes and no capital raisings at this time of year. Over the last 15 years the period from mid-December to year end has seen an average gain of 0.3% in US shares with shares up in this two-week period 9 years out of 15. In Australia, over the last 15 years the average gain over the last two weeks of December has been 0.9% with shares up 9 years out of 15. Of course, it’s not guaranteed and Santa didn’t come late last year with a bout of nerves ahead of the incoming Trump Administration – he then came in January this year. That said the rebound in US shares in the last two days is a positive sign that the Santa rally may be kicking in.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website